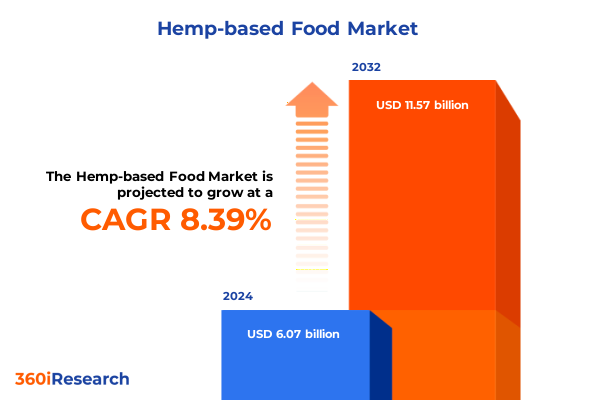

The Hemp-based Food Market size was estimated at USD 6.51 billion in 2025 and expected to reach USD 7.00 billion in 2026, at a CAGR of 8.54% to reach USD 11.57 billion by 2032.

Unveiling the Nutritional Powerhouse of Hemp-Based Foods Shaping the Future of Health and Sustainability in Global Diets

Hemp-based foods, derived from the seeds and oil of the Cannabis sativa plant, have emerged as a distinct category within the broader plant-based nutrition spectrum. Unlike cannabinoid-rich cannabis varieties regulated for psychoactive use, industrial hemp contains negligible levels of THC, making it suitable for mainstream food applications. Products ranging from nut-like shelled hemp seeds to cold-pressed hemp oil, protein powders milled from seed cake, and gluten-free hemp flour illustrate the versatility of hemp as a sustainable, nutrient-dense ingredient. Since the 2018 U.S. Farm Bill federally legalized hemp cultivation, innovation in processing technologies has enabled the development of consistent, high-quality hemp ingredients for functional foods and beverages.

Exploring How Regulatory Advances Innovation and Consumer Demands Are Driving Transformational Change Across the Hemp-Based Food Industry

The hemp-based food landscape is experiencing transformative shifts driven by evolving consumer preferences and regulatory landscapes. Consumers are increasingly gravitating toward products that blend nutritional benefits with convenience, prompting a surge in ready-to-blend smoothie boosters and single-serve wellness shots. This demand for functional formats has spurred legacy food companies and startups alike to integrate hemp into categories as diverse as non-dairy beverages, protein-fortified snacks, and bakery items. Major alcohol producers are also entering the fray by testing hemp-derived THC beverages, underscoring broader industry recognition of hemp’s potential as a disruptive ingredient in both food and drink applications.

Analyzing the Layered Impact of 2025 US Tariff Policies on Hemp-Based Food Supply Chains Costs and Competitive Dynamics

In April 2025, sweeping U.S. tariff measures introduced a universal 10% duty on imported goods, with reciprocal tariffs ranging as high as 145% on products from non-USMCA countries like China. These layered duties significantly elevate the landed cost of hemp seeds, oils, and derived ingredients, which are often sourced globally and subject to dual stacking of universal and country-specific tariffs. Hemp seeds and other oil seeds were explicitly listed among covered agricultural commodities, exposing food processors to higher input costs and prompting a strategic reevaluation of supply chain sourcing strategies.

Decoding Market Segmentation Insights Revealing Packaging End User Source Distribution Product Type and Application Trends in Hemp Foods

A nuanced segmentation analysis illuminates the varied pathways through which hemp-based foods reach consumers and underscores opportunities for targeted innovation. Packaging segments divide into bulk formats for industrial users-such as drums and bulk bags that serve large food-service operations or ingredient assemblers-and retail packages, offered in bottles, sachets, and tubs that cater to at-home use and e-commerce shoppers. End-users bifurcate between food-service channels, where chefs and manufacturers incorporate hemp for its functional attributes, and residential purchasers seeking health‐oriented options. Supply is further distinguished by conventional versus organic cultivation, with the premium organic sector commanding a loyalty among eco-conscious consumers while conventional volumes underpin mainstream accessibility. Distribution channels span convenience stores, online storefronts, specialty health outlets, and supermarkets/hypermarkets, each presenting distinct merchandising and regulatory considerations. Product types encompass flour, oil, protein powder, and whole seeds, reflecting hemp’s adaptability across culinary and nutritional applications such as bakery, beverages, dairy alternatives, meat substitutes, and functional snacks. This layered segmentation reveals how players can hone product features, pricing, and marketing to address specific channel demands and dietary contexts.

This comprehensive research report categorizes the Hemp-based Food market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging

- Source

- Product Type

- Application

- Distribution Channel

Mapping Regional Market Dynamics Highlighting Distinct Growth Drivers Challenges and Opportunities Across Americas EMEA and Asia Pacific

Regional dynamics are shaping divergent growth trajectories and regulatory environs for hemp-based foods. In the Americas, robust consumer interest in plant-powered nutrition converges with favorable federal and state hemp policies to create a sophisticated retail ecosystem, spanning mainstream grocery to digital marketplaces. Meanwhile, the Europe, Middle East & Africa region balances harmonized EU standards-such as a 0.3% THC limit for industrial hemp-with nascent market developments in the Middle East and Africa, where import regulations and supply chain establishment remain emergent. Asia-Pacific features both institutional innovators and regulatory heterogeneity; countries like Australia and Japan are advancing functional food approvals, while regulatory complexity in China and Southeast Asia requires companies to navigate licensing and product registration processes carefully. These regional distinctions influence go-to-market timing, product formulations, and channel partnerships as industry participants tailor strategies to local regulatory frameworks and consumer preferences.

