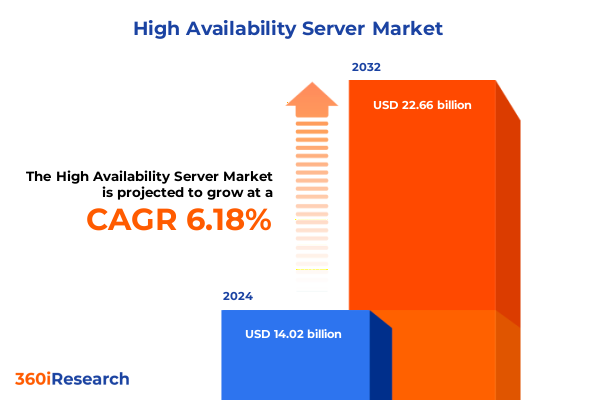

The High Availability Server Market size was estimated at USD 14.84 billion in 2025 and expected to reach USD 15.72 billion in 2026, at a CAGR of 6.23% to reach USD 22.66 billion by 2032.

Establishing the Foundation for Uninterrupted Enterprise Services through High Availability Server Architectures and Strategic Resilience

High availability servers have emerged as the backbone of modern enterprise infrastructures, ensuring continuous operation of mission-critical applications across diverse industries. As digital transformation initiatives accelerate, organizations cannot afford unplanned downtime that jeopardizes customer trust, regulatory compliance, or revenue streams. Consequently, strategic investment in high availability architectures has become indispensable to uphold service-level agreements and to maintain competitive differentiation in an increasingly digital-first landscape. Through redundancy, fault tolerance, and automated failover mechanisms, these solutions deliver the resilience necessary to support real-time analytics, e-commerce platforms, and compliance-sensitive workloads with unwavering reliability.

Reflecting this imperative, a recent survey of over 1,000 IT professionals revealed that 86% of organizations currently rely on dedicated server infrastructures to meet stringent performance and compliance requirements, with sectors such as finance, government, and information technology leading the adoption curve. Meanwhile, the growing complexity of distributed applications and data-intensive workflows has propelled spending on high availability systems to record levels in 2024, highlighting the critical role these servers play in sustaining business continuity.

This executive summary distills the most salient research findings into a concise overview, offering clear insights into transformative market shifts, the cumulative impact of recent U.S. tariffs, segmentation imperatives, regional dynamics, and leading provider strategies. By presenting rigorous analysis and actionable recommendations, this document equips decision-makers with the knowledge needed to architect resilient, high-performance environments and to navigate the evolving high availability server landscape.

Revolutionizing Infrastructure Reliability through Cloud Adoption AI-Driven Automation Composable Architectures and Edge-Centric Innovations

The high availability server market is undergoing rapid transformation as organizations reassess the balance between cloud convenience and infrastructure control. Over the past year, 42% of IT leaders reported migrating workloads back from public clouds to dedicated server environments, driven by the need for predictable performance, enhanced security, and compliance assurances in regulated industries. This shift underscores a growing recognition that hybrid and multi-cloud architectures, when complemented by on-premises high availability configurations, can deliver optimal reliability without sacrificing scalability.

Simultaneously, cloud providers have accelerated the rollout of native high availability services, embedding automated failover, geo-redundant architectures, and real-time load balancing into managed offerings. Enterprises are increasingly leveraging these cloud-based solutions to achieve five-nines uptime without the capital expenditure burden of traditional data center expansion. As the line between on-premises and cloud-based high availability blurs, businesses are prioritizing seamless orchestration tools that span both environments, enabling consistent policy enforcement and streamlined disaster recovery workflows.

Artificial intelligence is further reshaping how high availability infrastructures are monitored and maintained. AI-powered management platforms now predict hardware failures with unprecedented accuracy, automate routine operational tasks, and optimize resource allocation in real time to prevent service disruptions. By leveraging machine learning algorithms on telemetry data, these tools can initiate preemptive failover processes and generate prescriptive maintenance alerts, reducing both planned and unplanned downtime.

Enhancements in composable infrastructure also contribute to transformative shifts, as organizations gain the agility to pool compute, storage, and networking resources dynamically. This disaggregated approach allows IT teams to recompose server resources on demand, ensuring that high availability architectures remain aligned with fluctuating workload requirements and evolving business priorities.

Finally, the rise of edge computing is redefining expectations for server resilience at the network periphery. High availability clusters are increasingly deployed in remote or branch locations to support latency-sensitive applications and real-time analytics, complementing centralized data center investments. Advancements in virtualization and containerization further facilitate consistent failover and workload mobility across edge and core environments, reinforcing an enterprise-wide commitment to uninterrupted service delivery.

