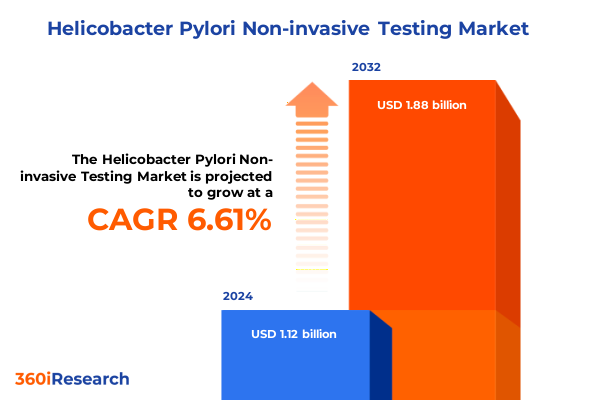

The Helicobacter Pylori Non-invasive Testing Market size was estimated at USD 1.19 billion in 2025 and expected to reach USD 1.27 billion in 2026, at a CAGR of 6.70% to reach USD 1.88 billion by 2032.

Unveiling the Vital Importance of Non-Invasive Helicobacter pylori Diagnostics in Enhancing Early Detection, Patient Comfort, and Clinical Outcomes

Helicobacter pylori remains one of the most pervasive pathogens affecting the human gastrointestinal tract, responsible for an estimated 26,890 new cases of stomach cancer in the United States in 2024 and nearly 11,000 related deaths, underscoring its critical public health impact. This bacterium colonizes the gastric mucosa of approximately one-third of the U.S. population, with infection rates disproportionately higher among racial and ethnic minority groups-reaching seroprevalence as high as 77% in some communities. Given its established role in peptic ulcer disease, chronic gastritis, and gastric malignancies, early and accurate detection of H. pylori is essential for reducing morbidity and improving clinical outcomes.

In response to the discomfort and risks associated with invasive endoscopic biopsies, non-invasive diagnostic methodologies have emerged as the frontline strategy for H. pylori detection. These approaches encompass serologic assays, which detect immunoglobulins directed against H. pylori antigens; stool antigen tests identifying bacterial proteins in fecal samples; and urea breath tests that leverage the organism’s urease activity to generate a measurable isotope-labeled carbon dioxide signature. Each modality offers a balance of sensitivity, specificity, patient convenience, and procedural simplicity, making non-invasive testing the cornerstone of test-and-treat strategies and surveillance protocols.

As healthcare systems grapple with evolving patient expectations, rising demand for outpatient diagnostics, and calls for value-based care, non-invasive H. pylori testing delivers on multiple fronts. It enhances patient compliance by eliminating the need for sedation or endoscopy, aligns with reimbursement frameworks favoring outpatient diagnostics, and supports antibiotic stewardship through accurate detection. This executive summary chronicles the landscape of non-invasive H. pylori diagnostics, illuminating drivers, challenges, and strategic imperatives for stakeholders across clinical, commercial, and regulatory domains.

Exploring the Rapid Technological Evolution in Helicobacter pylori Non-Invasive Testing Fueled by Point-of-Care Diagnostics, Biosensor Innovations, and Molecular Advancements

The non-invasive Helicobacter pylori testing arena is undergoing a profound transformation, driven by rapid technological innovations and a relentless focus on patient-centered care. Traditional laboratory-based serology and stool antigen assays are now complemented by sophisticated point-of-care (POC) platforms capable of delivering molecular insights at the bedside or in primary care settings without the need for complex infrastructure. These POC devices harness polymerase chain reaction (PCR) and next-generation sequencing (NGS) techniques to detect not only the presence of H. pylori DNA but also genetic markers of antibiotic resistance, particularly clarithromycin resistance mutations, enabling clinicians to tailor eradication regimens in a single visit to optimize outcomes and curb the emergence of resistant strains.

Concurrently, biosensor technologies have emerged as a disruptive force, offering rapid, sensitive, and portable detection modalities. Electrochemical and optical biosensors designed for breath or saliva samples are under active development, promising to detect urease activity or specific H. pylori antigens in minutes, thereby reducing turnaround times and expanding testing access in remote or resource-limited environments. These innovations are further bolstered by digital integration frameworks that link POC devices to electronic health records and telemedicine platforms, extending diagnostic capabilities into home-based and virtual care models, and supporting population screening initiatives in underserved regions.

