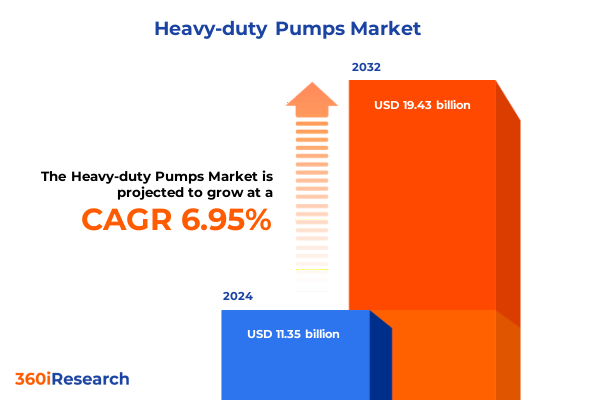

The Heavy-duty Pumps Market size was estimated at USD 12.08 billion in 2025 and expected to reach USD 12.86 billion in 2026, at a CAGR of 7.02% to reach USD 19.43 billion by 2032.

Unveiling the Critical Foundations of the Heavy-Duty Pump Sector through a Comprehensive Overview of Emerging Trends, Core Drivers, and Strategic Context

Heavy-duty pumps serve as the backbone of critical industries worldwide, facilitating fluid transport in sectors ranging from oil and gas to water treatment. Their robust design and operational reliability make them indispensable for maintaining uninterrupted processes in harsh environments. As global infrastructure projects accelerate and industrial modernization advances, understanding the foundational forces that shape this market has become a vital priority for decision-makers.

Against a backdrop of shifting supply chains and heightened sustainability pressures, heavy-duty pump manufacturers and end-users alike are navigating an evolving competitive landscape. Robust capital expenditures in energy, mining, and municipal projects underscore the ongoing demand for pumps engineered to deliver high efficiency and durability. Simultaneously, technological innovations in materials and control systems are rapidly redefining performance benchmarks.

This executive summary distills essential market insights into a concise overview. It introduces key transformative trends, examines the cumulative implications of United States tariff actions in 2025, and unveils segmentation and regional nuances that will shape strategic planning. By exploring leading corporate strategies and offering actionable recommendations, this analysis lays the groundwork for informed decision-making and sustainable value creation.

Exploring the Pivotal Technological Innovations and Sustainability Imperatives Catalyzing Transformative Shifts in the Heavy-Duty Pump Market Landscape

Innovations in digital connectivity and heightened environmental standards are catalyzing a profound transformation within the heavy-duty pump market. Industry stakeholders are adopting predictive maintenance powered by IoT sensors to reduce unplanned downtime, while advanced analytics facilitate real-time performance optimization. These technological enhancements not only extend equipment lifecycles but also generate operational efficiencies that translate directly into cost savings.

Concurrently, regulatory bodies worldwide are imposing stricter energy efficiency and emissions requirements, prompting manufacturers to integrate variable frequency drives and energy-saving impellers into pump designs. Such sustainability imperatives are fostering the development of next-generation materials, including high-performance alloys and composite polymers that resist corrosion and cavitation under extreme conditions. As a result, product lifespans are increasing and maintenance intervals are lengthening, fundamentally shifting value propositions.

Furthermore, the market is witnessing emerging business models such as pump-as-a-service agreements, where OEMs provide equipment installation, monitoring, and maintenance under outcome-based contracts. These innovative offerings underscore a strategic shift from traditional transactional relationships to long-term partnerships focused on shared performance goals. Taken together, these technological and sustainability-driven dynamics are reshaping competitive paradigms and unlocking new avenues for growth.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Measures on Heavy-Duty Pump Supply Chains, Costs, and Competitiveness

In 2025, the implementation of revised United States tariff measures has reshaped the economic calculus for heavy-duty pump manufacturers and distributors. Increased duties on key pump components and raw materials have elevated landed costs, compelling companies to reassess sourcing strategies and explore alternative supply hubs. For many, this has meant diversifying procurement beyond traditional regions or renegotiating contracts to mitigate cost escalations.