Evaluating the Aggregate Impact of 2025 U S Tariffs on High Availability Servers and Data Center Supply Chain Dynamics

The introduction of a 10% base tariff on all technology imports effective April 2025, followed by reciprocal duties on selected nations, has injected a new layer of complexity into high availability server procurement and deployment strategies. Originally announced at the start of Q2, these measures aim to bolster domestic manufacturing but have led to immediate cost pressures for solution providers and end users alike. In response, several leading server OEMs have signaled the need to adjust pricing models and rethink supply chain footprints to mitigate the financial impact.

Hewlett Packard Enterprise confirmed an average 8% increase in server pricing to offset higher component tariffs, while Cisco projected a 5–10% rise in networking equipment costs by mid-2025, driven by escalated manufacturing expenses in China and Taiwan. Dell Technologies also indicated that tariff-induced cost adjustments may result in broader pricing actions, with end customers likely to absorb a share of the increases over the coming quarters. This upward pricing trajectory has prompted renewals of existing contracts and accelerated procurement cycles as enterprises seek to lock in favorable terms ahead of further trade policy shifts.

Analysts warn that data center expansion and new facility buildouts could face setbacks, especially for projects reliant on imported power systems and cooling infrastructure. Industry research from IDC highlights that any data center buildout with non-U.S.-manufactured components is now subject to elevated costs, potentially discouraging greenfield investments and prompting a reassessment of total cost of ownership assumptions. As a result, developers are exploring modular data center designs, flexible power architectures, and long-term inventory strategies to insulate operations against tariff volatility.

On the semiconductor front, a 32% tariff on certain foreign-made chips initially imposed on Taiwanese imports, subsequently reduced to 10%, disrupted inventory planning for leading CPU and memory vendors, including AMD and NVIDIA manufacturers. Despite these headwinds, strategic investments in reshoring and U.S.-based packaging facilities aim to alleviate geopolitical exposure over the medium term. However, with only 14% of global chip production projected to occur domestically by 2032, supply chain fragmentation remains a significant risk to high availability server implementations.

Beyond immediate cost escalations, the unpredictability of tariff enforcement and prospective rate adjustments has introduced a premium on supply chain certainty. Industry leaders emphasize that uncertainty often outweighs known price increases, driving organizations to diversify vendor portfolios, expand regional sourcing, and implement dynamic procurement frameworks capable of responding swiftly to policy changes. In this evolving environment, agility and supply chain resilience have emerged as critical differentiators for enterprises seeking to maintain robust, high availability infrastructures.

Unveiling Critical Market Segments Defined by Components Organization Scale Deployment Models and Industry Verticals Revealing Diverse Needs

High availability server ecosystems are delineated first by component type, encompassing core hardware layers, specialized services, and advanced software stacks. Hardware solutions range from fault-tolerant chassis and redundant power supplies to modular storage arrays designed for synchronous replication. Service offerings include managed and professional services that orchestrate deployment, 24x7 support, and rapid incident response. Software layers, in turn, drive clustering, automated failover, and continuous data replication, ensuring stateful applications seamlessly migrate across nodes without human intervention. By interweaving these layers, enterprises tailor resiliency strategies to both performance and compliance criteria.

Institutional size further shapes high availability requirements. Large enterprises often architect multi-site, geographically distributed clusters under centralized governance frameworks, while small and medium enterprises favor turnkey, consumption-based solutions that balance cost containment with critical uptime guarantees. For SMEs, cloud-based high availability platforms alleviate capital investment burdens, providing elastic redundancy that scales in concert with business growth. In contrast, global corporations leverage on-premises redundancy to achieve granular control over data sovereignty and operational customization.

Deployment models define the scale and scope of redundancy strategies. Pure on-premises topologies continue to deliver deterministic performance for latency-sensitive applications, whereas public cloud configurations offer rapid provisioning and elastic scale for intermittent workloads. Hybrid cloud environments-combining private data center clusters with public cloud failover counterparts-address both performance and scalability objectives. Meanwhile, private cloud infrastructures deliver dedicated multi-tenant platforms with enhanced security controls, and hybrid cloud blends bridge connectivity between corporate networks and hyperscale clouds to optimize cost and resilience.

Industry verticals impose distinct availability mandates. Financial institutions demand subsecond failover and continuous transaction processing across banking ledgers, capital markets, and insurance platforms. Government agencies prioritize uninterrupted access to citizen services and critical infrastructure dashboards. Healthcare and life sciences organizations implement high availability servers in hospitals, medical device networks, and pharmaceutical research to protect patient safety and data integrity. Telecommunications providers, along with retail and e-commerce enterprises, require always-on clustering to support network management systems, online storefronts, and real-time order processing, underscoring the universal imperative for resilient infrastructure.

