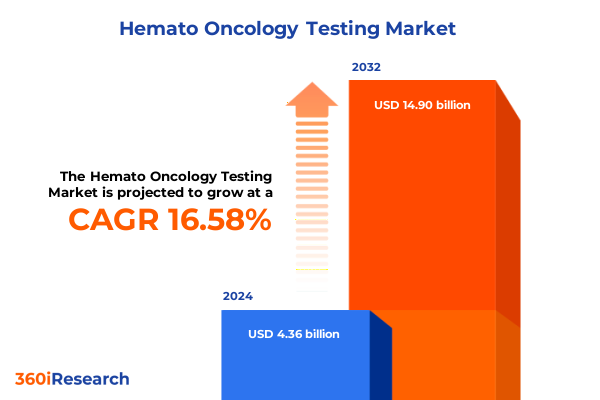

The Hemato Oncology Testing Market size was estimated at USD 5.07 billion in 2025 and expected to reach USD 5.90 billion in 2026, at a CAGR of 16.62% to reach USD 14.90 billion by 2032.

Unveiling the Fundamental Role of Hemato Oncology Testing in Driving Precision Diagnostics and Personalized Therapies Through Advanced Clinical Insights

In recent years, hemato oncology testing has emerged as a cornerstone for improving patient outcomes in the diagnosis and management of blood cancers. Across clinical settings, laboratories are embracing advanced testing modalities to detect disease at an earlier stage, enabling more precise therapeutic interventions. As a result, diagnostic workflows have evolved from traditional microscopy and morphology-based assays toward a more nuanced integration of molecular and immunophenotypic techniques.

Moreover, the demand for personalized medicine has driven laboratories and healthcare providers to refine their testing protocols, prioritizing assays that not only deliver rapid results but also provide actionable insights at a genetic and cellular level. Consequently, the hemato oncology testing landscape today is characterized by a collaborative ecosystem in which clinicians, researchers, and diagnostics manufacturers work in concert to expand the capabilities of testing platforms.

In this context, the introduction of high-resolution sequencing, multiplex immunoassays, and digital data analytics has elevated the standard of patient care. By offering a holistic view of disease biology, these technologies inform tailored treatment strategies and enable continuous monitoring of therapeutic response. As we embark on a deeper exploration of this critical industry, the following sections will delineate the transformative forces, regulatory considerations, and strategic imperatives that will define the next phase of growth in hemato oncology testing.

Exploring the Revolutionary Convergence of Cutting Edge Technologies and Clinical Protocols That Are Redefining Hemato Oncology Testing Paradigms

The hemato oncology testing arena is undergoing a period of extraordinary transformation, driven by breakthroughs in both technology and clinical practice. Single-cell analytics and emerging multiplex platforms now allow laboratories to dissect tumor heterogeneity at an unprecedented resolution, reshaping diagnostic algorithms. Equally important, the convergence of artificial intelligence with digital pathology has streamlined data interpretation, reducing manual variability and accelerating turnaround times.

Meanwhile, next generation sequencing (NGS) has become more accessible and cost-effective, prompting its integration into routine diagnostics. This shift toward comprehensive genomic profiling supports the identification of rare variants and prognostic biomarkers which, in turn, inform precision therapeutics. At the same time, targeted sequencing panels are increasingly complemented by RNA-based assays, broadening the scope of molecular insights that can be garnered from a single specimen.

Beyond molecular advances, immunophenotyping by flow cytometry has expanded its role beyond initial diagnosis to include minimal residual disease monitoring. Technologies such as digital PCR further enhance sensitivity, enabling the detection of low-frequency mutations that herald relapse. As laboratories adopt these technologies in tandem, streamlined workflows and cross-platform validation efforts are becoming the new standard. Through these advancements, hemato oncology testing is not merely evolving; it is redefining how clinicians approach diagnosis, prognosis, and long-term patient management.

Analyzing the Multifaceted Impact of Newly Imposed United States Tariffs on Hemato Oncology Testing Supply Chains and Service Accessibility in 2025

In 2025, newly imposed tariffs on imported reagents and instrumentation have presented significant challenges for laboratories performing hemato oncology testing. Supply chains, once optimized for global sourcing, are adjusting to the increased cost of key consumables. Consequently, many diagnostic providers are reevaluating procurement strategies to mitigate price fluctuations and maintain service continuity.

