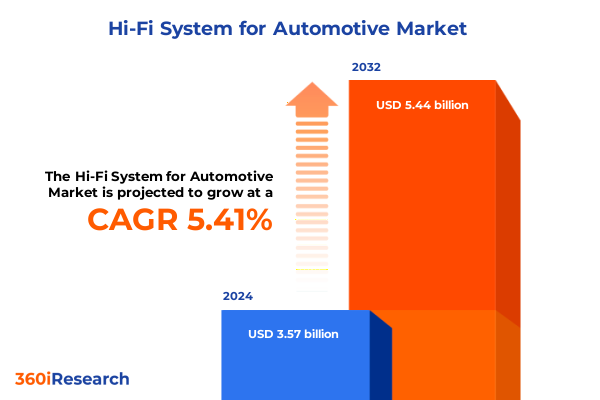

The Hi-Fi System for Automotive Market size was estimated at USD 3.76 billion in 2025 and expected to reach USD 3.96 billion in 2026, at a CAGR of 5.42% to reach USD 5.44 billion by 2032.

Discover the critical foundations and scope of automotive hi-fi systems driving the next generation of in-vehicle audio experiences and strategic innovation

The evolution of in-vehicle audio has transcended mere entertainment to become a cornerstone of the modern driving experience. What began as basic radio receivers and cassette players has developed into sophisticated hi-fi systems that integrate cutting-edge technologies, offering drivers and passengers immersive soundscapes tailored to personal preferences. Today’s automotive hi-fi platforms not only deliver crystal-clear audio reproduction, but they also interface seamlessly with navigation, communication, and infotainment systems, reflecting a paradigm shift in how consumers define value in their vehicles.

In an era defined by rapid technological convergence, automotive manufacturers and audio specialists are collaborating more closely than ever. The synergy between consumer electronics, digital signal processing, and materials science has driven remarkable innovations in sound purity, power efficiency, and system miniaturization. As a result, premium vehicles now feature multi-channel amplifiers, advanced equalization, and personalized sound zones that rival home theater setups, while even mainstream models offer upgraded speaker arrays and integrated connectivity options.

This executive summary offers a concise yet comprehensive overview of the market landscape for automotive hi-fi systems. By examining the transformational shifts, regulatory impacts, segmentation dynamics, regional variations, and competitive strategies, this summary equips decision-makers with the strategic insights needed to navigate the evolving market. The following sections will unpack the critical drivers and challenges that define the current environment, setting the stage for informed action.

Explore how digital connectivity, immersive sound innovations, and changing consumer preferences are catalyzing a shift in automotive hi-fi system capabilities

Automotive hi-fi systems are undergoing a transformative metamorphosis driven by breakthroughs in digital connectivity and immersive audio technologies. Wireless interfaces such as Bluetooth and Wi-Fi now permit seamless streaming of high-resolution audio files, while satellite radio and digital broadcasting deliver unparalleled content variety. Simultaneously, in-vehicle network architectures have matured to support multiple data streams, enabling real-time audio customization and tuning based on driving conditions or passenger profiles.

Equally significant is the rise of immersive sound techniques that leverage digital signal processors, advanced equalizers, and time-alignment algorithms. These innovations allow engineers to craft precise sound staging and dynamic range compression profiles that enhance clarity in cabins with challenging acoustic properties. In turn, consumers increasingly expect their vehicles to provide a concert-hall quality experience, prompting manufacturers to invest in bespoke audio tunings and partnerships with renowned sound brands.

Changing consumer preferences are reinforcing these technological shifts. The proliferation of mobile content consumption has made drivers more discerning about audio fidelity and convenience. Consequently, the market is witnessing a surge in demand for wireless integration, voice-activated controls, and personalized sound settings tied to user profiles. As mobility ecosystems expand to include autonomous and connected vehicles, audio systems will play a pivotal role in defining passenger comfort and experience, securing their place as strategic differentiators.