Together, these segmentation lenses inform tailored solution strategies, enabling vendors and system integrators to align availability architectures with unique organizational footprints, compliance obligations, and operational priorities.

This comprehensive research report categorizes the High Availability Server market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Architecture

- Availability Level

- Deployment

- End-User Industry

Dissecting Regional Dynamics across the Americas EMEA and Asia-Pacific Highlighting Distinct Drivers and Infrastructure Preferences

In the Americas, North America leads global high availability server consumption, accounting for nearly 39% of market deployments, with the United States driving 84% of regional demand in sectors such as banking, finance, and telecommunications. Favorable digital infrastructure investments, robust cloud adoption rates, and stringent regulatory standards in data privacy and cybersecurity underpin strong uptake of redundant server clusters and hybrid architectures. Meanwhile, emerging markets in Latin America increasingly invest in modern data centers to support expanding digital economies and resilience objectives, often launching greenfield facilities equipped with industry-standard high availability platforms.

Across Europe, the Middle East, and Africa, the combination of data sovereignty concerns and compliance frameworks such as GDPR fuels demand for on-premises and sovereign cloud high availability solutions. Policymakers and enterprises in the EU have proposed comprehensive initiatives to triple data center capacity by 2035 and to favor regional providers through prospective procurement reforms, intensifying focus on locally managed, fault-tolerant infrastructures. In addition, Gulf Cooperation Council countries invest heavily in mission-critical government platforms and financial services, driving adoption of enterprise-grade clustering technologies that guarantee minimal service interruptions.

Asia-Pacific constitutes approximately 26% of global high availability server deployments, with China and India contributing over 61% of the region’s demand. Rapid digital transformation initiatives, including smart city projects and e-commerce expansions, necessitate resilient server clusters capable of managing peak transactional loads and real-time analytics. Government-led cloud mandates and ongoing modernization of financial and healthcare infrastructures further reinforce high availability requirements. Japan and South Korea, two of the most mature markets, continue to pilot containerized failover solutions and edge-based redundancy frameworks to enhance localized service continuity in industrial IoT and 5G networks.

This comprehensive research report examines key regions that drive the evolution of the High Availability Server market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Approaches of Leading Technology Providers Elevating High Availability Solutions through Innovation and Partnerships

Leading hardware vendors such as Hewlett Packard Enterprise, Dell EMC, Supermicro, and Stratus Technologies have significantly enhanced their high availability portfolios by integrating AI-driven diagnostics and real-time failure monitoring into next-generation server platforms. HPE’s ProLiant Gen11 series features embedded clustering software and predictive maintenance agents that proactively identify component degradation, while Supermicro’s MicroCloud multi-node solutions deliver high-density resilience for space-constrained edge environments. These product innovations reflect a broader industry shift toward converged HA platforms that blend compute, storage, and networking resilience within unified chassis designs.

Software and service providers such as IBM and Cisco Systems have fostered strategic partnerships to deliver end-to-end high availability frameworks, coupling IBM PowerHA technologies with Cisco’s network fabric orchestration to ensure seamless workload mobility across hybrid landscapes. Additionally, Oracle’s integrated HA database appliances and ecosystem services empower enterprises in compliance-heavy sectors to achieve synchronous replication and rapid recovery for mission-critical systems. Meanwhile, strategic alliances between cloud hyperscalers and local integrators have catalyzed sovereign cloud offerings in key regions, enabling tailored service level agreements that meet regional regulatory and performance benchmarks.

In this competitive landscape, emerging players are carving niches by specializing in container-native failover solutions and AI-enhanced patch management. The proliferation of these niche innovators is fostering a dynamic ecosystem where continuous R&D investment and partnership models drive collective advancement in server resilience capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Availability Server market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- ASUSTek Computer Inc.

- Atos Group

- CenterServ International, Ltd.

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Fujitsu Limited

- GIGA-BYTE Technology Co., Ltd.

- Google LLC by Alphabet Inc.

- Hewlett Packard Enterprise Company

- Hitachi Vantara LLC

- Huawei Technologies Co., Ltd.

- Inspur Electronic Information Industry Co., Ltd.

- International Business Machines Corporation

- Jabil Inc.

- Lenovo Group Limited

- Microsoft Corporation

- MITAC HOLDINGS CORPORATION

- NEC Corporation

- Nutanix, Inc.

- Oracle Corporation

- OSNEXUS Corporation

- Penguin Solutions, Inc.