This technological renaissance is complemented by personalized medicine paradigms, whereby non-invasive assays are engineered to quantify bacterial load, assess virulence factors, and characterize host immune responses. Advanced immunoassays leverage monoclonal and polyclonal antibody platforms, while infrared and mass spectrometry techniques provide granular molecular profiles, laying the groundwork for predictive analytics and risk stratification. These transformative shifts underscore a future in which H. pylori detection transcends mere presence-absence testing, evolving into a comprehensive clinical decision-support tool.

Assessing the Far-Reaching Consequences of the 2025 United States Tariff Measures on Imported Non-Invasive H pylori Testing Kits and Supply Chains

The imposition of broad United States tariffs in April and May of 2025 has introduced new complexities for the non-invasive Helicobacter pylori testing market. A baseline global tariff of 10% on most imported goods remains in effect, despite a temporary 90-day pause on a subset of levies, while country-specific duties include 125% on China, 31% on Switzerland, and 20% on the European Union. These measures extend to diagnostic test kits and their constituent reagents, which are classified as medical devices under U.S. 510(k) provisions when manufactured outside the country.

Consequently, manufacturers with facilities located overseas face immediate cost pressures as the additional duties are translated into elevated prices for essential components such as urea substrates, isotope tracers, monoclonal antibodies, and PCR reagents. Companies with limited domestic production capabilities are thus compelled to either absorb increased costs, potentially compressing margins, or pass these costs along to end-users, resulting in higher prices for urea breath test kits, stool antigen assays, and serologic panels. Ongoing negotiations by industry associations underscore concerns that these tariffs may undermine patient access to timely H. pylori diagnostics and delay treatment initiation.

To mitigate tariff-induced disruptions, leading in vitro diagnostics (IVD) companies must evaluate strategic shifts in supply chain architectures. Options include rationalizing global manufacturing footprints by expanding U.S.-based production, seeking exemptions for critical medical products, or redesigning kits to incorporate domestically sourced reagents. Stakeholders should monitor policy developments closely, engage with trade regulators, and explore collaborative frameworks to secure tariff relief or phased duty reductions, thereby preserving affordability and continuity of care.

Delving into Comprehensive Market Segmentation Insights to Understand Nuanced Dynamics across Test Types, Technologies, End Users, and Distribution Channels

The non-invasive Helicobacter pylori testing market is delineated by multiple segmentation layers that collectively capture nuanced demand drivers and adoption patterns. By test type, serology tests are subdivided into immunoglobulin classes IGa, IGg, and IGm, each offering distinct temporal insights into past or active infections. Stool antigen assays leverage both monoclonal and polyclonal antibody formats, with monoclonal tests favored for higher specificity and consistent lot-to-lot performance. Urea breath tests represent a standalone category that measures urease activity, prized for accuracy in real-time infection assessment.

From a technology standpoint, immunoassays predominate, with enzyme-linked immunosorbent assays (ELISA) serving as laboratory standards and rapid immunoassays facilitating point-of-care deployment. Infrared spectrometry platforms deliver label-free detection by quantifying isotope-enriched carbon dioxide, while mass spectrometry techniques, including gas chromatography-mass spectrometry (GC-MS) and liquid chromatography-mass spectrometry (LC-MS), underpin high-throughput, multiplexed assay systems that integrate seamlessly with centralized diagnostic laboratories.

End users span gastroenterology clinics and primary care settings, where test-and-treat protocols for dyspeptic patients drive demand, as well as diagnostic laboratories equipped for batch processing and specialized hospitals-secondary care centers managing peptic ulcer disease and tertiary institutions conducting complex cases and research trials. Distribution channels bifurcate into offline pathways such as medical supply distributors and hospital procurement units, and online portals offering direct purchasing options to clinics and consumers, each channel calibrated to deliver kits, reagents, and consumables via differentiated logistics solutions.

This comprehensive research report categorizes the Helicobacter Pylori Non-invasive Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Technology

- End User

- Distribution Channel

Illuminating Regional Dynamics Shaping the Adoption and Growth of Non-Invasive Helicobacter pylori Testing in the Americas, EMEA, and Asia-Pacific

Across the Americas, the United States leads market expansion for non-invasive H. pylori diagnostics, propelled by favorable reimbursement policies, robust healthcare infrastructure, and a high incidence of dyspeptic and gastric cancer cases. In 2023, North America accounted for nearly USD 97.7 million in non-invasive H. pylori test revenues, a testament to proactive screening programs and the integration of non-invasive assays into primary care pathways. Canadian and Latin American markets exhibit growth potential as governments prioritize early detection and align regulatory frameworks with test-and-treat strategies.

