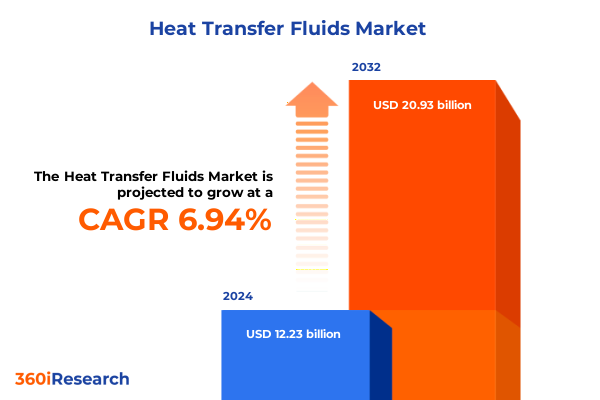

The Heat Transfer Fluids Market size was estimated at USD 13.10 billion in 2025 and expected to reach USD 13.89 billion in 2026, at a CAGR of 6.92% to reach USD 20.93 billion by 2032.

Driving Forward the Future of Heat Transfer Fluids Through Energy Efficiency, Renewables, and Innovation to Secure Sustainable Thermal Solutions Worldwide

Heat transfer fluids play an indispensable role in industrial temperature regulation, ensuring effective thermal management across complex processes such as chemical synthesis, photovoltaic power generation, and high-precision manufacturing. As industries strive for higher operational efficiency, the demand for advanced fluids capable of maintaining stable performance under extreme conditions has grown substantially. A recent analysis highlights the acceleration in demand for high-performance and sustainable thermal solutions, driven by sectors that require reliable heat exchange media to optimize energy consumption and reduce downtime amid tightening environmental regulations.

Against this backdrop, regulatory frameworks focused on emissions reduction and eco-friendly materials have propelled the adoption of energy-efficient fluids. Organizations are increasingly replacing conventional mineral oil-based products with synthetics and bio-based alternatives that reduce toxicity and extend service life without compromising thermal stability. Industry data indicates a sizable shift toward more energy-efficient operations, with companies embracing advanced fluids to achieve both cost savings and environmental compliance.

Meanwhile, the growth of renewable energy systems, particularly concentrated solar power (CSP) plants, underscores the strategic importance of specialized heat transfer fluids. Solar thermal installations must leverage fluids with exceptional thermal capacity and oxidation resistance to store and transport solar energy continuously. Global renewable energy reports reveal that over 150 GW of solar thermal capacity had been installed by 2024, further entrenching the role of heat transfer fluids in decarbonization and large-scale energy storage.

In parallel, the electrification of transportation has elevated demand for thermally optimized fluids in battery cooling and power electronics. Advanced glycol-based fluids are now integral to electric vehicle temperature management systems, helping maintain optimal cell temperatures and extend battery longevity. Projections suggest that electric vehicle thermal management applications will require hundreds of millions of liters of specialized fluids over the next decade, reflecting the critical role of heat transfer media in next-generation mobility solutions.

Harnessing Digitalization, Nanofluids, and Bio-Based Formulations to Revolutionize Heat Transfer Fluid Performance Across Industries

Innovation is reshaping the heat transfer fluids landscape as manufacturers harness cutting-edge technologies to meet evolving performance demands. One of the most profound shifts involves integrating nanofluid formulations, where suspensions of metal oxide and carbon-based nanoparticles significantly enhance thermal conductivity and heat capacity. This advancement enables rapid heat exchange within compact system footprints, a vital advantage for high-throughput chemical reactors and precision engineering applications.

Concurrently, the industry’s pivot toward bio-based fluid formulations addresses mounting pressure to reduce environmental footprints. Plant-derived esters and glycols are now being engineered to deliver comparable or superior thermal stability to synthetic counterparts while offering improved biodegradability and lower toxicity. Such formulations support stringent regional bans on harmful aromatic compounds, empowering food processing and pharmaceutical operations to maintain compliance without sacrificing process efficiency.

Moreover, digital transformation fuels a new era of operational visibility and predictive maintenance for fluid-based thermal systems. IoT-enabled sensors and cloud analytics allow real-time monitoring of fluid temperature, viscosity, and contamination levels. This data-driven approach prevents unscheduled downtime, extends fluid life cycles, and optimizes energy consumption across chemical plants and district heating networks. As a result, industry 4.0 integration is rapidly becoming a standard expectation within the thermal management sector.

