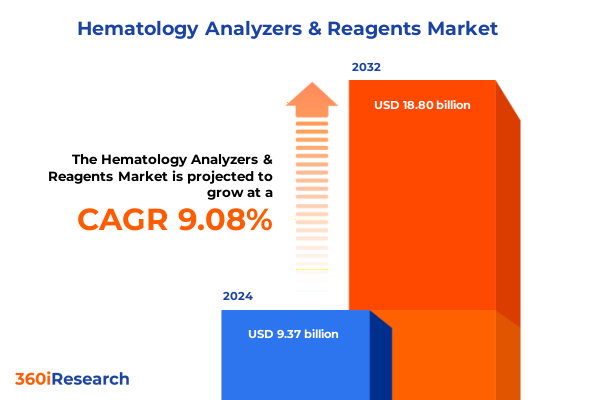

The Hematology Analyzers & Reagents Market size was estimated at USD 10.21 billion in 2025 and expected to reach USD 11.16 billion in 2026, at a CAGR of 9.10% to reach USD 18.80 billion by 2032.

Navigating the Cutting-Edge Convergence of Emerging Technologies, Regulatory Shifts, and Evolving Market Dynamics in Hematology Analysis and Reagent Solutions

Advancements in hematology analyzers and reagents sit at the nexus of technological innovation, clinical demand, and regulatory evolution. As healthcare systems worldwide grapple with increasing prevalence of blood-related disorders, the imperative to deliver rapid, accurate diagnostic results has never been greater. Laboratories are transitioning away from manual processes toward fully automated workflows that integrate digital imaging, artificial intelligence, and seamless connectivity. This convergence of capabilities is not only enhancing diagnostic precision but also driving new paradigms in laboratory efficiency, reagent utilization, and data-driven decision-making.

In parallel, regulatory landscapes and trade policies have introduced new dynamics into supply chain management and market access. Heightened scrutiny of imported diagnostic equipment and reagents, coupled with tariff adjustments and evolving certification requirements, is prompting companies to rethink production footprints and sourcing strategies. The interplay between innovation and regulation underscores the complexity of navigating this market: stakeholders must balance the pursuit of cutting-edge capabilities with the realities of global trade and compliance. Amid these transformative forces, this executive summary offers a panoramic view of the latest industry shifts, tariff implications, segmentation insights, regional nuances, and key competitive moves shaping hematology diagnostics.

Revolutionary Technological and Operational Transformations Shaping the Future of Hematology Analysis and Reagent Applications Worldwide

Hematology diagnostics is entering a new era defined by unprecedented levels of automation, artificial intelligence, and miniaturization. Laboratories now leverage AI-driven analyzers equipped with deep learning algorithms to perform complex cell morphology assessments, enabling the detection of subtle abnormalities that often elude conventional methodologies. Recent industry analyses indicate that AI-enhanced systems can achieve specificity rates exceeding 98 percent, markedly reducing false positives and streamlining pathologist workflows. As these capabilities mature, the continuous learning nature of machine learning models ensures diagnostic precision improves over time, laying the foundation for earlier disease detection and more personalized treatment pathways.

Concurrently, the rise of point-of-care and portable hematology platforms is reshaping diagnostic accessibility. Microfluidic flow cytometry–based analyzers, validated in waived settings, are delivering complete blood counts and five-part differentials in under ten minutes, revolutionizing emergency care and remote screenings. These compact devices, requiring minimal sample volumes, mitigate the logistical challenges of centralized laboratory testing and extend critical diagnostics to resource-limited environments. Moreover, integration with cloud-based data repositories fosters real-time collaboration among clinicians and epidemiologists, accelerating public health responses during outbreaks or emerging hematologic crises.

Beyond core analytical engines, laboratories increasingly adopt automated specimen processing and labeling systems that connect directly to laboratory information management systems. The automation of preanalytical tasks-from barcode-driven sample identification to precise aliquoting-has been shown to reduce manual error rates by over 90 percent and shrink turnaround times by up to 70 percent. This end-to-end digital transformation supports high-throughput operations and paves the way for harmonized workflows that align with regulatory requirements, ultimately enhancing patient safety and data integrity.

Assessing the Widespread Implications of 2025 United States Tariff Policies on Hematology Analyzer Equipment and Reagent Supply Chains

In March 2025, the United States implemented significant tariff increases affecting diagnostic equipment and reagent components, including semiconductors, steel constituents, and manufacturing inputs integral to hematology analyzers. Specifically, tariffs on China-origin semiconductors rose to 50 percent, while derivative products containing steel and aluminum faced levies of up to 25 percent. As blood analyzers rely on high-performance electronic and mechanical components, these measures have exerted upward pressure on production costs, prompting industry leaders to reassess their global manufacturing footprints.

