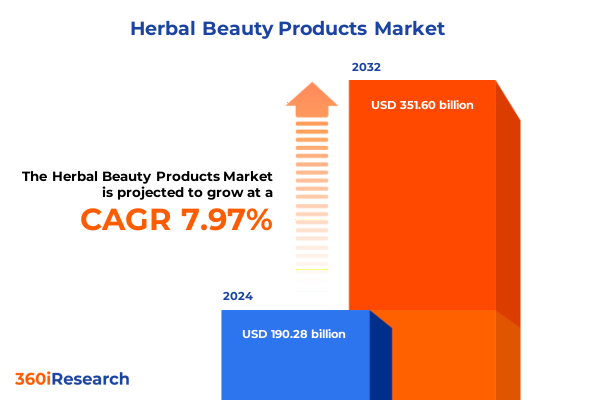

The Herbal Beauty Products Market size was estimated at USD 205.04 billion in 2025 and expected to reach USD 220.95 billion in 2026, at a CAGR of 8.00% to reach USD 351.60 billion by 2032.

Unlocking the Power of Nature Through Herbal Beauty Products: Industry Dynamics, Consumer Drivers, and Growth Trajectories

The herbal beauty product industry has emerged at the intersection of traditional wisdom and modern science, transforming botanical remedies into contemporary self-care solutions. Rising consumer demand for naturally derived formulations has propelled herbal skincare, hair care, and personal care offerings from niche artisanal goods to mainstream market staples. Today’s consumers prioritize transparency, efficacy, and environmental stewardship, seeking brands that combine potent extracts such as aloe vera, neem, tea tree, and turmeric with sustainable practices. This paradigm shift underscores the evolving relationship between botanical authenticity and consumer wellness rituals.

Against this backdrop of renewed botanical fascination, this executive summary distills the critical forces driving market evolution. It examines macroeconomic and regulatory shifts, including 2025 tariff adjustments, and traces how supply chain resilience and digital engagement strategies redefine competitive advantage. Key segmentation insights illustrate how diverse product categories, ingredient portfolios, packaging innovations, distribution channels, and end-user demographics intersect to unlock growth opportunities. Furthermore, regional analyses spanning the Americas, EMEA, and Asia-Pacific reveal differentiated adoption curves and market nuances.

Rapid innovation fueled by biotechnology partnerships and consumer-centric design has catalyzed both consolidation among established leaders and the emergence of agile niche brands. By integrating consumer feedback loops, data analytics, and sustainability benchmarks, industry participants are pioneering a new era of personalized herbal beauty experiences. This summary equips stakeholders with a cohesive roadmap to navigate complexity, harness innovation, and secure a commanding position in a market defined by dynamic consumer expectations.

Embracing Revolution: Key Transformational Shifts Redefining the Herbal Beauty Industry’s Competitive and Innovation Landscape

The herbal beauty market has undergone a profound metamorphosis shaped by shifting consumer values, technological breakthroughs, and an intensified focus on sustainability. What began as a return to age-old botanical remedies has accelerated into a full-scale industry renaissance, driven by the mainstream embrace of clean beauty principles and the demand for ingredient transparency. Brands are now leveraging advanced extraction techniques and biotechnology to isolate bioactive compounds, enhancing potency while minimizing environmental impact.

Moreover, the proliferation of digital touchpoints and content-driven engagement has redefined how consumers discover and evaluate herbal formulations. Social media platforms and influencer collaborations have democratized product education, enabling smaller players to achieve rapid brand traction. Concurrently, personalization has become a cornerstone of product development, with firms deploying consumer data analytics and skin-profiling technologies to create bespoke herbal regimens that address individual concerns.

At the same time, rising regulatory scrutiny and evolving sustainability standards are reshaping the competitive landscape. Companies must navigate complex compliance frameworks governing claims, certifications, and ethical sourcing. These transformative shifts highlight the imperative for agile business models that integrate scientific innovation, robust supply chain transparency, and digital-first consumer outreach. In this dynamic environment, strategic foresight and operational flexibility will determine which brands emerge as enduring leaders in the herbal beauty revolution.