Together, these technological and sustainability-centered innovations are redefining what heat transfer fluids can achieve. By combining nanotechnology, green chemistry, and digital intelligence, end users gain unprecedented control over thermal processes, driving improved operational resilience and unlocking new application frontiers.

Assessing the Cumulative Impact of U.S. Tariffs in 2025 on Cost Structures and Supply Chains for Heat Transfer Fluid Manufacturers and End Users

The introduction of sweeping U.S. tariffs in 2025 has introduced significant cost pressures across the chemical and materials ecosystem, extending to heat transfer fluid production. On March 12, 2025, steel and aluminum imports were uniformly subjected to a 25% tariff, later doubled to 50% in June, and further expanded to include household appliances. These measures removed previous exemption criteria, mandating that metal inputs be fully produced in the U.S. to avoid duty, fundamentally altering raw material sourcing and pricing structures.

Chemical manufacturers have voiced concerns that elevated duties on steel and aluminum will translate into increased operational expenses, particularly for facilities reliant on imported infrastructure and process components. Experts estimate that 33–37% increases in underlying chemical prices, combined with freight cost hikes exceeding 170%, could raise production costs for fluid feedstocks such as monoethylene glycol, aromatic oils, and high-purity mineral oils.

Consequently, heat transfer fluid producers are reevaluating supply chains, seeking alternative suppliers in regions with favorable trade agreements, and accelerating investment in domestic production capacity. However, the transition entails substantial capital commitments for new facilities and equipment upgrades, challenges that disproportionately affect smaller manufacturers without the scale or access to capital enjoyed by larger players in the market.

In response, many industry participants are shifting costs to end users through pricing adjustments, while others are mitigating exposure by locking in long-term contracts with steel suppliers and securing tariff exemptions where available. These strategic adaptations underscore the resilience of the heat transfer fluids sector, yet highlight the critical need for proactive cost management and supply chain diversification to navigate the ongoing tariff landscape.

Unveiling Key Segmentation Insights Highlighting Product Types, Temperature Ranges, Chemical Compositions, End-Use Applications, and Distribution Channels

Diverse product portfolios underpin the heat transfer fluids market, encompassing aromatic thermal oils offering high-temperature stability, glycol-based fluids prized for freeze protection, mineral oils valued for broad thermal ranges, and silicone fluids known for low-temperature performance. Each product category fulfills distinct operational requirements, from high-temperature concentrated solar power loops to refrigeration heat exchangers, illustrating the market’s multifaceted application landscape.

Temperature range segmentation further refines fluid selection, dividing solutions into high, medium, and low-temperature classes. High-temperature fluids, capable of stable operation above 300 °C, are crucial for petrochemical reactors and solar thermal plants, while medium-temperature fluids address food processing and pharmaceutical heating requirements. Low-temperature fluids, often employed in HVAC and refrigeration systems, deliver efficient heat exchange at sub-ambient conditions, showcasing the market’s technical granularity.

Chemical composition adds another layer of differentiation, distinguishing inorganic fluids such as molten salts used in power generation and specialty heat transfer oils from organic fluids including bio-based glycols and synthetic aromatic oils. Organic fluids dominate applications demanding rapid heat transfer and operational flexibility, whereas inorganic fluids offer cost-effective thermal storage solutions in concentrated solar installations and thermal energy storage systems.

End-use segmentation encompasses the automotive sector’s need for battery and powertrain cooling, chemical processing’s rigorous thermal requirements, food & beverage’s hygienic heating demands, oil & gas’s high-temperature processing, pharmaceuticals’ precision thermal control, and power generation’s efficiency optimization. Across these diverse industries, distribution channels range from traditional offline partnerships with distributors and OEMs to online platforms offering direct-to-customer procurement and rapid delivery options, reflecting the evolving ways in which heat transfer fluids reach end users.

This comprehensive research report categorizes the Heat Transfer Fluids market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Temperature Range

- Chemical Composition

- End-use

- Distribution Channel

Exploring Key Regional Dynamics Across the Americas, Europe Middle East Africa, and Asia-Pacific Shaping the Heat Transfer Fluids Market

The Americas region continues to lead market development, driven by substantial investments in renewable energy projects and the presence of major petrochemical and pharmaceutical hubs. In the United States, supportive policy frameworks for clean energy deployment and strict environmental regulations have intensified demand for high-efficiency heat transfer fluids, while Canada’s expansion of heavy industrial capabilities supports robust fluid consumption across power generation, mineral processing, and manufacturing operations.

