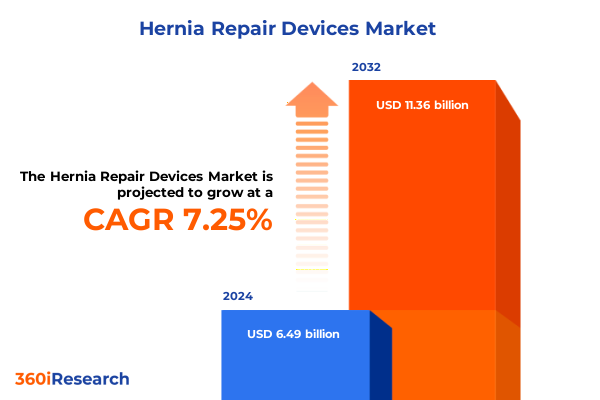

The Hernia Repair Devices Market size was estimated at USD 6.93 billion in 2025 and expected to reach USD 7.40 billion in 2026, at a CAGR of 7.31% to reach USD 11.36 billion by 2032.

Exploring the Integral Role of Hernia Repair Devices in Advancing Surgical Precision and Enhancing Patient Recovery Trajectories Globally

Hernia repair represents one of the most frequently performed surgical procedures worldwide, affecting millions of patients each year. Over the past decade, ongoing advancements in device technology have not only refined operative techniques but also elevated patient safety and accelerated recovery timelines. Surgeons now benefit from a diverse arsenal of solutions-from fixation devices to advanced mesh materials and sutures-each designed to address specific anatomical challenges and minimize postoperative complications. As a result, the field has witnessed a significant transformation, driven by material science innovations and procedural innovation that promise to redefine standards of care.

This executive summary delineates key developments shaping the hernia repair market, examining how evolving clinical practices, regulatory landscapes, and international trade policies converge to influence device selection and procurement. The analysis explores macro trends as well as granular segmentation insights, offering a clear understanding of product categories, hernia types, procedural approaches, patient demographics, and end-user settings. By synthesizing regional patterns and tariff impacts, readers will gain a holistic view of the environment in which device manufacturers and healthcare providers operate. Ultimately, this summary serves as a strategic compass for decision-makers seeking to navigate the complexities of a dynamic, innovation-driven sector.

How Material Science Innovations Combined with Surgical Robotics Are Disrupting Traditional Hernia Repair Paradigms

The hernia repair landscape has undergone transformative shifts as emerging technologies intersect with surgical best practices. Mesh materials have evolved from first-generation synthetic options to hybrid and bio-absorbable constructs that promote tissue ingrowth while reducing foreign-body response. Concurrently, fixation devices such as tacks and straps incorporate bioactive coatings to enhance biocompatibility. Surgeons increasingly leverage robotic platforms, exploiting three-dimensional visualization and articulated instruments to perform complex hernia reconstructions with minimally invasive access. This integration of robotics not only refines operative dexterity but also correlates with lower complication rates and accelerated patient mobilization.

Moreover, procedural pathways continue to diversify, blending laparoscopic and open techniques to optimize outcomes across patient groups. Absorbable sutures now feature advanced polymers tailored for gradual tensile retention, whereas non-absorbable counterparts are engineered for long-term strength in high-tension repairs. In parallel, collaborative research between device manufacturers and clinical institutions has yielded standardized protocols that guide device selection according to hernia type and procedural context. Consequently, this synergy between innovation and evidence-based practice reshapes the competitive landscape, compelling industry players to align development efforts with surgeon preferences and patient-centric metrics.

Assessing the Cumulative Effects of 2025 United States Tariff Adjustments on Global Hernia Repair Device Supply Chains

In 2025, the United States implemented recalibrated tariff schedules that have exerted a cumulative impact on imported hernia repair components. Amendments to duty classifications for surgical mesh-including both biological and synthetic variants-have elevated import costs for manufacturers reliant on cross-border supply chains. Consequently, stakeholders have grappled with margin compression, prompting a reassessment of sourcing strategies. Meanwhile, tariffs on fixation devices and specialized sutures introduced under the same legislative package have further amplified cost pressures, compelling device makers to explore domestic production capacities and strategic alliances with U.S.-based contract manufacturers.

This evolving tariff landscape also influences procurement cycles within hospitals and ambulatory centers. Purchasing departments now factor in duty-adjusted pricing models when negotiating long-term contracts, leading to extended negotiation timelines and segmented rollouts of new products. At the same time, emerging negotiations around trade exclusions have offered temporary relief on select biological mesh products, creating short-term arbitrage opportunities for agile manufacturers. Moreover, the rebalancing of global supply flows has spurred investment in additive manufacturing and localized material processing. In doing so, industry leaders aim to safeguard against future policy volatility while maintaining streamlined access to high-performance hernia repair solutions.

