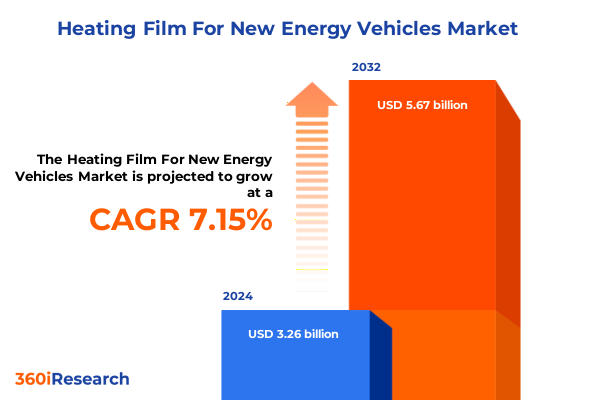

The Heating Film For New Energy Vehicles Market size was estimated at USD 3.50 billion in 2025 and expected to reach USD 3.77 billion in 2026, at a CAGR of 7.13% to reach USD 5.67 billion by 2032.

Harnessing Next-Generation Heating Films to Optimize Thermal Management and Passenger Comfort Across Diverse Climates in New Energy Vehicles

Heating films have emerged as a pivotal technology within new energy vehicles by addressing the escalating need for precise and efficient thermal regulation. As battery electric vehicles proliferate across varied climates, maintaining optimal battery temperature during cold starts has become essential to preserve energy density, extend cycle life, and ensure reliable range. Innovative solutions such as self-regulating graphene positive temperature coefficient (PTC) heaters rapidly elevate battery modules to their ideal operating window, even in subzero conditions, safeguarding performance and reducing energy wastage during preheating.

Beyond thermal battery management, passenger comfort has been revolutionized by the integration of ultra-thin graphene heater inks within seating and steering wheel elements. These next-generation films eliminate bulky wiring harnesses while delivering uniform warmth in under ten seconds at a fraction of the power draw of wire-based systems. As vehicle interiors prioritize weight reduction and space efficiency, heating films offer a dual advantage of enhanced comfort and extended driving range, underscoring their strategic value in the evolution of new energy automotive design.

Unveiling the Technological and Material Breakthroughs Revolutionizing Heating Film Design and Efficiency in Electric and Hybrid Vehicles

The heating film landscape has undergone rapid transformation driven by breakthroughs in material science and printing technologies. Traditional resistive-wire heaters are increasingly supplanted by carbon fiber and graphene-based films that leverage nanomaterials to achieve faster warm-up times, superior thermal uniformity, and lower power consumption. Graphene heater inks, for example, enable direct deposition onto flexible substrates, integrating seamlessly into seat assemblies and defogging elements while reducing system complexity and mass.

In parallel, manufacturers are embracing multi-layer carbon fiber films that marry woven and non-woven configurations to balance mechanical resilience with thermal conductivity. These hybrid carbon fiber architectures are now being deployed in steering wheel and cushion heating modules to deliver targeted warmth and rapid responsiveness. Furthermore, smart heating films embedded with thin-film sensors and conductive traces are ushering in zonal temperature control, enabling adaptive comfort based on occupancy and ambient conditions.

Emerging positive temperature coefficient (PTC) heating materials, often based on metal film or polymer sensors, offer autonomous self-regulation, enhancing safety and simplifying control systems. As a result, electric resistance heating and metal film PTC solutions are being combined in layered formats to optimize heat output curves across varying power budgets. This confluence of advanced materials, self-regulating properties, and digital integration is redefining the standards for thermal management in electric and hybrid vehicles.

Examining the Far-Reaching Effects of 2025 United States Import Tariffs on Heating Film Components for New Energy Vehicles

In 2025, United States import policy has imposed sweeping tariffs affecting the supply chain for heating film components. A presidential proclamation under Section 232 has ushered in a 25% tariff on imported passenger vehicles and light trucks as of April 2, 2025, with a subsequent 25% levy on automotive electrical components including modules crucial to heating films taking effect on May 3, 2025. These measures, intended to bolster domestic manufacturing, present significant cost challenges for films and conductive materials sourced globally.

Simultaneously, anti-dumping duties targeting Chinese battery graphite have been preliminarily set at 93.5%, effectively creating prohibitive rates when combined with existing duties. Graphite, a foundational element in carbon fiber and graphene precursor materials, may see supply constraints as U.S. purchasers evaluate alternative suppliers or invest in domestic graphite beneficiation. Moreover, the continuation of 100% tariff rates on finished electric vehicles and lithium-ion battery cells underscores an intensifying trade environment that will reshape procurement strategies for film manufacturers and OEMs alike.

The cumulative impact of these tariff adjustments demands adaptive sourcing, increased local content strategies under USMCA provisions, and accelerated investments in North American production capacities to maintain cost competitiveness and secure supply continuity.

