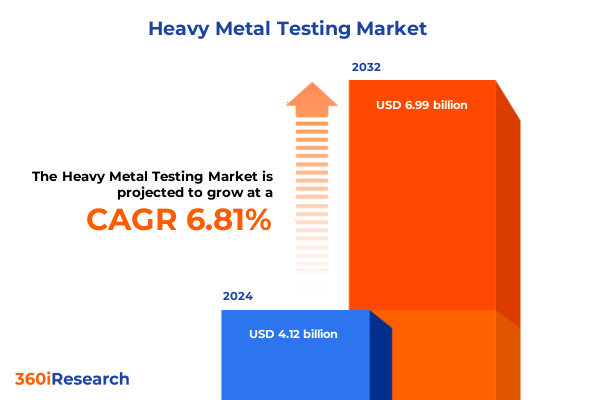

The Heavy Metal Testing Market size was estimated at USD 4.39 billion in 2025 and expected to reach USD 4.68 billion in 2026, at a CAGR of 6.86% to reach USD 6.99 billion by 2032.

Unveiling the Pivotal Role of Heavy Metal Testing in Ensuring Environmental Safety, Regulatory Compliance, and Public Health Protection

Heavy metals such as lead, mercury, cadmium, arsenic, and chromium pose persistent threats to environmental safety and public health, requiring rigorous analytical oversight across water, soil, food, and industrial processes. These elements accumulate through natural and anthropogenic activities, infiltrating food chains, contaminating drinking water, and causing neurological, renal, and developmental damage in humans and wildlife. As urbanization and industrial operations expand globally, the imperative for precise, reliable heavy metal detection has never been greater, driving demand for advanced testing solutions.

Regulatory agencies worldwide have strengthened legislation to monitor and limit heavy metal exposures, compelling laboratories, manufacturers, and environmental bodies to adopt stringent testing protocols. In the United States, the Lead and Copper Rule under the Safe Drinking Water Act has evolved through multiple revisions to enforce tighter action levels and corrosion controls, underscoring the critical role of analytical accuracy in safeguarding water quality. Moreover, the Food and Drug Administration’s Closer to Zero initiative targets reductions of lead, arsenic, cadmium, and mercury in infant and young children’s foods, exemplifying the intersection of policy and analytical rigor.

Against this backdrop, laboratories are embracing both traditional and emerging technologies-from atomic absorption spectroscopy to mass spectrometry platforms-to ensure the detection of heavy metals at trace levels. These advancements support compliance mandates, bolster supply chain integrity, and protect vulnerable populations. With increasing public scrutiny of environmental contaminants and a growing emphasis on sustainability, heavy metal testing stands at the forefront of efforts to maintain ecological balance and human well-being.

Emerging Technological Innovations and Market Forces Revolutionizing Heavy Metal Testing Across Industries

The heavy metal testing landscape is undergoing a profound transformation driven by innovations in instrumentation, digitalization, and workflow automation. Leading manufacturers are integrating artificial intelligence and machine learning into analytical platforms to optimize method development, decrease analysis time, and enhance data reliability. For example, the latest mass spectrometry systems feature smart algorithms that automatically adjust tuning parameters, reducing manual calibration and accelerating time to result.

In parallel, the rise of portable and handheld devices has expanded testing beyond centralized laboratories into field applications. Handheld XRF and portable water quality analyzers enable near real-time screening for contaminants, supporting rapid decision-making in environmental assessments, emergency response, and on-site compliance verification. Furthermore, cloud-enabled data management systems are streamlining collaboration across geographies, allowing stakeholders to access, review, and archive heavy metal profiles securely in real time.

Additionally, sustainability considerations are reshaping product design and consumable usage. Manufacturers are introducing green chemistry principles to reduce hazardous reagents, promote recyclable materials, and minimize waste generation. At conferences such as ASMS 2025, industry leaders showcased HPLC and GC/MS instruments certified under environmental standards, demonstrating a commitment to both analytical excellence and ecological stewardship. Moving forward, these transformative shifts will redefine laboratory operations, enabling faster, more accurate analyses while aligning with global sustainability goals.

