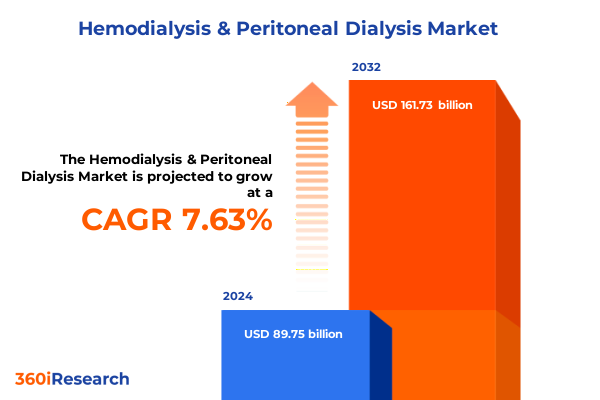

The Hemodialysis & Peritoneal Dialysis Market size was estimated at USD 95.91 billion in 2025 and expected to reach USD 102.50 billion in 2026, at a CAGR of 7.74% to reach USD 161.73 billion by 2032.

Exploring the Dynamic Interplay of Hemodialysis and Peritoneal Dialysis Shaping Future Treatment Paradigms and Market Opportunities Across Global Healthcare

The global landscape of renal replacement therapy has never been more dynamic, with hemodialysis and peritoneal dialysis at the forefront of efforts to address the growing burden of chronic kidney disease. Recent analyses have highlighted that approximately four million individuals worldwide are actively undergoing some form of dialysis treatment, underscoring the magnitude of clinical demand for reliable, patient-centric options. As populations age and the prevalence of diabetes and hypertension continues its upward trajectory, the imperative to refine existing modalities and develop novel therapeutic pathways has intensified.

In the United States, end-stage renal disease represents one of the most resource-intensive areas of care delivery. Clinicians and health systems are grappling with the dual challenge of optimizing clinical outcomes while controlling the substantial operational costs associated with frequent in-center sessions and specialized infrastructure. Meanwhile, patient preferences are evolving, with a discernible shift toward modalities that offer greater flexibility, autonomy and quality of life. These preferences are driving interest in home-based therapies, remote monitoring platforms and integrated care approaches that transcend the traditional boundaries of clinic walls.

Against this backdrop, industry stakeholders-from manufacturers and technology innovators to service providers and policymakers-are navigating a complex ecosystem shaped by shifting reimbursement models, accelerated technology adoption and heightened regulatory scrutiny. As we embark on this analysis, the following sections will unpack the pivotal trends, policy impacts and strategic imperatives redefining how dialysis care is conceived and delivered.

Unveiling the Technological Innovations and Care Model Disruptions Driving Hemodialysis and Peritoneal Dialysis Through Home and Sustainable Solutions

The dialysis landscape has undergone a notable transformation driven by both technological innovation and evolving care delivery models. One of the most impactful shifts is the accelerated adoption of home dialysis, catalyzed in part by digital health platforms that enable two-way remote patient management. Recent data indicate that the proportion of patients initiating home dialysis climbed from ten percent in early 2016 to nearly seventeen and a half percent by mid-2022, with regions participating in incentive-based payment models experiencing a proportional uplift. This digital empowerment extends beyond mere convenience-it has been associated with reduced hospitalization rates, improved technique retention and enhanced patient satisfaction.

Simultaneously, the introduction of high-volume online hemodiafiltration into the U.S. market marks a watershed moment for hemodialysis technology. In February 2024, the first FDA clearance of a next-generation hemodiafiltration system signaled tangible progress in integrating advanced solute clearance with environmental stewardship; simulation studies suggest that post-dilution hemodiafiltration can achieve equivalent removal efficiency while reducing water and dialysate consumption when compared to conventional high-flux dialysis. Beyond sustainability, early clinical evidence has demonstrated potential survival benefits and cardiovascular risk reduction for patients exposed to optimized hemodiafiltration protocols, framing a compelling value proposition for providers and payers alike.

In parallel, sustainable care imperatives have spurred the emergence of “green dialysis” initiatives championed by leading nephrology organizations. These programs focus on minimizing energy and resource utilization across both hemodialysis and peritoneal dialysis workflows through innovations such as point-of-care fluid generation, energy-efficient water treatment systems and biodegradable disposables. As environmental concerns gain prominence, the dialysis sector is increasingly evaluated not only on clinical metrics but also on its carbon footprint and waste profile. Altogether, these interwoven technological and delivery model evolutions are recalibrating expectations for what modern dialysis care can achieve.

