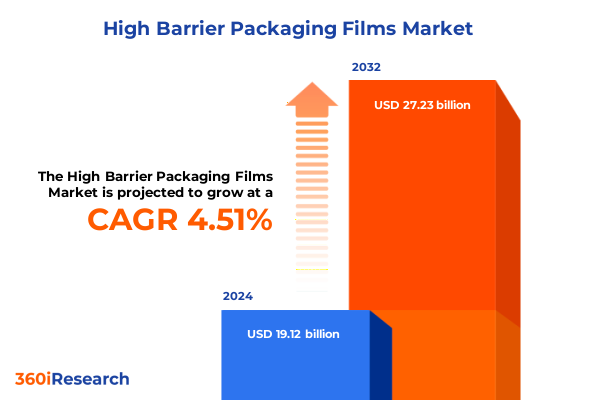

The High Barrier Packaging Films Market size was estimated at USD 32.82 billion in 2025 and expected to reach USD 35.18 billion in 2026, at a CAGR of 7.36% to reach USD 53.98 billion by 2032.

Exploring How Cutting-Edge Barrier Films Are Positioned to Meet Emerging Packaging and Sustainability Challenges Globally

The high barrier packaging films industry sits at the intersection of technological innovation and consumer-driven sustainability imperatives. As global supply chains evolve and regulatory pressures intensify, manufacturers and brand owners alike are seeking advanced film solutions that offer superior protection against moisture, oxygen, UV light, and contaminants. This demand is particularly acute in sectors such as food and beverage, pharmaceuticals, and electronics, where product integrity and shelf life directly impact consumer safety and brand reputation.

Moreover, the rapid expansion of e-commerce channels has introduced new packaging challenges - films must now endure varied shipping conditions while maintaining barrier performance and minimizing waste. At the same time, environmental concerns and strict recycling regulations are compelling stakeholders to explore mono-material and bio-based high barrier structures that align with circular economy principles. Confidence in product quality, operational resilience amid trade policy shifts, and a clear sustainability narrative have emerged as non-negotiable priorities for companies aiming to secure competitive advantage.

Revealing the Pivotal Technological and Sustainability-Driven Transformations Redefining High Barrier Packaging Films

In recent years, the high barrier packaging films sector has undergone transformative shifts driven by converging technological, regulatory, and consumer trends. Multilayer coextrusion and metallization techniques now routinely incorporate nano-engineered coatings, enabling films to deliver industry-leading oxygen and moisture resistance without sacrificing transparency or flexibility. Equally significant is the rise of mono-material film structures that streamline recycling processes, responding directly to stricter packaging waste regulations such as the EU’s Packaging and Packaging Waste Regulation.

Simultaneously, digitalization has penetrated film manufacturing lines through the integration of IoT-enabled quality control systems and AI-powered predictive maintenance tools. These advancements not only improve production efficiency but also ensure consistent barrier performance, reducing costly defects. At the same time, the emergence of bio-based resins and compostable barrier layers reflects a strategic pivot toward eco-friendly materials that resonate with environmentally conscious consumers. Together, these game-changing developments are reshaping both product portfolios and operational practices across the industry.

Assessing the Far-Reaching Consequences of New 2025 US Tariff Measures on High Barrier Film Sourcing and Material Costs

The introduction of sweeping United States tariffs in 2025 has generated a cumulative impact that reverberates throughout the high barrier films supply chain. A blanket 10% import tariff on polyolefin resins and up to 145% reciprocal duties on specific Chinese-origin additives have elevated material costs and pressured manufacturers to rethink sourcing strategies. Additionally, North American producers now confront reciprocal 25% duties on inputs sourced from Canada and Mexico that fail to comply with updated USMCA requirements, further complicating cross-border logistics.

In response, many film converters are stockpiling critical raw materials to buffer against price volatility, while others are accelerating shifts toward USMCA-compliant domestic resin suppliers. Some companies are also reevaluating their multilayer film designs to reduce reliance on high-tariff components such as specialty EVOH or metalized coatings. These tactical adjustments illustrate how tariff policy can drive broader supply chain realignments, as firms prioritize flexibility and tariff mitigation over conventional economies of scale.