Assessing the Comprehensive Economic and Strategic Consequences of 2025 U.S. Tariff Policies on Heavy Metal Testing Supplies

In 2025, new tariff frameworks imposed by the U.S. government created a complex economic environment for laboratories and suppliers of heavy metal testing equipment and consumables. In April, a universal 10% tariff was applied to most imported goods, followed by country-specific increases that elevated duties on Chinese laboratory-related products to a cumulative rate of 145%. This drastic escalation has increased procurement costs for instruments, reagents, and reference materials, compelling organizations to reevaluate sourcing strategies and supplier relationships.

The elevated tariffs have had cascading effects across supply chains. Specialty chemical manufacturers, dependent on intermediates and reagents from affected regions, have faced feedstock cost surges estimated between 8% and 15%, driving margin compression and longer lead times due to front-loaded shipments and shifting logistics. Consequently, laboratories have experienced budgetary pressures, causing some to delay capital expenditures on new instrumentation and prioritize in-house maintenance of existing platforms.

Retaliatory measures by trade partners have further complicated market dynamics, with European and Asian suppliers exploring alternative markets and bypass strategies. In response, U.S. laboratories are increasingly forging partnerships with domestic distributors, investing in USMCA-compliant procurement, and exploring in-country manufacturing options to mitigate tariff exposure. As the trade landscape evolves, stakeholders must remain agile, balancing cost considerations with the necessity of maintaining analytical rigor and regulatory compliance.

Analyzing Product Offerings, Sample Types, Technologies, End Users, and Applications as Drivers of Heavy Metal Testing Market Evolution

The heavy metal testing market is defined by an intricate interplay of product offerings, sample diversity, analytical technologies, end-user requirements, and application scopes that collectively shape service delivery and investment priorities. Consumables and reagents, encompassing acids, buffers, color reagents, filters, tubes, reference standards, and sample preparation kits, form the foundational components that laboratories rely on for precision. Meanwhile, instruments such as handheld XRF, LIBS analyzers, portable water quality platforms, and UV-Vis spectrophotometers provide versatile analytical capabilities, augmented by software solutions that automate workflows and data management processes.

Across sample types, the diverse nature of testing matrices-from blood, hair, tissue, and urine in biological analyses to air, sediment, soil, and water in environmental assessments-demands tailored protocols and sensitivity thresholds. Food and beverage testing spans beverages, dairy, grains, grains and cereals, seafood, and produce, each presenting unique matrix challenges. In industrial environments, corrosion products, effluents, process streams, and sludge require robust instrumentation that can withstand harsh conditions, while pharmaceutical materials, both excipients and finished dosage forms, necessitate compliance with stringent pharmacopoeial standards.

Analytical technology selection further influences market direction, with atomic absorption and fluorescence spectroscopy, electrochemical methods, ICP-MS and ICP-OES, neutron activation, and X-ray fluorescence spectroscopy addressing various detection limits and throughput requirements. The adoption of multi-quad ICP-MS platforms offers enhanced interference removal for trace-level determinations. End-user segmentation highlights laboratories across environmental testing, food and beverage manufacturing, regulatory agencies, healthcare providers, mining and metallurgy operations, pharmaceutical companies, and academic research institutions, each driving distinct demand signals based on regulatory mandates and quality assurance needs.

Within application domains, clinical and biomedical testing emphasizes patient safety and diagnostic certainty, environmental testing balances compliance and ecosystem protection, food safety and quality laboratories focus on consumer health, industrial and manufacturing sectors prioritize process control and waste management, mining and metallurgy operations center on ore grade analysis and workplace safety, and pharmaceutical and cosmetic testing underpins drug safety and product integrity. Together, these segmentation layers demonstrate the multifaceted nature of heavy metal testing and underscore the necessity for integrated solutions that span the entire analytical workflow.

This comprehensive research report categorizes the Heavy Metal Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Offering

- Sample Type

- Testing Technology

- End User

- Application

Exploring Key Regional Dynamics Shaping the Future of Heavy Metal Testing Markets across the Americas, EMEA, and APAC

Regional dynamics play a pivotal role in shaping heavy metal testing market trends, with each geographic zone exhibiting distinct drivers and challenges. In the Americas, regulatory frameworks such as the U.S. EPA’s Lead and Copper Rule and Canada’s aquatic life protection standards have elevated testing requirements, leading to high adoption rates of ICP-MS and atomic absorption platforms. The region’s robust pharmaceutical and food industries also contribute to sustained demand for trace elemental analysis, supported by investments in advanced instrumentation and domestic reagent manufacturing to offset trade tariffs.

