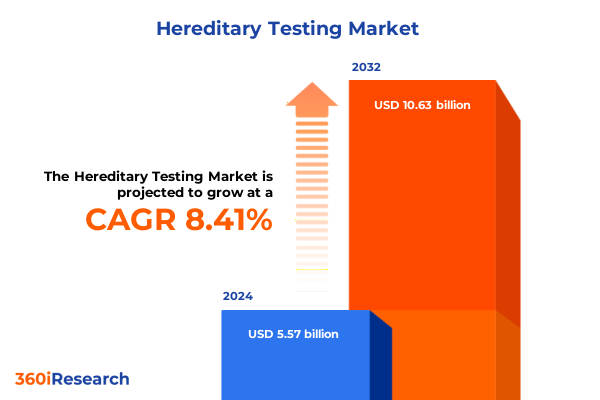

The Hereditary Testing Market size was estimated at USD 6.00 billion in 2025 and expected to reach USD 6.48 billion in 2026, at a CAGR of 8.49% to reach USD 10.63 billion by 2032.

Uncovering the Transformative Potential of Hereditary Testing Through Innovative Technologies and Holistic Patient-Centric Approaches

Hereditary testing has emerged as a cornerstone of precision medicine, enabling clinicians and researchers to decode complex genetic information that can impact patient care across the lifespan. As diagnostic laboratories and healthcare providers integrate genomic data into routine workflows, hereditary testing platforms are evolving from niche services into mainstream clinical tools that inform preventative strategies and personalized treatment plans. This growing acceptance is driven by advances in technology, enhanced reimbursement pathways, and a deepening understanding of genetic markers associated with disease risk.

In recent years, collaboration between academic institutions, biotechnology firms, and regulatory bodies has accelerated the translation of novel assays from bench to bedside. These partnerships have fostered the development of robust quality standards, streamlined approval processes, and expanded clinical guidelines, reinforcing confidence in hereditary testing applications. Consequently, the conversation has shifted toward optimizing test selection, maximizing analytical validity, and ensuring ethical stewardship of genomic information.

Looking ahead, the integration of digital health platforms and artificial intelligence will further refine hereditary testing workflows, enabling real-time data interpretation and seamless communication between laboratories and care teams. In this dynamic environment, organizations that embrace interdisciplinary collaboration and invest in data interoperability stand to lead the charge in elevating the impact of hereditary testing on population health and individual outcomes

Mapping the Revolution in Hereditary Testing with Next-Generation Sequencing and Data-Driven Insights Driving Clinical Innovation

The hereditary testing landscape is undergoing a profound transformation, propelled by next-generation sequencing, digital PCR innovations, and data-driven analytics that are redefining clinical decision making. Historically reliant on targeted gene panels and microarray techniques, the market has seen an infusion of cost-effective whole genome and exome sequencing solutions that offer unprecedented resolution and breadth of variant detection. This shift has enabled healthcare providers to identify rare hereditary conditions with greater confidence and to tailor screening protocols to individual risk profiles.

Concurrently, bioinformatics platforms equipped with machine learning algorithms are streamlining variant interpretation and facilitating the integration of real-world evidence into genomic databases. By harnessing large datasets, researchers can uncover novel gene-disease associations and refine pathogenicity assessments, which, in turn, informs more nuanced patient counseling and management strategies. Moreover, advances in digital PCR technologies such as droplet digital PCR have enhanced sensitivity for low-frequency variant detection, improving analytical performance in applications such as minimal residual disease monitoring and noninvasive prenatal testing.

At the same time, an increasing focus on regulatory harmonization and quality management systems is ensuring that hereditary testing modalities meet consistent analytical and clinical performance benchmarks across geographies. These developments, coupled with patient engagement tools like cloud-based portals and telehealth consultations, are shifting the paradigm from episodic testing to continuous care models, ultimately supporting early interventions and better health outcomes

Examining the Ripple Effects of 2025 United States Tariff Policies on Hereditary Testing Supply Chains and Cost Structures

2025 saw the implementation of new United States tariff measures that directly affected critical components of hereditary testing, including imported sequencing instruments and proprietary reagents. These policy changes have created cost pressures for diagnostic laboratories and kit manufacturers, necessitating a careful reexamination of supply chain strategies. In response, many stakeholders have diversified sourcing agreements, forging partnerships with domestic suppliers and establishing dual-sourcing arrangements to mitigate the impact of increased duties.

