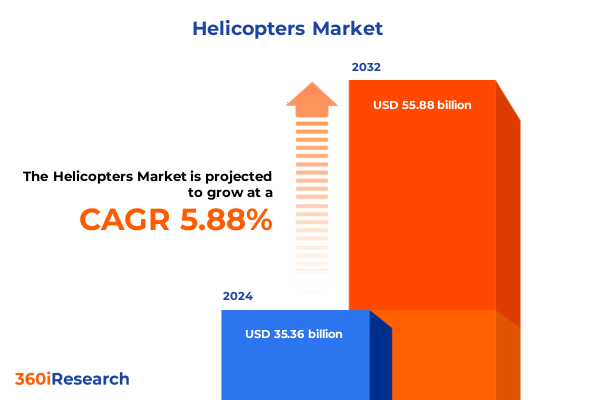

The Helicopters Market size was estimated at USD 37.34 billion in 2025 and expected to reach USD 39.44 billion in 2026, at a CAGR of 5.92% to reach USD 55.88 billion by 2032.

Setting the Stage for an In-Depth Executive Overview of Emerging Dynamics and Strategic Imperatives within the Global Rotary-Wing Aviation Sector

The helicopter industry occupies a pivotal role in today’s aviation ecosystem, serving as an adaptable solution across civil, commercial, and defense missions. From facilitating critical medical evacuations to supporting offshore energy operations and tactical military deployments, rotorcraft continue to demonstrate unmatched versatility and performance under challenging conditions. This venerable platform’s capacity to execute vertical takeoffs and landings, combined with ongoing technological refinements, reinforces its strategic importance within global transportation and security infrastructures.

As we embark on this executive summary, our goal is to illuminate the confluence of factors reshaping the rotary-wing market. Against a backdrop of regulatory innovation, technological breakthroughs, and evolving end-user requirements, stakeholders must navigate a complex terrain of emerging business models and competitive dynamics. By examining transformative shifts, geopolitical influences, and segmentation nuances, this analysis sets the stage for informed decision-making and the formulation of forward-looking strategies that harness the full potential of helicopter solutions.

Uncovering the Pivotal Technological, Regulatory, and Operational Transformations Reshaping Rotary-Wing Aircraft Development and Deployment

The helicopter sector is experiencing a profound metamorphosis driven by advances in propulsion technologies, automation systems, and decarbonization initiatives that collectively redefine aircraft capabilities and mission profiles. Industry frontrunners are pioneering hybrid-electric and fully electric powertrains, exemplified by Airbus Helicopters’ PioneerLab demonstrator, which aims to integrate a Pratt & Whitney Canada turbomachine with dual electric motors for enhanced efficiency and reduced carbon emissions by 2030. Concurrently, the FAA’s issuance of its first “powered-lift” regulations establishes the certification framework for eVTOL and hybrid tiltrotor aircraft, paving the way for advanced air mobility solutions that merge helicopter verticality with fixed-wing cruising performance.

Alongside technological progress, regulatory bodies and international consortia are forging safety and environmental standards to support novel rotorcraft architectures. The European Clean Sky 2 initiative and national research programs in France and Germany are underwriting studies on alternative fuels, composite materials, and autonomy systems to achieve significant reductions in noise and emissions. As the regulatory landscape evolves to accommodate these innovations, operators and OEMs are aligning their fleets and development pipelines to capitalize on emergent operational envelopes and market segments.

Assessing the Far-Reaching Consequences of Recent United States Trade Tariffs on Helicopter Supply Chains and Industry Economics in 2025 and Operational Margins

United States trade policy has introduced a series of tariffs throughout 2025, imposing levies on aluminum and steel imports and extending Section 301 measures on Chinese-origin aerospace components. The 25 percent tariffs on structural materials and a 10 to 15 percent duty on defense electronics have significantly inflated production costs across rotorcraft manufacturing and maintenance chains. Consequently, leading integrators and spare-part suppliers are recalibrating procurement strategies, prioritizing nearshoring and alternative suppliers in Taiwan and Europe to mitigate tariff-induced price surges.

These levies have not only strained margins for airframe and engine producers but also catalyzed a broader reevaluation of global supply networks. Major engine manufacturers, including RTX and GE Aerospace, anticipate aggregate tariff impacts exceeding $1 billion, necessitating cost-pass-through strategies and intensified engagement with domestic component vendors. While the disruptions have generated short-term financial headwinds, they also underscore the importance of supply chain resilience and diversified sourcing to sustain long-term sector growth and competitive differentiation.

