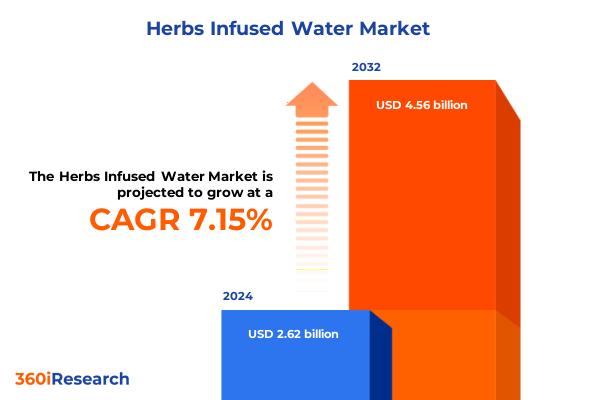

The Herbs Infused Water Market size was estimated at USD 2.80 billion in 2025 and expected to reach USD 3.00 billion in 2026, at a CAGR of 7.19% to reach USD 4.56 billion by 2032.

Unlocking the Refreshing Power of Herbs Infused Water: Exploring Consumer Preferences Health Benefits and Market Opportunities

Herbs infused water has emerged as a dynamic segment within the broader functional beverages category, blending the therapeutic properties of traditional botanical herbs with the refreshing qualities of purified water. This product innovation caters to increasingly health-conscious consumers who seek natural ingredients, clean labels, and elevated hydration experiences without added sugars or synthetic additives. Over recent years, the convergence of wellness trends and experiential consumption has propelled herbs infused water from niche artisanal offerings to mainstream retail shelves, supported by a culture eager to embrace alternative nourishment.

At its core, herbs infused water transcends mere hydration by offering consumers subtle flavor profiles and potential wellness benefits derived from ingredients like mint, ginger, basil, and rosemary. These herbs carry associations with digestive comfort, antioxidant support, stress relief, and immune function, creating a compelling value proposition in an era where preventive health behaviors are paramount. As a result, the segment has attracted innovative startups and established beverage conglomerates alike, all vying to capture discerning consumers through differentiated formulations and storytelling around natural efficacy.

Furthermore, the intersection of sustainability and convenience plays a critical role in how herbs infused water is marketed and consumed. Brands increasingly emphasize eco-friendly packaging solutions, ethical sourcing of botanicals, and transparent supply chains to align with consumer expectations of corporate responsibility. This alignment resonates particularly with millennials and Generation Z, who prioritize brand purpose and environmental stewardship alongside product performance. Consequently, herbs infused water has solidified its position as a leading contender in the competitive landscape of functional beverages, poised for continued evolution as consumer preferences shift toward holistic health solutions.

Navigating the Evolving Landscape of Herbs Infused Water Amid Rising Health Trends Sustainability Demands and Digital Commerce Innovations

The herbs infused water segment has undergone remarkable transformation as consumers demand both innovation and authenticity from their beverages. In recent years, the landscape has shifted dramatically under the influence of holistic wellness movements, driving brands to integrate novel herb combinations with clinically supported functional ingredients. As a result, beverage developers have expanded beyond classic mint and ginger infusions to incorporate adaptogens, probiotics, and bioactive compounds, creating hybrid products that straddle the line between hydration and supplementation.

Simultaneously, sustainability imperatives have reshaped supply chain and packaging models across the industry. Brands now source herbs through regenerative agriculture partnerships, ensuring that methods such as water conservation and soil regeneration underpin raw material acquisition. This farm-to-bottle transparency has fostered brand loyalty among eco-conscious consumers and established herbs infused water as a platform for demonstrating corporate responsibility.

Digital commerce and social media engagement have further catalyzed the segment’s growth by enabling direct-to-consumer launches and interactive community building. Through targeted influencer collaborations and immersive digital campaigns, brands cultivate personal connections and gather real-time feedback that inform product iteration. Together, these shifts underscore a landscape where agility, authenticity, and holistic value creation define success in herbs infused water.

Assessing the Cumulative Impact of 2025 U.S. Tariffs on Herbs Infused Water Sourcing Challenges Rising Costs and Strategic Adaptations in Supply Chains

The introduction of elevated U.S. tariffs in 2025 has exerted multifaceted pressures on the herbs infused water supply chain, affecting both botanical ingredient sourcing and packaging material costs. For spice-based components such as black pepper, cinnamon, and vanilla that cannot be commercially cultivated domestically, tariff-induced price hikes have created ripple effects throughout the value chain. As one industry leader noted, annual incremental costs could reach $90 million if sourcing strategies remain static, prompting companies to reevaluate supplier diversification and cost mitigation approaches.