Assessing the Ripple Effects of 2025 United States Tariffs on the Herbal Beauty Products Supply Chain and Consumer Pricing Landscape

In 2025, new United States tariffs on select imported herbs, botanical extracts, and packaging materials introduced significant cost pressures across the herbal beauty ecosystem. Manufacturers reliant on overseas suppliers for raw aloe vera, tea tree oil, turmeric powder, and glass or aluminum packaging faced immediate margin compression. To alleviate this strain, many companies accelerated the diversification of their supplier base, forging partnerships with domestic growers and local packaging facilities to reduce exposure to cross-border duties.

These strategic supplier realignments have reshaped procurement strategies, prompting an uptick in nearshoring and vertical integration. Several brands announced investments in in-house extraction facilities and cultivation sites, ensuring both supply continuity and quality control. Simultaneously, logistics providers optimized distribution networks to mitigate increased freight costs, leveraging consolidated shipping and rail alternatives where feasible.

On the consumer front, the tariff-induced cost increases have translated into measured price adjustments. Brands adopted tiered pricing models and value-add promotions to maintain accessibility for budget-conscious buyers. In higher-value segments such as customized serums and professional spa products, the ability to pass through incremental cost has remained more resilient. Overall, the 2025 tariff wave underscores the critical importance of supply chain agility, cost-management rigor, and transparent consumer communication in sustaining competitive positioning within the herbal beauty products market.

Harnessing Diverse Market Segmentation Insights to Drive Targeted Strategies in Product Type, Ingredient, Packaging, Channel, and End-User Dynamics

Understanding the intricate layers of market segmentation is essential for identifying high-priority growth avenues within the herbal beauty space. Segmenting by product type reveals that bath and body offerings, including body lotions, washes, and soap bars, continue to attract consumers seeking everyday wellness rituals. Cosmetics categories such as eyeshadow, foundation, lipstick, and mascara benefit from a growing appetite for clean color cosmetics infused with botanical extracts. Meanwhile, hair care products-from shampoo and conditioner to hair masks and oils-leverage heritage ingredients to address scalp health and styling trends. Oral care brands that integrate mouthwash and toothpaste with neem and tea tree formulations have tapped into holistic wellness narratives, and skin care innovations spanning face masks, washes, moisturizers, and serums spotlight the anti-inflammatory and brightening properties of turmeric and aloe vera.

Ingredient-based segmentation further highlights the enduring appeal of aloe vera’s soothing profile, neem’s antimicrobial credentials, tea tree’s clarifying benefits, and turmeric’s antioxidant potency. As consumer expectations for clean labels intensify, leveraging these hallmark botanicals within multi-ingredient formulations has become a key differentiator. Packaging preferences range from bio-based solutions such as bamboo and paper alternatives to recyclable glass bottles and jars, durable metal containers in aluminum and tin, and versatile plastic tubes, jars, and bottles. Each material choice reflects a balance between perceived sustainability, product preservation, and consumer convenience.

Distribution channel segmentation spans direct-to-consumer experiences at events and network marketing, digital outreach via brand websites and e-commerce platforms, traditional pharmacy and drugstore shelves, specialty beauty and salon outlets, as well as supermarkets and hypermarkets. Finally, end-user segmentation across children, elderly, men, unisex, and women demographics informs product positioning, messaging, and formulation complexity. Collectively, these layered insights guide targeted strategies that align portfolio design, go-to-market tactics, and consumer engagement for optimized market penetration.

This comprehensive research report categorizes the Herbal Beauty Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient Type

- Packaging Type

- Distribution Channel

- End User

Illuminating Regional Market Variations and Growth Drivers Across the Americas, EMEA, and Asia-Pacific Herbal Beauty Landscapes

Regional market dynamics showcase distinct growth trajectories and consumer preferences across the Americas, Europe, the Middle East & Africa, and Asia-Pacific. In North America, health-conscious consumers have elevated herbal beauty into a must-have lifestyle category, driving broad adoption across mass and premium tiers. Sustainability commitments by major retailers have amplified demand for certified botanical products, while digital natives continue to favor direct-to-consumer and online subscription models.

