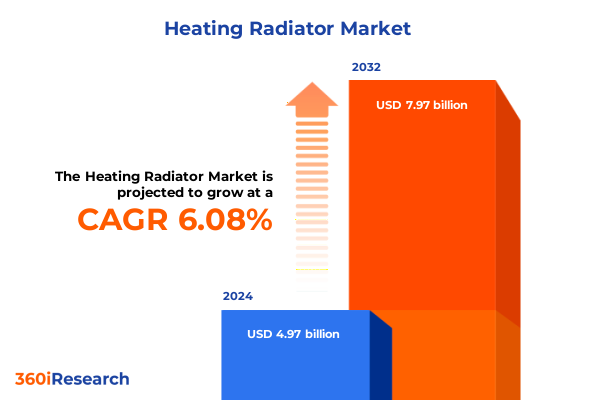

The Heating Radiator Market size was estimated at USD 4.97 billion in 2024 and expected to reach USD 5.26 billion in 2025, at a CAGR of 6.08% to reach USD 7.97 billion by 2032.

Understanding the Resurgent Role of Heating Radiators in Modern Energy-Efficient Building Designs and Sustainability-Focused Infrastructures

In today’s rapidly evolving built environment, heating radiators are experiencing a renaissance as key enablers of energy efficiency and occupant comfort. Far from their traditional role as mere heat emitters, modern radiator systems are now integral components of holistic building strategies aimed at reducing carbon footprints and optimizing energy consumption. This resurgence is driven by stringent regulatory frameworks focused on decarbonization, rising consumer awareness around sustainability, and the increasing affordability of advanced materials and smart controls.

As buildings continue to account for a substantial share of global energy use, decision-makers are seeking solutions that deliver reliable warmth without compromising eco-friendly goals. Radiators, especially those tailored for water-based hydronic systems and electrified alternatives, offer a compelling combination of retrofit convenience and compatibility with renewable energy sources. Moreover, their integration into smart building management systems is opening new avenues for predictive maintenance and real-time energy optimization, underscoring the sector’s pivotal role in next-generation infrastructure.

Decoding the Next Wave of Innovation Shaping the Heating Radiator Sector Through Technological Breakthroughs and Emerging Consumer Preferences

Over the past few years, the heating radiator landscape has undergone transformative shifts driven by technological breakthroughs and evolving customer preferences. Smart home ecosystems now routinely integrate wireless thermostatic radiator valves that adapt to occupant behavior, enabling dynamic heat zoning and delivering unprecedented levels of comfort and efficiency. Concurrently, manufacturers are exploring novel materials such as high-performance aluminum alloys and composites, which reduce thermal mass and enhance responsiveness to control signals.

Equally significant is the growing convergence of aesthetic design and functional performance. Contemporary interior design trends have propelled the adoption of low-profile panel radiators and designer column units that blend seamlessly with architectural finishes. This emphasis on form and function is complemented by advances in surface coatings that improve corrosion resistance and reduce maintenance cycles. Together, these developments are redefining customer expectations, spurring legacy players to innovate and new entrants to carve out distinctive niches.

Assessing How Ongoing Tariff Policies Have Consistently Altered Procurement Strategies and Production Costs in the United States Heating Radiator Industry

Tariff policies implemented over the past several years have left an indelible mark on the cost structures and supply chain strategies of heating radiator manufacturers operating in the United States. Section 232 measures on steel and aluminum imports, first introduced in 2018, continue to reverberate through the supply side, elevating raw material costs and prompting firms to reevaluate sourcing from traditional low-cost jurisdictions. At the same time, Section 301 duties on certain imports have compelled many organizations to diversify their supplier base to minimize exposure to geopolitical risk.

As a result, companies are increasingly investing in domestic production capacity or negotiating long-term contracts with regional partners to mitigate price volatility. These adjustments, while improving supply chain resilience, carry implications for capital expenditure and may accelerate the shift toward higher-value, premium product lines. In parallel, upward pressure on input costs is leading distributors and end users to seek value-added services-such as integrated controls and full-service maintenance packages-to offset incremental price increases.

Unearthing Highly Detailed Segmentation Dynamics That Drive Product Adoption Patterns Across Diverse Energy Types Mounting Options and Installation Preferences

A nuanced segmentation framework reveals the multifaceted drivers of radiator adoption across energy type, mounting configuration, distribution pathways, installation context, end-user category, material composition, and product flavor. From the energy perspective, the market bifurcates into electric systems, prized for rapid heat delivery and retrofit simplicity, and hot water setups that capitalize on existing hydronic infrastructure for efficiency and integration with renewable heating sources.