Unpacking Critical Segmentation Trends Across Material Types, Applications, Vehicle Categories, Sales Channels, and Technology Types in Heating Films

The heating film market is characterized by granular segmentation that illuminates nuanced opportunities across material compositions, applications, vehicle categories, distribution pathways, and heating technologies. Materials range from woven and non-woven carbon fiber films offering structural robustness and efficient heat transfer to ultra-thin graphene films prized for their exceptional conductivity and rapid response. Complementing these are PET films, valued for their cost efficiency and ease of integration into defogging and cabin heating applications.

Applications have expanded well beyond traditional seat warming to include precise battery preheating, comprehensive backrest and cushion heating modules for ergonomic comfort, steering wheel warming solutions for enhanced driver engagement, and windshield and mirror defogging systems critical for safety in adverse weather. Vehicle type segmentation spans across battery electric, fuel cell electric, and plug-in hybrid platforms, with commercial and passenger variations driving divergent performance and durability requirements.

Distribution channels bifurcate into OEM partnerships and aftermarket channels, the latter subdivided into digital platforms and brick-and-mortar outlets that cater to retrofit demand and regional service networks. Finally, technology typologies intersect electric resistance heating, metal film PTC, and positive temperature coefficient materials, where conventional film-based resistance and wire-based configurations coexist with innovative PTC films that self-regulate to prevent overheating. This layered segmentation matrix provides a roadmap for stakeholders to tailor strategies across niche segments and emerging growth pockets.

This comprehensive research report categorizes the Heating Film For New Energy Vehicles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Application

- Vehicle Type

- Sales Channel

- Technology Type

Exploring Regional Dynamics Shaping Heating Film Adoption Across the Americas, Europe Middle East & Africa, and Asia-Pacific Territories

In the Americas, the confluence of stringent environmental mandates, incentives for cold-weather electric vehicle deployment, and robust OEM investments is driving accelerated adoption of advanced heating films. U.S. and Canadian regulators have introduced subsidies and tax credits to support energy-efficient thermal management solutions, prompting manufacturers to localize film production and integrate self-regulating PTC technologies to mitigate power draw concerns.

Across Europe, the Middle East, and Africa, premium automakers are embracing graphene-based seat and steering wheel heaters to meet exacting standards for energy conservation and passenger well-being. Germany’s leading luxury brands have showcased graphene-enhanced cabin heating packages, demonstrating up to 40% reductions in energy consumption compared to legacy wire systems. Regulatory frameworks such as the EU’s Fit for 55 initiative underscore the importance of minimizing operational emissions, further reinforcing the value proposition of efficient heating films.

Asia-Pacific remains the largest manufacturing hub and growth engine for heating film technologies, anchored by major suppliers in China and South Korea. With over 40% of China’s automotive heating film production capacity concentrated among leading players and Korean specialists embedding IoT-enabled thermal cabin solutions in millions of vehicles, the region is at the forefront of scaling ultra-thin, rapid-response films to global markets.

This comprehensive research report examines key regions that drive the evolution of the Heating Film For New Energy Vehicles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Drivers Shaping the Competitive Landscape of Heating Film Solutions for New Energy Vehicles

A handful of specialized suppliers and technology innovators command a significant share of the heating film ecosystem. Tongcheng dominates China’s landscape with proprietary graphene nanotechnology capable of heating from –40°C to 60°C in under thirty seconds, leveraging scale and R&D alliances to address cold-climate EV performance challenges. Hanon Systems of South Korea has gained prominence by integrating smart thermal cabin solutions-combining heating films with HVAC controls and embedded sensors-into global OEM platforms, capturing a growing share of luxury and mass-market segments.

In the realm of material specialization, Haydale’s graphene heater inks have catalyzed a new category of ultra-thin seat and mirror defogging films that outperform wired elements on speed and efficiency, ushering in transformative design possibilities for interior architects and system integrators. Complementing these innovations, Heatix’s self-regulating graphene PTC battery heaters offer a compelling solution for cold-climate preconditioning, reducing startup energy draw and enhancing battery longevity without the risk of dry burning.

Leading automotive OEMs, including BMW with its iX SUV, have rapidly adopted graphene-based heating elements to extend range and elevate passenger comfort, fueling a virtuous cycle of demand that encourages further material and process optimization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Heating Film For New Energy Vehicles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- BorgWarner Inc.

- BYD Company Limited

- Continental AG

- Daikin Industries Ltd.

- Denso Corporation

- DuPont de Nemours Inc.

- Eberspächer Group

- Gentherm Incorporated

- Hanon Systems

- Hitachi Astemo Ltd.

- LG Chem Ltd.

- Magna International Inc.

- Mahle GmbH

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Saint-Gobain Sekurit

- Samsung SDI Co. Ltd.