Tariffs targeting aluminum and steel imports have also reshaped packaging economics for beverage cans and metal closures. Following the announcement on June 3, 2025, of a 50% tariff on all steel and aluminum imports-an escalation from the 25% rate imposed in February-domestic beverage can manufacturers have seen a mixed impact. While reliance on recycled aluminum, which comprises over 70% of raw material inputs, has insulated many producers, those requiring virgin metals face steeper costs and elongated lead times.

In parallel, glass bottle and carton packaging suppliers contend with similar headwinds as raw materials and transport fees climb. The elimination of country-specific exemptions and stricter “melted and poured” standards for metal derivatives have closed previous loopholes, leading to more uniform tariff application that extends to finished goods like aerosol cans and beverage closures. These compounding factors have forced brands to explore alternative packaging formats, renegotiate contracts, and pass through moderate price adjustments to maintain margin integrity.

Moreover, tariffs on Chinese-origin spices have introduced additional layers of complexity. Products such as garlic, dried ginger, and certain chili powders now carry total duty rates of 20% to 35%, up to 10 percentage points higher than prior levels, which has driven importers to seek new botanical sources in India, Egypt, and Peru. The convergence of these tariffs underscores the importance of agile sourcing strategies, dynamic pricing models, and localized production to mitigate geopolitical uncertainties and sustain product availability.

Decoding Core Segmentation Insights Distribution Channels Packaging Innovations and Diverse Product Offerings Shaping the Herbs Infused Water Market

A deep dive into distribution channels reveals nuanced consumer access pathways and purchasing behaviors across the herbs infused water market. In on-premise environments like convenience stores, impulse-driven purchases benefit from eye-catching cooler displays and compact multipacks designed for grab-and-go consumption. In contrast, supermarkets and hypermarkets serve as the primary battleground for household replenishment, where products must stand out on crowded shelves through striking label designs and premium positioning. Complementing these traditional channels, online retail has surged as a strategic vector for subscription models and direct-to-consumer fulfillment, enabling brands to cultivate loyalty programs, personalized flavor bundles, and expedited delivery options that cater to digital-savvy audiences.

Packaging plays an equally critical role in shaping consumer perceptions and operational efficiencies. Metal cans evoke an eco-forward narrative when produced with recycled materials, while glass bottles project heritage appeal and can premiumize the experience through clear visibility of herb infusions. Carton packaging provides cost-effective, space-efficient logistics and aligns with sustainability goals through recyclable components, whereas plastic bottles continue to dominate in scenarios that demand lightweight portability and resealable convenience.

Product type segmentation further defines market contours, beginning with fortified variants that incorporate electrolyte and vitamin C infusions to deliver functional performance akin to sports and wellness beverages. Multi-herb infused offerings bridge familiar flavor profiles with innovative blends such as herbal mixes and mint-ginger combinations, appealing to consumers seeking layered sensory experiences. Single herb infusions, focusing on basil, ginger, mint, and rosemary, enable targeted attribute marketing tied to digestive benefits or calming properties, with mint further differentiated into peppermint and spearmint to capture nuanced taste preferences. Together, these segmentation dimensions inform product development, pricing strategies, and marketing communication, ensuring that brands align formulation choices with channel dynamics and consumer zeitgeist.

This comprehensive research report categorizes the Herbs Infused Water market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Distribution Channel

Illuminating Regional Dynamics Market Drivers Consumer Behaviors and Growth Patterns in the Americas Europe Middle East & Africa and Asia-Pacific Regions

Regional dynamics in the herbs infused water market are shaped by distinct consumer priorities, regulatory environments, and distribution networks across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, North American markets lead in functional beverage adoption due to high consumer awareness of health trends and strong retail infrastructure. The demand for clean-label and sugar-free options is especially pronounced, prompting brands to innovate rapidly and vie for shelf space in both mass-market and premium segments. Latin American consumers, by contrast, exhibit growing enthusiasm for localized herb varieties and artisanal blends, creating space for small-batch producers that celebrate native flora.

Across Europe, Middle East & Africa, stringent labeling regulations and sustainability mandates drive brands to invest in transparent sourcing and eco-friendly packaging. Western European markets prioritize organic certifications and botanical provenance, leveraging regional agricultural heritage to differentiate products. In the Middle East, rising interest in wellness tourism and luxury beverages has elevated premium-priced infusions that incorporate exotic herbs and designer packaging. Meanwhile, Africa’s emerging urban centers signal an untapped growth frontier, where expanding modern trade channels and youthful demographics could catalyze mainstream acceptance given targeted education campaigns.

