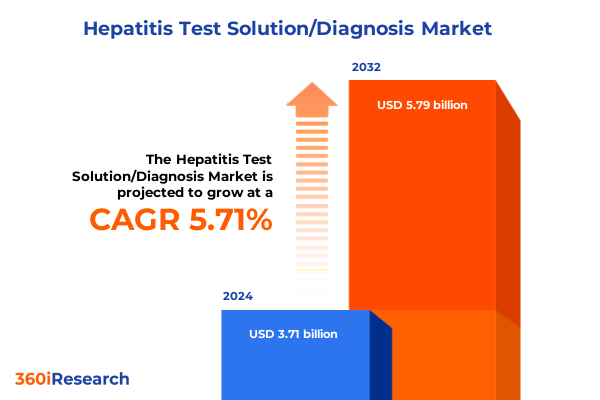

The Hepatitis Test Solution/Diagnosis Market size was estimated at USD 3.92 billion in 2025 and expected to reach USD 4.14 billion in 2026, at a CAGR of 5.72% to reach USD 5.79 billion by 2032.

Unveiling the Critical Imperative of Enhanced Hepatitis Diagnostic Solutions to Drive Early Detection and Transform Patient Management in Healthcare Settings

Hepatitis remains one of the most pressing public health challenges globally, with chronic viral infections silently progressing to severe liver disease and cancer if undetected. Despite breakthroughs in antiviral therapies, the cornerstone of clinical success lies in early and precise diagnosis. Recognizing this, healthcare authorities and clinicians are prioritizing enhanced testing protocols to identify infections at their onset, thereby improving treatment efficacy and curbing onward transmission through targeted interventions.

Advances in diagnostic methodologies are reshaping the field by overcoming traditional limitations in sensitivity, specificity, and turnaround time. High-performance laboratory assays are now complemented by portable point-of-care devices that deliver reliable results in community and primary care environments. Moreover, digital health platforms and connected analytics enable real-time monitoring of test performance and seamless integration of patient data, creating a cohesive ecosystem that supports streamlined workflows and informed clinical decision-making.

This executive summary distills the most critical insights within the evolving hepatitis testing landscape, offering a strategic lens for diagnostic innovators, healthcare decision makers, and policy strategists. It highlights transformative shifts, regional nuances, and segmentation analyses to guide stakeholders in aligning product development and investment priorities with emerging market and regulatory trends. By illuminating these key factors, this document aims to drive informed actions that enhance diagnostic accessibility and optimize patient care pathways nationwide.

Embracing Breakthrough Paradigm Shifts Redefining Hepatitis Testing from Centralized Platforms to Agile Point of Care and AI Empowered Diagnostics

The hepatitis diagnostics arena is experiencing a rapid evolution as testing moves away from centralized laboratories toward decentralized and point-of-care platforms. Traditional high-throughput instruments continue to serve reference facilities, yet there is a clear shift toward portable assay platforms that deliver near instantaneous results at community clinics and remote settings. This transition enhances patient engagement by providing immediate diagnostic feedback and supports integrated care models that connect primary providers with specialist networks, ultimately reducing barriers to timely assessment.

Parallel to hardware innovations, software intelligence and artificial intelligence algorithms are enabling more accurate interpretation of complex test data. Automated image analysis, predictive analytics, and machine learning–driven quality controls are now incorporated into diagnostic workflows, minimizing human error and increasing throughput. These digital tools facilitate seamless connectivity between testing sites and central databases, empowering laboratories to maintain standardized protocols, conduct remote troubleshooting, and generate actionable epidemiological insights that inform public health strategies.

Regulatory frameworks and reimbursement policies are also adapting to support these disruptive technologies. Recent guidelines have streamlined approval pathways for point-of-care diagnostics, while value-based reimbursement models incentivize timely and accurate testing. Collaborative initiatives among manufacturers, regulatory bodies, and healthcare providers are fostering co-development programs that accelerate product validation and market adoption. As a result, stakeholders across the healthcare continuum are poised to leverage these paradigm shifts to enhance patient outcomes and optimize resource allocation in hepatitis management.

Assessing the Far Reaching Consequences of Newly Imposed Tariffs on Hepatitis Test Reagents and Instruments and Their Impact on US Healthcare Costs

In 2025, the implementation of targeted tariffs on imported diagnostic reagents and instrumentation has introduced significant complexities for hepatitis testing stakeholders within the United States. These tariffs, applied primarily to high-sensitivity assay components and advanced analytical platforms, have resulted in immediate price increases for several key diagnostic consumables. As laboratories and point-of-care facilities absorb these additional costs, budgetary constraints are intensifying, challenging public health initiatives aimed at expanding screening and confirmatory testing programs across diverse patient populations.