Major diagnostic firms have responded with diverse mitigation strategies. Abbott Laboratories, anticipating a multi-hundred-million-dollar impact in 2025, is leveraging its global manufacturing network to absorb cost increases and exploring long-term tariff relief through strategic lobbying and supply chain realignment. Siemens Healthineers unveiled a $150 million investment to expand U.S. production capacity, relocating key manufacturing operations for its imaging and analyzer business to California to circumvent cross-border duties. Roche Diagnostics has similarly committed $550 million to enhance domestic reagent formulation and packaging facilities in Indiana, underscoring a broader industry pivot toward localized supply resilience.

Despite these investments, workflow disruptions and raw material shortages have impeded timely reagent deliveries, especially for specialized control and reticulocyte reagents. Hospital and laboratory associations, including the American Hospital Association, have petitioned for targeted tariff exemptions to safeguard patient care continuity and prevent potential shortages of critical diagnostics supplies. Until regulatory resolutions emerge, hematology providers must navigate a delicate balance between cost containment and fulfillment of clinical demand.

Uncovering Strategic Insights Across Type, Application, End User Habitat, and Distribution Channels in the Hematology Analyzer and Reagent Sphere

The hematology analyzer and reagent landscape can be dissected through multiple lenses, each revealing distinct value drivers and market dynamics. From a product standpoint, control reagents establish the baseline calibration and quality assurance that underpin reliable complete blood counts, while diluent reagents facilitate precise sample processing, and reticulocyte reagents enable specialized assessment of bone marrow function in anemias and related disorders. This spectrum of reagent types dictates the consumable lifecycle and shapes laboratory procurement strategies, with premium formulations often commanding higher margins but requiring robust compatibility protocols.

Exploring application areas illuminates the diverse clinical use cases for hematology diagnostics. Routine health screenings form the bedrock of preventative care, detecting common conditions such as anemia and thrombocytopenia before symptoms manifest. In parallel, the role of analyzers in drug development and research has expanded, supporting pharmacokinetic studies and hematotoxicity assessments in new therapeutic pipelines. Infectious disease diagnosis increasingly leverages hematologic markers to stratify severity and guide treatment, particularly in viral hemorrhagic fevers and sepsis, while blood-related disorders such as leukemia and hemoglobinopathies drive demand for highly sensitive differential analyses.

End-user segmentation further clarifies market positioning. Blood banks rely on high-throughput systems and specialized reagents to ensure compatibility and safety in transfusion services, requiring robust quality controls and digital traceability. Diagnostic laboratories prioritize throughput and automation, integrating analyzers into fully connected laboratory information systems to manage sample volumes with minimal manual intervention. Hospitals benefit from point-of-care platforms in emergency and intensive care units, balancing speed with clinical confidence, whereas research institutes favor modular systems offering deep customization for investigative protocols. Finally, distribution pathways-whether direct sales partnerships that deliver integrated service bundles or distributor networks that extend reach into tier-2 and tier-3 markets-shape go-to-market strategies and affect service-level agreements across geographies.

This comprehensive research report categorizes the Hematology Analyzers & Reagents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- End User

- Distribution Channel

Delineating Distinct Regional Dynamics and Growth Drivers Across Americas, Europe Middle East & Africa, and Asia-Pacific Hematology Markets

Regional dynamics within the hematology diagnostics sector reveal stark contrasts in adoption curves, infrastructure maturity, and growth potential. In the Americas, advanced laboratory automation and preventive health initiatives underpin its leading position, accounting for over one-third of global diagnostic procedures. More than 60 percent of facilities are now equipped with fully automated hematology systems, and routine screenings have surged over 30 percent amid heightened awareness of chronic blood disorders. The United States alone drives nearly 40 percent of point-of-care testing demand, buoyed by robust clinical trial activities that increasingly integrate hematologic biomarkers into oncology and infectious disease studies.

Europe maintains a stronghold, representing close to 28 percent of the global market. Public healthcare institutions lead in digital transformation, with nearly half of European laboratories employing digital hematology analyzers for day-to-day diagnostics. Key markets such as France, Germany, and the United Kingdom account for over 60 percent of regional volume, driven by expanding screening programs for anemia and leukemia that have grown by more than 33 percent. Research organizations in these countries contribute nearly one-fifth of test consumption, reflecting deep integration of hematologic endpoints in translational studies. Momentum around AI and automation solutions has accelerated by over 35 percent, spurred by pan-European initiatives to harmonize data exchange and quality standards.