Within Europe, the Middle East, and Africa, adoption patterns are heterogeneous. European markets embrace urea breath tests as the diagnostic gold standard per Maastricht Consensus guidelines, while stool antigen assays gain traction in regions with established laboratory networks. However, disparities in healthcare funding and variable guideline implementation contribute to uneven penetration across EMEA countries. In the Middle East and Africa, limited diagnostic infrastructure and lower awareness of H. pylori’s oncogenic risk slow adoption, although government-led initiatives and international partnerships are increasingly addressing these gaps.

In the Asia-Pacific region, the epidemiological burden of H. pylori infection-affecting up to 70% of populations in certain countries-drives urgent testing demand. High-volume markets such as China and India are witnessing rapid uptake of cost-effective stool antigen kits and POC breath test devices, supported by rising healthcare spending and expanding diagnostic networks in urban and rural settings. Governments are also piloting community-based screening campaigns aimed at reducing gastric cancer incidence, further catalyzing market growth.

This comprehensive research report examines key regions that drive the evolution of the Helicobacter Pylori Non-invasive Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation and Competitive Strategies in the Global Non-Invasive Helicobacter pylori Testing Market

Market leadership in non-invasive H. pylori testing is concentrated among established diagnostics firms and emerging innovators, each pursuing differentiated strategies. Abbott Laboratories is recognized for its Clearview™ H. pylori One Step Antigen Test Device, delivering rapid stool antigen results in under 10 minutes. Cardinal Health and Cardinal’s Fisher Scientific division supply a broad portfolio of urea breath test kits and ELISA-based serology panels, leveraging global distribution networks to support hospital systems and laboratories.

Meridian Bioscience’s ImmunoCard STAT! HpSA stool antigen assay has gained prominence for its robust sensitivity of 92.6% and specificity of 88.5%, while Quidel Corporation’s breath test offerings integrate infrared spectrometry detection modules for isotope-labeled carbon dioxide measurement, catering to both outpatient clinics and centralized labs. Bio-Rad Laboratories specializes in high-throughput immunoassays, and Certest Biotech has expanded its molecular diagnostics capabilities to include PCR-based resistance genotyping kits.

Emerging players such as Gulf Coast Scientific and Tri-Med Corp are focusing on point-of-care innovations, including lateral flow immunoassays and portable biosensor platforms tailored for decentralized testing. These companies are forging partnerships with telemedicine providers and academic centers to validate novel POC molecular assays, with a particular emphasis on simultaneous detection of H. pylori presence and clarithromycin resistance markers. Such collaborations underscore a competitive landscape in which product differentiation, regulatory approvals, and strategic alliances shape market positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Helicobacter Pylori Non-invasive Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ACON Laboratories, Inc.

- Bio-Rad Laboratories, Inc.

- BIOHIT OYJ

- Biomerica, Inc.

- Boditech Med Inc.

- CerTest Biotec S.L.

- Medline Industries, Inc.

- Meridian Bioscience Inc.

- Metabolic Solutions, Inc.

- Quidel Corporation

- Sekisui Chemical Co., Ltd.

- Thermo Fisher Scientific Inc.

Outlining Actionable Strategic Recommendations for Industry Leaders to Navigate Challenges and Capitalize on Opportunities in H pylori Non-Invasive Testing

Industry leaders should prioritize localization of manufacturing and reagent supply to mitigate the financial impact of import tariffs. Establishing or expanding U.S.-based production facilities and forging partnerships with domestic chemical and reagent suppliers can reduce duty liabilities and ensure pricing stability. In parallel, advocacy for medical device tariff exemptions and engagement with industry associations will be critical to preserving cost-effective access to essential diagnostic kits.

Embracing point-of-care testing solutions and integrating antibiotic resistance detection into non-invasive assays can unlock new revenue streams and reinforce clinical value propositions. Companies should accelerate regulatory submissions for POC molecular platforms, capitalize on biosensor miniaturization, and develop multiplexed assays capable of simultaneous pathogen detection and resistance profiling. Strategic investment in telehealth integrations and digital reporting systems will enhance remote diagnostics and facilitate patient monitoring in ambulatory care models.