Uncovering Market Dynamics Through In-Depth Insights into Resin, Technology, Barrier, and Application Dimensions

Diving into resin type reveals a clear performance hierarchy: films leveraging ethylene vinyl alcohol and polyamide layers consistently deliver the highest oxygen and moisture barriers, positioning them for sensitive food and medical packaging applications. Meanwhile, polyethylene terephthalate and polypropylene films strike a balance of moderate barrier performance and cost efficiency, making them attractive for shelf-stable snack foods and confectionery. Polyvinylidene chloride films, though less common, continue to find niche use where exceptional aroma retention is required.

When evaluating technology, coextruded films are emerging as the workhorse solution, enabling multilayer assemblies that combine different polymer chemistries in a single extrusion line. Coating processes-both solvent-based and solventless-offer precise control of barrier thickness but add complexity to recycling streams. Lamination remains a go-to approach for heat-sealable barrier pouches, while metallization provides a cost-effective oxygen and UV shield, particularly in regions where regulatory frameworks around metalized surfaces are less stringent.

Barrier type segmentation highlights the primacy of oxygen and moisture protection, which underpin nearly all high barrier film use cases. Aroma barriers play a critical role in specialty coffee and spice packaging, whereas UV resistance is gaining traction for light-sensitive pharmaceuticals and nutrient-enriched beverages.

Finally, across applications, food packaging remains the largest segment, with bakery, dairy, and meat products demanding custom film structures that extend freshness without refrigeration. Pharmaceutical and medical packaging continue to require the most stringent barrier specifications, particularly for biologics and diagnostic kits. Electronics packaging, though a smaller niche, benefits from films that control moisture and static, ensuring component reliability in global distribution networks.

This comprehensive research report categorizes the High Barrier Packaging Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Technology

- Barrier Type

- Application

Examining Regional Variations in Demand Patterns, Regulatory Pressures, and Innovation Priorities Worldwide

Regional dynamics in high barrier films reflect divergent growth drivers and regulatory landscapes. In the Americas, strong e-commerce penetration and a robust food processing industry sustain demand for flexible packaging films that extend shelf life while optimizing shipping efficiency. Meanwhile, cost pressures from domestic tariffs on imported resins have spurred a shift toward North American polymer suppliers and thin-gauge laminates.

Across Europe, the Middle East, and Africa, stringent circular economy mandates and the EU’s Packaging Waste Regulation are catalyzing investment in recyclable mono-material films and chemical recycling ventures. European film producers are also capitalizing on a mature pharmaceutical sector, delivering high-purity barrier solutions for parenteral drug packaging.

In the Asia-Pacific region, rapid urbanization and rising disposable incomes are driving dynamic growth in packaged convenience foods and ready-to-eat meals. Here, metallized barrier films remain prevalent due to lower material costs, even as leading converters explore coextrusion and bio-based resins to meet emerging sustainability benchmarks.

This comprehensive research report examines key regions that drive the evolution of the High Barrier Packaging Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Innovations, Acquisitions, and Circular Economy Efforts by Top Barrier Film Manufacturers

Key players in the high barrier packaging films market are differentiating through technology leadership and strategic value chain integration. Amcor has expanded its high barrier recyclable film portfolio using proprietary multilayer AmLite technology that merges oxidative protection with compatibility in existing recycling streams. Sealed Air has bolstered its presence in pharmaceutical packaging by acquiring specialty barrier film assets and integrating in-line coating capabilities for medical-grade applications.

Sonoco Products Company is advancing closed-loop recycling initiatives, piloting chemical recovery of EVOH and nylon from post-consumer multilayer films to feed a circular supply of barrier resins. At the same time, Toray Plastics (America) has introduced compostable barrier films tailored to organic food brands, underlining the rise of bio-based materials in the United States market. ProAmpac and Constantia Flexibles continue to pursue vertical integration strategies, acquiring resin compounding and coating facilities to secure raw material access and streamline production efficiencies.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Barrier Packaging Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Berry Global Group, Inc.

- Cosmo Films Limited

- Dunmore Corporation

- DuPont de Nemours, Inc.

- Flexopack S.A.

- Glenroy, Inc.

- Huhtamaki Group

- Innovia Films Ltd.

- Klockner Pentaplast Group GmbH

- Mitsubishi Chemical Corporation

- Mondi plc

- Sealed Air Corporation

- Toray Industries, Inc.