In Asia-Pacific, cultural familiarity with herb-based infusions fuels rapid category adoption, particularly in East Asian markets where beverage innovation thrives. Companies experiment with indigenous botanicals such as jasmine, holy basil, and lemongrass to resonate with local palates while exporting pan-Asian blends to global markets. Southeast Asian hubs leverage e-commerce ecosystems and mobile-first marketing to introduce subscription-based models that highlight freshness and artisanal quality. These regional distinctions underscore the need for tailored strategies that respect local taste preferences, regulatory constraints, and distribution idiosyncrasies.

As global expansion intensifies, synergistic regional partnerships and localized innovation will define winners in the herbs infused water arena, ensuring brands remain responsive to diverse market dynamics while building consistent global narratives.

This comprehensive research report examines key regions that drive the evolution of the Herbs Infused Water market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Brands Driving Competitive Advantage in the Herbs Infused Water Market Through Strategic Initiatives

Brand competition within the herbs infused water space spans an array of market incumbents, challenger brands, and niche artisans, each leveraging distinct strategic advantages. Established beverage conglomerates integrate herbs infused water into diversified portfolios, capitalizing on channel relationships and scale efficiencies to introduce products with competitive shelf pricing and widespread availability. In contrast, pure-play startups harness agility and brand storytelling to connect with wellness communities, often pioneering novel herb combinations or limited-edition seasonal drops that generate social media buzz.

Key commercial players differentiate through investments in formulation science, securing partnerships with botanical extract specialists and contract manufacturers that adhere to stringent quality standards. These alliances enable rapid prototyping of fortified variants and low-sugar flavor profiles that align with evolving consumer expectations. Moreover, companies increasingly adopt co-branding collaborations with lifestyle influencers and nutrition experts, amplifying credibility and fostering community-driven marketing strategies that translate into impactful conversion rates.

Supply chain collaboration also emerges as a competitive lever, with leading brands forging direct sourcing agreements with herb growers to guarantee traceability and secure volume commitments. This vertical integration minimizes exposure to ingredient price volatility and supports sustainable agriculture initiatives in core sourcing regions. Meanwhile, retail partnerships, including exclusive flavor launches with major grocery chains and convenience store banners, allow brands to engineer shopper journeys and leverage in-store marketing programs for heightened visibility.

Together, these concerted efforts around product innovation, channel partnerships, and brand narratives position companies to capture share in an increasingly crowded marketplace. Strategic differentiation through scientific validation, community engagement, and supply chain transparency will separate market leaders from aspirants.

This comprehensive research report delivers an in-depth overview of the principal market players in the Herbs Infused Water market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aadhunik Ayurveda Vitals

- ALO Drinks

- Aura Bora, Inc.

- Ayala's Herbal Water

- Ayushkalki Wellness Private Limited (Tova)

- D WA Herbals

- Danone S.A.

- Disruptive Beverages, Inc.

- Drinktreo

- Essentia Water LLC

- Flow Alkaline Spring Water LLC

- hinoki LAB

- Hint Inc.

- Keurig Dr Pepper Inc.

- Lunae Sparkling

- National Beverage Corp.

- Nawon Food and Beverage Co., Ltd

- Nestlé Waters S.A.

- nudus

- PepsiCo, Inc.

- SodaStream Inc.

- Spindrift Beverage Company, LLC

- The Coca-Cola Company

- Veda Oil

Strategic Imperatives for Industry Leaders to Capitalize on Growth Opportunities Enhance Consumer Engagement and Optimize Supply Chains in Herbs Infused Water

Industry stakeholders aiming to strengthen their foothold in the herbs infused water segment should consider implementing a suite of interconnected strategies. First, accelerating digital integration across commerce and marketing channels remains essential. By deploying data-driven personalization engines and subscription models, companies can enhance customer lifetime value while capturing first-party data that informs iterative product development. Complementary investments in omnichannel fulfillment capabilities ensure seamless user experiences whether consumers engage online or through brick-and-mortar outlets.

Second, portfolio innovation must be grounded in rigorous consumer insights and functional efficacy. Brands should conduct targeted sensory research and leverage clinical partnerships to substantiate health claims, such as digestive support or antioxidant benefits. These validated claims can then be woven into educational content formats, including branded digital media and in-store activations, to drive trial and repeat purchase.