The extended lead times and elevated landed costs for instrumentation have prompted some industry players to ramp up maintenance service models and offer flexible leasing options to preserve accessibility for academic research centers and smaller clinical laboratories. At the same time, reagent vendors have revisited formulation and packaging approaches to optimize shipping efficiencies and minimize tariff liabilities, often consolidating shipments or localizing distribution centers closer to end-user markets.

While short-term disruptions have challenged budget planning and inventory management, industry leaders are leveraging tariff analytics and scenario modeling to anticipate future regulatory shifts. By integrating tariff considerations into strategic roadmaps, organizations can implement pricing strategies that balance profitability with market competitiveness and ensure continuity of service delivery for hereditary testing across the United States

Decoding Critical Segmentation Dimensions to Reveal Distinct Product Type, Technology, Testing Type, Application, and End User Dynamics

Analyzing hereditary testing through the lens of product type reveals distinct opportunities and challenges for instruments, reagents and kits, and services. Instruments represent significant capital investments that often anchor a laboratory’s testing capabilities, driving long-term relationships between manufacturers and end users. Reagents and kits, by contrast, generate recurring revenue streams and require continuous innovation in assay sensitivity and specificity to maintain competitive differentiation. Meanwhile, service offerings provide critical scalability for institutions seeking to outsource complex workflows or to rapidly expand testing capacity without upfront equipment expenditures.

From a technology standpoint, microarray methodologies remain valuable for certain comparative genomic hybridization and gene expression studies, as well as high-throughput SNP genotyping. Next-generation sequencing platforms, encompassing exome, targeted, and whole genome sequencing, continue to capture attention due to their comprehensive variant detection and evolving cost efficiencies. PCR-based approaches, particularly digital PCR, qPCR, and RT-PCR, retain prominence in applications demanding ultra-high sensitivity or rapid turnaround times, such as noninvasive prenatal diagnostics and minimal residual disease monitoring.

When segmented by testing type, hereditary assays range from carrier testing that informs reproductive planning to newborn screening programs enabling early detection of metabolic disorders. Pharmacogenomic panels guide therapeutic optimization, whereas predictive testing empowers individuals to proactively manage long-term health risks. Prenatal testing completes the continuum, offering critical insights into fetal development and potential congenital anomalies.

Application segmentation highlights the concentration of hereditary investigations in oncology, where actionable targets drive patient treatment pathways. Cardiovascular disease markers and rare disease gene panels account for another significant segment, while reproductive health applications underscore the growing emphasis on fertility and prenatal care. Finally, end users such as diagnostic laboratories, hospitals and clinics, and research institutes each exhibit distinct adoption patterns based on operational scale, regulatory environment, and clinical focus areas

This comprehensive research report categorizes the Hereditary Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Testing Type

- Application

- End User

Unveiling Regional Nuances in Hereditary Testing Adoption and Infrastructure Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics in hereditary testing adoption and infrastructure reveal nuanced growth patterns and tailored market entry strategies. In the Americas, robust reimbursement frameworks and widespread laboratory accreditation programs have fostered early adoption of advanced sequencing assays. Major metropolitan medical centers and academic institutions continue to drive demand for precision diagnostics, while emerging telehealth initiatives extend testing services to under-served rural populations, bridging access gaps.

The Europe, Middle East and Africa region exhibits diverse regulatory landscapes and reimbursement policies, which necessitate adaptive market strategies. Established European markets benefit from centralized health technology assessments and well-defined genetic counseling networks, whereas Middle Eastern countries are investing in national genomics initiatives to build local testing capacity. In Africa, collaborative programs with international academic consortia and non-profit organizations are enhancing laboratory infrastructure and training, gradually expanding newborn screening and carrier testing offerings in key urban centers.

