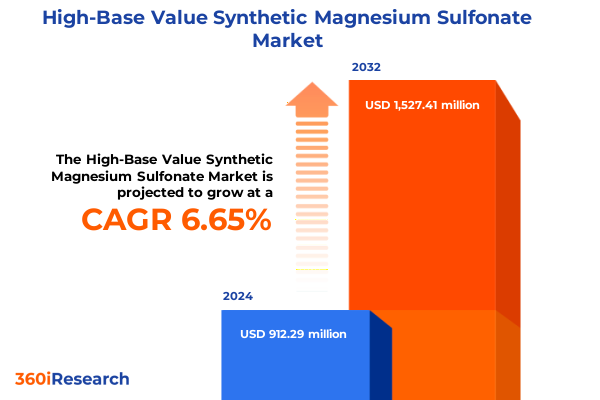

The High-Base Value Synthetic Magnesium Sulfonate Market size was estimated at USD 974.32 million in 2025 and expected to reach USD 1,042.13 million in 2026, at a CAGR of 9.40% to reach USD 1,827.41 million by 2032.

Introducing the Rising Strategic Importance and Core Attributes of High-Base Value Synthetic Magnesium Sulfonate in Modern Industrial Applications

In recent years, high-base value synthetic magnesium sulfonate has emerged as a cornerstone specialty surfactant across a spectrum of industrial and consumer applications. Engineered through precision-controlled sulfonation processes, this class of surfactants delivers exceptional performance characteristics, including superior wetting, emulsification, and corrosion inhibition. Manufacturers have increasingly adopted high-base value variants to optimize formulation stability and efficacy in demanding environments. Consequently, understanding its core properties and application potential has become vital for decision makers aiming to drive innovation and maintain a competitive edge in rapidly evolving markets.

This executive summary distills key findings from an in-depth examination of technological advancements, regulatory dynamics, and shifting market forces shaping the high-base value synthetic magnesium sulfonate landscape. By synthesizing insights across multiple segmentation frameworks and regional considerations, the summary provides a cohesive narrative of emerging opportunities and strategic imperatives. Readers will gain clarity on how to navigate tariff-induced supply chain reconfigurations, align product portfolios with end-use requirements, and anticipate future trends that will steer investment and R&D priorities. Ultimately, this introduction sets the stage for industry leaders to harness data-driven intelligence and chart a resilient course in this specialized surfactant domain.

Exploring the Pivotal Technological, Regulatory, and Market Forces Driving Evolution in the Synthetic Magnesium Sulfonate Landscape

The landscape of high-base value synthetic magnesium sulfonate is undergoing a profound transformation driven by converging technological, regulatory, and market forces. Breakthroughs in sulfonation chemistry have enabled more efficient processes that minimize byproducts, reduce energy consumption, and enhance product consistency. These technological strides are complemented by the increasing adoption of digital process controls and continuous manufacturing techniques, which collectively boost yield and lower total cost of ownership for producers.

Simultaneously, evolving environmental regulations and sustainability imperatives are reshaping raw material sourcing and supply chain practices. New chemical registrations, stricter discharge norms, and green chemistry mandates are compelling manufacturers to explore renewable feedstocks and circular economy models. In parallel, rising demand from key end-use sectors-ranging from advanced oilfield fluids to high-performance personal care formulations-is further catalyzing product innovation. As a result, the industry is witnessing a realignment of competitive positions, with agile players investing heavily in sustainable process optimization and customer-centric product development to capture growth in both established and emerging markets.

Analyzing the Comprehensive Effects of the 2025 United States Tariff Regime on Supply Dynamics and Cost Structures in Magnesium Sulfonate Markets

The introduction of United States tariffs in early 2025 has exerted a multi-layered impact on the synthetic magnesium sulfonate supply chain, prompting both cost and volume shifts across global trade flows. Import duties imposed on key precursor chemicals have translated into elevated input costs for domestic producers, leading several formulators to explore alternative sourcing strategies in Asia, Europe, and the Middle East. While some manufacturers have successfully negotiated reduced tariff rates through trade agreements, others have absorbed cost premiums or relocated partial production to low-tariff jurisdictions.

