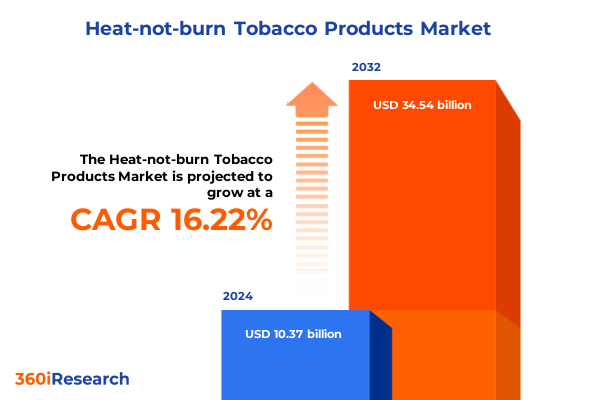

The Heat-not-burn Tobacco Products Market size was estimated at USD 11.98 billion in 2025 and expected to reach USD 13.83 billion in 2026, at a CAGR of 16.32% to reach USD 34.54 billion by 2032.

Understanding the Emergence and Strategic Importance of Heat-Not-Burn Tobacco Products in a Rapidly Evolving Tobacco Industry Landscape

The rise of heat-not-burn products marks a pivotal evolution in the global tobacco industry, as adult smokers increasingly seek alternatives that deliver tobacco’s sensory attributes without combustion. According to the Financial Times, the global heated tobacco market expanded to a value of $34.5 billion in 2023, reflecting accelerated consumer migration toward reduced-risk tobacco offerings in markets such as Japan and South Korea. This momentum underscores the convergence of technological innovation and shifting public health agendas that emphasize harm reduction strategies.

Within this landscape, leading tobacco manufacturers have doubled down on smokeless platforms to diversify revenue streams and respond to declining cigarette volumes. Philip Morris International’s IQOS ecosystem alone generated over $10 billion in 2023 revenues, evidencing a 21 percent increase in smokeless product sales and validating the commercial viability of heat-not-burn devices across multiple regions. As regulatory authorities refine frameworks for product evaluation and modified-risk classifications, the ascendancy of heat-not-burn solutions has become a defining growth vector for stakeholders aiming to harmonize consumer preferences with evolving public health benchmarks.

Unveiling the Transformative Shifts Reshaping the Heat-Not-Burn Tobacco Market Through Innovation, Regulation, and Consumer Behavior Dynamics

The heat-not-burn sector is undergoing transformative shifts driven by relentless innovation and dynamic regulatory responses. Device developers are integrating advanced heating mechanisms, such as precise battery-based temperature controls and inductive technologies, to optimize aerosol generation while minimizing toxicant formation. These enhancements facilitate a more consistent user experience that mirrors traditional cigarette consumption dynamics without the byproducts of combustion. Furthermore, companies are investing in next-generation consumables, refining tobacco stick compositions to deliver varied flavor profiles and extended usage cycles.

These technological strides coincide with a complex regulatory mosaic that is shaping market trajectories. The European Union’s ban on flavored heated tobacco products has compelled manufacturers to reengineer formulations and explore non-EU markets for flavor-led propositions. In the United States, delays in authorizations under the FDA’s modified-risk tobacco product pathway have heightened the urgency for robust clinical and chemical assessments, propelling industry players to generate extensive evidence on toxicant reduction and user acceptability. Additionally, as e-cigarette restrictions intensify in certain jurisdictions, heat-not-burn products are positioned as a viable alternative, bridging the demand for combustible-like satisfaction with evolving public health priorities.

Analyzing the Cumulative Impact of United States Tariffs on Heat-Not-Burn Tobacco Imports and Domestic Production Strategies in 2025

U.S. trade policy in 2025 has introduced a multilayered tariff framework that significantly impacts the importation and cost structures of heat-not-burn devices and consumables. Beginning in early February, a 10 percent duty was imposed under IEEPA authority, followed by an additional 10 percent levy a month later, cumulatively elevating the tariff rate to 20 percent on most vape and HnB goods imported from China and Hong Kong. President Trump’s announcement of reciprocal tariffs added a further 34 percent surcharge effective April 9, raising the total duty burden to an unprecedented 79 percent for certain product categories. Moreover, the elimination of the de minimis exemption for shipments under $800 has ensured that even small consumer orders are now fully subject to these heightened rates.

These tariff dynamics have already prompted strategic recalibrations among global heat-not-burn producers. Japan Tobacco International, for example, is contemplating U.S.-based assembly of its Ploom heated tobacco devices in response to the paused 32 percent tariff on Indonesian imports and an active 30 percent levy on Chinese-sourced e-cigarette components. While this manufacturing shift remains contingent on FDA marketing authorizations anticipated in mid-2025, it exemplifies the broader industry imperative to localize production, mitigate cost pressures, and preserve competitive pricing in the world’s largest tobacco market.