Simultaneously, organizations are navigating the operational complexities introduced by these tariffs. Extended lead times, inventory restocking challenges, and administrative compliance burdens have become commonplace. To maintain competitive pricing, end-users in oil and gas, mining, and power generation sectors are weighing in-house fabrication against imported solutions, often leveraging additive manufacturing or localized assembly hubs to circumvent tariff impacts.

While short-term price pressures have been significant, these measures have also stimulated strategic realignment within the industry. Businesses are expediting investments in automation and digital tracking to enhance supply chain resilience and traceability. In parallel, collaborative ventures between manufacturers and logistic partners are emerging to streamline customs procedures and optimize cross-border transit. Ultimately, the cumulative effect of United States tariffs in 2025 has driven a more agile, diversified, and innovation-oriented market ecosystem.

Unraveling Intricate Segmentation Patterns across Pump Types, End-Use Industries, Power Sources, and Material Preferences Driving Market Dynamics

A deep understanding of market segmentation reveals the nuanced drivers behind heavy-duty pump demand. When categorized by pump type, centrifugal solutions dominate routine high-flow applications, particularly in multi-stage configurations that deliver exceptional pressure outputs, while single-stage designs offer streamlined maintenance. Diaphragm pumps address the need for leak-free handling of corrosive or viscous fluids. Within the positive displacement segment, reciprocating mechanisms serve high-pressure scenarios, and rotary variants-encompassing gear, lobe, and screw designs-excel in metering and gentle fluid transfer. Submersible models, meanwhile, integrate pumping and sealing in compact units ideal for deep-well and sewage contexts.

Examining end-use industries further refines market perspectives. Commodity chemicals rely on robust pump systems for continuous processing, whereas specialty chemicals demand precise flow control and corrosion resistance. Food and beverage sectors value sanitary design in brewery, dairy, and packaged food operations. Surface and underground mining operations exert extreme wear conditions, just as upstream, midstream, and downstream oil and gas applications impose unique pressure and material specifications. Nuclear, renewable, and thermal power plants prioritize reliability under critical safety standards, while industrial and municipal water and wastewater facilities focus on energy efficiency and environmental compliance.

Power source segmentation underscores operational priorities: diesel-powered units offer portability and on-site flexibility, electric pumps deliver low operating costs and integration potential, gas-driven systems bridge remote installations, and steam turbines leverage existing plant energy flows. Material preferences-ranging from the toughness of alloy steel to the cost efficiency of cast iron and the corrosion resistance of stainless steel-further dictate application suitability and lifecycle economics. Together, these segmentation lenses equip stakeholders with a holistic view of market demand patterns and performance expectations.

This comprehensive research report categorizes the Heavy-duty Pumps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pump Type

- Power Source

- Pump Material

- End Use Industry

Comparative Examination of Regional Performance Drivers and Market Nuances across the Americas, EMEA, and Asia-Pacific Heavy-Duty Pump Domains

Regional market dynamics are shaped by distinctive economic, regulatory, and infrastructural factors. In the Americas, robust investments in oil and gas expansion, followed by upgrades in municipal water treatment facilities, underpin steady demand for heavy-duty pumps. State and provincial incentive programs for renewable energy projects have further catalyzed interest in electric-driven units, while aging infrastructure initiatives prompt fleet modernization and retrofit opportunities.

Meanwhile, Europe, the Middle East, and Africa present a heterogeneous landscape. Western Europe leads in stringent energy efficiency benchmarks and circular economy mandates, incentivizing advanced material and digital integration. The Middle East’s capital-intensive oil and gas sector continues to drive specialized high-pressure pump orders, supported by sovereign wealth fund investments in petrochemical capacity. In Africa, infrastructure development funds and mining expansion projects are elevating the need for reliable, ruggedized pumping solutions tailored to remote locations and harsh climates.