Supply chain disruptions have further compounded these financial pressures, as diagnostic manufacturers and distributors seek to navigate shifting import duties and compliance requirements. Delays at customs checkpoints and increased administrative overhead are extending lead times for critical test kits and molecular assay reagents. Consequently, some facilities have been forced to adjust testing schedules or reduce the frequency of confirmatory assays, potentially impacting patient care workflows and delaying therapeutic interventions for individuals with suspected hepatitis infections.

To counteract these emerging obstacles, industry leaders and policymakers are exploring strategic measures such as diversifying sourcing arrangements, fostering domestic manufacturing partnerships, and advocating for tariff exemptions on public health–essential diagnostics. By investing in local production capacities and negotiating supply agreements that account for duty fluctuations, the sector can mitigate cost volatility and ensure continuity of testing services. These proactive approaches are vital for safeguarding access to timely hepatitis diagnosis and preserving the momentum toward national viral elimination goals.

Uncovering Strategic Insights From Multi Dimension Segmentation Revealing How Technology Platforms and End User Profiles Shape Hepatitis Diagnostics Adoption

A nuanced analysis of technology segments reveals distinct adoption patterns within hepatitis testing. Chromatography methods are bifurcated into flow injection analysis and high-performance liquid chromatography, offering precision separations favored by specialized laboratory settings. Immunoassays encompass chemiluminescent protocols, enzyme-linked immunosorbent assays, and rapid immunoassays, balancing throughput and speed for both centralized clinics and field screening initiatives. Parallel progress in molecular diagnostics, including isothermal amplification, conventional polymerase chain reaction and real-time PCR, underpins the heightened sensitivity required for low-titer viral detection.

Delving into product-type segmentation uncovers divergent priorities across instruments, consumables, and digital solutions. Bench-top and high-throughput analytical platforms serve distinct operational scales, enabling laboratories to align capacity with testing volume goals. Chromatography kits and immunoassay kits coexist alongside molecular assay kits, each tailored with proprietary reagents to optimize assay performance. Meanwhile, integrated software suites and service models augment hardware deployments by offering data management, remote support and workflow customization essential for scalable diagnostics networks.

End-user segmentation highlights the multifaceted nature of hepatitis testing demand. Blood banks uphold rigorous screening mandates to maintain transfusion safety, whereas clinics emphasize rapid turnaround to initiate clinical care. Hospital-based and independent diagnostic laboratories each leverage distinct testing protocols, while home care settings introduce consumer-centric models for at-home screening. Both general and specialized hospitals integrate testing modalities as part of broader inpatient and outpatient services, with decision criteria guided by patient acuity and epidemiological priorities.

Insights into test-type preferences and use cases further refine strategic targeting. Confirmatory diagnostic methods, whether ELISA-based or PCR-driven, serve as critical arbiters of viral status following preliminary screens, which rely on cost-effective and rapid assays. The dual application domains of clinical diagnostics and research foster a dynamic interplay: clinical environments demand regulatory compliance and streamlined workflows, whereas research settings prioritize methodological flexibility and exploratory analyses to advance novel biomarker discovery.

This comprehensive research report categorizes the Hepatitis Test Solution/Diagnosis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Test Type

- Application

- End User

Navigating Distinct Regional Dynamics Shaping Hepatitis Diagnostic Endeavors Across the Americas Europe Middle East Africa and Asia Pacific

The Americas region exhibits a heterogeneous hepatitis diagnostic landscape characterized by well-established infrastructure in North America juxtaposed with evolving capacities in Central and South America. In the United States and Canada, advanced molecular platforms and robust reimbursement pathways facilitate widespread adoption of high-sensitivity assays. Meanwhile, in Latin American markets, efforts focus on expanding screening coverage through rapid immunoassays and mobile testing units, supported by public health programs aiming to close detection gaps in underserved communities.

Europe, the Middle East and Africa present a complex tapestry of regulatory frameworks and healthcare delivery models. European Union member states benefit from harmonized approval processes that accelerate market entry for innovative diagnostics, while resource-constrained regions in Africa contend with supply chain barriers and variable testing guidelines. Middle Eastern countries, leveraging public–private partnerships, are investing in point-of-care networks to detect and manage viral hepatitis among migrant and indigenous populations, reflecting a growing commitment to targeted screening and treatment initiatives.

