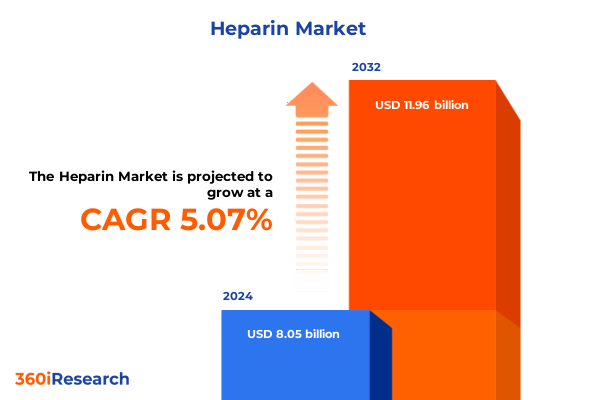

The Heparin Market size was estimated at USD 8.42 billion in 2025 and expected to reach USD 8.81 billion in 2026, at a CAGR of 5.14% to reach USD 11.96 billion by 2032.

Unlocking the Strategic Value of Heparin in Cardiovascular Care and Its Evolving Role Amidst Emerging Clinical and Regulatory Dynamics

Heparin has long stood as a cornerstone of anticoagulant therapy, underpinning critical interventions ranging from cardiovascular surgeries to the management of deep vein thrombosis. This executive summary introduces the multifaceted dynamics shaping the current heparin environment, highlighting how scientific advancements and evolving clinical needs are redefining its role in modern healthcare. As hospitals and ambulatory settings increasingly rely on tailored anticoagulation strategies, understanding the nuances of heparin’s molecular variants and application profiles becomes essential.

Moreover, the regulatory landscape governing heparin production and distribution has grown more complex, driven by heightened scrutiny over raw material sourcing and supply chain resilience. These factors, compounded by shifting healthcare priorities and patient demographics, are prompting stakeholders to reevaluate established procurement and deployment practices. By delving into recent developments across technology, policy, and market segmentation, this summary sets the stage for a holistic exploration of the opportunities and challenges that lie ahead. Ultimately, these insights will inform strategic decision-making for manufacturers, distributors, and clinical end users committed to leveraging heparin’s therapeutic potential.

Unveiling the Major Paradigm Shifts Transforming the Heparin Ecosystem Through Technological Advances Clinical Discoveries and Policy Realignments

Over the past several years, the heparin landscape has undergone a series of transformative shifts propelled by breakthroughs in biotechnology and the refinement of manufacturing techniques. Innovations in synthetic heparin analogues have emerged as a compelling alternative to traditional animal-derived sources, affording greater control over molecular weight distribution and reducing reliance on vulnerable raw material pipelines. Simultaneously, the integration of advanced characterization tools, such as mass spectrometry and high-resolution chromatography, has enhanced the ability to ensure batch-to-batch consistency and meet ever-stricter quality standards.

Clinical discoveries are also redefining patient pathways. Novel reversal agents and monitoring protocols have expanded the safety profile of heparin, enabling more precise dosing strategies for high-risk populations. These advances coincide with global efforts to harmonize regulatory guidelines, with agencies implementing comprehensive traceability requirements and real-time reporting frameworks. As a result, industry participants are adapting to an environment where agility in synthesis and transparency in product lineage are paramount. Together, these technological, clinical, and policy realignments are reshaping the contours of a market that must continually evolve to address the complexities of modern anticoagulation therapy.

Assessing the Ripple Effect of Recent United States Trade Levies on Heparin Supply Chain Dynamics and Manufacturer Cost Structures

Recent United States trade measures have introduced a new layer of complexity to the heparin supply chain, impacting the economics of raw material acquisition and manufacturing overhead. Tariffs imposed on imported excipients and API intermediates have elevated input costs for producers, prompting many to evaluate their dependence on overseas suppliers. In response, forward-looking companies have explored vertical integration initiatives and strategic stockpiling to shield production schedules from tariff-driven disruptions.

These trade dynamics have further catalyzed innovation in sourcing strategies, with a growing emphasis on synthetic pathways and diversification of procurement channels. Manufacturers are forging partnerships with domestic biotechnology firms and exploring contract development and manufacturing opportunities to localize critical processes. At the same time, healthcare providers are revisiting inventory management protocols to balance cost pressures with the imperative of uninterrupted patient care. By examining the cumulative impact of these levies, stakeholders can develop resilience frameworks that mitigate tariff risks and preserve continuity across the heparin value chain.