Illuminating Critical Demand Drivers through Multi-Dimensional Segmentation Insights Spanning Type, Componentry, Propulsion, Weight, and Application Spectrums

A nuanced understanding of the helicopter market emerges when it is viewed through multiple segmentation lenses, each offering distinct insights into demand drivers and competitive behavior. Examining rotorcraft by type reveals diverging trajectories for coaxial and compound models, where the former addresses high-speed requirements and the latter integrates fixed-wing elements to extend range and payload capabilities; meanwhile, traditional single-main rotor platforms continue to dominate utility operations due to their proven reliability. Intermeshing rotor systems and tandem-rotor configurations cater to heavy-lift and specialized missions, while tilt-rotor designs are advancing toward commercialization under the FAA’s new powered-lift category.

Delving deeper into component-level segmentation highlights the criticality of avionics and propulsion upgrades. Avionics suites now converge flight control, communication, and navigation systems within integrated digital architectures, accelerating situational awareness and safety. Turboshaft engines coexist with emerging piston-powered models in light-class helicopters, even as hybrid and electric propulsion systems gradually penetrate the market. Landing gear and airframes are likewise benefiting from new composite materials, further enhancing performance and reducing maintenance demands.

When considering weight classes, heavy helicopters meet the logistical and military transport demand with robust lift capabilities, while medium and light variants address civil utility, emergency medical services, and offshore support with greater operational flexibility. Across propulsion systems, conventional fuel remains predominant, but the rise of electric and hybrid powerplants underscores a strategic shift toward sustainability. The application-driven segmentation landscape spans civil utility missions such as medevac and logistics, juxtaposed with military roles from attack and reconnaissance to maritime search and rescue, revealing a complex mosaic of end-use requirements and competitive dynamics.

This comprehensive research report categorizes the Helicopters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Propulsion System

- Weight Class

- Application

Dissecting Regional Helicopter Market Characteristics to Reveal Differential Trends and Strategic Opportunities across the Americas, EMEA, and Asia-Pacific

Regional disparities in economic indicators, regulatory frameworks, and infrastructure development are reshaping the geographic distribution of helicopter demand. The Americas continue to lead in civil rotary-wing adoption, buoyed by robust offshore energy operations, corporate transport services, and burgeoning EMS networks that leverage advanced avionics and mission-specific configurations. The United States’ investment in urban air mobility corridors and updated FAA regulations on powered-lift aircraft further position North America as a vanguard for next-generation rotorcraft deployment.

In Europe, Middle East & Africa, a combination of defense modernization programs and stringent environmental mandates is stimulating procurement of hybrid and electric-capable platforms. European nations are collaborating under Clean Sky initiatives to refine aerodynamic improvements and integrate sustainable aviation fuels, while the Middle East’s investment in heliports and training centers underscores a strategic focus on emergency response capabilities and VIP transport. Meanwhile, Africa’s nascent rotorcraft market is driven by critical NGO operations and resource exploration activities, fostering opportunities for light-class and medium-lift helicopters in remote areas.

The Asia-Pacific region exhibits dynamic growth, propelled by rapid urbanization and ambitious infrastructure projects that necessitate versatile rotary-wing solutions. National initiatives in China, Japan, and Australia promote indigenous manufacturing and regulatory adaptations to support local OEMs. Concurrently, rising interest in air taxi services is catalyzing partnerships between regional authorities and eVTOL technology providers, signaling a transformative shift toward advanced air mobility.

This comprehensive research report examines key regions that drive the evolution of the Helicopters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants to Uncover Strategic Partnerships, Competitive Positioning, and Innovation Trajectories among Helicopter Manufacturers

Leading rotorcraft manufacturers and service providers are forging strategic alliances and technology partnerships to maintain or expand their competitive positioning. Airbus Helicopters, for instance, enlisted Collins Aerospace and Pratt & Whitney Canada to develop the hybrid-electric PioneerLab demonstrator, aiming to validate a 30 percent reduction in fuel consumption by 2027 and to reinforce its sustainability credentials. Simultaneously, GE Aerospace and Airbus completed the first phase of their next-generation propulsion system study, focusing on engine efficiency and emissions reduction, which cements their collaborative commitment to future rotorcraft architectures.

Emergent players are also staking claims in niche segments, with tilt-rotor innovators advancing toward FAA certification and specialized unmanned rotorcraft entering anti-submarine and logistical missions. Legacy defense contractors have augmented their portfolios through targeted acquisitions, integrating advanced sensors, autonomy software, and composite materials into their product lines. This confluence of incumbents and disruptors underscores a competitive ecosystem where technological differentiation, aftermarket services, and ecosystem partnerships determine long-term market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Helicopters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SAS

- Alpi Aviation SRL

- Collins Aerospace by RTX Corporation

- Columbia Helicopters, LLC

- DB Aerocopter Ltd.

- Enstrom Helicopter Corporation

- Helicopteres Guimbal S.A.S

- Hiller Aircraft Corporation

- Hindustan Aeronautics Limited

- Kaman Corporation

- Karem Aircraft, Inc.