Asia-Pacific encompasses some of the world’s most populous markets and carries an outsized burden of hepatitis infections. Countries such as China, India and Indonesia are scaling up laboratory infrastructure with a focus on real-time PCR and isothermal amplification technologies, supported by domestic manufacturing of assay reagents. Conversely, Pacific island nations and Southeast Asian communities prioritize portability and affordability, deploying rapid immunoassays and centralized data platforms to track epidemiological trends and inform vaccination and treatment campaigns across diverse geographic terrains.

This comprehensive research report examines key regions that drive the evolution of the Hepatitis Test Solution/Diagnosis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies of Leading Stakeholders Driving Innovation Partnerships and Market Expansion Within the Hepatitis Diagnostics Domain

Leading diagnostics companies are forging strategic partnerships and pursuing targeted acquisitions to broaden their hepatitis testing portfolios. Collaborations between assay developers and instrument manufacturers enable integrated solutions that streamline laboratory workflows and reduce total cost of ownership. Simultaneously, alliances with biotechnology firms drive the incorporation of novel biomarkers and assay chemistries, strengthening the sensitivity and specificity profiles of next-generation platforms. This strategic consolidation accelerates product development cycles and enhances competitive positioning.

Innovation remains a central pillar of growth as stakeholders invest in point-of-care platforms and connected diagnostics. Forward-looking organizations are deploying modular devices optimized for decentralized use, paired with cloud-based analytics for remote monitoring and quality assurance. Such approaches bolster testing capacity in community settings and support telemedicine initiatives by delivering rapid results to clinicians and patients. At the same time, digital service offerings, including subscription-based data management and training programs, provide recurring revenue streams and deepen client relationships.

Geographic expansion strategies are increasingly nuanced, with global players tailoring go-to-market approaches to regional dynamics and regulatory landscapes. In mature markets, companies leverage existing distribution networks to upsell advanced assays, whereas in emerging economies they engage in co-development agreements with local manufacturers to ensure cost-effective production and faster market access. Through these calibrated alliances and tailored product launches, stakeholders optimize resource allocation and align product portfolios with diverse customer requirements across multiple geographies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hepatitis Test Solution/Diagnosis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- Avantor Inc.

- Beckman Coulter, Inc.

- Bio-Rad Laboratories Inc.

- bioMérieux SA

- Cepheid

- Creative Diagnostics

- DiaSorin S.p.A.

- Epitope Diagnostics, Inc.

- Everlywell, Inc.

- F. Hoffmann-La Roche AG

- FUJIREBIO Inc.

- GenMark Diagnostics, Inc.

- Grifols S.A.

- Hologic, Inc.

- Laboratory Corporation of America Holdings

- MedMira Inc.

- Merck & Co., Inc

- Meridian Bioscience, Inc.

Empowering Industry Visionaries With Actionable Strategies to Enhance Diagnostic Accessibility Strengthen Supply Chains and Leverage Emerging Technologies

Industry leaders should prioritize the integration of automation and digital reporting across testing workflows to drive efficiency and consistency. By deploying laboratory robotics alongside connected data platforms, organizations can minimize manual interventions, accelerate result turnaround and ensure adherence to quality standards. Embracing scalable software-as-a-service models for data management enhances visibility into performance metrics while supporting remote troubleshooting and continuous improvement initiatives, ultimately elevating diagnostic reliability and patient care.

Strengthening supply chain resilience is equally critical for sustaining hepatitis testing operations. Executives should diversify procurement strategies to include multiple qualified suppliers for key reagents and instruments, thereby mitigating risks associated with geopolitical disruptions and tariff fluctuations. Investing in regional manufacturing partnerships or localized assembly facilities can further insulate organizations from import constraints and enable rapid response to surges in testing demand. These proactive measures will secure continuity of critical diagnostics and maintain service levels during periods of volatility.

Finally, proactive engagement with regulatory agencies and collaborative research entities will be instrumental in accelerating approval of innovative diagnostics and broadening reimbursement frameworks. Establishing joint validation studies with academic institutions can generate robust performance data to satisfy evolving compliance requirements. Engaging policymakers in discussions around public health imperatives can also foster supportive policies for point-of-care and confirmatory testing. By cultivating these strategic relationships, industry visionaries can catalyze market readiness and pave the way for transformative diagnostic solutions.