Decoding Market Segmentation Layers to Reveal Distinct Product Source Administration Application and Channel Patterns Driving Heparin Adoption

A comprehensive segmentation analysis reveals distinct performance drivers across multiple dimensions of the heparin market. From a product type perspective, low molecular weight heparin exhibits a favorable safety profile and predictable pharmacokinetics, while ultra-low molecular weight variants offer even finer control for sensitive patient cohorts; unfractionated heparin remains the standard in acute care settings due to its reversible action. When considering source, bovine-derived heparin has garnered attention for its historical availability but faces renewed scrutiny over prion safety, porcine-derived formulations continue to dominate in established markets, and synthetic heparin is gaining momentum as a next-generation substitute.

Administration routes further differentiate usage patterns, with intravenous injection preferred in hospital intensive care units and subcutaneous injection enabling outpatient management of chronic thrombotic conditions. Application areas span atrial fibrillation management, cardiovascular surgery protocols, deep vein thrombosis prophylaxis, kidney dialysis anticoagulation, and pulmonary embolism treatment, each requiring tailored dosing regimes. End users, from ambulatory surgical centers and clinics to hospitals and research institutions, engage with heparin on diverse operational cadences and compliance frameworks. Finally, distribution channels ranging from hospital pharmacies to online and retail outlets shape accessibility and govern supply chain responsiveness. Integrating these segmentation layers yields a nuanced portrait of market dynamics and illuminates pathways for targeted growth strategies.

This comprehensive research report categorizes the Heparin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Administration Routes

- Application

- End Users

- Distribution Channel

Mapping Regional Dynamics Across the Americas Europe Middle East Africa and Asia Pacific to Illuminate Heparin Utilization Trends

Regional dynamics exert a profound influence on heparin uptake and distribution configurations. In the Americas, mature reimbursement structures and established supplier networks underpin widespread adoption, with an entrenched porcine supply chain and specialized clinical pathways driving sustained demand. Shifting patient demographics and evolving cardiovascular care guidelines in this region continue to inform stakeholder investments in formulation diversity and inventory resilience.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts are advancing amid a mosaic of national standards, challenging manufacturers to align quality and traceability protocols while navigating localized sourcing constraints. Emerging economies within this region are seeking to bolster domestic API production and downstream processing capabilities to reduce import dependency. Conversely, the Asia-Pacific region is characterized by rapid clinical market expansion fueled by increasing procedural volumes and government-led initiatives to enhance access to essential medicines. Collaborative ventures between multinational firms and local manufacturers are driving capacity expansions, while regulatory agencies work toward streamlined approval processes to meet burgeoning healthcare needs.

This comprehensive research report examines key regions that drive the evolution of the Heparin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Positioning Strategies and Innovation Efforts of Leading Heparin Manufacturers Shaping Global Industry Trajectories

Leading organizations are deploying differentiated strategies to secure competitive advantage in a tightening heparin marketplace. Established multinational manufacturers are investing heavily in synthetic heparin platforms to mitigate supply volatility, while also forging alliances with contract development and manufacturing partners to optimize API throughput. Some innovators have released extended-release and low-monitoring dosage forms, capturing niche clinical segments and elevating patient convenience.

Meanwhile, specialized biotechnology enterprises are carving out roles as critical suppliers of high-purity intermediates, leveraging precision fermentation techniques that bypass traditional animal-based extraction processes. These players are also participating in co-development agreements with global pharmaceutical firms to scale novel products and accelerate market entry. Across the board, intellectual property portfolios are expanding to protect unique processes, and targeted merger and acquisition activity is consolidating fragmented assets. Such strategic initiatives underscore a collective drive toward integrated value chains and continuous innovation across the heparin industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Heparin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aspen Pharmacare Holdings Limited

- B. Braun Melsungen AG

- Bioiberica S.A.U.

- Bristol-Myers Squibb Co.

- Cipla Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Fresenius SE & Co. KGaA

- GlaxoSmithKline plc

- Grifols S.A.

- Hebei Changshan Biochemical Pharmaceutical Co., Ltd.

- Hikma Pharmaceuticals plc

- LEO Pharma A/S

- Merck KGaA

- Novartis AG

- Opocrin S.p.A.

- Otsuka Pharmaceutical Co., Ltd.

- Pfizer Inc.