Mounting choices range from classic column-mounted units renowned for their high thermal inertia to sleek floor-standing modules and versatile wall-mounted designs, which further divide into concealed installations for minimal visual impact and exposed variants that double as architectural accents. Meanwhile, distribution channels span traditional offline partners-distributors, specialty outlets, and mass-market hypermarkets-to direct-to-consumer e-commerce platforms and manufacturer portals, each channel reflecting evolving buyer preferences and service expectations.

Installation scenarios differentiate new builds, encompassing fresh construction and renovation projects, from replacement interventions that target either complete system upgrades or component-level swaps. End-user segments further stratify the market: commercial environments such as hospitality venues, office complexes, and retail spaces demand scalable solutions with advanced controls; industrial applications stress durability and customized configurations; residential dwellings, whether multi-family units or single-family homes, prioritize user-friendly interfaces and aesthetic integration.

Material innovation underpins these developments. Aluminum radiators, cast or extruded, offer lightweight performance and rapid response, while cast iron variants-available in ductile or gray iron-deliver unmatched longevity and heat retention. Steel radiators, whether pressed or welded, strike a balance between cost and durability. Product types span baseboard heaters, column units available in single, double, or triple sections, panel models including single and double panels as well as double convector designs, and niche towel radiators that serve bath and hospitality markets.

This comprehensive research report categorizes the Heating Radiator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Source

- Mounting Type

- Building Type

- Application

- Distribution Channel

Interpreting Critical Regional Nuances and Market Behaviors Spanning the Americas Europe the Middle East and Africa and Asia-Pacific for Strategic Expansion

Regional distinctions are shaping divergent growth trajectories in the heating radiator sector. Within the Americas, the United States and Canada lead renovation-driven demand, buoyed by incentives for energy retrofits and a surge in smart home investments. Latin America, though more price-sensitive, is witnessing gradual adoption of electric radiator systems as grid reliability challenges and urban electrification projects advance.

Across Europe, stringent building performance standards and robust retrofit programs are elevating demand for high-efficiency hydronic radiators, while the Middle East’s rapid commercial and hospitality expansion favors large-format floor-standing and custom designer radiators. In Africa, nascent infrastructure investments and rising living standards are creating pockets of opportunity, particularly in urban centers where modern apartment complexes seek reliable, low-maintenance heating options.

In the Asia-Pacific region, dynamic urbanization in China, India, and Southeast Asia is driving large-scale residential and commercial developments that increasingly prioritize energy-efficient HVAC solutions. Moreover, government mandates on building codes in Australia and Japan are accelerating the shift toward integrated control systems, underscoring the region’s role as a proving ground for next-generation radiator technologies.

This comprehensive research report examines key regions that drive the evolution of the Heating Radiator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Gleaning Strategic Insights into Key Market Players Driving Innovation Operational Excellence and Competitive Differentiation in the Heating Radiator Space

A handful of established manufacturers continue to dominate the global radiator landscape by leveraging deep engineering expertise and extensive distribution networks. European leaders renowned for precision casting and low-temperature hydronic systems have set the bar for product reliability and thermal performance. In parallel, newer entrants from Asia are gaining traction through disruptive pricing models and streamlined e-commerce fulfillment channels.

Strategic partnerships and joint ventures are reshaping competitive dynamics. Companies with legacy portfolios are forging alliances with technology firms to embed connectivity features, while forward-looking players are acquiring specialized coating and materials businesses to shorten time-to-market for advanced product lines. This wave of consolidation and cross-sector collaboration highlights the imperative for agility and continuous innovation in maintaining market relevance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Heating Radiator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arbonia GmbH

- Beizhu Group Co., Ltd.

- Carisa Radiators Ltd

- Chromalox by Spirax-Sarco Engineering plc

- Daikin Industries Ltd.

- Danfoss A/S

- Hudson Reed

- Hunt Heating

- Industrias Royal Termic, S.L.

- IRSAP S.p.a.

- Kartell UK

- Kermi GmbH

- KORADO GROUP

- Mestek, Inc.

- MHS Radiators Ltd

- Paladin Radiators

- Purmo Group Plc

- REHAU Pty Ltd

- Reina Group

- Robert Bosch GmbH

- Scudo by Harrison Bathrooms Ltd.

- Slant/Fin Baseboard

- Smith's Environmental Products

- Stelrad Group plc

- TERMA SP. Z OO

- U.S. Boiler Company, LLC

- Zehnder Group AG

- ZheJiang Nuociss HVAC Technology Co.,Ltd.

Implementing Actionable Tactics to Capitalize on Emerging Trends Optimize Supply Chains and Enhance Profitability Amidst Shifting Competitive Pressures

To thrive amid intensifying competition and evolving consumer expectations, industry leaders must pursue a multi-pronged strategic agenda. First, investing in smart radiator platforms that seamlessly interface with building management systems will capture growing demand for digitalized climate control, enabling predictive maintenance and energy optimization. By integrating sensors and analytics, manufacturers can offer value-added services that extend beyond hardware sales and foster long-term customer loyalty.