Detailing Rigorous Research Protocols Combining Secondary Data Triangulation Expert Interviews and Advanced Analytical Frameworks to Ensure Data Robustness

The research underpinning this report followed a systematic secondary data collection process, drawing upon peer-reviewed literature, regulatory documents, and publicly accessible databases. Industry white papers and conference proceedings provided historical context and baseline insights into assay performance metrics and technology lifecycles. Governmental health agency publications and clinical guidelines were reviewed to map out prevailing testing protocols and reimbursement policies that influence diagnostic adoption across different healthcare systems.

To enrich these findings and validate emerging trends, a series of in-depth interviews were conducted with key opinion leaders, laboratory directors, assay developers, and healthcare policymakers. These discussions probed topics such as unmet clinical needs, procurement drivers, and the practical implications of tariff-induced cost pressures. Feedback obtained from these stakeholders informed the interpretation of secondary data, allowing for nuanced perspectives on regional variations and operational challenges encountered by diagnostic end users.

Advanced analytical techniques, including cross-segmentation analysis and scenario planning, were applied to synthesize insights from diverse sources. Comparative assessments across technology platforms, product types, end-user environments, and regional contexts enabled the identification of strategic inflection points. Data triangulation ensured consistency between qualitative inputs and quantitative observations, while iterative peer reviews and validation rounds guaranteed the accuracy and reliability of the conclusions presented in this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hepatitis Test Solution/Diagnosis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hepatitis Test Solution/Diagnosis Market, by Product Type

- Hepatitis Test Solution/Diagnosis Market, by Technology

- Hepatitis Test Solution/Diagnosis Market, by Test Type

- Hepatitis Test Solution/Diagnosis Market, by Application

- Hepatitis Test Solution/Diagnosis Market, by End User

- Hepatitis Test Solution/Diagnosis Market, by Region

- Hepatitis Test Solution/Diagnosis Market, by Group

- Hepatitis Test Solution/Diagnosis Market, by Country

- United States Hepatitis Test Solution/Diagnosis Market

- China Hepatitis Test Solution/Diagnosis Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Core Discoveries to Illuminate Critical Opportunities and Strategic Imperatives in the Evolving Hepatitis Diagnostics Landscape

This analysis has illuminated several pivotal developments shaping the hepatitis diagnostics ecosystem. Technological innovations are blurring the lines between centralized and decentralized testing, with chromatography, immunoassays and molecular platforms each carving out unique use cases. The interplay among bench-top instruments, high-throughput systems, and modular point-of-care devices underscores the need for adaptable solutions that can meet the diverse requirements of blood banks, clinics, laboratories and home care settings alike.

Regional dynamics further highlight the importance of tailored strategies, as the Americas, Europe, Middle East and Africa, and Asia-Pacific regions present distinct infrastructural, regulatory and economic landscapes. Tariff-induced cost pressures within the US market have underscored the necessity of supply chain diversification and domestic production initiatives. At the same time, emerging markets are rapidly expanding testing capacities through public health programs and collaborations that prioritize affordability and rapid results.

Collectively, these insights point to strategic imperatives for stakeholders: invest in technology integration to streamline workflows, build resilient procurement and manufacturing frameworks, and engage proactively with regulatory and policy environments. By aligning research and development priorities with real-world clinical and operational needs, industry participants can unlock new avenues for growth and drive progress toward global hepatitis elimination goals.

Securing Exclusive Access to the Comprehensive Hepatitis Diagnostics Market Report by Engaging With the Lead Associate Director for Personalized Insight

For stakeholders seeking an in-depth understanding of the hepatitis diagnostics landscape, direct engagement with Ketan Rohom, Associate Director of Sales & Marketing, offers personalized guidance and a tailored walk-through of the full report. Leveraging extensive experience in market analysis and stakeholder collaboration, this dedicated consultation will ensure you extract maximum value from the insights, methodologies and strategic recommendations contained within the document.

By securing access to the comprehensive study, decision makers will gain clarity on transformative technology trends, regulatory shifts and segmented market dynamics critical to shaping competitive advantages. Reach out today to arrange a discussion, explore tailored subscription options and initiate the process of incorporating these evidence-based insights into your strategic planning initiatives.

To facilitate seamless engagement, an introductory briefing deck can be provided ahead of your consultation, highlighting relevant case studies and regional analyses tailored to your organizational priorities. Early dialogue ensures that your unique questions are addressed and enables prompt access to supplementary datasets, setting the stage for informed investment, partnership or product development decisions.

- How big is the Hepatitis Test Solution/Diagnosis Market?

- What is the Hepatitis Test Solution/Diagnosis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?