Furthermore, these trade measures have accelerated the push for domestic manufacturing and local partnerships. By establishing regional production hubs, stakeholders aim to reduce reliance on cross-border logistics and the associated financial burdens. In parallel, strategic alliances between reagent suppliers and diagnostics laboratories have emerged as an effective mechanism to negotiate stable pricing agreements and ensure priority access to critical materials.

Amid these dynamics, laboratories are also reassessing their test menus, balancing the need for comprehensive panels with cost-containment imperatives. Some institutions have adopted a tiered testing approach, where a core suite of assays is prioritized, and additional specialized tests are reserved for cases with complex clinical indications. While these measures help preserve diagnostic capabilities, they also necessitate robust communication with clinicians to align testing pathways with therapeutic goals.

Looking ahead, the interplay between tariffs, supply chain resilience, and strategic procurement will continue to influence both the cost structure and the accessibility of hemato oncology diagnostics. Industry leaders who proactively address these factors will be best positioned to sustain high-quality patient care in an increasingly regulated environment.

Uncovering Comprehensive Segmentation Insights That Illuminate Diverse Testing Modalities Sample Types and Applications Tailored Hemato Oncology Diagnostics

The market for hemato oncology testing can be examined through multiple lenses, each offering unique insights into sample acquisition, analytical technologies, clinical applications, and end user dynamics. First, sample type influences both diagnostic yield and workflow logistics. Bone marrow sampling remains the gold standard for comprehensive morphological and cytogenetic evaluation, whereas peripheral blood enables less invasive longitudinal monitoring. Tissue biopsy complements these methods when marrow or blood profiles prove inconclusive, particularly in cases of lymphoid neoplasms.

Technology selection further refines diagnostic precision. Flow cytometry, which encompasses both immunophenotyping and minimal residual disease analysis, provides rapid quantification of cell populations. Fluorescence in situ hybridization techniques, covering chromosomal abnormality detection as well as gene fusion detection, address structural genomic alterations with high specificity. Immunohistochemistry assays-whether chromogenic or fluorescent-facilitate the visualization of protein expression within tissue context. Next generation sequencing, through approaches such as RNA sequencing, targeted gene panels, whole exome sequencing, and whole genome sequencing, deciphers genetic landscapes at varying depths of coverage. Finally, polymerase chain reaction methods, which include digital PCR, quantitative PCR, and reverse transcription PCR, enable ultra-sensitive detection of molecular markers.

Clinical applications of these technologies encompass the full spectrum of blood cancers. Acute lymphoblastic leukemia, acute myeloid leukemia, chronic lymphocytic leukemia, and chronic myeloid leukemia each demand specific assay combinations for optimal detection and monitoring. Similarly, lymphomas, including Hodgkin and non-Hodgkin subtypes, and plasma cell disorders such as myeloma, benefit from tailored diagnostic workflows. End users range from academic and research centers, where novel assay development thrives, to diagnostic laboratories, hospitals, and specialized institutes that deliver routine patient diagnostics.

By integrating these segmentation dimensions, stakeholders can identify optimal testing pathways, prioritize resource allocation, and drive innovation that addresses unmet clinical needs.

This comprehensive research report categorizes the Hemato Oncology Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sample Type

- Technology

- Application

- End User

Revealing Regional Dynamics Spanning Americas Europe Middle East Africa and Asia Pacific That Define Hemato Oncology Testing Accessibility

Regional nuances significantly influence how hemato oncology testing services are delivered and adopted. In the Americas, a combination of advanced reimbursement frameworks and robust research infrastructure supports rapid uptake of high-end molecular and immunophenotypic assays. This environment encourages collaboration between academic centers and commercial laboratories, accelerating the translation of novel technologies into clinical practice.

Moving to Europe, Middle East, and Africa, the regulatory landscape varies widely across jurisdictions. In Western Europe, centralized healthcare funding models promote equitable access to comprehensive testing, while emerging markets within the region grapple with resource constraints that limit adoption to core diagnostics. Regulatory harmonization initiatives and public–private partnerships are helping bridge these gaps, enabling broader deployment of advanced assays.