In EMEA, the European Union’s stringent regulatory framework around claims and certification has fostered high transparency standards, pressuring brands to validate ingredient provenance and efficacy. Concurrently, luxury connoisseurs in Middle Eastern markets prize premium formulations that blend traditional botanicals with cutting-edge delivery systems. African markets, though smaller in scale, present untapped potential as local botanical diversity gains recognition, and domestic producers begin to export heritage ingredients to global brands.

The Asia-Pacific region stands out for its rapid growth and innovation leadership. East Asian markets have long integrated herbal extracts into beauty regimens, and China’s booming e-commerce ecosystem accelerates product discovery through live-streaming and social commerce. South Asian producers leverage indigenous Ayurvedic traditions, while Southeast Asian startups combine local ingredients with modern aesthetics to appeal to both domestic and export audiences. These regional nuances underline the importance of calibrated market entry strategies, tailored marketing narratives, and localized supply chain configurations to capture the full spectrum of global herbal beauty demand.

This comprehensive research report examines key regions that drive the evolution of the Herbal Beauty Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Alliances Driving Disruption and Competitive Advantage in the Herbal Beauty Sector

Leading companies within the herbal beauty segment exemplify a blend of legacy strength and innovation agility. Established global brands that first championed natural formulations have consolidated market presence through strategic acquisitions of niche botanical specialists, extending their portfolios into emerging subsegments. At the same time, agile challengers have achieved rapid scale by championing direct-to-consumer models, leveraging influencer partnerships, and optimizing supply chains for traceability and sustainability.

Collaborative ventures between cosmetic houses and ingredient innovators have accelerated new product pipelines, with joint research projects unlocking proprietary extract technologies. In parallel, private-label manufacturers and contract development organizations have expanded their service offerings to include turnkey botanical product solutions, enabling smaller brands to enter the market with speed and reduced capital expenditure. Moreover, select players have aligned with technology providers to deploy AI-driven formulation software, shortening development cycles and enhancing efficacy profiling.

This confluence of strategic mergers, partnership-driven innovation, and digital infrastructure upgrades illustrates how competitive advantage in the herbal beauty space hinges on integrated ecosystems. Companies that balance robust brand heritage with forward-looking research collaborations and consumer-centric distribution models are best positioned to capture evolving market demand and sustain long-term growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Herbal Beauty Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aubrey Organics, Inc.

- Biotique Corporation

- Dabur India Limited

- Forest Essentials Limited

- Lotus Herbals Limited

- Natreve Inc.

- Nature's Essence Private Limited

- Nature's Gate, Inc.

- Patanjali Ayurved Limited

- Shahnaz Husain Group

- Shalimar Chemical Works Private Limited

- Shalina Healthcare Pvt. Ltd.

- Shanti Cosmetics

- Sharry Cosmetics

- Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

- The Himalaya Drug Company

- Vicco Laboratories

- VLCC Health Care Limited

- Weleda AG

Empowering Industry Leaders with Strategic Actions to Harness Herbal Beauty Market Opportunities and Navigate Emerging Challenges

To capitalize on emerging opportunities and safeguard against volatility, industry leaders should prioritize strategic initiatives that reinforce resilience and spur innovation. First, strengthening supply chain agility through geographic diversification and nearshoring will mitigate the impact of regulatory shifts and tariff fluctuations. Investing in partnerships with domestic growers and regional packaging suppliers can ensure consistency in quality while reducing exposure to cross-border cost pressures.

Second, embedding sustainability at the core of product design and packaging strategy will resonate with eco-aware consumers. Brands should adopt certified bio-based materials, expand refill and reuse programs, and partner with carbon-neutral logistics providers. These measures not only lessen environmental footprints but also enhance brand equity and compliance with evolving green standards.

Third, deepening consumer engagement via digital platforms and personalization tools will sharpen competitive positioning. Implementing advanced analytics for skin profiling, offering virtual consultations, and leveraging user-generated content can foster loyalty and amplify word-of-mouth referrals. Additionally, a hybrid omnichannel approach that harmonizes direct-to-consumer, specialty retail, and mass channels will broaden reach and adapt to shifting shopping behaviors.

Finally, dedicating resources to collaborative R&D will drive the next frontier of herbal innovation. By forging alliances with biotech firms and academic institutions, companies can explore novel extraction methods and ingredient synergies. Coupled with agile product development frameworks, this strategy will shorten time-to-market and sustain a pipeline of cutting-edge offerings that meet evolving consumer expectations.

