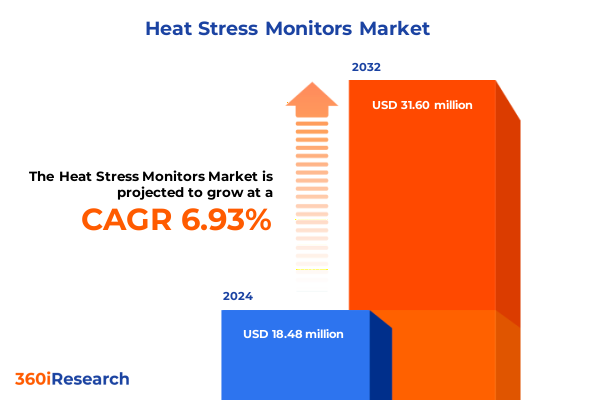

The Heat Stress Monitors Market size was estimated at USD 19.74 million in 2025 and expected to reach USD 27.20 million in 2026, at a CAGR of 6.94% to reach USD 31.60 million by 2032.

Pioneering Insights into Heat Stress Monitoring: Unveiling the Evolving Intersection of Technology, Health and Workplace Safety

The intensifying impacts of climate change have elevated heat stress from an occasional occupational hazard to a critical safety and productivity concern across multiple sectors. Recent field trials demonstrate that wearable sensor kits capable of continuously tracking core body temperature and environmental conditions have led to significant reductions in heat-related incidents on industrial sites. For example, a major U.S. cleanup contractor reported a 30% decrease in medical interventions after deploying armband sensors and real-time analytics during a 2024 heatwave. These developments underscore the potential of integrated monitoring solutions to transform workplace health outcomes.

Regulatory momentum is also reshaping adoption patterns. The Occupational Safety and Health Administration’s proposed rule on Heat Injury and Illness Prevention in Outdoor and Indoor Work Settings, published in the Federal Register on August 30, 2024, with a public hearing slated for June 16, 2025, would mandate formal heat stress management programs and continuous monitoring protocols for high-risk industries. Anticipated compliance requirements are driving investment in both wearable and stationary monitoring platforms as organizations seek to preemptively address emerging mandates.

Fundamentally, heat stress monitoring is evolving from isolated tools to integrated components of broader occupational health strategies. Advances in miniaturization, sensor fusion, and cloud connectivity are enabling real-time visibility across geographically dispersed workforces. As heat waves become more frequent and intense, these technologies are poised to become indispensable assets for safeguarding employee well-being and operational resilience.

Harnessing Next-Generation Technologies: Transformational Shifts Redefining Heat Stress Monitoring Solutions for Enhanced Worker Safety

The convergence of artificial intelligence and machine learning with heat stress monitoring hardware is revolutionizing how organizations predict and prevent heat-related incidents. Modern systems leverage predictive algorithms trained on historical temperature, humidity, and physiological datasets to issue proactive alerts before conditions reach critical thresholds. This shift from reactive to predictive capabilities has already yielded tangible benefits: pilots of AI-embedded platforms reported up to 40% fewer heat exhaustion events in industrial trials thanks to early warning prompts.

Simultaneously, multi-sensor integration is enhancing measurement fidelity. Wearable devices now combine infrared thermography with humidity sensors, accelerometers, and heart rate monitors to generate a holistic view of an individual’s heat exposure and physiological response. Innovations in flexible electronics have enabled ultra-thin, fabric-embedded sensors that conform to the body, improving comfort and accuracy even during strenuous activity.

The proliferation of cloud-native platforms further amplifies value by enabling remote data aggregation and cross-site analytics. Safety managers can monitor multiple worksites in real time, detect emerging risk patterns, and deploy resources dynamically. This cloud backbone, combined with edge computing to reduce latency, underpins a new era of scalable, data-driven heat stress management solutions.