- Toyota Boshoku Corporation

- Valeo SA

- Webasto Group

- ZF Friedrichshafen AG

Strategic Pathways and Practical Recommendations for Industry Leaders Capitalizing on Heating Film Innovations in the EV Supply Chain

Industry participants should prioritize strategic partnerships that blend material science expertise with system integration capabilities. Collaborations between film material developers and OEM thermal system architects can accelerate co-development of tailored solutions that align with unique vehicle architectures while minimizing design iterations.

As supply chain dynamics evolve under tariff pressures and raw material constraints, diversifying sourcing strategies through dual procurement channels and investing in localized manufacturing footprints will be essential to mitigate risk and control cost inflation. Establishing regional centers of excellence for heating film assembly can ensure compliance with origin requirements and expedite time to market.

Companies must also pursue continuous innovation in self-regulating PTC and nanomaterial-based films, integrating digital sensing and control features that enhance safety, zonal comfort, and diagnostic visibility. Leveraging modular film designs and standardized interfaces will enable faster application across multiple vehicle lines and aftermarket retrofit programs.

Finally, proactive engagement with regulatory bodies and industry consortia can shape evolving standards around energy efficiency, materials sustainability, and safety validation. Early involvement can unlock incentive programs, inform policy directions, and position leading firms as trusted partners in the transition to electrified mobility.

Detailing Robust Research Methodologies and Data Collection Approaches Underpinning Comprehensive Analysis of Heating Film Markets

This analysis is grounded in a rigorous mixed-methods research framework combining primary interviews with key technology suppliers, OEM thermal system engineers, and regulatory experts alongside a review of patent filings, technical white papers, and industry conference proceedings. Proprietary material characterization data was supplemented with third-party laboratory performance assessments to validate thermal response times, power consumption profiles, and durability metrics under cyclic temperature conditions.

Secondary research included a systematic evaluation of trade policies, tariff annuity schedules, and origin rules affecting heating film supply chains, leveraging government publications, trade commission notices, and customs bulletins. Segmentation analyses drew on technical specifications, application roadmaps, and integration case studies across carbon fiber, graphene, PET, metal film, and wire-based heating solutions.

Regional insights were informed by policy reviews, incentive scheme analyses, and OEM production announcements, enabling a comprehensive mapping of adoption drivers in the Americas, EMEA, and Asia-Pacific. Competitive intelligence was enriched through patent landscaping and market share estimations derived from import–export shipment data and corporate disclosures.

Findings were synthesized using triangulation to ensure convergent validity, with key trends and strategic implications distilled through a cross-functional editorial committee consisting of thermal systems engineers, materials scientists, and market analysts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Heating Film For New Energy Vehicles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Heating Film For New Energy Vehicles Market, by Material Type

- Heating Film For New Energy Vehicles Market, by Application

- Heating Film For New Energy Vehicles Market, by Vehicle Type

- Heating Film For New Energy Vehicles Market, by Sales Channel

- Heating Film For New Energy Vehicles Market, by Technology Type

- Heating Film For New Energy Vehicles Market, by Region

- Heating Film For New Energy Vehicles Market, by Group

- Heating Film For New Energy Vehicles Market, by Country

- United States Heating Film For New Energy Vehicles Market

- China Heating Film For New Energy Vehicles Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Drawing Conclusive Insights on the Role of Advanced Heating Films in Propelling the Performance and Market Maturity of New Energy Vehicles

Advanced heating films represent a transformative enabler for new energy vehicles, unlocking gains in battery performance, passenger comfort, and energy efficiency across diverse operating environments. The convergence of carbon fiber weaving techniques, graphene ink applications, and self-regulating PTC formulations has yielded a versatile toolkit for automotive designers seeking lighter, faster, and smarter thermal management solutions.

The imposition of new U.S. tariffs and anti-dumping duties has introduced supply chain complexities that warrant strategic realignment and local manufacturing investments. Meanwhile, disparate regional policies-from North American origin requirements to Europe’s energy efficiency mandates and Asia-Pacific’s scale-driven innovation-underscore the importance of tailored market approaches.

Leading suppliers and OEMs are already demonstrating the value of collaborative development, digital integration, and material innovation, signaling a maturing landscape where performance differentiation and cost control coalesce. As the industry transitions from proof-of-concept to mass adoption, heating films will play a pivotal role in reinforcing the resilience and competitiveness of electric and hybrid vehicle portfolios worldwide.

Take action today to partner with Associate Director Ketan Rohom for exclusive access to a deep dive new energy vehicle heating film market report

Ready to explore the full breadth of actionable data, in-depth competitive analysis, and strategic recommendations detailed in our comprehensive report? Connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure immediate access to the definitive study on heating film opportunities in the new energy vehicle landscape. Benefit from personalized guidance on leveraging our insights to enhance your market positioning, optimize product portfolios, and stay ahead of regulatory and technological shifts. Contact Ketan Rohom today to discuss your specific requirements and unlock exclusive research pricing tailored to your organizational goals.

- How big is the Heating Film For New Energy Vehicles Market?

- What is the Heating Film For New Energy Vehicles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?