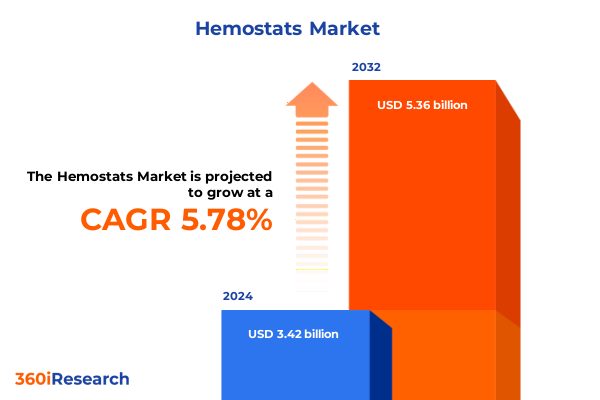

The Hemostats Market size was estimated at USD 3.61 billion in 2025 and expected to reach USD 3.82 billion in 2026, at a CAGR of 5.79% to reach USD 5.36 billion by 2032.

Exploring the Critical Role of Hemostatic Technologies in Enhancing Patient Outcomes and Surgical Efficiency

The hemostats market has emerged as a cornerstone of modern surgical practice, balancing the dual imperatives of patient safety and procedural efficiency. As surgical volumes continue to rise globally, fueled by demographic shifts and a growing burden of chronic conditions, the effectiveness of hemostatic solutions becomes increasingly critical. The industry encompasses a spectrum of technologies-from active agents that harness biological coagulation cascades to mechanical barriers that provide immediate physical tamponade-each designed to address specific bleeding scenarios across diverse surgical disciplines.

This executive summary provides a foundational overview of market dynamics, highlighting technological advances, shifting regulatory frameworks, and evolving clinical preferences. By examining these elements in concert, stakeholders gain a nuanced appreciation of the factors driving innovation and adoption. Through careful analysis of supply chain considerations, emerging materials, and competitive strategies, this document sets the stage for a deeper exploration of the transformative shifts reshaping the hemostats landscape.

How Emerging Nanotechnology, Absorbable Biopolymers, and Regulatory Acceleration Are Redefining Hemostatic Practices

In recent years, the hemostats landscape has undergone transformative shifts as biopolymer innovations and advanced delivery formats redefine clinical practice. Absorbable agents formulated with tunable degradation rates enable surgeons to achieve hemostasis without the need for device removal, marking a departure from conventional gauze and fabric sponges. Simultaneously, flowable and sprayable hemostats have gained prominence, offering precise application in anatomically complex or minimally invasive procedures where traditional barriers prove impractical.

Nanotechnology has emerged as another catalyst for change, with nanostructured materials demonstrating the capacity to accelerate clot formation and enhance bioadhesion. These developments promise to shorten procedural times and reduce postoperative bleeding risks, particularly in trauma and emergency care settings. Alongside material innovation, a favorable regulatory environment has accelerated the introduction of next-generation hemostatic agents. A significant portion of new products have benefited from expedited review pathways, reflecting regulators’ recognition of hemostats’ critical role in surgical safety.

Moreover, the surge in minimally invasive and outpatient surgeries has further propelled demand for rapid-deploy hemostatic solutions. As hospitals and ambulatory centers seek to optimize operating room turnover and support same-day discharge models, devices that combine ease of use with proven efficacy are rapidly supplanting older technologies. These shifts underscore the industry’s ongoing commitment to innovation, propelled by clinician feedback and patient-centric design principles.

Assessing the Rising Cost of Innovation as U.S. Trade Policy Introduces New Tariff Pressures on Hemostatic Device Supply Chains

In 2025, U.S. trade policy adjustments have introduced heightened Section 301 tariffs on a swath of Class I and II medical devices, encompassing surgical instruments and components integral to hemostatic product manufacturing. According to GlobalData, reinstated tariffs targeting devices imported from China are expected to exacerbate cost pressures and disrupt established supply chains, prompting medtech companies to reassess sourcing strategies amidst rising duties.

Financial markets have already responded to these developments, with medical device equities experiencing downturns following tariff announcements. The Wall Street Journal reported that stocks of leading device manufacturers declined as investors weighed potential margin contractions and earnings adjustments tied to import levies. Concurrently, the Financial Times highlighted advocacy efforts by industry associations such as AdvaMed, which underscores that high tariffs on devices and components-some reaching rates above 25%-could ultimately impair patient access and inflate healthcare costs.

In response, several firms are exploring partial re-shoring of production to North American and Southeast Asian facilities, despite the complexity and expense of relocating specialized manufacturing lines. This trend reflects a broader emphasis on supply chain resilience, even as stakeholders lobby for tariff exemptions and streamlined exclusion processes. The cumulative impact of these policies underscores the need for proactive supply chain diversification and strategic contingency planning in the hemostats sector.