Examining the Far-Reaching Effects of US Trade Measures: Cumulative Tariff Pressures Shaping Heat Stress Monitor Supply Chains in 2025

Since 2018, Section 301 tariffs have imposed additional duties on a wide array of Chinese imports, and the latest modifications include significant increases on semiconductors and related electronic components vital to heat stress monitoring devices. Under the finalized rules, effective January 1, 2025, tariff rates on semiconductor imports will rise to 50%, while parts such as battery components face a 25% levy. These measures have substantially increased the landed cost of both handheld and wearable monitors that depend on advanced microelectronic circuits.

Although the United States and China reached a reciprocal tariff agreement on May 12, 2025, reducing broad retaliatory duties to 10%, Section 301 remains unchanged, maintaining steep rates on critical sensor modules and circuit assemblies. The cumulative impact of these layered trade measures has led manufacturers to reassess global supply chains and explore domestic or near-shore sourcing alternatives to mitigate margin erosion.

In practical terms, the elevated input costs have accelerated partnerships with U.S. semiconductor fabricators and spurred investment in in-country assembly capabilities. However, the fragmented nature of domestic production capacity presents challenges in scaling quickly enough to meet rising demand. Consequently, businesses are balancing tariff-induced cost pressures with the need to maintain rigorous performance and reliability standards in their heat stress monitoring portfolios.

Deep-Dive into Segment-Specific Dynamics: Key Insights on Product Types End Users Distribution Channels Applications and Technologies

Insights across product types reveal that handheld monitors remain indispensable for field personnel conducting spot checks, with infrared scanners favored for rapid surface temperature assessments and thermal imaging devices delivering detailed heat maps. In contrast, stationary monitors are increasingly deployed in both portable fixed and wall-mounted configurations to deliver continuous environmental surveillance in high-traffic or hazardous zones. Wearable monitors are experiencing strong uptake among frontline workers, particularly chest straps that offer precise biometric readings, clip-on devices prized for their unobtrusive form factor, and wrist-worn units optimized for general safety and comfort.

End users across sectors are adapting these technologies to their unique operational contexts. Construction sites leverage modular solutions to monitor both commercial and infrastructure projects, while residential builds adopt portable systems for targeted safety checks. Healthcare environments use handheld infrared units in clinics, hospitals, and research labs for patient and post-operative heat stress assessments. Manufacturing plants tailor solutions to automotive and electronics assembly lines, and military training programs integrate rugged wearables for deployment and basic drills. Mining operations, whether open cast or underground, assign portable or wall-mounted monitors to manage subterranean temperature hazards, and oil and gas facilities deploy specialized sensors both onshore and offshore. Meanwhile, sports organizations-from amateur fitness centers to professional teams-utilize wearable monitors to optimize performance and prevent heat-related injuries.

Distribution strategies are equally nuanced. Corporate clinical and on-site sales teams secure large-scale direct installations, while national and regional distributors and resellers extend reach into niche markets. OEM partnerships embed component-level sensors into integrated platforms, and manufacturers’ online channels, from e-commerce platforms to branded websites, offer streamlined digital procurement pathways. Across applications-from consumer wellness and patient monitoring to military drills and industrial R&D-providers are aligning their technology choices, whether electrochemical sensing, infrared thermal imaging, optical fiber solutions, or wired and wireless networked sensors, with the specific performance requirements of each use case.

This comprehensive research report categorizes the Heat Stress Monitors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Technology

- End User

- Distribution Channel

Regional Nuances Unearthed: Uncovering Varying Drivers and Challenges Shaping Heat Stress Monitor Adoption Across Americas EMEA and Asia Pacific

In the Americas, stringent Occupational Safety and Health Administration and National Institute for Occupational Safety and Health guidelines mandate heat stress mitigation plans, driving widespread adoption of integrated monitoring systems. Employers are embracing engineering controls, administrative policies, and sensor-driven work-rest cycles backed by NIOSH recommendations on hydration, break schedules, and environmental assessment protocols. As a result, North American manufacturers and service providers are tailoring devices to meet rigorous compliance standards and interoperability requirements with existing safety software.