Assess the overall impact of the 2025 United States tariffs on supply chains, manufacturing costs, and strategic partnerships within the automotive hi-fi sector

In 2025, the imposition of additional United States tariffs on imported consumer electronics components has exerted material pressure on automotive hi-fi system supply chains. Amplifier and processor modules, often manufactured in regions subject to higher duties, have seen cost structures rise, prompting original equipment manufacturers to reevaluate sourcing strategies. These tariffs have also intensified the competitiveness of domestically produced components, as manufacturers seek to offset increased import expenses and maintain margin integrity.

Beyond unit cost, the tariffs have affected inventory management and production planning. Tier-one suppliers are adapting by diversifying supplier bases across multiple geographies, favoring low-tariff regions for critical components such as DSP chips and power transistors. Meanwhile, some automotive OEMs have accelerated onshore tooling investments to secure localized manufacturing capabilities for key parts. These shifts have generated both short-term disruptions and long-term opportunities to fortify supply resilience and optimize total cost of ownership.

Strategic partnerships have emerged as an essential response to the tariff environment. Audio technology firms are entering joint ventures with local assemblers to co-develop modules that meet rigorous quality standards while minimizing tariff liabilities. Collaborative R&D initiatives have gained momentum as stakeholders pursue integrated solutions that balance performance with cost efficiencies. As the market adjusts to this new tariff landscape, companies that proactively manage regulatory risks and strengthen cross-border collaborations will secure a decisive competitive edge.

Unlock segmentation insights revealing how component types, distribution channels, technologies, and vehicle classifications define the automotive hi-fi market

The automotive hi-fi market is characterized by a multifaceted segmentation framework that illuminates key growth areas and competitive battlegrounds. Based on component type, the ecosystem is comprised of amplifiers, digital signal processors and processors, speakers, and subwoofers. Amplifiers encompass 2-channel, mono, and multi-channel designs, each tailored to distinct power and channel requirements. Digital signal processors and processors include crossover units, equalizers, and time alignment modules that refine signal integrity and acoustic staging. Speaker offerings range from compact 5.25-inch drivers to mid-range 6.5-inch units and elongated 6×9-inch formats, while subwoofer configurations span 8-inch, 10-inch, and 12-inch options for low-frequency reinforcement.

Distribution channel segmentation divides the market into aftermarket and original equipment manufacturer segments. The aftermarket segment benefits from retrofit demand, driven by consumers seeking to upgrade audio experiences in existing vehicles, whereas the OEM channel integrates audio systems at the point of vehicle manufacture, emphasizing seamless design integration and warranty coverage. Technological segmentation further differentiates wired and wireless solutions. Wired interfaces include auxiliary input and USB connectivity, offering reliable signal paths and universal compatibility, while wireless systems leverage Bluetooth, digital radio standards, satellite radio services, and Wi-Fi streaming to meet the demand for cord-free convenience.

Vehicle type segmentation distinguishes commercial vehicles from passenger cars. Commercial vehicles prioritize durability, ease of maintenance, and driver comfort over extended operational hours, resulting in robust, vibration-resistant audio modules. Passenger cars, by contrast, focus on premium sound quality, stylistic speaker grilles, and customizable acoustic profiles that cater to discerning consumers. By understanding these interlocking segmentation dimensions, stakeholders can pinpoint targeted value propositions and invest in solutions that resonate with their intended end-users.

This comprehensive research report categorizes the Hi-Fi System for Automotive market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System Type

- Technology Level

- Connectivity

- Power Output Range

- Vehicle Category

- End Customer Type

- Sales Channel

Reveal regional market dynamics across the Americas, EMEA, and Asia-Pacific that are shaping demand and competitive positioning in automotive hi-fi systems

Regional analysis reveals divergent growth trajectories and strategic priorities across global markets. In the Americas, strong consumer appetite for premium in-vehicle experiences and the presence of leading audio brands underpin a robust landscape for hi-fi system adoption. Automakers headquartered in the region are collaborating with local suppliers to integrate branded sound systems as standard or optional equipment, reflecting an emphasis on product differentiation and enhanced customer loyalty.