Unveiling the Complex Interplay Between Product Types, Materials, Forms, Applications, and Channels Shaping the Hemostats Market

Insights into product type segmentation reveal that active hemostats, which incorporate biological catalysts such as thrombin and fibrin, continue to anchor the market due to their rapid onset of clotting and compatibility with a wide range of surgical scenarios. At the same time, combination hemostats are gaining traction by coupling mechanical barriers with biochemical agents to deliver synergistic effects, particularly in more challenging bleeding cases. Flowable hemostats, designed for application via syringe or spray, address the needs of minimally invasive and endoscopic surgeries, allowing precise coverage in confined spaces. Mechanical hemostats-fabricated from materials like oxidized regenerated cellulose-remain valued for their broad accessibility and cost-effectiveness in general surgery settings.

Material segmentation further underscores innovation trends. Natural materials such as cellulose, chitosan, collagen, and gelatin leverage inherent biocompatibility and native hemostatic properties. Chitosan, for instance, offers antimicrobial benefits alongside clot promotion, while collagen-based agents support tissue regeneration. Synthetic materials-ranging from dextran and polyethylene glycol to emerging polyhemoglobin formulations-enable fine-tuning of absorption rates and mechanical strength, catering to specialized surgical requirements.

Form factors shape clinical adoption with liquid and spray formats gaining preference for rapid deployment in trauma and laparoscopic procedures. Semisolid gels provide conformability on irregular surfaces, while solid sponges and pads offer straightforward application in conventional open surgeries.

Application segmentation drives product design toward the nuanced hemostatic demands of cardiovascular, general, gynecological, neurological, orthopedic, and reconstructive surgeries. Each specialty’s unique bleeding profile informs the selection of appropriate hemostatic solutions.

In distribution channels, traditional offline pathways through distributor networks and hospital procurement systems coexist with expanding online options, including e-commerce platforms and manufacturer websites, which improve accessibility for smaller clinics and ambulatory centers. End users range from hospitals-where high surgical volume sustains demand-to ambulatory surgery centers, clinics, and specialty centers that increasingly favor rapid, user-friendly hemostats for outpatient procedures.

This comprehensive research report categorizes the Hemostats market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Form

- Application

- Distribution Channel

- End User

Mapping the Variations in Hemostats Adoption and Growth Drivers Across the Americas, EMEA, and Asia-Pacific Regions

The Americas region remains at the forefront of hemostats consumption, underpinned by advanced healthcare infrastructure, substantial research investment, and established reimbursement frameworks that facilitate rapid adoption of novel technologies. The U.S. leads in clinical trial activity and product approvals, serving as a critical launchpad for global commercialization efforts.

Europe, the Middle East, and Africa present a multifaceted landscape where mature markets in Western Europe coexist with growth opportunities in emerging economies. Regulatory harmonization under the European Medicines Agency has streamlined market entry across EU member states, while Middle Eastern nations are investing in state-of-the-art surgical facilities. In Africa, infrastructure challenges persist, yet targeted public-private partnerships are driving incremental uptake of cost-effective hemostatic solutions.

Asia-Pacific is the fastest-expanding region, propelled by rising healthcare expenditures, growing surgical volumes, and government initiatives to bolster domestic medical device manufacturing. China, India, and Southeast Asian countries are central to this growth, with local players and multinational corporations alike scaling production capabilities to meet surging demand. Investments in innovation hubs and strategic partnerships with Western firms continue to enhance regional competitiveness.

This comprehensive research report examines key regions that drive the evolution of the Hemostats market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Moves by Industry Leaders to Expand Hemostatic Portfolios Through Innovation, Acquisitions, and Clinical Collaborations

Key players in the hemostats market are leveraging diverse strategies to fortify their positions. Johnson & Johnson’s Ethicon division continues to expand its hemostatic portfolio, exemplified by the introduction of the ETHIZIA™ Hemostatic Sealing Patch and acquisition of GATT Technologies to integrate synthetic polymer technology into its biosurgery offerings. Baxter International strengthened its surgical sealant franchise through the acquisition of CryoLife’s hemostatic sealant business, augmenting its presence in combination and active agent segments. Other prominent companies-such as B. Braun Melsungen, Terumo, Boston Scientific, Medtronic, Stryker, and Zimmer Biomet-are intensifying R&D collaboration, investing in next-generation materials, and executing targeted acquisitions to broaden their competitive portfolios.

Additionally, these firms are prioritizing clinical partnerships and real-world evidence generation to validate product efficacy and secure favorable reimbursement pathways. Geographic expansion efforts focus on establishing regional manufacturing footholds and distribution networks, particularly in high-growth Asia-Pacific markets. Such multi-pronged approaches underscore the critical role of strategic alliances and inorganic growth in navigating an increasingly complex market environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hemostats market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.R. Medicom, Inc.