Across Europe, the Middle East, and Africa, regulatory frameworks emphasize comprehensive risk assessment and worker consultation under the Directive on the Introduction of Measures to Encourage Improvements in the Safety and Health of Workers at Work. Employers are integrating early warning heat action plans with technical and organizational controls, informed by pan-regional guidance on risk factor identification and collective protective measures. In the Gulf region, rising temperatures and labor regulations have catalyzed demand for stationary and wearable monitoring solutions in construction, oil and gas, and logistics operations.

In Asia-Pacific, established high-temperature labor protection measures in China require employers to adjust work schedules, provide cooling amenities, and conduct occupational health exams, with clear temperature thresholds for work suspension. Hong Kong is also refining its three-tier heat stress warning system to improve forecast accuracy and worker compliance, demonstrating the region’s commitment to evolving heat safety protocols. Elsewhere, rapid industrialization and urbanization are spurring adoption of wearable and IoT-enabled monitors across manufacturing hubs and developing economies.

This comprehensive research report examines key regions that drive the evolution of the Heat Stress Monitors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles and Competitive Landscape: Unraveling the Strategies of Leading Heat Stress Monitor Providers Driving Industry Innovation

Market leadership in heat stress monitoring is characterized by a blend of robust hardware platforms and advanced software ecosystems. Draeger, for instance, offers a connected safety framework that fuses multi-gas detection with heat stress analytics, leveraging machine learning to predict risk events hours in advance and achieving documented incident reductions in offshore and mining projects. Kenzen specializes in non-invasive smart patches that analyze sweat composition, skin temperature, and exertion metrics to create individualized hydration and rest protocols validated in European construction trials, underscoring the value of physiological data integration.

Honeywell’s portfolio includes IoT-enabled wearables and edge-AI thermal imagers that power centralized dashboards for large industrial sites. A 2023 deployment in Middle Eastern oil fields demonstrated a significant reduction in heat-related downtime by correlating worker vitals with site-specific weather data. Teledyne FLIR continues to push the envelope in thermal imaging with both long-range fixed cameras and portable handheld units optimized for precision diagnostics in high-risk environments. Meanwhile, MSA Safety has expanded its ReflectIR Thermal Barrier hard hats and fall protection harnesses to incorporate heat sensing and cooling materials, supporting OSHA’s proposed heat stress regulations and aligning product design with emerging PPE standards.

Collectively, these players are forging strategic partnerships, investing in R&D for next-generation sensors, and scaling cloud-based analytics to deliver end-to-end heat stress management solutions that span detection, prediction, and response.

This comprehensive research report delivers an in-depth overview of the principal market players in the Heat Stress Monitors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Active Environmental Solutions

- Air-Met Scientific Pty Ltd.

- Anaum International Electronics LLC

- BESANTEK Corporation

- Concept Controls Inc.

- Doculam (Pty) Ltd

- Envirocon Instrumentation

- General Tools & Instruments, LLC

- Instrumex

- LSI Lastem S.r.l.

- Nielsen-Kellerman Co.

- PCE Instruments UK Ltd.

- Reed Instrument

- Romteck Australia

- Runrite Electronics (Pty) LTD

- Sato Keiryoki Mfg. Co., Ltd

- SCADACore

- Scarlet Tech

- Sensidyne, LP

- Sper Scientific

- Teledyne FLIR LLC

- TES Electrical Electronic Corp.

- Thermon

- TSI Incorporated

- VWR International, LLC

- W. W. Grainger, Inc.

Actionable Strategic Imperatives: Recommendations to Empower Industry Leaders in Navigating Technological Regulatory and Market Complexities

To capitalize on the shifting landscape, industry leaders should prioritize strategic partnerships with domestic semiconductor fabricators and sensor component suppliers to mitigate tariff-related cost pressures. By co-developing localized assembly and calibration facilities, organizations can enhance supply chain resilience and reduce lead times for critical monitoring hardware.