- Kawasaki Heavy Industries, Ltd.

- KOREA AEROSPACE INDUSTRIES, LTD.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MD HELICOPTERS LLC

- Mitsubishi Heavy Industries, Ltd.

- Robinson Helicopter Company

- Rotor X Aircraft

- Russian Helicopters

- Savback Helicopters AB

- Schweizer

- Subaru Corporation

- Textron, Inc.

- The Boeing Company

Defining Actionable Strategies and Tactical Imperatives to Drive Operational Efficiency, Supply Chain Resilience, and Market Penetration for Aviation Executives

To capitalize on evolving market dynamics, industry leaders should pursue a multi-pronged approach that fortifies resilience while driving innovation. Priority one involves establishing a robust supply chain network by qualifying multiple suppliers for critical materials and components, thereby mitigating tariff exposure and reducing single-source dependencies. Concurrently, integrating predictive maintenance analytics into fleet management can curtail downtime and optimize lifecycle costs, enhancing operator value propositions.

Adopting hybrid and electric propulsion technologies requires a commitment to co-development partnerships and pilot projects, with an emphasis on aligning R&D roadmaps to regulatory timelines for eVTOL certification. Cultivating cross-sector alliances with energy providers and infrastructure developers will facilitate the rollout of charging and hydrogen refueling networks essential for sustainable operations. Finally, executives should invest in workforce upskilling programs, ensuring that pilots, technicians, and engineers are equipped to support advanced avionics, autonomy features, and digitalized maintenance protocols.

Outlining Rigorous Methodological Framework Employing Multi-Source Data Collection, Analytical Techniques, and Validation Protocols to Ensure Research Integrity

This analysis synthesizes insights from an extensive research process combining primary interviews, secondary literature review, and proprietary data triangulation. Primary engagements included consultations with OEM executives, regulatory authorities, and end-users, capturing firsthand perspectives on regulatory shifts, technological adoption, and operational priorities. Secondary sources encompassed industry publications, regulatory filings, and investment disclosures to benchmark emerging trends against established benchmarks.

Quantitative data underpins the segmentation and impact assessments, while qualitative insights illuminate strategic considerations such as partnership dynamics and innovation drivers. Rigorous validation protocols ensured data integrity, including cross-referencing tariff measures with government trade notices and corroborating technological milestones through multiple independent announcements. This methodological framework provides a transparent and replicable foundation for the conclusions and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Helicopters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Helicopters Market, by Type

- Helicopters Market, by Component

- Helicopters Market, by Propulsion System

- Helicopters Market, by Weight Class

- Helicopters Market, by Application

- Helicopters Market, by Region

- Helicopters Market, by Group

- Helicopters Market, by Country

- United States Helicopters Market

- China Helicopters Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings to Provide a Compelling Narrative on the Evolution, Challenges, and Strategic Outlook of the Global Rotary-Wing Aircraft Sector

The global helicopter market stands at a crossroads, shaped by an interplay of geopolitical shifts, regulatory evolution, and technological breakthroughs that collectively redefine industry trajectories. While traditional rotorcraft remain indispensable for critical missions, the advent of hybrid-electric and eVTOL platforms heralds a new era of mobility that promises reduced environmental impact, enhanced operational flexibility, and expanded service horizons.

Tariff challenges have underscored the imperative of resilient supply networks, prompting a strategic pivot toward regional sourcing and diversified alliances. Concurrently, segmentation insights reveal a mosaic of demand drivers across weight classes, components, and applications that necessitate tailored market approaches. Regional divergences accentuate the importance of localized strategies, with North America, EMEA, and Asia-Pacific each presenting unique catalysts and barriers.

In synthesis, stakeholders who adeptly integrate technological innovation with robust operational frameworks and strategic partnerships will secure a competitive edge in the rapidly evolving rotorcraft landscape. This confluence of factors establishes a compelling narrative for informed leadership and decisive investment in the technologies and alliances that define the future of vertical flight.

Seize the Opportunity to Engage Directly with Ketan Rohom for Exclusive Access to Comprehensive Rotary-Wing Market Intelligence and Strategic Insights

We invite you to elevate your strategic decision-making through direct engagement with Ketan Rohom, Associate Director, Sales & Marketing, who stands ready to guide you toward unlocking unprecedented value from our comprehensive report. His expert insights and tailored consultations will ensure you harness the full potential of this definitive analysis, transforming it into actionable initiatives within your organization’s roadmap. Reach out to secure exclusive access to in-depth discussions, bespoke data interpretations, and a seamless acquisition experience that aligns with your timelines and objectives. Embark on a journey of informed leadership by connecting with Ketan and accessing the helicopter market’s most authoritative intelligence.

- How big is the Helicopters Market?

- What is the Helicopters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?