- Advamedica Inc.

- Aegis Lifesciences Private Limited

- B. Braun SE

- Baxter International, Inc.

- Becton, Dickinson and Company

- Cotran Corporation, USA

- Dolphin Sutures by Futura Surgicare Pvt. Ltd.

- Dynarex Corporation

- Gelita Medical GmbH

- George & Georges Medisurg Limited

- Johnson & Johnson Services, Inc.

- Medline Industries, Inc.

- Medtronic PLC

- Meril Life Sciences Pvt. Ltd.

- Pfizer Inc.

- Rousselot by Darling Ingredients International Holding B.V.

- SeraSeal

- Shilpa Medicare Ltd.

- SYMATESE

- Teleflex Incorporated

- Terumo Cardiovascular Systems Corporation

Four Actionable Strategies for Developers to Innovate, Diversify Supply Chains, Enhance Digital Reach, and Embed Sustainability in Hemostatic Solutions

Industry leaders must prioritize research and development investments in advanced formulations-particularly flowable, sprayable, and nanostructured hemostats-to address the growing demand for precision hemostasis in minimally invasive and emergency settings. Cultivating partnerships with academic centers and clinical specialists can accelerate product iteration and bolster real-world evidence for new technologies.

In light of tariff-driven supply constraints, firms should diversify manufacturing footprints by establishing additional production sites in low-tariff jurisdictions and strengthening relationships with local suppliers. Engaging proactively with trade policy stakeholders may yield targeted exemptions or relief measures, reducing cost burdens and supply chain volatility.

To capitalize on shifting procurement dynamics, companies should enhance digital engagement channels, optimizing e-commerce platforms and direct-to-customer portals for ambulatory centers and clinics. Concurrently, reinforcing distributor relationships in the offline channel will ensure comprehensive market coverage.

Finally, embracing sustainability-through biodegradable materials and eco-efficient manufacturing-can address emerging environmental standards and resonate with healthcare institutions seeking to minimize ecological footprints, thereby differentiating products in a competitive marketplace.

Leveraging Multi-Source Data, Expert Interviews, and Quantitative Analysis to Deliver a Robust Hemostats Market Perspective

This report synthesizes insights from a multi-tiered research methodology. Secondary research encompassed analysis of regulatory filings, peer-reviewed literature, industry publications, and company disclosures. Primary research involved in-depth interviews with surgeons, procurement officers, and medical device executives across key regions, providing qualitative validation of market drivers and challenges.

Data were triangulated through quantitative analysis of shipment data, clinical trial registries, and tariff schedules to assess market dynamics and the impact of trade policies. Segmentation frameworks were designed in collaboration with subject matter experts, ensuring alignment with clinical use cases and commercial channels. Regional insights incorporate macroeconomic indicators and healthcare investment trends, while competitive benchmarking draws on merger and acquisition activity and patent landscapes.

This rigorous approach ensures a balanced and actionable view of the hemostats market, offering stakeholders a reliable foundation for strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hemostats market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hemostats Market, by Product Type

- Hemostats Market, by Material

- Hemostats Market, by Form

- Hemostats Market, by Application

- Hemostats Market, by Distribution Channel

- Hemostats Market, by End User

- Hemostats Market, by Region

- Hemostats Market, by Group

- Hemostats Market, by Country

- United States Hemostats Market

- China Hemostats Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Positioning for Leadership in a Dynamic Hemostats Market Defined by Innovation, Resilience, and Strategic Agility

The hemostats market stands at an inflection point, driven by technological breakthroughs, evolving surgical paradigms, and geopolitical considerations that are redefining supply chain dynamics. Advanced materials and delivery systems are enabling more precise, efficient bleeding control, while regulatory incentives and expanding clinical applications continue to unlock new growth avenues.

However, emerging tariff pressures and competitive consolidation underscore the importance of supply chain resilience and strategic agility. Companies that can integrate innovation with robust procurement strategies, digital engagement, and sustainability initiatives will be best positioned to capture value across this dynamic landscape.

In sum, a holistic understanding of segmentation nuances, regional dynamics, and competitive strategies will be essential for stakeholders aiming to lead the next wave of hemostatic innovation and deliver superior patient outcomes.

Drive Strategic Growth with an Expert-Curated Hemostats Market Report Tailored to Your Business Objectives

For decision-makers seeking to navigate the evolving hemostats market landscape, securing a comprehensive market research report is essential. Our in-depth analysis delivers robust insights into segmentation trends, regional dynamics, competitive positioning, and regulatory impacts. To obtain the full report and unlock tailored strategic guidance, please reach out to Ketan Rohom, Associate Director, Sales & Marketing. With a deep understanding of industry challenges and opportunities, Ketan can assist in acquiring the data-rich report that will empower informed investment, partnership, and product development decisions.

- How big is the Hemostats Market?

- What is the Hemostats Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?