Investing in modular, interoperable platforms that integrate wearable and stationary devices with existing safety management systems will streamline adoption and increase user engagement. Offering open APIs and seamless cloud integration empowers end users to leverage predictive analytics and custom alert thresholds that align with sector-specific risk profiles.

Collaboration with regulatory bodies to refine standards and certification processes can unlock opportunities for early mover advantage. Engaging in pilot programs that validate device efficacy under diverse environmental conditions will build credibility and support evidence-based policymaking.

Finally, embedding privacy-by-design principles, secure data governance frameworks, and opt-in consent mechanisms will address employee concerns around biometric monitoring and safeguard long-term program sustainability.

Rigorous Research Blueprint: Methodological Framework Underpinning the Comprehensive Heat Stress Monitor Market Analysis

This analysis is grounded in a multi-tiered research framework that combines primary and secondary methodologies. Primary insights were derived from in-depth interviews with key stakeholders, including product developers, safety managers, and regulatory experts across major industrial sectors. These discussions illuminated real-world pain points, technology adoption barriers, and emerging use cases.

Secondary research encompassed a thorough review of publicly available regulatory filings, industry publications, and technical white papers to map the evolving policy landscape and benchmark technological advancements. Trade press reports and academic studies were evaluated for data consistency and trend validation.

A triangulation approach ensured robustness by cross-verifying interview findings with market news and peer-reviewed research. Additionally, an expert advisory panel of occupational safety specialists conducted a review of preliminary conclusions, providing critical feedback that refined segmentation categorizations and regional interpretations.

Throughout, ethical data collection practices and confidentiality commitments were upheld to maintain stakeholder trust and ensure that all proprietary insights were appropriately anonymized.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Heat Stress Monitors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Heat Stress Monitors Market, by Product Type

- Heat Stress Monitors Market, by Application

- Heat Stress Monitors Market, by Technology

- Heat Stress Monitors Market, by End User

- Heat Stress Monitors Market, by Distribution Channel

- Heat Stress Monitors Market, by Region

- Heat Stress Monitors Market, by Group

- Heat Stress Monitors Market, by Country

- United States Heat Stress Monitors Market

- China Heat Stress Monitors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4929 ]

Converging Insights and Forward Trajectory: Summarizing Key Findings to Illuminate the Future Outlook of Heat Stress Monitoring

The collective evolution of heat stress monitoring technologies-ranging from AI-driven wearables to cloud-native analytic platforms-marks a pivotal era in occupational health and safety. By integrating predictive algorithms, multi-parameter sensing, and remote management capabilities, organizations are now equipped to address heat-related risks proactively and at scale.

Trade policies and regulatory advancements have introduced new complexities, with Section 301 tariffs reshaping supply chains and proposed OSHA rules setting higher compliance bars. Navigating these forces demands a strategic balance between cost management and technology leadership, underscoring the importance of localized manufacturing and deep regulatory engagement.

Segmentation insights reveal that no single one-size-fits-all solution exists; product types, end-user needs, distribution strategies, applications, and enabling technologies all maintain distinct dynamics that must be orchestrated holistically. Regional frameworks-from the U.S. to EMEA and Asia-Pacific-further accentuate variations in adoption drivers and compliance imperatives.

In this context, only those organizations that embrace partnership-driven innovation, prioritize data security, and remain agile in the face of trade and regulatory shifts will secure a sustainable competitive edge. The path forward lies in leveraging integrated monitoring ecosystems that deliver seamless, evidence-based safety interventions for a hotter world.

Empowering Decisions with Expert Market Intelligence: Reach Out to Ketan Rohom to Secure the Full Heat Stress Monitor Industry Report Today

To gain comprehensive insights into the evolving dynamics, challenges, and opportunities within the heat stress monitor industry, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through the detailed market research report that arms decision-makers with the intelligence needed to stay ahead. Secure your copy of this indispensable resource and embark on a data-driven journey toward safer, smarter, and more resilient operational practices by reaching out today

- How big is the Heat Stress Monitors Market?

- What is the Heat Stress Monitors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?