Europe, the Middle East, and Africa (EMEA) present a diverse regulatory tapestry, with stringent REACH and environmental compliance standards in the European Union spurring innovation in non-toxic and biodegradable fluids. In parallel, rapid industrialization in key Middle Eastern economies is driving large-scale process integration across petrochemical and solar thermal applications. African markets, though smaller in scale, are embracing off-grid solar thermal systems, creating niche opportunities for concentrated solar power-optimized thermal oils.

Asia-Pacific (APAC) represents the fastest-growing regional market, underpinned by accelerated industrial expansion, burgeoning solar power installations, and an increasing focus on electric vehicle production. Governments across China, India, and Southeast Asia are channeling resources into renewable energy capacity additions and clean manufacturing, prompting widespread adoption of advanced heat transfer fluids that deliver operational reliability and compliance with emerging environmental mandates.

This comprehensive research report examines key regions that drive the evolution of the Heat Transfer Fluids market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovations from Leading Heat Transfer Fluid Manufacturers Shaping Market Competitiveness and Future Trajectories

Leading chemical and energy companies are actively shaping market trajectories through strategic investments and product innovations. Eastman Chemical recently expanded its European heat transfer fluid production capacity by 15%, reducing lead times and meeting rising demand in solar power and automotive thermal management applications. Dow has introduced a new low-toxicity glycol-based fluid with enhanced biodegradability and thermal efficiency, targeting food, pharmaceutical, and cold-chain logistics sectors.

Shell’s deployment of next-generation aromatic fluids for concentrated solar power applications provides 22% greater thermal stability, reinforcing its leadership in renewable energy markets. This launch supports rapidly expanding solar projects in regions such as the Middle East and Southern Europe, where high-temperature resilience is critical. Lanxess has bolstered its bio-based fluid portfolio with 100% renewable feedstocks, achieving a 32% reduction in greenhouse gas emissions compared to conventional formulations and aligning with strict environmental directives in North America and Europe.

Clariant’s establishment of a dedicated R&D center for heat transfer fluid innovation underscores an industry-wide emphasis on advanced formulation and green chemistry. This center collaborates with industrial clients to co-develop fluids capable of meeting the next generation of thermal management challenges, signaling a shift toward customer-centric innovation models that drive enhanced performance and sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Heat Transfer Fluids market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- BP plc.

- Caldera

- Chevron Corporation

- Clariant AG

- Duratherm Extended Life Fluids

- Dynalene, Inc.

- Eastman Chemical Company

- ExxonMobil Corporation

- FRAGOL AG

- Global Heat Transfer

- Huntsman Corporation

- Indian Oil Corporation Ltd.

- LANXESS AG

- MultiTherm LLC

- Paratherm

- Radco Industries Inc.

- Shell plc.

- The Dow Chemical Company

- The Lubrizol Corporation

Delivering Actionable Recommendations for Industry Leaders to Optimize Heat Transfer Fluid Strategies, Enhance Efficiency, and Capitalize on Opportunities

Industry leaders should prioritize strategic partnerships with domestic steel and chemical suppliers to mitigate exposure to fluctuating tariff regimes and secure preferential pricing structures. By integrating long-term procurement agreements and exploring consortium-based sourcing models, companies can enhance supply chain resilience and achieve greater cost predictability. In addition, diversifying raw material bases by qualifying secondary suppliers in regions with favorable trade dynamics will reduce reliance on any single market and bolster continuity of supply.

To maximize performance and lifecycle value, manufacturers and end users must accelerate the adoption of digital monitoring platforms capable of real-time analysis of fluid condition and system performance. Deploying IoT-enabled sensors and predictive analytics tools will facilitate condition-based maintenance, extend fluid intervals, and optimize energy utilization. Such digital strategies not only improve operational efficiency but also provide the data transparency necessary for compliance reporting and environmental audits.

Embracing product innovation through joint R&D initiatives can drive the rapid development of next-generation bio-based and nanofluid formulations. Collaborative frameworks engaging academia, government research bodies, and technology startups will yield advanced thermal solutions with enhanced sustainability profiles and differentiated performance attributes. Furthermore, targeting emerging applications such as electric vehicle battery cooling and district heating networks can unlock new revenue streams and reinforce market positioning.

