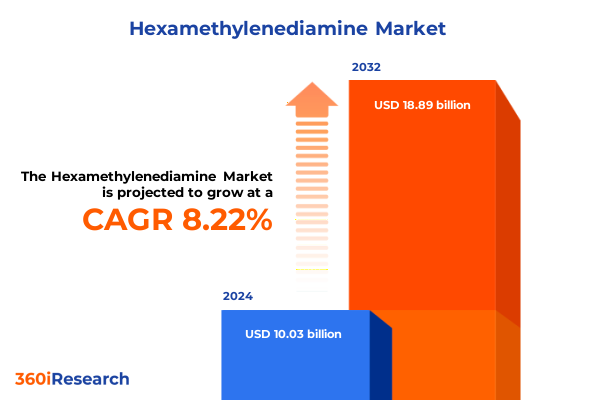

The Hexamethylenediamine Market size was estimated at USD 10.80 billion in 2025 and expected to reach USD 11.63 billion in 2026, at a CAGR of 8.30% to reach USD 18.89 billion by 2032.

Introducing the Strategic Importance and Market Dynamics of Hexamethylenediamine’s Role in Modern Industrial Material Solutions

Hexamethylenediamine is the cornerstone of nylon 6,6 production, synthesized through the catalytic hydrogenation of adiponitrile followed by polycondensation with adipic acid. The resulting polymer exhibits exceptional thermal stability, mechanical strength and chemical resistance, attributes that underlie its pervasive use in high-performance applications. Drawing upon its pivotal role in the polyamide supply chain, manufacturers rely on hexamethylenediamine as an indispensable building block for engineering plastics that meet rigorous specifications across automotive, electrical and textile sectors.

Beyond its function as a nylon precursor, hexamethylenediamine serves as a versatile intermediate in the formulation of adhesives, coatings and epoxy curing agents. Its bifunctional amine groups enable crosslinking reactions that enhance adhesion, durability and corrosion resistance in coated surfaces, making it a preferred choice for protective and decorative applications. Its classification under HS code 2921.22 underscores its strategic importance within the organic chemicals chapter of the Harmonized System, reflecting both its structural characteristics and its industrial significance.

In recent years, demand has been propelled by the automotive sector’s shift toward lightweight, high-performance components and by the electronics industry’s requirements for robust, heat-resistant materials for insulation and connectors. According to S&P Global’s analysis, growth in light vehicle output and expansion of EV manufacturing have reinforced the upstream demand for nylon 6,6 resins, indirectly driving hexamethylenediamine consumption in both North America and China.

Identifying Transformative Shifts Redefining the Hexamethylenediamine Market Landscape Amidst Sustainability, Technology and Regulatory Evolution

The global hexamethylenediamine market is undergoing transformative evolution driven by ambitious sustainability targets and regulatory mandates. Leading chemical producers are integrating bio-derived feedstocks via microbial fermentation and plant-based precursors to reduce reliance on fossil-derived adiponitrile. Pilot-scale initiatives, such as BASF’s roadmap for a bio-based hexamethylenediamine facility in Ludwigshafen, illustrate the industry’s commitment to circular economy principles and carbon footprint reduction.

Concurrently, digitalization across the chemical value chain is accelerating efficiency gains and transparency. Advanced process control, predictive maintenance and blockchain-enabled traceability are enabling producers to optimize reactor performance, minimize downtime and assure raw material provenance. These innovations not only elevate operational excellence but also reinforce compliance with increasingly stringent environmental and safety regulations.

Finally, geopolitical dynamics and trade policy shifts have prompted companies to reassess global supply networks. Nearshoring strategies are gaining traction as organizations seek to mitigate disruptions, manage inventory costs and strengthen resilience. As a result, integrated production hubs in North America and Europe are expanding capacity, while Asian manufacturers diversify into highvalue specialty polyamides, setting the stage for a more agile, regionally balanced hexamethylenediamine landscape.

Analyzing the Cumulative Impact of Recent United States Tariffs on Hexamethylenediamine Supply Chains and Cost Structures in 2025

In 2025, hexamethylenediamine imports into the United States are subject to multiple layers of tariffs that cumulatively reshape cost structures and sourcing decisions. At the federal level, the Harmonized Tariff Schedule designates HS code 2921.22 for hexamethylenediamine and its salts, with a base duty rate of 6.5 percent ad valorem on most non-FTA imports. On top of this, a special additional duty of 46 percent plus a fixed charge of 15.4 cents per kilogram applies to shipments from designated producing countries, amplifying landed costs significantly.