Assessing the Multidimensional Impact of New 2025 United States Tariff Policies on the Cost Structures and Supply Chain Resilience of Dialysis Care

The reimplementation and expansion of U.S. tariff policies in 2025 are exerting multi-layered pressure on the dialysis supply chain, with the potential to elevate equipment and consumable costs across the care continuum. At the onset of the year, administration measures imposed a ten percent duty on medical-device imports from China while pausing the existing 25 percent tariffs on products from Canada and Mexico. Observers warn that even modest duty increases could translate into double-digit price upticks for dialysis machines, bloodlines and catheters given the sector’s reliance on specialized components manufactured overseas.

Adding to this, the Section 232–inspired tariffs targeting steel and aluminum derivatives took effect on March 12, 2025, introducing a 25 percent levy on items containing these base metals. Dialysis equipment manufacturers, which depend heavily on precision-machined steel frames and housings, are likely to incur higher material costs. This is expected to reverberate through capital equipment pricing and maintenance contracts, compelling providers to reassess procurement strategies and budget allocations.

Simultaneously, higher duties on semiconductor chips, syringes, needles and personal protective gear could meaningfully increase the recurring costs of fluid concentrates, tubing sets and ancillary disposables. The American Hospital Association projects that these tariffs could add billions to annual medical supply expenditures, compounding the financial strains already felt by dialysis centers and integrated healthcare systems nationwide.

Finally, analyses from industry research firms caution that a proposed 20 percent tariff on European medical-device imports, alongside China’s retaliatory duties of up to 65 percent, risks constricting the availability of high-margin hemodialysis and peritoneal dialysis machines. Should these levies become permanent, manufacturers may be compelled to pass on incremental cost burdens to payers and patients, potentially affecting treatment affordability and access over the mid to long term.

Delving into the Critical Market Segmentation Dimensions Revealing Treatment, Modality, Technology, Product and User Profiles in Dialysis Care

In analyzing market segmentation by treatment type, the dialysis ecosystem unfolds across two central modalities: hemodialysis, which remains the predominant therapy administered through extracorporeal blood purification systems, and peritoneal dialysis, which leverages the patient’s own peritoneal membrane to facilitate solute clearance. Within peritoneal dialysis, the advent of automated peritoneal dialysis platforms has complemented the well-established continuous ambulatory approach, offering patients programmable and remote-managed overnight exchanges that can enhance adherence and clinical stability.

Segmentation by modality further delineates the market into home-based and in-center care models. Assisted care home dialysis services are emerging to support medically complex or mobility-limited patients, while self-care configurations empower educated and motivated individuals to perform treatments independently. Despite the convenience of home options, in-center modalities maintain critical roles in acute case management, resource consolidation and emergency access to multidisciplinary care teams.

From a technology perspective, conventional hemodialysis technology continues to advance with refined membrane chemistries and streamlined control interfaces, even as the uptake of online hemodiafiltration technologies accelerates. The latter’s capacity to generate replacement fluid in real time, combined with mixed-flow and substitution-flow configurations, allows for tailored convection therapies aimed at enhanced middle-molecule removal and potential inflammatory modulation.

Diving into product type, the market spans from fluid concentrates and modular dialysis machines to specialized dialyzers, monitoring systems and tubing sets. Within the dialyzer category, high-flux options deliver superior permeability profiles for larger solutes, while low-flux membranes remain critical for patients with lower fluid and solute removal requirements. Sophisticated monitoring systems now integrate multi-parameter data analytics to enable real-time treatment optimization, further reinforcing the convergence of hardware and software in today’s dialysis solutions.

Considering end users, the spectrum ranges from traditional hospital and specialty clinic environments to dedicated dialysis centers and home care settings, each defined by unique operational workflows and reimbursement pathways. Finally, patient type segmentation-adult, geriatric and pediatric-underscores the necessity for age-appropriate device design, fluid management protocols and supportive care services that meet the diverse physiological and social needs across the lifespan.

This comprehensive research report categorizes the Hemodialysis & Peritoneal Dialysis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Modality

- Technology

- Product Type

- Patient Type

- End User

Analyzing Regional Dynamics and Market Nuances Shaping Hemodialysis and Peritoneal Dialysis Across the Americas, EMEA and Asia-Pacific Territories

The Americas region continues to lead in dialysis service penetration, underpinned by robust reimbursement frameworks and a dense network of specialty clinics. In the United States specifically, regulatory incentives have catalyzed home dialysis adoption and spurred industry investment in remote-monitoring platforms. Canada mirrors these trends, driven by public health priorities and an emphasis on decentralized care models that reduce the burden on urban centers. Across Latin America, diverse economic stratifications yield a patchwork of access levels, with urban hubs reflecting advanced care offerings while rural areas still contend with infrastructural limitations.