- Uflex Limited

Offering Actionable Strategies to Enhance Supply Chain Agility, Sustainability Practices, and Collaborative Innovation

To navigate the evolving high barrier films landscape, industry leaders should fortify supply chain resilience by diversifying resin procurement across USMCA-compliant and Asian suppliers, reducing exposure to tariff fluctuations. Investment in digital manufacturing solutions-such as real-time quality analytics and predictive maintenance-can minimize film defects and operational downtime, preserving margin across multilayer production lines.

Embracing mono-material and bio-based film structures not only addresses regulatory recycling targets but also resonates with consumer sustainability expectations. Collaborative pilots with recyclers and packaging converters will be essential for validating closed-loop processes at commercial scale. Furthermore, fostering partnerships with end-user segments-particularly in food, pharmaceutical, and electronics-can yield co-developed film solutions that precisely meet barrier, printability, and mechanical requirements.

Finally, maintaining agility in product design by modularizing film layer architectures allows rapid adaptation to emerging barrier needs or material substitutions, ensuring competitive differentiation without major capital outlay.

Detailing How Industry Executive Interviews, Regulatory Data, and Technical Standards Shape Our Comprehensive Analysis

This research integrates a comprehensive approach combining primary interviews with senior R&D, procurement, and sustainability executives at leading packaging converters and brand owners. Secondary data sources include public filings, industry publications, regulatory frameworks, and technical standards from bodies such as ASTM and ISO. Our analysis encompasses detailed technology mapping of coextrusion, coating, lamination, and metallization processes, as well as barrier characterization techniques for oxygen, moisture, aroma, and UV protection.

Additionally, tariff policies and trade data were reviewed from government databases, including the U.S. International Trade Commission and customs authorities, to quantify the cumulative impact of 2025 trade measures. Regional insights were validated through discussions with market experts across the Americas, Europe, Middle East, Africa, and Asia-Pacific. Company profiles draw on recent press releases, patent filings, and mergers and acquisitions activity to capture strategic priorities and innovation footprints across the competitive landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Barrier Packaging Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Barrier Packaging Films Market, by Resin Type

- High Barrier Packaging Films Market, by Technology

- High Barrier Packaging Films Market, by Barrier Type

- High Barrier Packaging Films Market, by Application

- High Barrier Packaging Films Market, by Region

- High Barrier Packaging Films Market, by Group

- High Barrier Packaging Films Market, by Country

- United States High Barrier Packaging Films Market

- China High Barrier Packaging Films Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing the Interplay of Innovation, Sustainability, and Trade Dynamics Shaping the Future of Barrier Films Market

The high barrier packaging films market stands at a pivotal juncture where technological prowess, sustainability commitments, and policy dynamics converge. As brands and converters seek to protect sensitive products and meet evolving eco-regulatory mandates, the adoption of advanced multilayer and mono-material films will accelerate. Digital manufacturing technologies will play an increasingly vital role in ensuring consistent barrier performance and operational efficiency.

Simultaneously, the ramifications of the 2025 U.S. tariff landscape underscore the importance of flexible sourcing strategies and supply chain diversification. Companies that proactively integrate tariff mitigation into product design and procurement will maintain cost competitiveness while safeguarding quality. The most successful participants will be those who drive collaborative innovation, leverage closed-loop recycling, and adapt film architectures to emerging end-user requirements.

By synthesizing these trends, stakeholders can confidently craft strategies that unlock value, optimize sustainability pathways, and secure market leadership in the evolving high barrier packaging films arena.

Unlock Strategic Advantages in High Barrier Packaging Films with a Personalized Consultation and Exclusive Market Report

Don’t let indecision slow your next strategic move in high barrier packaging films. Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to explore how our comprehensive market research report can illuminate growth opportunities, guide your tariff mitigation strategies, and strengthen your competitive positioning. Whether you’re pursuing sustainable packaging innovation, optimizing supply chains, or evaluating emerging regional prospects, our team is ready to offer you tailored insights that drive high-impact decisions. Contact Ketan today to secure your copy of the report and unlock the actionable intelligence you need to navigate the high barrier packaging films landscape with confidence

- How big is the High Barrier Packaging Films Market?

- What is the High Barrier Packaging Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?