In Asia-Pacific, government-led precision medicine agendas and growing healthcare investments are driving rapid expansion of hereditary testing services. Countries such as China, Japan and South Korea are scaling up domestic production of sequencing instruments and reagents to achieve supply chain self-sufficiency. Meanwhile, Southeast Asian nations are forming public-private partnerships to integrate pharmacogenomics and oncogenetic panels into national health programs, signaling a strategic shift toward proactive disease management and early disease interception across rapidly aging populations

This comprehensive research report examines key regions that drive the evolution of the Hereditary Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Innovators and Strategic Collaborators Shaping the Hereditary Testing Ecosystem Through Advanced Product Portfolios

Leading innovators and strategic collaborators continue to shape the hereditary testing ecosystem through differentiated product portfolios and comprehensive service frameworks. Illumina remains at the forefront, extending its sequencing platforms with real-time data analytics modules and expanding clinical laboratory partnerships to facilitate seamless workflow integration. Complementing this, Thermo Fisher Scientific has bolstered its reagent and kit offerings with next-generation digital PCR solutions, optimizing sensitivity for challenging sample types and supporting minimal residual disease applications.

Roche Diagnostics is integrating hereditary assays into its broader diagnostics portfolio, aligning tumor genomic profiling with companion diagnostics to streamline oncology care pathways. Qiagen focuses on sample preparation excellence and robust PCR platforms, delivering turnkey solutions that accelerate assay development and reduce time to result for clinical laboratories. Meanwhile, BGI Genomics has leveraged its scale to offer cost-effective sequencing services and to collaborate on population-scale genomic studies, reinforcing its presence in Asia-Pacific and beyond.

Invitae’s clinical testing services, underpinned by a broad variant database and telemedicine-enabled genetic counseling, are transforming patient engagement models and democratizing access to genetic insights. Myriad Genetics continues to leverage its proprietary variant interpretation expertise, particularly in oncology and hereditary cancer risk assessments. Collectively, these companies are investing in collaborative research programs and platform interoperability initiatives that promise to accelerate adoption and expand the clinical utility of hereditary testing

This comprehensive research report delivers an in-depth overview of the principal market players in the Hereditary Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 23andMe, Inc.

- Abbott Laboratories

- Agilent Technologies, Inc.

- BGI Group

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Color Genomics, Inc.

- CooperSurgical, Inc.

- Devyser AB

- Eurofins Scientific SE

- Exact Sciences Corporation

- F. Hoffmann‑La Roche Ltd.

- Fulgent Genetics, Inc.

- Hologic, Inc.

- Igenomix S.L.

- Illumina, Inc.

- Invitae Corporation

- Laboratory Corporation of America Holdings

- Mapmygenome India Ltd.

- MedGenome, Inc.

- MyHeritage Ltd.

- Myriad Genetics, Inc.

- Natera, Inc.

- NeoGenomics Laboratories, Inc.

- PerkinElmer, Inc.

- Qiagen N.V.

- Quest Diagnostics, Inc.

- SOPHiA GENETICS S.A.

- Takara Bio Inc.

- Thermo Fisher Scientific, Inc.

Driving Strategic Growth in Hereditary Testing with Data Integration, Collaborative Partnerships, and Regulatory Engagement to Enhance Market Positioning

To secure competitive differentiation, industry leaders should prioritize data integration initiatives that connect laboratory information management systems with electronic health records and patient engagement platforms. Streamlining data flows not only enhances variant interpretation accuracy but also fosters more informed care pathways and longitudinal patient monitoring. Leaders are advised to pursue collaborative partnerships with specialty clinics and research consortia, leveraging pooled expertise to co-develop novel assays and to validate emerging biomarkers under real-world clinical conditions.

Early engagement with regulatory authorities and health technology assessment bodies can expedite product approvals and facilitate reimbursement negotiations. By aligning study design with evidentiary requirements and establishing health economic models that illustrate long-term cost offsets, organizations can improve market access outcomes. Diversifying supply chains to include both domestic and international manufacturing partners will mitigate geopolitical risks and tariff-driven cost escalations while maintaining product availability and service continuity.