Third, supply chain resilience is paramount amidst ongoing geopolitical uncertainties and tariff pressures. Diversifying herb sourcing across multiple geographies, reinforcing local ingredient networks, and exploring hybrid packaging materials-such as lightweight sustainable polymers and returnable glass assets-can mitigate cost fluctuations and reduce carbon footprints.

Finally, sustainability and social responsibility should be embedded in core business practices. Initiatives such as carbon-neutral production commitments, water stewardship programs in herb cultivation regions, and community investment projects not only resonate with conscious consumers but also enhance brand equity. By aligning purpose-driven narratives with measurable environmental and social outcomes, companies can solidify long-term differentiation in a crowded market.

Comprehensive Research Approach Combining Primary Interviews Secondary Data Analysis and Robust Validation Techniques for Herb Infused Water Insights

This research employs a structured methodology that combines comprehensive secondary data analysis with targeted primary research to ensure robust and reliable insights. Secondary research encompassed an exhaustive review of industry publications, regulatory filings, corporate announcements, and trade association reports, enabling triangulation of market trends, tariff developments, and packaging innovations. These sources provided contextual frameworks for understanding segment dynamics, regional variations, and competitive landscape evolution.

Primary research efforts included in-depth interviews with executives at leading beverage brands, packaging suppliers, and botanical growers, delivering first-hand perspectives on supply chain challenges, consumer preferences, and innovation pipelines. Additionally, guided discussions with retail category managers and foodservice operators shed light on channel-specific performance metrics, merchandising strategies, and forecasted growth drivers.

Quantitative data collection involved the analysis of retail scanner datasets, e-commerce sales figures, and import-export statistics, allowing for the cross-verification of distribution channel shares and packaging mix trends. Data triangulation techniques were applied to reconcile disparate data points and ensure consistency across multiple sources.

Finally, all findings were subjected to rigorous validation through a review process involving subject-matter experts and industry advisors. This iterative approach ensured that the final deliverables reflect current market realities and actionable insights for stakeholders across the value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Herbs Infused Water market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Herbs Infused Water Market, by Product Type

- Herbs Infused Water Market, by Packaging Type

- Herbs Infused Water Market, by Distribution Channel

- Herbs Infused Water Market, by Region

- Herbs Infused Water Market, by Group

- Herbs Infused Water Market, by Country

- United States Herbs Infused Water Market

- China Herbs Infused Water Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Key Takeaways and Strategic Reflections Highlighting the Future Trajectory and Growth Potential of the Herbs Infused Water Market Landscape

The evidence presented underscores that herbs infused water has evolved from a niche boutique offering to a mainstream functional beverage category defined by health, sustainability, and convenience. Consumer demand for clean labels and botanical authenticity continues to fuel product innovation and premiumization. Simultaneously, distribution channels are diversifying, with online retail complementing traditional grocery and convenience store networks to meet varied consumption occasions.

While geopolitical developments, notably the 2025 tariff landscape, have introduced cost pressures on packaging materials and imported botanical ingredients, agile sourcing strategies and recycled content utilization are mitigating risk. Brands that proactively address supply chain vulnerabilities while emphasizing scientific validation of functional benefits stand to reinforce competitive differentiation.

Regional nuances further highlight the importance of localized brand narratives, whether leveraging cultural botanical heritage in Asia-Pacific, aligning with sustainability mandates in Europe, or tapping into clean-label momentum in North America. Concurrently, robust brand portfolios and strategic partnerships offer pathways to scale and channel penetration.

Looking ahead, the herbs infused water segment is poised for sustained growth driven by consumer gravitation toward holistic wellness, environmental stewardship, and experiential consumption. Stakeholders who invest in data-driven innovation, resilient supply chains, and purpose-led marketing will be best positioned to capitalize on the market’s expanding horizons.

Connect with Associate Director Ketan Rohom to Unlock In-Depth Insights and Secure Your Comprehensive Herbs Infused Water Market Research Report Today

This comprehensive research report offers a deep dive into consumer motivations, industry dynamics, and competitive strategies that define the herbs infused water market. As an industry leader seeking actionable intelligence, you can unlock granular insights and data-driven perspectives that empower strategic decision-making. To explore customized market scenarios, detailed company profiles, and targeted growth opportunities, reach out today. Ketan Rohom, Associate Director of Sales & Marketing, is ready to guide you through pricing options, subscription tiers, and exclusive access packages. Don’t miss the chance to equip your organization with the authoritative analysis needed to stay ahead of evolving trends and drive sustainable growth in the herbs infused water sector. Contact Ketan Rohom now to secure your copy of the full market research report and embark on the next phase of market leadership.

- How big is the Herbs Infused Water Market?

- What is the Herbs Infused Water Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?