- Progress Software Corporation

- Quanta Computer Inc.

- Super Micro Computer, Inc.

- Tencent Cloud Europe B.V.

- Unisys Corporation

- Veritas Technologies LLC by Cohesity

- VMware by Broadcom Inc.

Empowering Industry Leaders with Actionable Strategies to Enhance Server Resilience Optimize Architectures and Navigate Market Complexities

Organizations should prioritize the deployment of AI-enabled monitoring tools that integrate machine learning models trained on historical telemetry data to detect anomalies and trigger automated failover before disruptions occur. By embedding predictive maintenance capabilities at the hardware level, enterprises can reduce Mean Time to Detection and Mean Time to Recovery metrics, translating to tangible improvements in system availability and operational efficiency. This proactive stance on infrastructure health is essential to sustaining five-nines uptime commitments and mitigating costly outages.

In parallel, decision-makers must evaluate hybrid cloud high availability architectures that balance on-premises control with public cloud elasticity. A cohesive orchestration layer spanning private and public environments ensures consistent policy enforcement and enables dynamic workload migration based on real-time performance and cost considerations. Leaders are advised to conduct rigorous pilot programs that stress-test failover scenarios across both domains, thereby validating end-to-end resilience while optimizing total cost of operations.

To navigate tariff-induced cost challenges, procurement teams should diversify component sourcing and negotiate volume-based agreements with regional manufacturers to mitigate import duty exposure. Establishing strategic inventory reserves for critical server and power infrastructure components can further buffer short-term pricing volatility. Finally, cross-functional collaboration between IT, finance, and legal stakeholders will be instrumental in aligning contractual terms, budget planning, and regulatory compliance strategies, ensuring that high availability initiatives remain financially viable in an uncertain trade policy environment.

Outlining a Rigorous Research Framework Combining Primary Interviews Secondary Analysis and Quantitative Evaluation to Ensure Data Integrity

This research combines primary insights gathered from in-depth interviews with CIOs, infrastructure architects, and senior IT operations managers across global enterprises, ensuring firsthand perspectives on high availability deployment challenges and success factors. These primary contributions are complemented by secondary analysis of industry reports, vendor documentation, and regulatory publications, creating a robust foundation for trend validation and triangulation.

Quantitative evaluation leverages a proprietary database of deployment metrics, including failover performance data, service level achievement records, and technology adoption rates. This data-driven approach is augmented by qualitative analyst reviews, which synthesize emerging patterns and contextualize numerical findings within broader market forces. Adherence to rigorous methodological standards, including cross-verification and peer review, underpins the integrity and reliability of the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Availability Server market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Availability Server Market, by Component

- High Availability Server Market, by Architecture

- High Availability Server Market, by Availability Level

- High Availability Server Market, by Deployment

- High Availability Server Market, by End-User Industry

- High Availability Server Market, by Region

- High Availability Server Market, by Group

- High Availability Server Market, by Country

- United States High Availability Server Market

- China High Availability Server Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights to Reinforce the Imperative of High Availability Servers in Sustaining Mission Critical Enterprise Operations

The business imperative for high availability servers has never been more pronounced. As enterprises grapple with evolving digital workloads, regulatory constraints, and emerging trade policy complexities, the ability to maintain continuous service delivery stands as a competitive differentiator and risk mitigator. The convergence of cloud-native HA services, AI-enhanced management platforms, and composable infrastructure heralds a new era of resilient architectures capable of supporting mission-critical applications under any circumstance.

By aligning segmentation strategies with organizational scale, deployment preferences, and vertical-specific requirements, businesses can deploy tailored high availability configurations that optimize resource utilization and compliance adherence. Regional nuances-ranging from North American digital initiatives to European data sovereignty mandates and Asia-Pacific smart city ambitions-underscore the importance of flexible solution models that address local demands without sacrificing global consistency.

Ultimately, enterprises that embrace proactive monitoring, hybrid orchestration, and diversified supply chain strategies will secure a sustainable foundation for uninterrupted operations and long-term digital growth.

Engage with Ketan Rohom to Secure Exclusive Access to the Comprehensive High Availability Server Market Research Report Today

Are you ready to elevate your enterprise’s uptime and resilience? Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your exclusive copy of the comprehensive high availability server market research report. Gain unparalleled intelligence on transformative trends, tariff impacts, key segments, and actionable strategies tailored for 2025 and beyond. Don’t miss this opportunity to equip your organization with the insights needed to drive robust infrastructure investments and competitive advantage. Connect with Ketan today to unlock the full potential of uninterrupted digital operations.

- How big is the High Availability Server Market?

- What is the High Availability Server Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?