Across Europe, the Middle East, and Africa, regulatory frameworks and consumer preferences drive a distinct set of market dynamics. Emissions and sustainability regulations in Europe incentivize lightweight speaker materials and energy-efficient amplifiers. At the same time, demand for digital radio and satellite broadcasting remains high across the region, fueled by infrastructure investments and a culturally ingrained audio heritage. In emerging markets within the Middle East and Africa, improving road networks and rising vehicle ownership are expanding the customer base, creating opportunities for aftermarket upgrades.

The Asia-Pacific region represents the fastest-growing market, propelled by rapid urbanization, expanding vehicle fleets, and increasing disposable incomes. Mobile device manufacturers in East Asia are partnering with automakers to introduce seamless smartphone-to-dashboard audio integration. In markets such as India and Southeast Asia, the aftermarket segment thrives on cost-effective upgrade kits that enable drivers to enhance factory audio installations. As infrastructure continues to modernize and consumer expectations mature, Asia-Pacific will remain a focal point for both global audio brands and regional innovators seeking market expansion.

This comprehensive research report examines key regions that drive the evolution of the Hi-Fi System for Automotive market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine leading industry players strategies, collaborations, and offerings driving innovation and differentiation within the automotive hi-fi ecosystem

Leading companies are redefining the automotive hi-fi ecosystem through targeted strategies and collaborative initiatives. A multinational consumer electronics firm has recently partnered with a premium automaker to co-engineer an immersive sound platform that employs spatial audio rendering and adaptive equalization. This strategic alliance underscores how joint development can accelerate time-to-market while ensuring seamless integration with vehicle infotainment architectures.

A specialized audio technology company has expanded its product portfolio by introducing a line of modular amplifiers that feature software-defined tuning profiles. By offering over-the-air firmware updates, the company positions itself at the forefront of the connected mobility trend, enabling continuous feature enhancements and personalized user experiences. Meanwhile, a leading OEM supplier has invested in advanced materials research to create smaller, lighter acoustic transducers without sacrificing performance, addressing the dual imperatives of weight reduction and sound quality.

Smaller regional players are also gaining traction through niche offerings and agile manufacturing models. By focusing on aftermarket DSP modules optimized for specific vehicle brands, these companies can deliver high-value solutions with accelerated development cycles. Collectively, these strategies illustrate the diverse approaches that established and emerging players employ to capture market share and drive innovation in the automotive hi-fi sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hi-Fi System for Automotive market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpine Electronics, Inc.

- Bang & Olufsen Group

- Bose Corporation

- Burmester Audiosysteme GmbH

- Continental AG

- Denso Corporation

- Dynaudio A/S

- Faurecia Clarion Electronics Co., Ltd.

- Focal-JMLab

- Harman International Industries, Incorporated

- JL Audio

- Mark Levinson

- Meridian Audio

- Naim Audio

- Panasonic Holdings Corporation

- Pioneer Corporation

- Sony Group Corporation

- Visteon Corporation

Recommend strategic approaches for industry leaders to leverage audio innovations, streamline operations, and elevate consumer engagement in automotive hi-fi

Industry leaders can capitalize on market momentum by prioritizing modular design architectures that accommodate future technology upgrades. By decoupling hardware components from software functionalities, manufacturers will be able to introduce new audio processing features and connectivity standards without requiring complete system overhauls. This modularity not only reduces lifecycle costs but also bolsters customer satisfaction through continuous product enhancements.

Furthermore, strategic partnerships with semiconductor and chipset producers can secure privileged access to the latest digital signal processing innovations. Co-development agreements can align roadmaps, enabling integrated solutions with optimized power efficiency and acoustic fidelity. By collaborating early with silicon vendors, audio system providers will mitigate supply risks and accelerate deployment of next-generation features such as adaptive noise cancellation and immersive spatial audio.