Next, diversifying material portfolios to include high-performance aluminum and advanced steel composites can address varied end-user preferences-from lightweight retrofit solutions to durable industrial applications. Parallel to product R&D, optimizing supply chain resilience through nearshoring and strategic sourcing partnerships will mitigate the ongoing effects of tariff fluctuations and logistical disruptions, thereby stabilizing margins.

Expanding direct-to-OEM and direct-to-consumer digital channels will complement traditional distribution networks, driven by consumers’ increasing comfort with online purchasing and demand for seamless ordering experiences. This digital pivot should be accompanied by robust after-sales service frameworks, offering remote diagnostics and modular replacement options to reduce lifecycle costs and elevate brand reputation.

Finally, collaborating proactively with regulatory bodies and industry associations to shape performance standards and sustainability guidelines will position organizations as thought leaders. Securing certifications for low embodied carbon and recyclability can differentiate offerings in environmentally conscious markets, while partnerships with renewable heat technology providers will open new avenues for integrated system solutions.

Outlining a Robust Research Methodology Emphasizing Data Integrity Multi Source Triangulation and Rigorous Qualitative Quantitative Analysis Practices

This report synthesizes a comprehensive research methodology designed to ensure data integrity and actionable insights. Primary research involved in-depth, semi-structured interviews with heating system engineers, HVAC contractors, and senior executives from leading radiator manufacturers. Coupled with these qualitative engagements were structured online surveys targeting distributors, wholesalers, and end users to capture real-world purchasing behaviors and product performance feedback.

Secondary research comprised exhaustive reviews of industry association publications, regulatory compliance documents, and peer-reviewed engineering journals to validate technological trends and performance benchmarks. To enhance the robustness of our findings, all data streams underwent multi-source triangulation, cross-checking supply-side inputs against distribution channel intelligence and end-user adoption patterns.

Rigorous quantitative analyses were conducted using statistical software to identify correlations between tariff policies and price movements, while thematic coding techniques were applied to qualitative interview transcripts to uncover emerging market narratives. Throughout the research lifecycle, an advisory panel of subject-matter experts provided continuous peer review, ensuring that interpretations remained grounded in practical industry realities and reflected the latest technological advancements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Heating Radiator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Heating Radiator Market, by Product Type

- Heating Radiator Market, by Material

- Heating Radiator Market, by Source

- Heating Radiator Market, by Mounting Type

- Heating Radiator Market, by Building Type

- Heating Radiator Market, by Application

- Heating Radiator Market, by Distribution Channel

- Heating Radiator Market, by Region

- Heating Radiator Market, by Group

- Heating Radiator Market, by Country

- United States Heating Radiator Market

- China Heating Radiator Market

- France Heating Radiator Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 3040 ]

Drawing Conclusive Strategic Perspectives on Future Radiator Technology Adoption Market Synergies and Evolving Regulatory Dynamics

In conclusion, the heating radiator market stands at the confluence of sustainability mandates, digital innovation, and shifting trade policies. The sector’s future will be shaped by the successful integration of smart control technologies, material innovations that enhance performance and responsiveness, and strategic supply chain realignments that mitigate the lingering impact of tariffs.

Segmentation insights underscore the importance of tailored solutions-from electric radiators in retrofit scenarios to premium hydronic units in commercial complexes-while regional nuances reveal differentiated pathways to growth across mature and emerging markets. Leading companies are those that combine operational excellence with forward-looking partnerships, enabling them to adapt swiftly to evolving consumer demands and regulatory landscapes.

Ultimately, the organizations best positioned to capture value are those that treat radiators not merely as static appliances but as dynamic, interconnected components of intelligent building ecosystems. By embracing a holistic approach that integrates product design, data-driven services, and sustainable practices, industry leaders can unlock new revenue streams and cement their roles as stewards of a lower-carbon built environment.

Seize the Opportunity to Access Comprehensive Heating Radiator Market Intelligence by Partnering with Ketan Rohom for Advanced Strategic Guidance

To unlock unparalleled insights tailored to your strategic imperatives in the heating radiator sector, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His deep domain expertise and customer-centric approach will ensure you receive bespoke guidance on how to leverage the data and analyses contained in this report. By partnering with Ketan, you can transform generalized observations into actionable strategies designed specifically for your organization’s goals and operational context. Reach out today to arrange a personalized consultation, and take the definitive step toward elevating your competitive advantage with the most comprehensive market intelligence available.

- How big is the Heating Radiator Market?

- What is the Heating Radiator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?