Across Asia-Pacific, market dynamics reflect a blend of established markets such as Japan and Australia alongside rapidly developing economies. Investment in local manufacturing and government-led screening programs drives adoption in urban centers, even as rural areas encounter logistical hurdles. Regional collaborations aimed at standardizing testing protocols and quality assurance frameworks are gaining traction, ensuring consistency in diagnostic accuracy.

Understanding these regional perspectives enables stakeholders to tailor deployment strategies, align with local healthcare priorities, and address unique barriers to adoption. By doing so, they can enhance the global reach of cutting-edge hemato oncology testing technologies.

This comprehensive research report examines key regions that drive the evolution of the Hemato Oncology Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Innovators and Strategic Collaborators Shaping the Competitive Hemato Oncology Testing Market Through Cutting Edge Partnerships

Some of the most influential players in hemato oncology testing have prioritized platform diversification and strategic collaborations to maintain competitive advantage. Market leaders have invested heavily in expanding their next generation sequencing portfolios, often partnering with specialized reagent suppliers to create turnkey solutions for genomic profiling. This approach streamlines implementation for laboratories and reduces the time to clinical validation.

At the same time, companies renowned for their expertise in flow cytometry have broadened their offerings to include integrated software and data analytics tools. These enhancements not only improve standardization but also support remote data review and telepathology, addressing the growing demand for decentralized diagnostic models. Organizations with established immunohistochemistry platforms have similarly innovated by introducing multiplex assays that combine protein markers with digital image analysis, enabling simultaneous evaluation of multiple biomarkers within a single tissue section.

Meanwhile, emerging entrants focused on digital PCR have carved out a niche in ultra-sensitive detection markets, especially for minimal residual disease and low frequency variant monitoring. By forging alliances with clinical research networks, these companies accelerate market validation and generate real-world evidence that underscores their platforms’ clinical utility. Additionally, diagnostic developers offering end-to-end services-ranging from sample logistics to data interpretation-are differentiating themselves through value-added programs that help laboratories optimize their operational workflows.

Across all segments, the most successful companies balance internal innovation with open collaboration, fostering ecosystems that bring together hardware, reagents, and informatics solutions to meet the complex demands of hemato oncology testing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hemato Oncology Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Adaptive Biotechnologies Corporation

- Agilent Technologies, Inc.

- ARUP Laboratories

- bioMérieux SA

- Danaher Corporation

- F. Hoffmann-La Roche AG

- Guardant Health, Inc.

- Illumina, Inc.

- Invivoscribe, Inc.

- Laboratory Corporation of America Holdings

- NeoGenomics Laboratories, Inc.

- QIAGEN N.V.

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Empowering Industry Leaders with Targeted Strategies to Optimize Hemato Oncology Testing Adoption Enhance Operational Efficiency and Foster Sustainable Growth

Industry leaders seeking to capitalize on growth opportunities in hemato oncology testing should consider multifaceted strategies that encompass technology investment, operational excellence, and stakeholder engagement. First, prioritizing the integration of emerging platforms-such as single cell sequencing and digital PCR-will position organizations at the forefront of diagnostic innovation, delivering higher sensitivity and deeper molecular insights.

Concurrently, optimizing supply chain resilience through diversified sourcing and local manufacturing partnerships can mitigate the impact of trade disruptions. By establishing dual sourcing agreements and protective stock buffers, laboratories can safeguard continuity while maintaining cost efficiency. Moreover, fostering relationships with reagent and instrument manufacturers for long-term agreements will secure preferential pricing and priority access in times of scarcity.

From an operational standpoint, investing in workforce development is crucial. Training programs that equip laboratory personnel with skills in bioinformatics, digital pathology, and quality management will enhance assay reliability and turnaround times. Engaging clinicians through educational initiatives will further ensure that testing innovations translate into improved patient care pathways.

Finally, proactive collaboration with regulatory bodies and professional societies will help shape guidelines and reimbursement policies that support the adoption of advanced hemato oncology assays. By participating in working groups and contributing to evidence generation, industry leaders can ensure that their innovations are recognized and reimbursed appropriately. Taken together, these recommendations form a cohesive roadmap for achieving sustainable growth and clinical impact.

