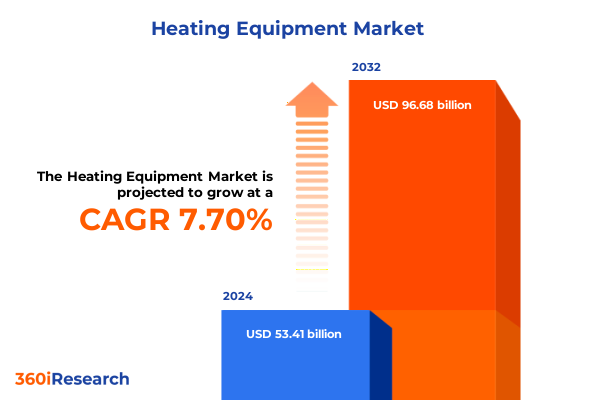

The Heating Equipment Market size was estimated at USD 57.41 billion in 2025 and expected to reach USD 61.72 billion in 2026, at a CAGR of 7.72% to reach USD 96.68 billion by 2032.

Unveiling the Core Dynamics Propelling a Revolution in Heating Solutions Across Technology, Sustainability, and Policy Landscapes

The current landscape of heating equipment is being fundamentally reshaped by a convergence of decarbonization imperatives, evolving consumer priorities, and relentless technological advancement. Electrification, driven by the rapid ascent of heat pumps, now accounts for a majority of new heating system installations, signaling a clear shift away from traditional fossil fuel solutions. Simultaneously, the imperative to reduce carbon emissions has elevated efficiency standards, prompting both manufacturers and end users to prioritize low-carbon heat sources within residential, commercial, and industrial segments.

Against this backdrop, stakeholders across the value chain are realigning investment priorities to capture the benefits of smart connectivity, agile supply chains, and policy incentives for clean energy. As cost structures evolve in response to geopolitical shifts and material constraints, dynamic adaptability and innovation in product design and service delivery have become critical factors in securing competitive advantage and long-term resilience.

Observing Transformational Forces Driving Decarbonization, Digitalization, and Consumer-Centric Innovation in Heating Equipment Markets

Significant momentum in heating electrification is transforming system design, channeling investment toward heat pump technology that delivers two to four times the efficiency of gas furnaces even in cold climates. This surge is supported by advanced building automation platforms that integrate real-time data from temperature, humidity, and occupancy sensors, enabling proactive adjustments to optimize performance and energy consumption.

Beyond hardware innovation, the landscape is being redefined by stringent emissions regulations and climate action commitments, which are accelerating the retirement of high-emission boilers and furnaces. This regulatory momentum is complemented by growing consumer awareness around lifecycle emissions, intensifying demand for green-certified products and traceable supply chains. As a result, market participants are forging strategic partnerships to co-develop next-generation solutions that balance reliability, cost-effectiveness, and environmental stewardship.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Raw Materials, Supply Chains, and End-User Heating Equipment Costs

The introduction of 25% tariffs on steel and aluminum imports from Canada and Mexico, coupled with a 10% levy on Chinese goods, has significantly increased input costs for heat exchangers, ductwork, and casings used in heating equipment. These measures have compounded the impact of existing supply chain pressures, leading manufacturers to reassess sourcing strategies, adjust pricing models, and accelerate localization of critical components.

Consequently, stakeholders throughout the value chain are experiencing widened cost pressures. Residential and commercial end users face higher upfront equipment prices as manufacturers pass through raw material surcharges. Meanwhile, service providers and contractors are adapting to compressed lead times and fluctuating inventory levels. Although these adjustments introduce short-term headwinds, they also present opportunities for domestic production expansion and the adoption of alternative materials and design efficiencies that could mitigate long-term tariff exposure.

Revealing Critical Insights from Multifaceted Segmentation to Illuminate Diverse Fuel Types, Products, Mechanisms, End Users, and Distribution Channels

Comprehensive segmentation reveals a multifaceted market landscape where fuel-type considerations span from advanced biomass solutions, including pellet and wood chip applications, to electric offerings such as heat pumps and resistance systems, as well as gas technologies differentiated by LPG and natural gas, oil-based systems, and both active and passive solar installations. Product innovation extends across condensing and non-condensing boilers, electric and gas furnaces, air-source and ground-source heat pumps, and convection and fan heaters. Variations in heat delivery mechanisms include ducted or ductless forced-air configurations, hydronic systems via baseboards or radiators, and radiant designs embedded in ceiling or floor constructions. End users range from distinct commercial environments like hospitality, office, and retail, to industrial sectors such as food processing, manufacturing, and petrochemical applications, alongside residential deployments in both single-family homes and multifamily dwellings. Distribution pathways encompass national and regional dealers, OEM direct sales and project contractors, e-commerce platforms and manufacturer websites, as well as home improvement and specialty retail outlets. This layered segmentation underscores the necessity for tailored strategies that address each intersection of technology, end user, and channel to unlock market potential.

This comprehensive research report categorizes the Heating Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Type

- Product Type

- Mechanism

- End User

- Distribution Channel

Unearthing Regional Nuances Shaping Heating Equipment Demand Across Americas, Europe Middle East & Africa, and Asia-Pacific Powerhouses

In the Americas, the United States and Canada have witnessed a surge in heat pump adoption driven by favorable policy incentives, growing consumer emphasis on operational efficiency, and the acceleration of decarbonization goals. Residential retrofit programs and utility rebates in key markets, alongside robust industry support for electrified heating, have collectively bolstered system installations and aftermarket services. Energy resilience initiatives in northern states have further amplified demand, creating opportunities for integrated heating and power configurations that enhance grid stability.