Europe, Middle East, and Africa benefit from harmonized standards under the EU’s REACH regulation and the Water Framework Directive, driving cross-border collaboration on contamination monitoring and risk assessment. Growing environmental consciousness in EMEA has led to increased funding for independent testing laboratories and mobile analytical services to rapidly address pollution incidents. Meanwhile, emerging economies within the region are digitizing laboratory operations and integrating cloud-based reporting to enhance transparency and accelerate decision-making processes.

In Asia-Pacific, rapid industrialization and stringent food safety regulations in countries such as China, India, Japan, and Australia are fueling demand for heavy metal testing across water, soil, and agricultural sectors. Investments in domestic analytical technology development and government initiatives to modernize public health laboratories are expanding market opportunities. Additionally, regional trade agreements and supply chain diversification efforts are mitigating risks associated with tariffs and geopolitical tensions, leading to greater resilience in reagent and instrument procurement. Collectively, these regional insights underscore the importance of tailoring strategies to local regulatory landscapes, economic priorities, and technological capabilities.

This comprehensive research report examines key regions that drive the evolution of the Heavy Metal Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategies in Advancing Heavy Metal Testing Solutions and Services

The heavy metal testing landscape is dominated by a cohort of global leaders whose portfolios span instruments, consumables, software, and services. Thermo Fisher Scientific has reinforced its position through the introduction of the iCAP MX Series ICP-MS, offering high-matrix tolerance and simplified trace elemental analysis across environmental, food safety, and industrial applications. This platform combines single and triple quadrupole options with advanced tuning technologies to extend maintenance intervals and optimize throughput.

Agilent Technologies continues to drive innovation with its InfinityLab Pro iQ Series for LC/MS and enhanced 8850 GC systems, integrating My Green Lab certification and smart assist features that automate instrument control and diagnostics. These solutions target high-sensitivity small molecule analyses and low-footprint lab environments, catering to life sciences, environmental, and food safety laboratories seeking both performance and sustainability.

PerkinElmer has expanded its multi-quad ICP-MS offerings with the NexION 300 and QSight 500 LC/MS/MS systems, addressing complex sample matrices and high-throughput contaminant screening such as PFAS, pesticides, and emerging toxins. These instruments emphasize robustness and reproducibility for laboratories confronting stringent regulatory testing cycles and diverse application demands.

Complementary providers-Bruker, Shimadzu, Hitachi High-Tech, and Metrohm-have continued to refine niche capabilities, including handheld XRF analyzers, laser-induced breakdown spectroscopy systems, and potentiometric sensors, thereby broadening the ecosystem of heavy metal testing solutions. Through targeted R&D investments and strategic partnerships, these companies are enhancing data analytics, method development services, and application support, positioning themselves to capture emerging opportunities across sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Heavy Metal Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc

- Albemarle Corporation

- Alkemist Labs

- AlpHa Measurement Solutions LLC

- ALS Limited

- Applied Technical Services, LLC

- AsureQuality Limited

- Aurora Biomed Inc.

- BJP Laboratories Pty Ltd.

- Brooks Applied Labs by IEH Company

- Consumer Product Testing Company, Inc.

- EMSL Analytical, Inc.

- Eurofins Scientific Inc.

- Ichor Health

- Intertek Group PLC

- LGC Limited

- Merck KGaA

- Microbac Laboratories, Inc.

- Mérieux NutriSciences Corporation

- Quicksilver Scientific, Inc.

- SGS Société Générale de Surveillance SA

- Southern Scientific Services Ltd.

- Standard Analytical Laboratory (ND) Pvt.

- TPS Laboratories PVT LTD.

- TÜV SÜD AG

- UFAG Laboratorien AG

- ZRT Laboratory

Actionable Strategic Initiatives to Enhance Competitive Advantage and Resilience in the Heavy Metal Testing Sector

To navigate the evolving heavy metal testing marketplace, industry leaders should prioritize strategic diversification of supply chains. Establishing multiple sourcing channels for reagents and consumables across regions reduces vulnerability to tariff fluctuations and logistical disruptions. Concurrently, investing in domestic production capabilities and collaborating with local distributors can stabilize access to critical laboratory materials while fostering resilience against future trade policy changes.