In Europe, the Middle East and Africa, the dialysis narrative is one of heterogeneity. Western European health systems are characterized by widespread uptake of high-volume hemodiafiltration and well-resourced home therapy programs, often supported by green dialysis mandates. The Middle East is rapidly expanding its dialysis infrastructure to meet growing chronic kidney disease rates, investing in both peritoneal and hemodialysis capacities. Conversely, several African markets are still emerging, with prioritization of hemodialysis centers in major population centers and ongoing efforts to introduce cost-effective peritoneal dialysis options to increase geographic and socioeconomic inclusivity.

The Asia-Pacific region, home to over half of the global dialysis population, presents both the largest market potential and the most pronounced disparities. Japan and parts of East Asia boast advanced home hemodialysis and peritoneal programs, supported by aging populations and national health insurance coverage. In contrast, South and Southeast Asia are confronting rapidly rising diabetes incidence, prompting urgent scale-up of dialysis access, often through public-private partnerships and philanthropic models. Australia and New Zealand continue to pioneer sustainable dialysis practices, leveraging stringent environmental regulations to drive green dialysis innovations and balance clinical excellence with ecological stewardship.

This comprehensive research report examines key regions that drive the evolution of the Hemodialysis & Peritoneal Dialysis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Initiatives and Innovation Roadmaps of Leading Dialysis Market Participants Elevating Renal Therapy Solutions Globally

The reorganization of Baxter’s renal care division into the standalone company Vantive in February 2025 reflects a strategic pivot toward deeper commitments in automated peritoneal dialysis and remote patient management. Backed by significant investment from a leading global private equity firm, the company’s mission to elevate digital connectivity and expand access to vital organ therapies is emblematic of a broader industry move to integrate hardware, consumables and cloud-based services around the patient journey.

Fresenius Medical Care persists as a dominant force in the dialysis equipment arena, with its recent Annual Medical Report spotlighting global strategies to scale high-volume hemodiafiltration. By accelerating the deployment of post-dilution online HDF and investing in membrane and fluid management technologies, the company aims to reconcile long-term clinical gains with environmental targets through water- and energy-saving design principles.

B. Braun, long recognized for its Dialog family of hemodiafiltration systems, continues to innovate with the Dialog+ and Dialog IQ platforms that have seen extensive adoption in North America and beyond. These systems integrate advanced user-interface enhancements and automated safety checks designed to reduce setup complexity, optimize convection volumes and support emerging pay-for-performance reimbursement models.

Nipro maintains a critical role as a leading supplier of dialysis disposables and fluid concentrates, routinely updating its dialyzer portfolio to offer both high-flux and low-flux options. Through strategic partnerships in emerging markets and incremental improvements to membrane coatings, the company reinforces its commitment to the global scaling of safe and effective dialysis therapies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hemodialysis & Peritoneal Dialysis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Kasei Medical Co., Ltd.

- B. Braun Melsungen AG

- Baxter International Inc.

- DaVita Inc.

- Diaverum AB

- Fresenius Medical Care AG & Co. KGaA

- Jafron Biomedical Co., Ltd.

- Medica S.p.A.

- Medtronic plc

- Nipro Corporation

- NxStage Medical, Inc.

- Rockwell Medical, Inc.

- Toray Industries, Inc.

Implementing Proactive Strategies and Ecosystem Collaborations to Enhance Value, Resilience and Patient-Centricity in Dialysis Care Delivery

Industry leaders should prioritize the integration of remote patient management systems to enhance care continuity and operational efficiencies. By leveraging real-time treatment data and predictive analytics, providers can reduce hospitalizations, improve treatment adherence and drive superior clinical outcomes.

To mitigate the impact of fluctuating tariff environments, executives must diversify their supply chain networks. Identifying alternative manufacturing hubs, securing local content exemptions and establishing strategic stockpiles of critical components can safeguard cost structures and ensure uninterrupted access to essential dialysis devices and consumables.

Investment in sustainable dialysis practices is imperative for future-proofing operations. Pursuing resource-efficient water treatment solutions, exploring point-of-care dialysate generation and adopting biodegradable waste management protocols will not only lower environmental footprints but also align with emerging regulatory expectations.