Moreover, Section 301 measures remain in effect for certain chemical imports originating from China, imposing an extra 25 percent ad valorem tariff on top of existing rates. These supplementary duties stem from investigations into unfair trade practices and have been maintained through recent administrative reviews. The aggregate impact of combined ad valorem and per-unit charges has incentivized buyers to seek regional alternatives and to invest in domestic or near-shore production capacity.

Complementing these measures, U.S. customs enforcement and exclusion processes under the Section 301 framework require importers to verify HTS subheadings and pursue case-by-case duty relief petitions. Enterprises navigating this environment must dedicate resources to classify shipments accurately, secure potential exclusions and maintain compliance with evolving policy determinations.

Unveiling Key Insights from Application, End Use Industry, Grade, Form and Distribution Channel Segmentation for Hexamethylenediamine

Segmentation analysis reveals application insights where polyamide intermediates command commanding share, driven by nylon synthesis that spans fiber, film and resin output. This vertical depth in polyamide production underscores the molecule’s foundational role in performance textiles, industrial films and engineering plastics for high-temperature environments.

Across end use industries, the automotive sector remains the primary demand pillar, reflecting hexamethylenediamine’s integration into lightweight engine components, fuel system parts and underthehood modules. Consumer goods applications leverage its utility in durable connectors and structural elements, while the electrical and electronics segment exploits its insulating properties for circuit boards and connectors. Industrial equipment manufacturers depend on both performance polymers and specialty coatings derived from this diamine to enhance longevity under mechanical stress.

Grade selection offers precision across analytical, industrial and reagent categories, with industrial grade prevailing for large-scale polymer synthesis and reagent grade facilitating specialty formulations in laboratory and pharmaceutical settings. Form factors including flakes, pellets and solution variants cater to production preferences, enabling optimized handling and feed rates in extrusion, molding and coating processes. Distribution channels blend direct sales relationships for strategic accounts with distributor networks for regional reach, while e-commerce platforms are emerging as supplementary pathways for niche volumes and rapid replenishment.

This comprehensive research report categorizes the Hexamethylenediamine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Form

- Application

- End Use Industry

- Distribution Channel

Highlighting Critical Regional Dynamics Shaping Hexamethylenediamine Demand across the Americas, Europe Middle East and Africa as well as Asia Pacific

Regional dynamics are reshaping the competitive landscape for hexamethylenediamine. In the Americas, the United States has emerged as both a significant importer and a burgeoning producer, spurred by nearshore investments that offset tariff exposures and streamline supply chains. Canada and Mexico complement this hub, supporting cross-border integration under USMCA provisions and localized manufacturing clusters.

Turning to Europe, Middle East and Africa, robust regulatory frameworks such as the EU’s REACH regime and stringent environmental standards have steered production toward advanced, low-emission technologies. European incumbents are fortifying their footholds through capacity upgrades and strategic joint ventures, while Middle Eastern petrochemical groups leverage abundant feedstocks to pursue downstream specialization in polyamide intermediates.

Asia-Pacific continues to account for the largest production and consumption volumes, driven by China’s integrated adiponitrile-hexamethylenediamine-polyamide value chain and by rapid growth in India’s manufacturing footprint. Regional policy incentives and infrastructure investments are accelerating scale-up, even as global buyers diversify sourcing to balance cost efficiencies with supply security.

This comprehensive research report examines key regions that drive the evolution of the Hexamethylenediamine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delivering Strategic Perspectives on Leading Hexamethylenediamine Producers Driving Innovation, Expansion and Market Competitiveness

Leading chemical producers are advancing innovative capacity expansions and partnerships to secure market leadership. BASF’s pilot-scale bio-based hexamethylenediamine facility in Ludwigshafen exemplifies the integration of renewable feedstocks and process intensification to meet sustainability mandates while preserving product performance. This approach not only reduces lifecycle carbon emissions but also sets a blueprint for broader commercialization by 2026.

In China, Shandong Haili Chemical’s Q4 2023 commissioning of an additional 50,000 metric ton per annum plant underscores domestic ambitions to capture specialty chemical market share, diversify away from import reliance and serve Asia-Pacific’s fast-growing downstream sectors. Concurrently, Invista’s strategic alliance with a Middle Eastern consortium to develop an HMDA hub for GCC markets leverages proximity to feedstock supply and infrastructure, strengthening its global distribution network and risk diversification.

Other key players are enhancing their portfolios through technology licensing, efficiency upgrades and targeted investments to align with evolving regulatory, sustainability and customer requirements. These collective actions illustrate a market in which incumbents and emerging producers alike vie to deliver differentiated solutions across performance, cost and environmental dimensions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hexamethylenediamine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Kasei Corporation

- Ascend Performance Materials LLC

- Ashland Inc.

- BASF SE

- Domo Chemicals GmbH

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Genomatica, Inc.