Asia-Pacific stands out for its accelerated industrialization and urbanization trends. Rapid growth in chemical and power generation capacities, coupled with large-scale water management programs, signals sustained heavy-duty pump procurement. Technological adoption is defined by competitive manufacturing hubs in China, India, and Southeast Asia, where cost-effective production coincides with a swift transition toward digitalized maintenance regimes. These diverse regional narratives underscore the importance of tailored strategies for market entry, channel partnerships, and product adaptation.

This comprehensive research report examines key regions that drive the evolution of the Heavy-duty Pumps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Competitive Movements Shaping Innovation, Partnerships, and Market Positioning in Heavy-Duty Pumps

Leading corporations continue to redefine market boundaries through targeted investments, strategic partnerships, and breakthrough innovations. Industry stalwarts with a global footprint leverage extensive OEM networks to deliver comprehensive aftermarket services, while nimble specialists focus on niche applications that demand bespoke designs and rapid customization. Collaborative ventures between electronics suppliers and traditional pump manufacturers are driving the integration of smart monitoring solutions, yielding advanced predictive maintenance offerings that enhance uptime and reduce total cost of ownership.

Strategic acquisitions have emerged as a key growth lever, enabling companies to expand material science capabilities, enter new geographic markets, or augment digital service portfolios. Joint research initiatives with academic institutions and government laboratories are accelerating advancements in corrosion-resistant coatings and energy-efficient impeller geometries. Concurrently, bespoke financing models-such as performance-based leasing and outcome-oriented service contracts-are reshaping customer engagement frameworks.

In response to escalating competition, market leaders are strengthening their brand propositions by emphasizing sustainability credentials and compliance with global regulatory standards. They are also deploying regional centers of excellence to localize production and reduce lead times. By synthesizing these strategic maneuvers, it becomes clear that the competitive landscape is evolving toward a hybrid model blending product excellence with service innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Heavy-duty Pumps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- Aspen Pumps Limited

- Atlas Copco AB

- Baker Hughes Company

- Crompton Greaves Consumer Electricals Limited

- Ebara Corporation

- Flowserve Corporation

- Gardner Denver

- Gates Corporation

- GEA Group Aktiengesellschaft

- General Electric Company

- Grundfos Holding A/S

- Ingersoll Rand, Inc.

- ITT Inc.

- KSB AG

- LUBI Industries LLP

- MAN Energy Solutions

- Metso Corporation

- Oilon OY

- Siemens AG

- SKF Group

- Star Refrigeration Ltd.

- Sulzer Ltd.

- Thermax Ltd.

- Weir Group PLC

Crafting Targeted Strategic Recommendations to Empower Industry Leaders in Navigating Competitive Pressures and Capitalizing on Emerging Opportunities

Industry leaders must prioritize agility and foresight to maintain a competitive edge as market dynamics evolve. By investing in digital twins and advanced simulation tools, organizations can optimize pump design and predict maintenance needs before operational disruptions occur. Coupled with cloud-based asset monitoring, this approach enables real-time data analytics to inform strategic decisions and extend equipment lifecycles.

Supply chain diversification is equally critical. Companies should establish secondary sourcing hubs and strengthen relationships with logistics partners to mitigate tariff-related cost impacts and geopolitical uncertainties. Localized assembly and modular design principles can further enhance responsiveness to client requirements while reducing lead times.

Sustainability initiatives should be embedded across the product lifecycle. Adopting energy-efficient drive technologies, specifying recyclable materials, and offering end-of-life reclamation programs will not only meet regulatory demands but also resonate with environmentally conscious customers. Collaborative innovation with end-users can uncover application-specific opportunities to reduce carbon footprints, such as integrating waste-heat recovery systems in steam turbine-driven pumps.

By aligning investment strategies with these imperatives-digital transformation, supply chain resilience, and sustainability-industry players can unlock new revenue streams, strengthen customer loyalty, and position themselves as trusted partners in the heavy-duty pump ecosystem.