Unveiling Rigorous Research Methodology Underpinning Comprehensive Analysis of Herbal Beauty Product Market Trends and Dynamics

This research leverages a rigorous, multi-layered methodology designed to capture the full complexity of the herbal beauty products market. Primary research encompassed in-depth interviews with industry stakeholders, including executives from manufacturing, ingredient supply, retail, and e-commerce channels. These qualitative insights were complemented by consumer surveys across key demographics, providing a nuanced understanding of purchase drivers, formulation preferences, and brand perceptions.

Secondary research drew on an extensive review of regulatory filings, trade publications, botanical and cosmetic science journals, and sustainability certification bodies. Data triangulation techniques ensured consistency across multiple sources, while competitive benchmarking illuminated strategic positioning and innovation trajectories among leading players. Geographic market sizing and segmentation analyses employed proprietary frameworks to classify product types, ingredient categories, packaging formats, distribution pathways, and end-user segments with precision.

Quantitative models assessed the impact of 2025 tariff measures, while scenario planning workshops with cross-functional experts provided stress tests for potential regulatory and economic developments. All research phases adhered to stringent data integrity protocols, and findings were validated through peer review by subject-matter specialists. The resulting insights offer a robust, evidence-based foundation for strategic decision-making in the dynamic herbal beauty sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Herbal Beauty Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Herbal Beauty Products Market, by Product Type

- Herbal Beauty Products Market, by Ingredient Type

- Herbal Beauty Products Market, by Packaging Type

- Herbal Beauty Products Market, by Distribution Channel

- Herbal Beauty Products Market, by End User

- Herbal Beauty Products Market, by Region

- Herbal Beauty Products Market, by Group

- Herbal Beauty Products Market, by Country

- United States Herbal Beauty Products Market

- China Herbal Beauty Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Concluding Synthesis Highlighting Critical Insights and Future Outlook for the Evolving Herbal Beauty Products Market Landscape

The herbal beauty products market stands at a pivotal juncture, shaped by an interplay of consumer demands for authenticity, regulatory evolution, and groundbreaking scientific advancements. Through the lenses of product, ingredient, packaging, and distribution segmentation, this analysis has illuminated the multifaceted pathways through which brands can capture market share and foster loyalty. Regional perspectives illustrate that while adoption rates vary across the Americas, EMEA, and Asia-Pacific, a unifying emphasis on transparency and sustainability drives purchasing behavior globally.

The introduction of 2025 tariff measures has served as a catalyst for supply chain reinvention, emphasizing the strategic importance of supplier diversification and domestic capacity building. Concurrently, transformative shifts in digital engagement and personalization underline the need for brands to harness data intelligence and deliver tailored consumer experiences. By profiling the competitive strategies of leading innovators and examining strategic alliances, the report underscores how integrated ecosystems and R&D collaborations will define long-term success.

As industry participants navigate this complex landscape, the imperative for agile strategy and operational excellence has never been greater. Companies that embrace sustainable practices, invest in cutting-edge ingredient science, and deploy consumer-centric distribution models will be best equipped to thrive in an environment characterized by rapid change and heightened consumer scrutiny. These insights chart a clear course for stakeholders seeking to unlock the full potential of the herbal beauty revolution.

Secure In-Depth Market Intelligence on Herbal Beauty Products Today by Connecting with Ketan Rohom for Your Comprehensive Research Report Access

To access the full suite of in-depth analysis, strategic imperatives, and proprietary data visualizations encapsulated in this market research report, please reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan will guide you through the tailored solutions available-whether you require focused insights on specific ingredients, segmentation deep dives, or customized competitive intelligence. By securing this report, you gain the intelligence required to outpace competitors, optimize supply chains in light of evolving regulations, and harness emerging consumer trends before they become mainstream. Don’t miss the opportunity to anchor your next strategic initiative in robust, field-tested market evidence. Connect with Ketan Rohom today to unlock your competitive advantage and drive sustainable growth in the dynamic herbal beauty products sector.

- How big is the Herbal Beauty Products Market?

- What is the Herbal Beauty Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?