The Asia-Pacific region emerges as the fastest-growing market, responsible for over a quarter of global demand. China, India, and Japan lead infrastructure expansions, with half of new diagnostic laboratories established in the past five years. Automated hematology analyzer installations have risen by more than 42 percent, a response to escalating prevalence of blood disorders and government-driven healthcare investments. Public health campaigns have boosted routine blood testing volumes by 37 percent, while strategic partnerships between government entities and private sector players have accelerated laboratory development projects by 33 percent. These trends underscore the region’s critical role in driving global reagent consumption and positioning hematology diagnostics as a cornerstone of emerging healthcare systems.

This comprehensive research report examines key regions that drive the evolution of the Hematology Analyzers & Reagents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Leaders and Their Strategic Innovations in the Hematology Analyzer and Reagent Market Landscape

Leading companies in the hematology diagnostics arena are deploying multifaceted strategies to capture market share while navigating supply chain complexities and regulatory pressures. Sysmex Corporation, a stalwart in automated analyzers, secured U.S. FDA 510(k) clearance for its XR™-Series Automated Hematology Analyzer in June 2025, paving the way for early market launch and reinforcing its commitment to technological excellence. Concurrently, Sysmex America expanded its 3-part differential portfolio with the XQ-320 model, optimized for low-volume laboratories and physician office environments, demonstrating throughput of up to 70 samples per hour and minimal maintenance demands. These launches are complemented by investments in sustainable manufacturing, including closed-loop reagent container recycling certified under Japan’s Plastic Resource Circulation Act.

Abbott Laboratories, confronting a projected tariff impact of several hundred million dollars in 2025, is leveraging its extensive global manufacturing network to mitigate cost fluctuations. The company has specifically bolstered transfusion business capabilities through expanded R&D and production facilities in Illinois and Texas, ensuring resilience in its reagent and analyzer supply chains. Abbott’s proactive engagement with policymakers and ongoing exploration of tariff exemptions signal a strategic approach to regulatory engagement and long-term supply stabilization.

Siemens Healthineers announced a $150 million expansion of its U.S. manufacturing site to support the Varian business, transferring operations from Mexico to California to better align with evolving trade policies. This initiative underscores the importance of onshore production for critical diagnostic and imaging systems, reducing exposure to cross-border duties while enhancing local service responsiveness. At the same time, Roche Diagnostics committed $550 million to upgrade reagent production capacity in Indianapolis, reinforcing its domestic supply chain and supporting innovation in hematologic reagent formulations.

This cohort of industry pioneers exemplifies the drive toward integrated solutions that blend advanced instrument platforms with consumable offerings, underpinned by localized manufacturing, strategic partnerships, and sustainability initiatives. Their collective actions set the bar for operational agility and product innovation within the hematology segment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hematology Analyzers & Reagents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ACON Laboratories, Inc.

- Beckman Coulter, Inc. by Danaher Corporation

- BIOBASE Group

- Bioevopeak Co., Ltd.

- Biogenix Inc. Pvt. Ltd.

- Biosystems S.A. by Ginper S.L.

- Boule Diagnostics AB

- Cellavision AB

- Chengdu Seamaty Technology Co., Ltd.

- CPC Diagnostics Pvt. Ltd.

- Diatron Medical Instruments Limited

- Drucker Diagnostics, LLC

- EDAN Instruments, Inc.

- EKF Diagnostics Holdings Plc

- ERBA Diagnostics Mannheim GmbH

- F. Hoffmann-La Roche Ltd.

- Genrui Biotech Co., Ltd.

- Getein Biotech, Inc.

- HORIBA, Ltd

- Labnics Equipment Ltd.

- Labomed Inc.

- Linear Chemicals S.L.U.

- Medtronic PLC

- Mindray Bio-Medical Electronics Co., Ltd.

- Nihon Kohden Corporation

- Nova Biomedical Corporation

- PZ Cormay S.A.

- Siemens AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Trivitron Healthcare

Actionable Strategic Imperatives for Industry Leaders to Navigate Market Disruptions and Capitalize on Emerging Hematology Trends

Industry leaders should prioritize the integration of artificial intelligence and automation within their analyzer portfolios to stay ahead of increasingly complex diagnostic requirements. By investing in scalable AI frameworks that continuously learn from real-world data, manufacturers can enhance detection accuracy, reduce false flags, and deliver added clinical value across diverse end users.

Diversification of supply chains is essential in light of ongoing tariff volatility and component scarcity. Establishing flexible manufacturing footprints-combining onshore and strategic offshore sites-can mitigate cost pressures while ensuring uninterrupted reagent availability. Engaging proactively with trade authorities to pursue targeted exemptions or carve-outs for critical diagnostics supplies will further strengthen resilience.