Meanwhile, the Europe, Middle East & Africa region has experienced a complex interplay of regulatory shifts and cost dynamics. While high electricity prices in core markets have temporarily constrained heat pump uptake, long-term directives on building efficiency and carbon neutrality continue to drive pipeline growth. In emerging markets within EMEA, infrastructure investments are focusing on hybrid heat solutions that bridge conventional gas systems with renewable energy integration. Across Asia-Pacific, nations such as Japan, South Korea, and Australia are scaling heat pump deployments through targeted subsidies and stringent emissions standards, while China’s domestic manufacturing capacity and technology advancements are reshaping competitive landscapes and supply availability.

This comprehensive research report examines key regions that drive the evolution of the Heating Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovation Trajectories of Leading Global Players Steering the Heating Equipment Sector Forward

Leading corporations are realigning their portfolios to capitalize on the shift toward low-carbon heating. Carrier has intensified its focus on heat pump innovation and advanced monitoring services, leveraging its expansive service network to deliver integrated energy solutions. Trane Technologies has expanded its ground-source heat pump offerings and formed strategic partnerships for digital building platforms, enhancing real-time system optimization capabilities.

At the same time, global HVAC players such as Daikin and Lennox have accelerated their investments in smart thermostats and cloud-based energy management services, aiming to capture share in the burgeoning connected-home segment. Mitsubishi Electric continues to strengthen its position through localized manufacturing and modular system designs, while newcomers and specialized OEMs are disrupting traditional channels by bundling turnkey installations with performance-guarantee contracts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Heating Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. O. Smith Corporation

- BDR Thermea Group B.V.

- Carrier Global Corporation

- Daikin Industries, Ltd.

- Danfoss A/S

- Emerson Electric Co.

- Fujitsu General Limited

- Honeywell International Inc.

- Johnson Controls International plc

- Lennox International, Inc.

- Mitsubishi Electric Corporation

- NIBE Industrier AB

- Panasonic Corporation

- Rheem Manufacturing Company

- Robert Bosch GmbH

- Siemens AG

- Trane Technologies plc

- Vaillant Group GmbH & Co. KG

- Viessmann Werke GmbH & Co. KG

Providing Actionable Roadmaps for Industry Leaders to Navigate Technological, Environmental, and Trade Complexities in the Heating Equipment Arena

To thrive amidst evolving market complexities, industry leaders should prioritize strategic diversification of supply chains by forging relationships with alternative material producers and enhancing domestic manufacturing capabilities. Investment in next-generation heat pump platforms and modular designs can accelerate time-to-market and reduce cost volatility, while integrating AI-enabled controls will unlock new value through predictive maintenance and dynamic load management. Engaging proactively with policymakers to shape pragmatic efficiency standards and tariff frameworks can safeguard competitive positioning.

Moreover, forging cross-industry collaborations and pilot programs with energy utilities and technology partners will accelerate the adoption of integrated heating and energy-storage solutions. By aligning product roadmaps with sustainability commitments and consumer expectations, organizations can differentiate their offerings and secure premium pricing power.

Detailing a Rigorous, Multi-Tiered Research Methodology Combining Primary Interviews, Secondary Sources, and Advanced Analytical Frameworks

This analysis is underpinned by a rigorous research methodology that integrates primary interviews with C-level executives, engineering leads, and policy experts, alongside secondary research from regulatory filings, industry whitepapers, and credible news outlets. Quantitative data is cross-verified through triangulation, ensuring consistency across supply chain metrics, tariff schedules, and technology adoption figures. Advanced analytical frameworks, including SWOT analysis and scenario planning, have been applied to synthesize insights and test strategic hypotheses. All findings have been peer-reviewed by domain specialists to validate accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Heating Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Heating Equipment Market, by Fuel Type

- Heating Equipment Market, by Product Type

- Heating Equipment Market, by Mechanism

- Heating Equipment Market, by End User

- Heating Equipment Market, by Distribution Channel

- Heating Equipment Market, by Region

- Heating Equipment Market, by Group

- Heating Equipment Market, by Country

- United States Heating Equipment Market

- China Heating Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3816 ]

Synthesizing Key Findings to Illuminate the Path Forward for a Resilient and Sustainable Heating Equipment Ecosystem

By synthesizing emerging technological trends, evolving regulatory landscapes, and shifting consumer priorities, this executive summary underscores the imperative for agility and innovation in the heating equipment industry. Organizations that embrace electrification pathways, leverage digital solutions, and proactively manage supply chain exposures will be best positioned to navigate the challenges of tariff volatility and carbon reduction mandates. The convergence of sustainable design, smart connectivity, and streamlined operations offers a compelling blueprint for growth and resilience in a landscape defined by rapid transformation.

Take the Next Step Toward Informed Decision-Making and Secure Exclusive Insights with Executive Report Acquisition

To explore comprehensive market intelligence that delves into technological breakthroughs, competitive positioning, and regulatory influences shaping the future of heating equipment, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He can guide you through tailored report options and help you secure actionable insights that will inform strategic decisions, drive revenue growth, and enhance market positioning.

Connect with Ketan to discover how this in-depth analysis can empower your organization to stay ahead in a rapidly evolving landscape and capitalize on emerging opportunities.

- How big is the Heating Equipment Market?

- What is the Heating Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?