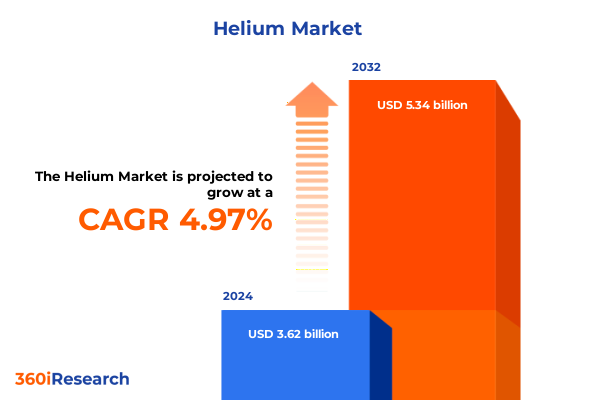

The Helium Market size was estimated at USD 3.79 billion in 2025 and expected to reach USD 3.97 billion in 2026, at a CAGR of 5.00% to reach USD 5.34 billion by 2032.

Comprehensive Overview of the Helium Market Setting the Foundation for Strategic Insights into Industry Drivers Supply Constraints and Growth Opportunities

An intricate web of strategic applications and supply chain dynamics underscores the critical importance of helium across multiple industries. As the lightest and second most abundant element in the universe, helium has transcended its historical use in simple lift and buoyancy functions to become a foundational component in advanced technologies. With its unique properties of superfluidity, inertness, and cryogenic stability, the element has emerged as an integral input for semiconductor manufacturing, medical imaging, aerospace guidance systems, and metal fabrication processes. Over recent years, tightening supply conditions have brought renewed attention to market vulnerabilities and underscored the need for diversified sourcing and resilient infrastructures.

Against this backdrop, stakeholders are seeking a clear understanding of evolving demand patterns, supply constraints, and the strategic imperatives necessary to navigate an increasingly complex landscape. This introduction offers a concise yet comprehensive primer on the multifaceted drivers and emerging risks shaping the horizon of the helium sector, equipping decision-makers with the foundational context required for informed planning and sustained competitiveness.

Identification of Critical Transformative Shifts Reshaping Helium Supply Chains Technological Innovations and Emerging Demand Patterns Across Key Sectors

Recent years have witnessed a cascade of transformative shifts that are redefining the contours of the helium landscape. Breakthroughs in extraction technology, such as advanced membrane separation and cryogenic distillation enhancements, have enabled producers to optimize yields from air separation units while reducing energy intensity. Concurrently, primary extraction from natural gas fields has become more efficient through the deployment of integrated sensor networks and machine-learning models, which enhance reservoir characterization and minimize waste. Complementing these upstream innovations, recycling initiatives within semiconductor fabs and medical facilities have reached unprecedented scale, converting formerly lost gas streams into viable supply streams for specialized applications.

On the demand side, a surge in high-volume chip fabrication sites coupled with unprecedented growth in MRI and nuclear magnetic resonance spectroscopy systems has reshaped consumption profiles. Meanwhile, the revitalization of space exploration programs has elevated the role of helium as a rocket pressurant and leak detection medium in aerospace assemblies. These concurrent developments underline the dynamic interplay between supply augmentation efforts and application-driven demand surges, reinforcing the necessity for agile strategies that can accommodate both cyclical fluctuations and disruptive technological advances.

Analysis of the Cumulative Impact of Recent United States Tariffs on Helium Imports Domestic Production Costs and Industry Competitiveness Through 2025

In early 2025, the introduction of new United States tariff measures on select helium imports marked a significant inflection point for the sector. With levies imposed on both bulk gaseous and liquid shipments, downstream consumers faced immediate impacts in landed cost structures that reverberated across procurement strategies and inventory policies. These duties elevated import parity prices, prompting many distributors to reassess supplier portfolios and prioritize domestic production and recycling partnerships.

As a consequence, domestic facilities expanded their recovery capacity and accelerated investments in closed-loop capture systems to mitigate reliance on foreign-origin supply. The cumulative toll of these adjustments manifested in heightened logistical complexity, as companies sought to shield critical operations from tariff volatility by diversifying supply chains. Simultaneously, global competitors reconfigured trade routes and leveraged preferential agreements to bypass the tariffs, intensifying competitive pressures on U.S. producers. Through this lens, the tariff regime has acted as both a catalyst for local capability enhancement and a driver of cross-border strategic realignments.