- Henan Shenma Nylon Chemical Co., Ltd.

- Huafeng (China) Co., Ltd.

- INVISTA

- LANXESS AG

- Merck KGaA

- Radici Partecipazioni S.p.A.

- Rennovia, Inc.

- Solvay S.A.

- Tianchen Qixiang New Material Co., Ltd.

- Toray Industries, Inc.

- UBE Industries, Ltd.

Crafting Actionable Recommendations to Navigate Evolving Supply Chain, Sustainability and Regulatory Challenges in the Hexamethylenediamine Industry

Industry leaders should prioritize the integration of bio-based hexamethylenediamine production pathways to align with escalating environmental regulations and customer sustainability goals. By investing in pilot reactors, biocatalyst development and fermentation optimization, organizations can preemptively meet emerging decarbonization targets and secure first-mover advantages.

Simultaneously, adaptive supply chain strategies that combine regional production nodes with agile logistics and digital risk monitoring can mitigate tariff exposures and geopolitical uncertainties. Enterprises are advised to deploy advanced analytics to model cost impacts under varying duty scenarios and to cultivate strategic partnerships for raw material sourcing in diversified geographies.

Finally, continuous engagement with policymakers, trade bodies and industry consortia will ensure proactive alignment with evolving standards. By fostering collaborative R&D ecosystems, sharing best practices and participating in exclusion request processes, companies can shape policy outcomes, refine safety protocols and drive innovation that sustains long-term competitiveness.

Outlining Rigorous Research Methodology Ensuring Reliable Data Collection Interview Insights and Comprehensive Analysis for Hexamethylenediamine

This report’s findings are grounded in a hybrid research methodology that combines exhaustive primary and secondary data collection. Primary inputs were obtained through in-depth interviews with C-level executives, process engineers and procurement specialists across major producing regions, ensuring firsthand perspectives on capacity trends, technology adoption and policy impacts.

Complementary secondary research drew upon authoritative sources including government tariff schedules, USTR documentation, academic journals and industry association publications. Data from the Harmonized Tariff Schedule, USTR’s Section 301 database and peer-reviewed Green Chemistry studies provided the basis for quantitative analyses on trade flows, duty structures and lifecycle assessments.

Analytical rigor was maintained through cross-validation of multiple data streams, triangulation of stakeholder insights and iterative peer review. Statistical modeling techniques were applied to elucidate cost-structure sensitivities, while scenario analysis projected the potential impact of emerging regulatory and sustainability drivers. These methodological elements combine to deliver robust, actionable intelligence for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hexamethylenediamine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hexamethylenediamine Market, by Grade

- Hexamethylenediamine Market, by Form

- Hexamethylenediamine Market, by Application

- Hexamethylenediamine Market, by End Use Industry

- Hexamethylenediamine Market, by Distribution Channel

- Hexamethylenediamine Market, by Region

- Hexamethylenediamine Market, by Group

- Hexamethylenediamine Market, by Country

- United States Hexamethylenediamine Market

- China Hexamethylenediamine Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing Key Takeaways and Strategic Implications for Stakeholders in the Hexamethylenediamine Value Chain with Forward Looking Perspectives

The evolving hexamethylenediamine landscape reflects the intersection of sustainability imperatives, trade policy complexities and technological innovation. Stakeholders must navigate a terrain characterized by escalating environmental standards, multifaceted tariff regimes and rising demand for high-performance, eco-friendly materials.

Resilient sourcing strategies that blend domestic and regional capacities, underpinned by digital supply chain visibility, will be vital to managing cost volatility and mitigating geopolitical risk. Concurrently, advancing bio-derived production routes offers a pathway to decouple growth from traditional petrochemical constraints and to fulfill stringent decarbonization objectives.

As leading producers and end-users realign their portfolios and partnerships, collaborative R&D initiatives and policy engagement will shape the next wave of product innovation. By embracing these strategic imperatives, companies across the value chain can strengthen competitiveness, optimize resource utilization and seize emerging market opportunities.

Engage with Ketan Rohom to Unlock Comprehensive Hexamethylenediamine Insights and Secure Full Market Research Report Tailored for Strategic Decision Making

To secure the comprehensive market research report on hexamethylenediamine and gain access to in-depth analysis, advanced data visualizations and tailored strategic insights, please contact Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through the report’s unique value proposition, demonstrate how its findings can accelerate your strategic initiatives and outline customized engagement options to align with your organization’s objectives. Reach out today to explore pricing packages, discuss bespoke add-on services and establish a partnership that empowers your decision-making with actionable market intelligence.

- How big is the Hexamethylenediamine Market?

- What is the Hexamethylenediamine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?