Revealing Key Market Segmentation Insights Across Product Types, Flavor Profiles, Device Technologies, and Distribution Channels in Heat-Not-Burn Sector

The heat-not-burn tobacco market is meticulously segmented to capture the nuanced preferences and usage patterns of adult smokers. In terms of product type, offerings range from single-use sticks and refillable capsules to standalone electronic devices and multifunctional vaporizers, each tailored to distinct user experiences. This diversification enables companies to address both entry-level consumers seeking intuitive products and advanced users demanding customizable settings and premium device aesthetics.

Beyond form factor, the market distinguishes between flavored tobacco and regular tobacco variants, reflecting the importance of sensory customization in driving trial and loyalty. Flavored formulations often target segments that prioritize palatability and novelty, while classic tobacco blends appeal to those seeking closer analogs to traditional smoking. On the technology front, device innovations are classified by heating method-battery-based systems deliver rapid temperature ramp-up and precise control, whereas inductive solutions offer uniform heating and longer lifecycle durability. Finally, distribution channels span established retail networks, including specialty tobacco outlets and convenience stores, as well as digital platforms that facilitate direct-to-consumer sales, subscription services, and targeted marketing communications.

This comprehensive research report categorizes the Heat-not-burn Tobacco Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Type

- Device Technology

- Distribution Channels

Highlighting Key Regional Insights and Emerging Opportunities for Heat-Not-Burn Tobacco Products in the Americas, EMEA, and Asia-Pacific Markets

The Americas represent a landscape of both promise and complexity for heat-not-burn products as smoking prevalence and regulatory scrutiny converge. In the United States, the anticipated FDA clearance of IQOS in 2025 will mark a watershed moment, enabling the first major heat-not-burn rollout in North America. This regulatory milestone, coupled with Altria’s joint-venture investments and strategic alliances, underscores the region’s potential as a growth engine, even as state-level excise taxes and flavor restrictions necessitate adaptive pricing and product design.

The Europe, Middle East & Africa corridor exhibits a fragmented yet vibrant ecosystem. While the EU’s flavored tobacco ban has narrowed certain market segments, diverse national frameworks-from harm-reduction endorsements in the United Kingdom to precautionary measures in select Eastern European states-create both obstacles and openings for targeted portfolio deployment. Regional hubs such as the UAE and South Africa are emerging as strategic launchpads, leveraging high disposable incomes and growing health awareness among smokers.

Asia-Pacific continues its leadership in HnB adoption, with Japan serving as the global blueprint for market penetration, regulatory accommodation, and consumer acceptance. The region’s advanced distribution networks, supportive policy environment, and cultural receptivity to novel nicotine-delivery systems have fostered rapid uptake, making Asia-Pacific the proving ground for next-generation devices, aggressive brand collaborations, and premium premiumization strategies.

This comprehensive research report examines key regions that drive the evolution of the Heat-not-burn Tobacco Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Moves and Market Positioning of Leading Heat-Not-Burn Tobacco Innovators and Industry Stakeholders in the Global Competitive Landscape

Philip Morris International has emerged as the leading architect of heat-not-burn expansion, leveraging its IQOS platform to redefine adult tobacco consumption. By integrating robust scientific substantiation, global marketing campaigns, and high-visibility retail activations, PMI has crafted a cohesive ecosystem that spans device innovation, consumable optimization, and regulatory engagement. The acquisition of Swedish Match strengthened its oral nicotine presence, complementing heat-not-burn offerings and reinforcing its smoke-free vision.

British American Tobacco pursues a multipronged strategy with its Glo device and Velo nicotine pouch lineup, seeking synergies across its extensive global distribution network. Despite facing challenges from illicit vaping and varying regulatory frameworks, BAT has intensified R&D investments in flavor technologies and hybrid devices that combine heat-not-burn with closed pod systems, thereby diversifying its reduced-risk proposition and addressing market fragmentation.

Japan Tobacco International, while currently less prominent in Europe and North America, is prioritizing joint ventures and in-market partnerships to accelerate Ploom rollouts. The company’s deliberation over U.S. manufacturing reflects a broader commitment to operational flexibility and supply-chain resilience. Collectively, these key players exemplify the competitive contours of the heat-not-burn domain, blending scale, innovation, and regulatory foresight to capture shifting adult smoking behaviors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Heat-not-burn Tobacco Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altria Group, Inc.

- Aspire by Shenzhen Eigate Technology Co., Ltd.

- British American Tobacco PLC

- Broad Far Hong Kong Limited

- Ccobato (Shenzhen) Technology Co., Ltd.

- Cerulean by Coesia S.p.A.

- Essentra PLC

- Hanwa Biotech (Dongguan) Co., LTD.

- HEECHI Group

- Imperial Brands PLC

- Japan Tobacco Inc.

- Joyetech Group.

- Kandypens Inc.

- KT&G Corporation

- Maskking (Shenzhen) Technology Co., Ltd.

- Mysmok Electronic Technology Co., Ltd.

- PAX Labs, Inc.