Collaboration with value-based care partners and payers can accelerate the shift toward patient-centric reimbursement models. Engaging in pilot programs that reward home therapy adoption and clinical quality metrics will position organizations to capture emerging premium incentives tied to the U.S. End-Stage Renal Disease Treatment Choices initiatives.

Finally, maintaining a focused research and development agenda that addresses the unique needs of geriatric and pediatric populations will unlock new growth avenues, enhance patient satisfaction and solidify competitive differentiation in a rapidly evolving marketplace.

Outlining Robust Research Frameworks Integrating Secondary Analysis, Primary Insights and Rigorous Validation to Ensure Dialysis Market Intelligence Integrity

This research synthesizes findings from an extensive program of secondary research, including peer-reviewed journal articles, regulatory filings and public-domain financial disclosures. Concurrently, primary insights were garnered through interviews with key opinion leaders, dialysis center administrators and technology innovators, ensuring a balanced perspective on clinical and operational considerations.

Our methodology employed a dual-track triangulation approach, combining top-down analyses of macroeconomic and policy frameworks with bottom-up assessments of product portfolios and service delivery models. Market intelligence was validated through cross-comparison of proprietary datasets and public reporting metrics, with discrepancies reconciled via direct stakeholder engagement.

Where applicable, statistical significance tests were applied to quantitative findings, particularly in home dialysis utilization trends and supply chain impact projections. Qualitative thematic coding of interview transcripts further enriched the narrative, providing real-world context to emerging innovation and reimbursement shifts.

Rigorous quality controls, including peer review by senior research analysts and independent expert panels, were embedded throughout the study lifecycle to ensure integrity, reproducibility and actionable relevance for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hemodialysis & Peritoneal Dialysis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hemodialysis & Peritoneal Dialysis Market, by Treatment Type

- Hemodialysis & Peritoneal Dialysis Market, by Modality

- Hemodialysis & Peritoneal Dialysis Market, by Technology

- Hemodialysis & Peritoneal Dialysis Market, by Product Type

- Hemodialysis & Peritoneal Dialysis Market, by Patient Type

- Hemodialysis & Peritoneal Dialysis Market, by End User

- Hemodialysis & Peritoneal Dialysis Market, by Region

- Hemodialysis & Peritoneal Dialysis Market, by Group

- Hemodialysis & Peritoneal Dialysis Market, by Country

- United States Hemodialysis & Peritoneal Dialysis Market

- China Hemodialysis & Peritoneal Dialysis Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights to Illustrate the Converging Trends, Challenges and Strategic Imperatives in Dialysis Care Innovation and Delivery

The convergence of digital, clinical and sustainability imperatives is reshaping the dialysis ecosystem at an unprecedented pace. As home dialysis uptake accelerates and online hemodiafiltration gains footholds in markets once resistant to change, providers and manufacturers are presented with a dual challenge: delivering superior patient outcomes while maintaining operational and environmental viability.

Concurrently, the reconfiguration of U.S. trade policies underscores the importance of adaptive supply chain strategies. Tariff fluctuations and component sourcing risks necessitate proactive procurement and localized manufacturing approaches to preserve financial margins and secure treatment availability.

Within this dynamic context, the imperative for segmentation-driven product and service offerings has never been greater. From tailored peritoneal dialysis platforms for pediatric care to high-flux dialyzers optimized for geriatric patients, precision in addressing distinct end-user needs will define competitive leadership.

Ultimately, the dialysis market is poised at the intersection of technological promise and systemic challenge. Success will accrue to organizations that marry clinical innovation with strategic foresight, leveraging robust research, cross-sector collaboration and policy acumen to transform patient care and drive sustainable growth.

Engage with Associate Director Ketan Rohom Today to Unlock Comprehensive Market Research and Propel Your Dialysis Strategy to the Forefront of Innovation

To explore how in-depth intelligence can translate into tangible advantages for your organization, reach out to Associate Director, Sales & Marketing Ketan Rohom. Engage in a strategic dialogue to tailor insights that align with your specific operational and growth objectives in the dialysis market. Discover how our rigorous analysis can guide your upcoming investments, partnership decisions and innovation roadmaps. Partner with Ketan Rohom to secure early access to the full market research report and position your enterprise at the leading edge of renal care innovation and competitive differentiation

- How big is the Hemodialysis & Peritoneal Dialysis Market?

- What is the Hemodialysis & Peritoneal Dialysis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?