Finally, collaboration with healthcare providers to tailor reimbursement strategies and demonstrate cost-effectiveness through real-world evidence studies will strengthen market adoption. Cross-sector partnerships with public health agencies can support community screening initiatives, while targeted educational programs will elevate awareness among primary care practitioners, driving widespread adoption of non-invasive H. pylori testing.

Detailing a Robust and Transparent Research Methodology Undergirding the Insights and Analyses of the Non-Invasive Helicobacter pylori Testing Market

This analysis is founded on a rigorous research methodology integrating primary and secondary data sources. Industry expert interviews, conducted with leading diagnostics executives, gastroenterologists, and regulatory specialists, provided firsthand insights into market dynamics and strategic priorities. Secondary research encompassed peer-reviewed literature, including consensus guidelines and epidemiological studies from sources such as the American Cancer Society and the U.S. National Library of Medicine, as well as publicly available company reports and financial disclosures.

Quantitative data were extracted from government databases, trade associations, and proprietary market intelligence platforms to chart historical and current market trends, pricing structures, and shipment volumes. Regulatory frameworks and tariff schedules were reviewed through official government publications and legal notices. Segmentation definitions, test performance metrics, and technology categorizations were validated against established protocols and scientific consensus statements.

Analytical techniques such as SWOT analysis, Porter’s Five Forces, and scenario modeling underpinned the evaluation of competitive landscapes and external risk factors. Triangulation of data points ensured consistency and reliability, while peer review by subject-matter experts and iterative validation improved the precision of strategic recommendations. This transparent and multifaceted approach underlies the comprehensive insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Helicobacter Pylori Non-invasive Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Helicobacter Pylori Non-invasive Testing Market, by Test Type

- Helicobacter Pylori Non-invasive Testing Market, by Technology

- Helicobacter Pylori Non-invasive Testing Market, by End User

- Helicobacter Pylori Non-invasive Testing Market, by Distribution Channel

- Helicobacter Pylori Non-invasive Testing Market, by Region

- Helicobacter Pylori Non-invasive Testing Market, by Group

- Helicobacter Pylori Non-invasive Testing Market, by Country

- United States Helicobacter Pylori Non-invasive Testing Market

- China Helicobacter Pylori Non-invasive Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights and Strategic Imperatives to Highlight the Future Trajectory of Non-Invasive Helicobacter pylori Testing

Non-invasive Helicobacter pylori testing has emerged as a pivotal component of modern gastrointestinal healthcare, driven by the imperative to improve patient experience, enhance diagnostic accuracy, and optimize treatment pathways. The evolution from invasive biopsy-based methods to serologic, breath, and stool antigen assays reflects a broader shift toward patient-centric, value-based care. Technological advancements in point-of-care platforms, molecular diagnostics, and biosensor systems are reshaping the competitive landscape and expanding access across care settings.

However, the market faces headwinds from international tariff policies that threaten supply chain resilience and cost structures, necessitating strategic intervention through localized manufacturing and policy advocacy. Regional disparities in adoption underscore the need for tailored market entry strategies that address reimbursement landscapes and healthcare infrastructure variations. Leading companies are distinguishing themselves through rapid assay innovation, integrated resistance detection, and digital health integrations.

To sustain growth, industry stakeholders must invest in agile manufacturing, regulatory alignment, and stakeholder education. Collaborative efforts between private sector innovators, healthcare providers, and public health agencies will be essential to scale screening initiatives, drive guideline adherence, and ultimately reduce the global burden of H. pylori-associated diseases. This consolidated view of market trends, segmentation, regional dynamics, and strategic imperatives provides a roadmap for navigating the complexities of the non-invasive H. pylori testing landscape.

Engage with Ketan Rohom, Associate Director of Sales and Marketing, to Secure Your Comprehensive Market Research Report on Non-Invasive H pylori Testing

To obtain a deep dive into the competitive landscape, segmentation dynamics, regulatory considerations, and the strategic implications of the United States tariffs on non-invasive Helicobacter pylori testing, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expert team can guide you through tailored pricing structures and provide immediate access to the full research report. Connect with Ketan to explore custom data packages, prioritized client support, and a seamless purchase experience designed to accelerate your market entry and growth initiatives.

- How big is the Helicobacter Pylori Non-invasive Testing Market?

- What is the Helicobacter Pylori Non-invasive Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?