To capitalize on regional growth, companies must tailor commercial strategies to distinct market needs. In North America and Europe, emphasize value-added service bundles, remote diagnostics support, and integration with electronic health records. In Asia-Pacific, focus on cost-effective, high-throughput solutions coupled with local partnerships to navigate regulatory landscapes and expedite laboratory deployments.

Strengthening collaborations with clinical trial sponsors and research institutes can unlock new application territories-particularly in immunohematology and oncology. Co-development agreements around novel biomarker modules will position analyzers as indispensable tools in precision medicine protocols.

Finally, sustainability in reagent development and packaging should be elevated from compliance checkbox to strategic differentiator. Eco-friendly formulations, reduced plastic waste, and closed-loop container recycling will resonate with health systems seeking to align environmental stewardship with fiscal responsibility.

Comprehensive Multi-Source Research Methodology Ensuring Robust, Triangulated Insights into Hematology Analyzers and Reagents

This market research report synthesizes insights through a dual-phased methodology combining extensive secondary research and primary validation. The secondary component encompassed analysis of publicly available regulatory filings, corporate press releases, reputable news outlets, and white papers from accredited industry associations. Specialized databases were consulted for tariff schedules, trade policy updates, and regional adoption statistics. To ensure breadth and avoid reliance on single-source data, findings were cross-referenced against peer-reviewed journals, government trade bulletins, and international standard-setting bodies.

Primary research involved structured interviews with senior executives, product managers, and technical directors from leading analyzer manufacturers, reagent suppliers, and end-user organizations. These conversations probed operational challenges, innovation roadmaps, and region-specific market dynamics. Insights were further refined through consultations with clinical pathologists, laboratory operations managers, and supply chain specialists to validate practical implications and future outlooks.

Quantitative data was triangulated with qualitative inputs to construct a robust framework that accounts for current market realities and emerging trends. By integrating these methodologies, the report delivers a multi-dimensional perspective on the hematology analyzer and reagent landscape, ensuring actionable intelligence for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hematology Analyzers & Reagents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hematology Analyzers & Reagents Market, by Type

- Hematology Analyzers & Reagents Market, by Application

- Hematology Analyzers & Reagents Market, by End User

- Hematology Analyzers & Reagents Market, by Distribution Channel

- Hematology Analyzers & Reagents Market, by Region

- Hematology Analyzers & Reagents Market, by Group

- Hematology Analyzers & Reagents Market, by Country

- United States Hematology Analyzers & Reagents Market

- China Hematology Analyzers & Reagents Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Discoveries to Provide a Cohesive Perspective on the Future Trajectory of Hematology Analyzers and Reagents

This executive summary has delineated the key forces driving the hematology analyzer and reagent market, spanning technological breakthroughs, tariff influences, segmentation dynamics, regional heterogeneity, and competitive strategies. The synthesis underscores that the convergence of artificial intelligence, automation, and point-of-care capabilities is fundamentally redefining diagnostic workflows, while trade policy shifts necessitate agile supply chain architectures.

Segmentation analysis revealed the nuanced value chains of control, diluent, and reticulocyte reagents across applications from routine screenings to specialized clinical research, highlighting the importance of tailored platform offerings for diverse end-user settings. Regional insights confirmed that mature markets in the Americas and Europe will maintain leadership through continuous innovation and regulatory sophistication, whereas the Asia-Pacific region will drive volume growth and serve as the testing ground for cost-effective, scalable solutions.

Leading players are charting paths that blend product innovation with strategic manufacturing localization, policy engagement, and sustainability initiatives. The actionable recommendations offer a roadmap for industry stakeholders to harness technological potential, navigate regulatory complexities, and seize regional opportunities. As hematology diagnostics continues to evolve at the intersection of data intelligence and patient-centric care, the companies that align their capabilities with these trends will shape the next chapter of precision medicine.

Secure Exclusive Access to Comprehensive Hematology Analyzer and Reagent Market Intelligence by Connecting with Ketan Rohom Today

To gain an unparalleled competitive advantage in the rapidly evolving hematology analyzer and reagent sector, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engage in a personalized consultation to explore how our proprietary insights can inform your strategic roadmaps, accelerate innovation cycles, and optimize supply chain resilience. Elevate your decision-making with actionable intelligence tailored to your business objectives and operational context. Connect now to secure exclusive access to the full market research report, and set a new standard of excellence in hematology diagnostics.

- How big is the Hematology Analyzers & Reagents Market?

- What is the Hematology Analyzers & Reagents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?