Finally, proactive engagement with regulatory bodies to shape evolving environmental policies and secure R&D incentives will be instrumental. By participating in industry consortia and standards-setting organizations, stakeholders can influence rulemaking, accelerate approval pathways for novel fluids, and safeguard competitive advantage.

Detailing a Robust Research Methodology Incorporating Primary and Secondary Data Collection Tools and Analytical Techniques Ensuring Data Integrity

This study employs a comprehensive research methodology combining both primary and secondary data collection approaches. Primary research included in-depth interviews with executives and technical experts from leading heat transfer fluid manufacturers, end-user organizations across automotive, chemical processing, and renewable energy sectors, as well as trade association representatives. Insights gathered from these discussions provided qualitative validation of market drivers, challenges, and adoption patterns.

Secondary research involved an extensive review of industry publications, technical journals, government and regulatory databases, and publicly available financial reports. Key sources included sector analyses from energy agencies, patent filings, and environmental compliance documentation, ensuring a robust foundation of authenticated data points. Publicly disclosed information on government tariffs and trade measures informed the analysis of supply-chain disruptions and cost implications.

Data triangulation techniques were applied to ensure consistency and accuracy across multiple data sources, enabling cross-verification of quantitative and qualitative inputs. Market intelligence software tools facilitated the aggregation of market activity indicators, while standardized frameworks were utilized to segment the market by product type, temperature range, chemical composition, end-use, and distribution channel.

Finally, findings were validated through peer review sessions with subject-matter experts to refine insights, address potential biases, and confirm strategic interpretations. This rigorous approach underpins the credibility and actionable value of the strategic recommendations and market insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Heat Transfer Fluids market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Heat Transfer Fluids Market, by Product

- Heat Transfer Fluids Market, by Temperature Range

- Heat Transfer Fluids Market, by Chemical Composition

- Heat Transfer Fluids Market, by End-use

- Heat Transfer Fluids Market, by Distribution Channel

- Heat Transfer Fluids Market, by Region

- Heat Transfer Fluids Market, by Group

- Heat Transfer Fluids Market, by Country

- United States Heat Transfer Fluids Market

- China Heat Transfer Fluids Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Strategic Insights on Market Trends, Challenges, and Growth Pathways to Guide Informed Decision-Making in Heat Transfer Fluids Industry

The heat transfer fluids market is undergoing a transformative phase characterized by heightened sustainability standards, digital integration, and evolving geopolitical dynamics. Across product categories, the shift toward bio-based and nano-enhanced formulations is setting new benchmarks for thermal stability and environmental performance. Technological advancements in IoT-enabled condition monitoring are elevating operational reliability and optimizing lifecycle costs, proving essential for industries facing stringent regulatory scrutiny.

Simultaneously, the imposition of broad tariffs on steel, aluminum, and chemical feedstocks has underscored the importance of supply chain agility and strategic sourcing. Companies that effectively navigate tariff complexities through domestic partnerships and diversified procurement will secure a competitive edge, while those that fail to adapt may encounter escalating input costs and disrupted production schedules.

Regional dynamics reveal that while the Americas sustain market leadership through robust investment in renewables and petrochemical infrastructure, EMEA and APAC are rapidly advancing adoption. Regulatory drivers in EMEA propel innovation in low-toxicity fluids, and APAC’s large-scale industrial expansion fuels demand for both conventional and specialty fluids, positioning these regions as pivotal contributors to global market growth.

In sum, stakeholders equipped with a nuanced understanding of segmentation nuances, tariff impacts, and emerging technology trends will be best positioned to capitalize on new opportunities, drive sustainable expansion, and lead the next generation of thermal management solutions.

Connect with Ketan Rohom to Explore Tailored Market Research Insights and Purchase the Comprehensive Heat Transfer Fluids Report for Strategic Advantage

For tailored insights and strategic data on the dynamic heat transfer fluids market, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Gain immediate access to comprehensive analysis and expert guidance to inform capital investments, product development, and distribution strategies. Elevate your competitive edge by securing a deep-dive report designed to uncover critical trends, tariff impacts, and segmentation nuances in product compositions, temperature ranges, and regional dynamics. Engage with Ketan to explore customized research deliverables that align with your organizational objectives, and accelerate decision-making with authoritative market intelligence for sustainable growth and innovation.

- How big is the Heat Transfer Fluids Market?

- What is the Heat Transfer Fluids Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?