Detailing the Rigorous Research Methodology and Analytical Framework Underpinning Comprehensive Assessment of the Heavy-Duty Pump Market

This analysis employs a multi-tiered research methodology designed to deliver rigorous and reliable insights. Primary research was conducted through structured interviews with OEM executives, distribution channel partners, and end-use industry experts. These discussions provided qualitative perspectives on demand drivers, technological adoption, and competitive strategies.

Secondary data sources, including regulatory publications, technical journals, and proprietary white papers, were systematically reviewed to validate quantitative findings and contextualize market trends. We cross-referenced corporate financial disclosures, press releases, and patent filings to track strategic movements and innovation trajectories. The integration of these data sets enabled a robust triangulation process, ensuring the accuracy of segmentation breakdowns and regional analyses.

Quantitative modeling techniques were applied to assess tariff impacts, price elasticity, and regional demand forecasts. Scenario analysis was utilized to test sensitivity under varying regulatory and economic conditions. Finally, internal validation workshops with industry stakeholders confirmed that the conclusions and recommendations align with real-world experiences. This comprehensive framework ensures that the insights presented are both actionable and grounded in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Heavy-duty Pumps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Heavy-duty Pumps Market, by Pump Type

- Heavy-duty Pumps Market, by Power Source

- Heavy-duty Pumps Market, by Pump Material

- Heavy-duty Pumps Market, by End Use Industry

- Heavy-duty Pumps Market, by Region

- Heavy-duty Pumps Market, by Group

- Heavy-duty Pumps Market, by Country

- United States Heavy-duty Pumps Market

- China Heavy-duty Pumps Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesizing Core Findings and Forward-Looking Perspectives to Illuminate Future Trajectories in the Heavy-Duty Pump Industry

Having examined technological disruptions, policy impacts, market segments, regional distinctions, and competitive strategies, this summary coalesces into a cohesive understanding of the heavy-duty pump landscape. The convergence of digital innovation and sustainability mandates has redefined operational benchmarks, while 2025 tariff shifts have underscored the need for agile supply chain strategies.

Segmentation insights offer a granular view of how pump type configurations, end-use requirements, power source options, and material selections dictate performance criteria across diverse applications. Regional analysis highlights the varied growth dynamics and regulatory environments that demand localized approaches, and corporate profiling illustrates how strategic alliances and service-oriented models are becoming key differentiators.

Looking ahead, organizations that embrace data-driven decision-making, diversify sourcing, and embed sustainable practices will be best positioned to capitalize on emerging opportunities. The collective insights derived from this research provide a robust foundation for steering investments, guiding product development, and fostering long-term value creation in the heavy-duty pump sector.

Seize Strategic Advantage with In-Depth Heavy-Duty Pump Market Intelligence—Partner with Ketan Rohom to Access the Full Research Report Today

To unlock unparalleled insights and drive your strategic initiatives forward, secure full access to the comprehensive heavy-duty pump market research report by reaching out to Ketan Rohom, Associate Director, Sales & Marketing. He can guide you through tailored solutions that align precisely with your organizational objectives, ensuring that you leverage the most up-to-date segmentation breakdowns, tariff impact analyses, and region-specific forecasts.

By partnering with Ketan, you gain direct access to granular data on pump type performance, end-use industry trends, power source efficiencies, and material preferences, all synthesized into actionable intelligence. This collaboration will equip your team with the clarity needed to optimize product portfolios, refine go-to-market strategies, and identify high-growth opportunities.

Engaging with Ketan Rohom guarantees a personalized consultation to address your unique challenges, from mitigating supply chain disruptions to capitalizing on emerging technological shifts. His expertise in translating complex market dynamics into strategic roadmaps ensures you can outmaneuver competitors and secure sustainable growth.

Contact Ketan today to initiate your purchase process and take the first step toward making informed, data-driven decisions that accelerate profitability and market leadership. The full report awaits to become your definitive guide in the evolving heavy-duty pump landscape.

- How big is the Heavy-duty Pumps Market?

- What is the Heavy-duty Pumps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?