Investing in educational resources for both healthcare professionals and patients is equally critical. Developing digital training modules, peer-reviewed case studies, and community outreach initiatives builds confidence in hereditary testing and supports ethical stewardship of genetic data. Embedding these actionable recommendations into strategic roadmaps will empower companies to navigate evolving regulatory environments, enhance clinical adoption rates, and realize the full potential of hereditary testing innovations

Outlining Rigorous Research Methodologies and Data Validation Frameworks Underpinning the Hereditary Testing Market Analysis Process

The research underpinning this analysis was conducted through a rigorous, multi-faceted methodology designed to ensure depth, accuracy, and relevance. Primary data collection involved in-depth interviews with executives and key opinion leaders across clinical laboratories, hospitals, academic institutions, and regulatory bodies. These direct engagements provided qualitative insights into technological priorities, reimbursement challenges, and emerging application scenarios.

Secondary research encompassed a comprehensive review of scientific literature, patent filings, clinical trial registries, regulatory guidelines, and published health technology assessments. Accredited databases and public records were systematically analyzed to identify recent assay approvals, tariff regulations, philanthropic initiatives, and infrastructure investments. Each data point was cross-validated through triangulation, comparing multiple independent sources to mitigate bias and confirm consistency.

Analytical frameworks were applied to classify technologies by maturity, to map segment dynamics across product types, and to evaluate competitive positioning through proprietary scoring models. A dedicated team of analysts performed iterative data quality checks and conducted sensitivity analyses on key variables such as supply chain resilience, regulatory timelines, and reimbursement trajectories. The resulting insights were synthesized into this report, guided by a peer review process that ensured methodological transparency and reliability

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hereditary Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hereditary Testing Market, by Product Type

- Hereditary Testing Market, by Technology

- Hereditary Testing Market, by Testing Type

- Hereditary Testing Market, by Application

- Hereditary Testing Market, by End User

- Hereditary Testing Market, by Region

- Hereditary Testing Market, by Group

- Hereditary Testing Market, by Country

- United States Hereditary Testing Market

- China Hereditary Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights and Future Imperatives to Guide Stakeholders in Navigating the Evolving Hereditary Testing Ecosystem Effectively

The convergence of technological innovation, regulatory evolution, and strategic partnerships has established a dynamic hereditary testing ecosystem that is reshaping clinical pathways. Advances in next-generation sequencing, digital PCR, and bioinformatics have expanded the scope of detectable variants, while tariff-driven supply chain reconfigurations have underscored the importance of flexible sourcing and cost management. Segment analysis highlights the differentiated growth trajectories across instruments, reagents and kits, and services, as well as the nuanced requirements of diverse testing types and applications.

Regional landscapes vary significantly, reflecting the interplay of reimbursement policies, infrastructure investments, and healthcare priorities in the Americas, Europe, Middle East and Africa, and Asia-Pacific. Leading companies continue to invest in end-to-end solutions, forging alliances that span diagnostic laboratories, academic research centers, and clinical care networks. Actionable recommendations emphasize data interoperability, early regulatory alignment, diversified manufacturing partnerships, and stakeholder education as critical enablers of sustained market leadership.

Collectively, these insights underscore the imperative for organizations to adopt a holistic, adaptive strategy that aligns technological capabilities with evolving clinical and policy environments. By doing so, stakeholders can drive meaningful improvements in patient outcomes, unlock new value propositions, and position themselves at the vanguard of the hereditary testing revolution

Engage with Associate Director of Sales & Marketing to Unlock Comprehensive Hereditary Testing Market Insights and Drive Strategic Decisions

To explore the full breadth of insights, strategic analysis, and granular regional and segment data, please reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise in market dynamics and client needs will ensure you secure the detailed market research report tailored to your strategic priorities.

By engaging directly with Ketan, you will gain personalized guidance on how to navigate the complexities of the hereditary testing landscape, leverage the findings to inform investment decisions, and identify opportunities for innovation and growth. Contact Ketan to arrange a briefing, discuss licensing options, and access complementary executive summaries and excerpted data tables that showcase the actionable insights underpinning this comprehensive study.

- How big is the Hereditary Testing Market?

- What is the Hereditary Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?