- Sanofi S.A.

- Stada Arzneimittel AG

- Sun Pharmaceutical Industries Ltd.

- Viatris Inc.

- Watson Laboratories, Inc. by Teva Pharmaceuticals USA, Inc.

- Zhejiang Hisun Pharmaceutical Co., Ltd.

Strategic Imperatives and Action Plans to Accelerate Heparin Market Leadership Amidst Changing Regulatory and Competitive Landscapes

To navigate the evolving heparin landscape, industry leaders should prioritize the development of synthetic heparin capabilities that circumvent tariffs and supply disruptions, establishing dual-track production models to balance traditional extraction and biotechnology-based synthesis. Early engagement with regulatory authorities on traceability submissions and quality management system enhancements will facilitate expedited approvals and maintain compliance across jurisdictions. In addition, strengthening partnerships with contract manufacturing organizations can accelerate scale-up timelines and ensure flexibility in raw material sourcing.

Commercial teams are advised to implement value-based contracting models aligned with clinical outcome metrics, thereby reinforcing the therapeutic advantages of advanced heparin formulations. Simultaneously, investment in digital inventory management tools will optimize distribution channel performance, reducing stock-out risks in hospital pharmacies and retail networks. By integrating these recommendations into strategic roadmaps, organizations can achieve greater operational resilience, foster innovation pipelines, and capture emerging opportunities in specialized segments and regional markets.

Explaining the Rigorous Research Framework Data Collection Techniques and Analytical Approaches Underpinning the Heparin Market Study

This analysis draws upon a multi-tiered research framework combining primary and secondary data sources to ensure rigor and credibility. Primary research comprised structured interviews with key stakeholders including manufacturing executives, regulatory advisors, procurement managers, and clinical practitioners. These conversations yielded qualitative insights into supply chain challenges, formulation preferences, and emerging clinical protocols.

Secondary research involved systematic reviews of regulatory filings, peer-reviewed journals, and patent registries to map technological advances and policy developments. Data triangulation techniques were applied to reconcile variations across sources, while quantitative assessments of shipment trends and raw material flows informed contextual understanding. Analytical models incorporated scenario-based evaluations to test the resilience of sourcing strategies under tariff shock simulations. Expert panel validation sessions were conducted to corroborate findings and refine strategic recommendations, ensuring alignment with the latest industry standards and operational realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Heparin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Heparin Market, by Product Type

- Heparin Market, by Source

- Heparin Market, by Administration Routes

- Heparin Market, by Application

- Heparin Market, by End Users

- Heparin Market, by Distribution Channel

- Heparin Market, by Region

- Heparin Market, by Group

- Heparin Market, by Country

- United States Heparin Market

- China Heparin Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Insights Emphasizing the Key Takeaways Emerging Opportunities and Future Considerations in the Heparin Therapeutics Arena

The insights presented in this summary illuminate a heparin landscape in transition, driven by technological breakthroughs, regulatory reforms, and geopolitical trade measures. Stakeholders across the value chain are converging on synthetic alternatives and diversified sourcing to strengthen supply resilience, while clinical innovations and refined administration protocols continue to expand therapeutic applications. Regional nuances underscore the importance of tailored strategies, as mature and emerging markets navigate distinct regulatory and infrastructural contexts.

Looking ahead, the organizations that will succeed are those that integrate cross-functional expertise, invest in advanced manufacturing platforms, and adopt agile regulatory engagement. By synthesizing segmentation insights, regional trends, and competitive dynamics, decision-makers can craft strategic initiatives that maximize heparin’s clinical impact and commercial potential. This conclusion serves as a foundation for informed decision-making and underscores the imperative of proactive adaptation in a complex and rapidly evolving environment.

Engage with Associate Director of Sales and Marketing to Secure Comprehensive Heparin Market Intelligence and Unlock Actionable Growth Insights

To explore how these findings translate into tangible advantages for your organization, reach out to Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch. By engaging directly with his team, you can secure tailored insights that align with your strategic priorities and gain access to an in-depth market research report designed to inform critical business decisions. Whether you aim to refine your supply chain strategies or accelerate product development timelines, this comprehensive resource will equip you with the evidence-based guidance needed to navigate the complex heparin landscape. Don’t miss the opportunity to partner with Ketan Rohom and leverage his expertise in translating nuanced market intelligence into competitive growth initiatives

- How big is the Heparin Market?

- What is the Heparin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?