- Pluscig by Shenzhen Simeiyue Technology Co., Ltd

- Shenzhen Dorteam Technology Co., Ltd.

- Shenzhen Ruigu Technology Co., Ltd.

- Shenzhen Yukan Technology Co., Ltd.

- Sixhill by ShenZhen Union Technology Development Co.,Ltd.

- SLANG Worldwide Inc.

- SMISS Technology Co., Ltd.

- Smoore International Holdings Limited

- Taat Global Alternatives Inc.

- UWOO

- Yunnan Xike Science & Technology Co., Ltd.

- Zhengde Hanyuan (Shenzhen) Technology Co., Ltd

Delivering Actionable Recommendations to Empower Industry Leaders in Accelerating Growth, Navigating Regulatory Changes, and Optimizing Strategies in Heat-Not-Burn Market

Industry leaders should prioritize localizing manufacturing and assembly capabilities to navigate tariff complexities and stabilize supply chains. Establishing regional production hubs can mitigate duty burdens, reduce lead times, and foster closer collaboration with regulatory agencies, bolstering market access and operational agility. Moreover, cross-industry alliances-spanning technology firms, ingredient suppliers, and health-science institutions-can accelerate innovation cycles and enhance the evidence base for modified-risk communications.

Regulatory engagement must become a core competency; proactive data sharing and transparent toxicological assessments can streamline authorization processes and foster trust with public health authorities. Companies should also refine consumer-centric strategies by expanding flavor portfolios within compliant frameworks, optimizing device ergonomics for diverse demographics, and leveraging digital channels for targeted education and brand building. Lastly, continuous surveillance of competitive and illicit trade dynamics will enable timely countermeasures, ensuring legal market growth and reinforcing the integrity of reduced-risk portfolios.

Detailing the Robust Research Methodology Employed to Analyze the Heat-Not-Burn Tobacco Market Leveraging Primary, Secondary, and Analytical Techniques

This analysis synthesizes insights from both primary and secondary research to deliver a rigorous understanding of the heat-not-burn landscape. Primary research comprised in-depth interviews with senior executives, product developers, and regulatory specialists from across the tobacco and technology spectrum. Secondary research encompassed the review of peer-reviewed journals, regulatory filings, trade notifications, and public company disclosures to map macro- and micro-economic drivers.

Data triangulation was applied to validate segment structures-aligning product typologies, flavor categories, device technologies, and channel distributions with observed market behaviors. Advanced analytical techniques, including SWOT and PESTEL frameworks, were employed to decode competitive positioning and regulatory influences. Quality assurance protocols ensured consistency, while iterative peer reviews with subject-matter experts fortified the robustness and relevance of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Heat-not-burn Tobacco Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Heat-not-burn Tobacco Products Market, by Product Type

- Heat-not-burn Tobacco Products Market, by Type

- Heat-not-burn Tobacco Products Market, by Device Technology

- Heat-not-burn Tobacco Products Market, by Distribution Channels

- Heat-not-burn Tobacco Products Market, by Region

- Heat-not-burn Tobacco Products Market, by Group

- Heat-not-burn Tobacco Products Market, by Country

- United States Heat-not-burn Tobacco Products Market

- China Heat-not-burn Tobacco Products Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Reflections on Heat-Not-Burn Tobacco Market Dynamics and Strategic Imperatives for Stakeholders to Drive Sustainable Growth

The heat-not-burn tobacco market stands at an inflection point where technology, regulation, and consumer dynamics intersect to redefine future growth pathways. The convergence of advanced heating platforms, strategic tariff responses, and nuanced market segmentation creates a complex yet promising environment for stakeholders seeking reduced-risk alternatives. Regional variations-from North America’s regulatory milestones to Asia-Pacific’s rapid adoption-underscore the importance of tailored market approaches.

Key players have demonstrated that scale and scientific rigor underpin successful market penetration, while agile responses to trade policy shifts and evolving public health frameworks will determine long-term sustainability. As the industry advances, collaboration across disciplines and proactive engagement with regulatory bodies will be essential to unlock the full potential of heat-not-burn solutions and contribute meaningfully to global harm reduction objectives.

Contact Ketan Rohom to Access Comprehensive Heat-Not-Burn Tobacco Market Research Report That Unlocks Critical Insights and Strategic Roadmaps

Ready to elevate your strategic outlook and gain an unrivaled edge in the heat-not-burn tobacco landscape? Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure access to the comprehensive market research report that distills critical insights, unveils granular segmentation analysis, and equips your organization with actionable roadmaps. Don’t miss the opportunity to harness authoritative data, foresight into regulatory evolutions, and competitive intelligence designed to catalyze growth and drive sustainable leadership within this rapidly transforming sector. Partner with Ketan today to invest in intelligence, sharpen your decision-making, and position your business at the forefront of the heat-not-burn revolution.

- How big is the Heat-not-burn Tobacco Products Market?

- What is the Heat-not-burn Tobacco Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?