Finally, investing in advanced data analytics capabilities will empower companies to glean actionable insights from vehicle telematics and user interaction data. By leveraging machine learning algorithms, stakeholders can identify usage patterns, predict maintenance requirements, and deliver personalized audio experiences. Such data-driven strategies will enhance customer loyalty and open new revenue streams through subscription-based content and feature-as-a-service offerings.

Outline the methodology using robust primary and secondary research and analytical frameworks to deliver authoritative insights into automotive hi-fi systems

This research employs a blended methodology incorporating both primary and secondary research to ensure comprehensive market coverage. Primary insights were gathered through in-depth interviews with senior executives from OEMs, tier-one suppliers, and aftermarket specialists, providing first-hand perspectives on technological trends, regulatory impacts, and strategic priorities. These qualitative inputs were complemented by workshops with acoustic engineers and product designers to validate technical feasibility and market relevance.

Secondary research involved a systematic review of corporate filings, industry publications, patents databases, and public trade data to map competitive landscapes and supply chain relationships. By synthesizing quantitative shipment data with qualitative intelligence, the analysis captures a holistic view of market dynamics. Cross-validation techniques, such as triangulating interview findings with documented case studies, ensure the robustness and reliability of the conclusions.

Analytical frameworks, including SWOT and Porter’s Five Forces, were applied to assess market attractiveness, competitive intensity, and potential barriers to entry. These structured approaches enable stakeholders to identify strategic inflection points and formulate evidence-based roadmaps. Collectively, the rigorous methodology underpins the credibility of the insights and empowers decision-makers to navigate the evolving automotive hi-fi landscape with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hi-Fi System for Automotive market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hi-Fi System for Automotive Market, by Component

- Hi-Fi System for Automotive Market, by System Type

- Hi-Fi System for Automotive Market, by Technology Level

- Hi-Fi System for Automotive Market, by Connectivity

- Hi-Fi System for Automotive Market, by Power Output Range

- Hi-Fi System for Automotive Market, by Vehicle Category

- Hi-Fi System for Automotive Market, by End Customer Type

- Hi-Fi System for Automotive Market, by Sales Channel

- Hi-Fi System for Automotive Market, by Region

- Hi-Fi System for Automotive Market, by Group

- Hi-Fi System for Automotive Market, by Country

- United States Hi-Fi System for Automotive Market

- China Hi-Fi System for Automotive Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2862 ]

Synthesize the key findings and strategic implications affirming innovation trends, competitive dynamics, and growth opportunities in the automotive hi-fi market

The synthesis of market trends, technological advancements, and regulatory influences underscores a pivotal moment for automotive hi-fi systems. Advancements in wireless connectivity and digital audio processing are reshaping consumer expectations, while tariff‐driven supply chain realignments are prompting strategic adjustments across the value chain. Segmentation analysis reveals diverse value propositions driven by component type, distribution channel, technology preferences, and vehicle classifications.

Regional insights demonstrate that growth will continue to be propelled by demand for premium in-vehicle experiences in the Americas, regulatory and sustainability drivers in EMEA, and rapid adoption of connected audio solutions in Asia-Pacific. Leading companies are responding with collaborative development models, modular architectures, and data-centric approaches that reinforce innovation and differentiation. As the market accelerates toward fully integrated mobility ecosystems, stakeholders who embrace agile partnerships, technological modularity, and actionable analytics will be best positioned to seize emerging opportunities and maintain competitive advantage.

Engage with Ketan Rohom to access the definitive market research report on automotive hi-fi systems and transform strategic planning with data-driven insights

For organizations seeking to stay ahead in the rapidly evolving landscape of automotive audio, now is the moment to secure comprehensive market insights that will inform strategic decision-making and drive competitive advantage. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to access the definitive automotive hi-fi systems market research report. His expertise and guidance will ensure you understand the critical trends, emerging technologies, and strategic imperatives that will shape your next moves. Reach out to Ketan Rohom to purchase the full report and gain actionable intelligence tailored to your organization’s needs, empowering you to innovate with confidence and lead the market with clarity.

- How big is the Hi-Fi System for Automotive Market?

- What is the Hi-Fi System for Automotive Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?