In-Depth Interpretation of Helium Market Segmentation Based on Product Form Source Grade Type End Use and Distribution Channels Driving Strategic Clarity

Segmenting the helium market by product form reveals distinct dynamics between gaseous supply, which is vital for continuous-flow industrial processes, and liquid deliveries that feed cryogenic applications requiring ultra-low temperatures. Underpinning these forms are varied sources ranging from mature air separation units that generate helium as a byproduct of industrial oxygen and nitrogen production, to primary extraction in natural gas fields where helium concentrations justify dedicated recovery operations. In parallel, recycling frameworks have matured, transforming spent helium streams from semiconductor fabs and medical suites into reusable assets that alleviate supply pressures.

Diverse grade types dictate the quality thresholds and purification intensity applied, from balloon grade material suitable for non-critical lift uses to high-purity and research grade variants required for precision instruments. At the extreme end of the spectrum, ultra-high purity (UHP) helium commands rigorous contaminant controls, servicing niche applications where even trace impurities would compromise performance. Across end-use categories, the aerospace and defense sector relies on helium for both leak testing assemblies and as a reliable rocket pressurant, while the electronics and semiconductor segment exploits chilled helium flows for chip fabrication and wafer cooling. The energy sector leverages helium for cryogenic power storage and specialized leak detection, even as healthcare institutions deploy the gas in MRI and NMR spectroscopy systems. Metal production and fabrication operations harness its inert shielding for arc welding, high-temperature brazing, and precision laser cutting, while research laboratories pursue frontier investigations in superconductivity and quantum computing. Finally, distribution channels have bifurcated into offline networks, where direct sales agreements and established industrial gas suppliers cater to bulk and contract-based demands, and online platforms that facilitate smaller volume orders and rapid restocking for specialized users.

This comprehensive research report categorizes the Helium market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Source

- Grade Type

- End‑Use

- Distribution Channel

Comprehensive Examination of Regional Dynamics Impacting Helium Consumption Production and Trade Across the Americas EMEA and Asia Pacific Regions

A regional lens highlights stark contrasts in helium availability, demand drivers, and policy frameworks. In the Americas, North American production hubs have historically anchored global supply, supported by extensive natural gas infrastructures and large-scale recycling capabilities. Investment in recovery expansions across Texas and Alberta continues to reinforce this position, while demand centers in the United States and Canada drive steady uptake in semiconductor wafer fabs and medical imaging facilities.

Europe, the Middle East, and Africa exhibit a mosaic of strategies, from emerging recovery projects in Qatar and Algeria to an uptick in regional interconnectivity initiatives that channel surplus volumes to Western Europe. Policy harmonization efforts around critical minerals and strategic gasses have encouraged cross-border pipelines and joint ventures, even as legacy reliance on imports prompts accelerated recycling and storage infrastructure build-out. In Asia-Pacific, surging demand from new chip fabrication campuses in Taiwan, South Korea, and mainland China has placed unprecedented pressure on supply chains. Simultaneously, regional producers in Australia and India are advancing primary extraction schemes to serve burgeoning healthcare and aerospace markets. Together, these divergent regional dynamics reflect a deeply interdependent market where shifts in one geography can cascade to global pricing and allocation patterns.

This comprehensive research report examines key regions that drive the evolution of the Helium market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles and Comparative Insights into Leading Helium Sector Companies Highlighting Competitive Strategies Collaborations and Market Differentiators

Leading players in the helium ecosystem are deploying differentiated strategies to fortify their market positions. Major industrial gas conglomerates have expanded strategic alliances with semiconductor and healthcare equipment manufacturers to secure long-term commitments and co-develop recycling solutions. These collaborations often include joint investment in custom purification facilities tailored to ultra-high purity requirements, ensuring a locked-in supply for mission-critical processes.

Meanwhile, independent specialists are capitalizing on niche strengths, such as on-site gas generation units and mobile cryogenic storage, to offer flexible and localized supply models. Some companies have established proprietary scanning and monitoring platforms that provide real-time visibility into consumption patterns, enabling end users to optimize usage and minimize waste. A subset of market leaders is also exploring vertical integration by acquiring interests in natural gas extraction fields with elevated helium content, effectively broadening their upstream footprint. Across the board, a clear trend emerges: those who can seamlessly integrate supply chain control with customer-centric service offerings are best positioned to navigate supply volatility and capture emerging application opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Helium market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Air Products and Chemicals, Inc. by Honeywell International Inc.

- Air Water Inc.

- Axcel Gases

- Chart Industries, Inc.