Unraveling Key Segmentation Drivers That Inform Device Innovation Choices for Diverse Hernia Repair Scenarios

Within the hernia repair market, product diversity spans fixation devices, mesh materials, and sutures, each tailored to address distinct surgical requirements. Fixation devices have matured to feature enhanced ergonomic designs and bioactive coatings that reduce postoperative adhesions. Mesh offerings bifurcate into biological implants derived from extracellular matrices and synthetic constructs engineered for durability and flexibility. Sutures similarly diverge between absorbable polymers that gradually resorb to support healing tissues and non-absorbable filaments that maintain long-term tensile strength in high-tension repairs.

Equally important, hernia type segmentation guides device deployment according to anatomical site and clinical complexity. Inguinal hernias dominate case volumes, followed by ventral presentations subdivided into epigastric, incisional, and umbilical repairs. Hiatal and femoral hernias, while less prevalent, drive niche demand for low-profile meshes and specialized fixation techniques. Procedural segmentation highlights the rise of laparoscopic interventions, which now coexist with open and robotic-assisted surgeries to meet diverse clinical scenarios. Patient demographics further delineate market priorities, as pediatric repairs emphasize biocompatibility and minimized foreign-body burden while adult cases often necessitate reinforced mesh configurations. Finally, end-user differentiation spans ambulatory surgical centers, outpatient clinics, and hospital operating rooms, each environment imposing unique regulatory, logistical, and cost considerations that inform device selection and training requirements.

This comprehensive research report categorizes the Hernia Repair Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Hernia Type

- Procedure Type

- Patient Type

- End User

Examining Regional Trends That Are Redefining Demand Dynamics and Regulatory Pathways for Hernia Repair Devices Globally

Regional trends underscore how economic dynamics, regulatory frameworks, and healthcare infrastructure collectively shape the hernia repair landscape. In the Americas, robust reimbursement policies and high procedural volumes underpin demand for premium mesh and minimally invasive technologies. Healthcare systems in North America prioritize standardized outcome metrics, driving rapid adoption of evidence-based device innovations that demonstrate clear value in reducing recurrence and length of stay. Across Latin America, emerging middle-income markets present opportunities for cost-competitive mesh solutions and modular fixation devices.

Conversely, in Europe, Middle East, and Africa, varying regulatory pathways affect time to market and pricing structures. The European Union’s medical device regulations emphasize clinical data transparency, incentivizing manufacturers to invest in post-market surveillance and real-world evidence generation. In the Gulf Cooperation Council countries, government-backed healthcare initiatives accelerate facility upgrades and drive demand for next-generation hernia repair kits. Meanwhile, resource variability in Africa underscores the importance of durable, low-maintenance suture and mesh options. In Asia-Pacific, burgeoning medical tourism hubs and expanding hospital networks in China and India stimulate high-volume procurement of laparoscopic and robotic instruments. National initiatives to enhance domestic manufacturing capabilities further promote regional self-sufficiency and technology transfer partnerships.

This comprehensive research report examines key regions that drive the evolution of the Hernia Repair Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring How Leading Manufacturers and Emerging Innovators Are Shaping Competitive Strategies Through R&D and Partnerships

Major industry players continue to refine their hernia repair portfolios through targeted investments and strategic collaborations. Ethicon, under the umbrella of a global healthcare conglomerate, leverages its R&D infrastructure to introduce next-generation composite meshes featuring smart-release antimicrobial barriers. Medtronic has expanded its robotic system compatibility, integrating proprietary fixation tools that streamline workflow in minimally invasive hernia procedures. B. Braun emphasizes value engineering, offering modular kits that consolidate mesh, tacks, and sutures into cost-efficient bundles tailored for high-volume surgical centers.

At the same time, emergent firms focus on biologically derived implants and digital integration. One such innovator collaborates with computational modeling experts to develop patient-specific mesh topographies that optimize load distribution. Another startup has partnered with a contract research organization to accelerate clinical trials on absorbable scaffold technology aimed at reducing chronic pain and mesh sensation. Acquisition activity remains brisk, as established players acquire niche device manufacturers to bolster their product ecosystems and expand geographic reach. Overall, corporate strategies illustrate a dual emphasis on scientific differentiation and distribution excellence to capture evolving market opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hernia Repair Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Aran Biomedical by Integer Holdings Corporation

- B. Braun SE

- Baxter International Inc.

- Becton, Dickinson and Company

- Betatech Medical

- BioCer Entwicklungs-GmbH

- Boston Scientific Corporation

- Coloplast A/S

- CooperSurgical, Inc.

- Cousin Surgery

- Deep Blue Medical Advances, Inc.