Elucidating a Robust Research Methodology Combining Expert Qualitative Interviews with Advanced Quantitative Data Analysis to Ensure Rigorous Outcomes

This research employs a robust, mixed-methods approach designed to capture both the quantitative and qualitative nuances of the hemato oncology testing market. Primary data collection involved in-depth interviews with leading hematologists, laboratory directors, and healthcare administrators across multiple regions, providing firsthand perspectives on clinical adoption barriers and evolving diagnostic needs.

Complementing these insights, a thorough review of peer-reviewed journals, conference proceedings, and publicly available regulatory filings ensured an extensive understanding of emerging technologies and approval timelines. Structured data extraction from clinical trial registries enabled mapping of ongoing research initiatives, while an analysis of corporate publications and investor presentations offered visibility into strategic investments and pipeline developments.

All quantitative data underwent triangulation to validate trends and minimize bias, incorporating cross-references between public health databases and proprietary analytics. A dedicated quality assurance process, featuring peer review by subject matter experts, verified the accuracy and consistency of key findings. Geographic coverage was meticulously balanced, ensuring that perspectives from mature markets and emerging economies informed regional insights.

Ultimately, this comprehensive methodology ensures that the findings presented reflect the current state of hemato oncology testing and provide reliable guidance for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hemato Oncology Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hemato Oncology Testing Market, by Sample Type

- Hemato Oncology Testing Market, by Technology

- Hemato Oncology Testing Market, by Application

- Hemato Oncology Testing Market, by End User

- Hemato Oncology Testing Market, by Region

- Hemato Oncology Testing Market, by Group

- Hemato Oncology Testing Market, by Country

- United States Hemato Oncology Testing Market

- China Hemato Oncology Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings to Illuminate the Strategic Imperatives and Future Directions Driving Advancements in Hemato Oncology Testing Ecosystems

As the hemato oncology testing landscape continues to mature, the synthesis of cutting-edge technologies, adaptive regulatory frameworks, and strategic partnerships will drive the next wave of diagnostic innovation. Organizations that embrace a holistic approach-integrating high-resolution sequencing, advanced immunophenotyping, and robust data analytics-will deliver more accurate diagnoses and improve patient management across diverse clinical contexts.

Moreover, geographic considerations and trade policies will influence both cost structures and accessibility. Stakeholders who proactively adapt procurement strategies and engage with local manufacturing initiatives will be better equipped to maintain service continuity in a shifting economic environment. Equally important, collaboration with payers and professional societies will be vital in securing reimbursement pathways that reflect the value of advanced testing.

Looking ahead, the intersection of digital health platforms, machine learning algorithms, and multiomic integration promises to elevate hemato oncology testing from a diagnostic tool to a decision support system. By leveraging these trends, laboratories can offer actionable insights that inform treatment strategies, monitor disease progression, and enhance long-term outcomes. Ultimately, the future of hemato oncology testing rests on a foundation of innovation, collaboration, and unwavering commitment to patient-centric care.

Connect with Associate Director of Sales and Marketing to Unlock Exclusive Insights and Empower Decision Makers with Hemato Oncology Testing Reports

To access deeper insights and strategic guidance tailored to your organization’s needs in hemato oncology testing, reach out today to Ketan Rohom, Associate Director of Sales and Marketing at 360iResearch. Engaging with Ketan ensures you receive personalized attention on how our comprehensive report can empower your decision makers with actionable intelligence.

By connecting with Ketan, you will gain a direct line to discuss which components of the report best align with your objectives, whether you seek deeper analysis around tariff impacts, segmentation strategies, or regional adoption trends. This consultation provides an opportunity to ask targeted questions, explore bespoke data sets, and secure flexible pricing structures that suit your budgetary requirements.

Take this step now to transform your investment in hemato oncology testing research into a strategic advantage. Contact Ketan Rohom to schedule a private briefing and discover how our tailored insights can guide your next move in this rapidly evolving market. Propel your organization forward with the confidence that comes from partnering with a dedicated expert who is committed to your success.

- How big is the Hemato Oncology Testing Market?

- What is the Hemato Oncology Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?