- Exxon Mobil Corporation

- Gazprom Pererabotka Blagoveshchensk LLC

- Gulf Cryo Holding FZCO

- Iwatani Corporation

- Jinhong Gas Co., Ltd

- Linde PLC

- Matheson Tri‑Gas, Inc. by Taiyo Nippon Sanso Corporation

- Messer Group GmbH

- nexAir LLC

- Noble Helium Limited

- Om Air Special Gases

- Praxair, Inc.

- QatarEnergy LNG

- Qualitrol Company LLC

- RasGas Company Limited

- Salasar Carbonics Pvt. Ltd.

- Super Helium India Pvt. Ltd

- Taiyo Nippon Sanso Corporation

- Weil Group

- Zephyr Solutions LLC

Actionable Recommendations for Industry Leaders to Navigate Supply Constraints Optimize Value Chains and Capitalize on Emerging Applications in the Helium Market

Industry leaders are advised to adopt a multi-pronged approach that simultaneously addresses near-term supply risks and long-term strategic resilience. First, diversifying sourcing portfolios by engaging both established regional producers and innovative recycling partners can reduce exposure to single-source disruptions. Second, investing in advanced leak detection and recovery technologies will not only conserve inventory but also generate ancillary revenue streams from captured gas that was previously vented or flared.

Additionally, companies should formalize strategic partnerships with end-use sectors, co-investing in tailored purification and storage solutions to align production schedules with usage profiles. Engaging proactively with policymakers to shape balanced tariff and export frameworks can help mitigate abrupt regulatory shocks. Finally, embedding digital analytics and machine-learning models into procurement and logistics operations will enhance forecast accuracy for maintenance and application planning, thereby enabling more agile responses to market fluctuations. By weaving these tactical initiatives into a cohesive strategy, leaders can transform supply chain challenges into competitive advantages.

Transparent Overview of the Rigorous Research Methodology Underpinning Helium Market Analysis Including Data Collection Validation and Analytical Frameworks

This research employs a structured mixed-methodology framework designed to ensure rigor, transparency, and reproducibility. The process began with a comprehensive review of authoritative publications, patent filings, trade data, and regulatory filings to establish a robust secondary information foundation. Concurrently, in-depth interviews were conducted with executives, technical experts, and procurement managers across the helium value chain, yielding firsthand insights into operational challenges and strategic priorities.

Following data collection, the analysis team applied qualitative coding to interview transcripts and performed triangulation against secondary datasets to validate emerging trends and reconcile discrepancies. A proprietary analytical model then integrated thematic findings with supply chain mapping techniques, enabling clear visualization of industry interdependencies. Throughout, peer reviews and cross-functional workshops provided iterative feedback loops, ensuring that the final deliverables reflect both macro-level dynamics and ground-level realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Helium market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Helium Market, by Product Form

- Helium Market, by Source

- Helium Market, by Grade Type

- Helium Market, by End‑Use

- Helium Market, by Distribution Channel

- Helium Market, by Region

- Helium Market, by Group

- Helium Market, by Country

- United States Helium Market

- China Helium Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Key Findings Underscoring Strategic Imperatives and Forward Looking Perspectives for Stakeholders in the Evolving Helium Market

In sum, the helium ecosystem is at a pivotal juncture where supply constraints, technological progress, and regulatory shifts converge to reshape long-term trajectories. The interplay among upstream extraction enhancements, strategic tariffs, and recycling innovations underscores the necessity for holistic strategies that transcend traditional procurement paradigms. End users and producers alike must remain vigilant to evolving application demands-especially within semiconductors, medical imaging, and aerospace-while also safeguarding against geopolitical and policy-driven disruptions.

As stakeholders chart their next moves, there is a clear imperative to integrate diversification, digitalization, and partnership in pursuit of supply security and operational excellence. The insights detailed herein serve as a strategic compass, guiding industry participants toward informed decisions that will optimize resource utilization and unlock new avenues for growth. Ultimately, those who embrace an adaptive mindset and leverage collaborative frameworks will be best positioned to thrive in an increasingly complex and interdependent helium market.

Engage with Ketan Rohom to Unlock Exclusive Helium Market Intelligence and Elevate Your Business Strategy

To explore the comprehensive insights and strategic intelligence contained in this authoritative analysis of the helium market, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, and secure your copy of the full market research report. By partnering with Ketan Rohom you will gain direct access to the nuanced data, expert interviews, and tailored recommendations that can empower your decision-making processes and strengthen your competitive positioning. Act now to ensure you leverage these findings ahead of industry shifts and maximize the return on your strategic investments.

- How big is the Helium Market?

- What is the Helium Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?