- Dolphin Sutures

- Getinge AB

- HERNIAMESH S.r.l.

- Hwainmedi Co., Ltd.

- Insightra Medical Inc.

- Integra LifeSciences Holdings Corporation

- Intuitive Surgical, Inc.

- Johnson & Johnson Services, Inc.

- KATSAN Katgüt Sanayi ve Tic. A.Ş.

- Medtronic PLC

- Meril Life Sciences Pvt. Ltd.

- Momentis Surgical Ltd.

- Novus Scientific AB

- Olympus Corporation

- Secant Group, LLC

- Surgimatix, Inc.

- TELA Bio, Inc.

- W. L. Gore & Associates, Inc.

- Zimmer Biomet Holdings, Inc.

Implementing Strategic Investments in Innovation, Supply Chain Resilience, and Collaborative Education to Drive Market Leadership

Industry leaders should prioritize strategic investment in advanced materials that enhance biocompatibility while enabling simplified surgical workflows. By channeling research funding toward hybrid mesh constructs with integrated drug-eluting capabilities, manufacturers can address persistent challenges in infection control and tissue integration. In addition, device developers ought to fortify supply chain resilience by diversifying production sites and engaging in contractual agreements with domestic suppliers to mitigate tariff-induced cost fluctuations. Hospitals and surgical centers might consider forging closer partnerships with manufacturers to pilot new technologies under real-world conditions, thereby accelerating adoption curves and generating crucial clinical data.

Moreover, expanding professional education programs on robotic-assisted hernia repair will empower surgeons to leverage these platforms effectively and reduce variability in patient outcomes. Collaborative initiatives with key opinion leaders can amplify best-practice guidelines and create standardized training modules adaptable to global markets. Finally, industry stakeholders should explore value-based contracting models that align device reimbursement with patient-centric outcomes, fostering long-term relationships between manufacturers, providers, and payers.

Leveraging a Multi-Tiered Research Approach That Integrates Secondary Analysis, Primary Insights, and Quantitative Triangulation for Robust Findings

This report synthesizes insights from a rigorous, multi-tiered research methodology that combines secondary data analysis, primary interviews, and quantitative triangulation. Secondary sources included regulatory filings, peer-reviewed clinical studies, and government policy documents to establish a robust baseline of device classifications, material specifications, and procedural guidelines. Primary research involved structured interviews with senior surgeons, procurement directors, and key opinion leaders across major healthcare markets, enabling direct validation of emerging trends and unmet clinical needs.

Quantitative data were cross-validated through triangulation techniques, integrating publicly disclosed sales volumes with anonymized procurement records and feedback from global distribution partners. To maintain methodological integrity, the study team applied standardized inclusion criteria for data sources and conducted iterative peer reviews. Limitations of the research include potential variability in reporting standards among regional healthcare institutions, though rigorous quality checks and sensitivity analyses were employed to mitigate these risks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hernia Repair Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hernia Repair Devices Market, by Product

- Hernia Repair Devices Market, by Hernia Type

- Hernia Repair Devices Market, by Procedure Type

- Hernia Repair Devices Market, by Patient Type

- Hernia Repair Devices Market, by End User

- Hernia Repair Devices Market, by Region

- Hernia Repair Devices Market, by Group

- Hernia Repair Devices Market, by Country

- United States Hernia Repair Devices Market

- China Hernia Repair Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Market Dynamics and Strategic Imperatives to Chart the Future Trajectory of Hernia Repair Device Innovation

The evolution of hernia repair devices reflects a convergence of material science breakthroughs, surgical innovation, and evolving policy frameworks. As mesh and suture technologies diversify and robotic platforms redefine procedural norms, the market landscape grows ever more intricate. Meanwhile, the cumulative impact of tariff adjustments underscores the necessity for agile supply chain strategies and domestic production initiatives. Segmentation analysis highlights how device preferences vary across hernia types, patient demographics, and end-user settings, while regional insights reveal differentiated adoption patterns shaped by reimbursement policies and regulatory standards.

For decision-makers, these insights illuminate pathways to optimize product development, streamline market entry, and foster strategic collaborations. The confluence of R&D investments, education programs, and value-based contracting stands to propel the next wave of innovation, ensuring that hernia repair devices continue to enhance patient outcomes and operational efficiencies across global healthcare systems.

Secure Exclusive Access to In-Depth Research on Hernia Repair Device Trends to Accelerate Your Strategic Advantage

Should you require a deeper dive into the comprehensive analysis of hernia repair devices, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your full report. Our research offers unparalleled detail on device innovation, regulatory shifts, and competitive dynamics that will empower your strategic roadmap and decision-making process.

- How big is the Hernia Repair Devices Market?

- What is the Hernia Repair Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?