This comprehensive research report examines key regions that drive the evolution of the Hemp-based Food market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Revealing How Key Companies Are Shaping Product Development Sustainability and Market Penetration Strategies

Key companies are accelerating innovation and expanding distribution to meet surging demand for hemp-based foods. Manitoba Harvest, a pioneer in seed-based nutrition, recently collaborated with national grocery chains to launch protein-packed Hemp+ smoothie boosters, leveraging the brand’s regenerative organic certification to underscore sustainability commitments. Concurrently, Nutiva continues to pioneer cold-pressed oils, shelled hemp hearts, and protein powders, emphasizing clean-label processing and transparency around trace constituents as mandated by regulatory regimes such as California’s Proposition 65. Across the value chain, these leading innovators are investing in research partnerships, regenerative agriculture programs, and retail alliances, which are defining new benchmarks for quality and consumer trust in the hemp food segment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hemp-based Food market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aurora Cannabis Inc.

- Bob's Red Mill Natural Foods, Inc.

- Canopy Growth Corporation

- Charlotte's Web Holdings, Inc.

- Cronos Group Inc.

- CV Sciences, Inc.

- Elixinol Global Ltd

- Hemp Foods Australia Pty Ltd

- Hemp, Inc.

- HEXO Corp.

- Isodiol International Inc.

- Manitoba Harvest Quality Foods LLC

- Nutiva, Inc.

- Pure Hemp Technology Inc.

- The Hain Celestial Group, Inc.

- Tilray Brands, Inc.

- VIVO Cannabis Inc.

Strategic Playbook for Industry Leaders Prioritizing Innovation Sustainability and Regulatory Readiness to Capitalize on Hemp-Based Food Market Opportunities

To capitalize on evolving market dynamics, industry leaders should adopt a multifaceted strategic approach. First, optimizing packaging innovation-from eco-friendly materials to single-serve convenience-will align with both consumer demand and sustainability imperatives. Next, diversifying product portfolios across high-growth application areas, such as plant-based dairy and meat alternatives, can capture incremental share while mitigating category risk. Strengthening supply chain resilience through dual-sourcing and domestic cultivation partnerships will buffer against tariff volatility and regulatory shifts. In parallel, proactive engagement with policymakers and adherence to national guidelines will reduce compliance friction and foster a conducive operating environment. Finally, investing in consumer education around hemp’s nutritional profile and functional benefits will differentiate offerings and build long-term brand loyalty.

Rigorous Mixed Method Research Approach Blending Primary Interviews Secondary Data and Quantitative Analysis to Illuminate Hemp Food Market Insights

The research methodology underpinning these insights combined rigorous primary and secondary approaches to ensure depth and reliability. Primary research included structured interviews with leading food-service chefs, ingredient suppliers, and retail category managers, providing firsthand perspectives on product adoption and channel dynamics. Secondary analysis incorporated data from government trade releases, tariff schedules, regulatory filings, and peer-reviewed studies on nutritional composition. Quantitative modeling leveraged segmentation and region-specific adoption rates to contextualize strategic implications, while expert panels validated emerging trends and risk factors. This mixed-method framework ensured a comprehensive understanding of both macroeconomic drivers and granular market patterns.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hemp-based Food market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hemp-based Food Market, by Packaging

- Hemp-based Food Market, by Source

- Hemp-based Food Market, by Product Type

- Hemp-based Food Market, by Application

- Hemp-based Food Market, by Distribution Channel

- Hemp-based Food Market, by Region

- Hemp-based Food Market, by Group

- Hemp-based Food Market, by Country

- United States Hemp-based Food Market

- China Hemp-based Food Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings Emphasizing Market Complexities Growth Drivers and Strategic Imperatives in the Evolving Hemp-Based Food Sector

In summary, the hemp-based food sector stands at an inflection point characterized by rapid innovation, regulatory evolution, and expanding consumer acceptance. Segmentation analysis reveals multifaceted channel and product strategies, while regional insights underscore the need for localized approaches to regulatory compliance and market entry. Tariff developments in 2025 have added complexity to global sourcing, heightening the importance of supply chain optimization. Leading companies are forging new product categories and sustainability credentials that resonate with modern consumers. As the market matures, decision-makers must balance agility with strategic foresight to harness hemp’s nutritional advantages and environmental attributes.

Connect with Ketan Rohom Associate Director Sales Marketing to Access Comprehensive Hemp-Based Food Market Research for Strategic Business Advantage

To explore detailed market insights or to secure your organization’s competitive edge in the hemp-based food space, please connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive expertise in guiding executives through the nuances of market dynamics and can tailor a research package aligned with your strategic objectives. Reach out to Ketan to discuss how our comprehensive hemp-based food market research report can inform product innovation, support go-to-market planning, and provide the actionable intelligence you need to drive growth.

- How big is the Hemp-based Food Market?

- What is the Hemp-based Food Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?