Innovation remains a cornerstone of competitive advantage. Companies must accelerate R&D efforts to integrate automation, artificial intelligence, and miniaturized instrumentation that lower total cost of ownership and expand field applicability. By streamlining workflows through digital platforms and predictive maintenance, organizations can optimize resource utilization and improve data quality, ultimately supporting faster decision making and risk mitigation.

Furthermore, fostering strategic alliances between instrument manufacturers, software providers, and end-users enhances solution interoperability and method development. Such collaborations can yield standardized protocols that streamline regulatory compliance and facilitate cross-industry benchmarking. In addition, sustainability initiatives-from green chemistry in consumables manufacturing to energy-efficient instrument design-will resonate with stakeholders increasingly focused on environmental stewardship, offering both reputational and operational benefits.

Rigorous Multimodal Research Approach Underpinning Insights into the Heavy Metal Testing Market Landscape

This analysis is grounded in a rigorous, multimodal research framework combining secondary and primary data collection. Secondary research involved an exhaustive review of regulatory documents, peer-reviewed scientific literature, press releases from leading instrument providers, and publicly available company filings to map industry developments, technology launches, and tariff policies.

Primary insights were derived from structured interviews with stakeholders across environmental testing laboratories, food safety authorities, pharmaceutical quality assurance teams, and academic researchers. These conversations elucidated operational challenges, adoption drivers, and procurement considerations in diverse end-user settings. Quantitative data were synthesized through a proprietary database tracking global product launches, patent filings, and trade flows to identify emerging trends and competitive positioning.

Furthermore, regional case studies were incorporated to contextualize regulatory impacts and infrastructure readiness in key markets. Methodological rigor was ensured through data triangulation, validity checks against independent expert panels, and iterative feedback loops with industry practitioners. This comprehensive approach underpins the credibility of findings and supports actionable recommendations tailored to varying market segments and geographic regions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Heavy Metal Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Heavy Metal Testing Market, by Product Offering

- Heavy Metal Testing Market, by Sample Type

- Heavy Metal Testing Market, by Testing Technology

- Heavy Metal Testing Market, by End User

- Heavy Metal Testing Market, by Application

- Heavy Metal Testing Market, by Region

- Heavy Metal Testing Market, by Group

- Heavy Metal Testing Market, by Country

- United States Heavy Metal Testing Market

- China Heavy Metal Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Bringing Together Insights to Highlight Trends, Challenges, and Opportunities in Heavy Metal Testing Markets Worldwide

The confluence of stringent regulatory mandates, technological breakthroughs, and shifting trade environments has positioned heavy metal testing as an indispensable pillar of environmental protection, public health, and industrial quality assurance. Collaborative efforts between instrument manufacturers, software innovators, and laboratories have enhanced detection capabilities, driving methodological precision across diverse sample matrices.

However, the cumulative impact of elevated tariffs and geopolitical uncertainties underscores the need for strategic resilience in supply chains and procurement practices. Laboratories and suppliers must balance cost management with sustained investment in high-performance instrumentation, ensuring that analytical capabilities keep pace with evolving regulatory thresholds and sustainability objectives.

Looking ahead, the maturation of cloud-based analytics, field-deployable instruments, and green chemistry initiatives will redefine value propositions in heavy metal testing. By embracing integrated solutions and strategic collaborations, industry stakeholders can unlock new efficiencies, enhance data integrity, and reinforce the critical role of heavy metal analysis in safeguarding environmental and human well-being.

Engage With Our Associate Director to Secure Exclusive Access to the Definitive Heavy Metal Testing Market Research Report

For tailored guidance on leveraging these insights to drive growth and mitigate risks in the evolving heavy metal testing market, connect with Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly with Ketan, you can gain personalized recommendations, explore custom data packages, and secure early access to proprietary findings that will empower your organization’s strategic decision-making. Take this opportunity to equip your team with the definitive analysis and recommendations needed to stay ahead in a competitive landscape and ensure your investments in heavy metal testing deliver maximum value.

- How big is the Heavy Metal Testing Market?

- What is the Heavy Metal Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?