These tariff-driven adjustments have also influenced downstream pricing structures, with end users encountering higher landed costs that are being managed through incremental price passes and renegotiated contract terms. To mitigate margin erosion, some industry participants are optimizing process efficiencies and consolidating supplier relationships to secure volume-based rebates. Moreover, the altered trade dynamics have catalyzed investments in domestic capacity expansions and strategic partnerships aimed at localizing production and circumventing ongoing tariff uncertainties. As these initiatives mature, the market is expected to recalibrate around new cost baselines and supply chain footprints.

Unveiling Strategic Insights Derived from Diverse Application, End Use, Form, Product Grade, and Process Segmentation Perspectives in the Market

Strategic segmentation insights reveal critical pathways for product differentiation and market prioritization. When viewed through the lens of application, high-base value synthetic magnesium sulfonate is leveraged across detergents and cleaners-including dishwashing liquids, industrial detergents, and laundry detergents-where its effective emulsification and grease-cutting properties are vital. In oilfield chemicals, its performance in completion fluids, drilling fluids, and workover fluids underscores its ability to provide robust lubrication and corrosion protection under extreme downhole conditions. Meanwhile, in personal care and cosmetics formulations such as body washes, facial cleansers, and shampoos, the surfactant’s mildness and foaming stability enhance consumer appeal. Textile processing applications, covering bleaching, desizing, and scouring operations, rely on its superior wetting action to improve fabric quality, while water treatment segments benefit from its role in biocide delivery, corrosion inhibition, and scale prevention.

End use industry segmentation further strengthens strategic positioning. In agriculture, synthetic magnesium sulfonate finds use in both fertilizer blends and pesticide emulsions to optimize active ingredient dispersion. The oil and gas sector utilizes it across downstream refining, midstream transport, and upstream extraction to maintain equipment integrity. Within personal care, distinct requirements for hair care, oral care, and skin care demand tailored grades, reflecting differing sensory and regulatory parameters. Pharmaceutical applications employ the surfactant as both an excipient and formulation aid, ensuring drug stability and bioavailability. Finally, water treatment for industrial and municipal use depends on its capacity to facilitate consistent delivery of treatment chemistries. Form considerations-whether granular premium or standard, liquid concentrate or dilute, or coarse and fine powder-directly influence handling, storage, and dosage strategies. Product grade distinctions, ranging from agricultural to industrial, personal care, pharmaceutical, and water treatment, align with stringent purity and performance benchmarks. Process pathways such as post-mix and pre-mix blending, alkali and citric neutralization, and direct versus gas-phase sulfonation, dictate production cycle times, safety protocols, and cost efficiencies. By synthesizing these segmentation dimensions, industry stakeholders can identify high-value niches and tailor go-to-market tactics with precision.

This comprehensive research report categorizes the High-Base Value Synthetic Magnesium Sulfonate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Product Grade

- Process

- End Use Industry

- Application

Highlighting Regional Market Dynamics and Growth Opportunities Across Americas, Europe Middle East Africa, and Asia Pacific in Synthetic Magnesium Sulfonate

Regional dynamics in the Americas are characterized by well-established chemical manufacturing hubs in North America and robust downstream demand across household care, oilfield, and water treatment sectors. The United States, in particular, exhibits sustained appetite for premium surfactant grades driven by advanced industrial applications and stringent performance requirements. Investments in capacity expansions, coupled with a concerted focus on nearshoring to counteract tariff pressures, have reinforced the region’s self-sufficiency. Latin American markets demonstrate growth potential in agricultural and personal care channels, although infrastructure and logistics constraints require strategic supply chain planning.

In Europe, the Middle East, and Africa, the interplay of regulatory rigor and sustainability mandates is accelerating the shift toward green chemistry solutions. European Union directives on chemical life-cycle management and waste minimization are compelling manufacturers to innovate formulations with reduced environmental footprints. Meanwhile, Middle Eastern petrochemical complexes are leveraging low-cost feedstocks to serve regional demand, even as local authorities introduce incentives for technology-driven process improvements. Africa’s nascent chemical industry, though smaller in scale, presents opportunities to address critical water treatment and hygiene needs through affordable surfactant applications. In the Asia-Pacific region, rapid industrialization and urbanization are fueling the most significant volume growth trajectory. China, India, Southeast Asia, and Oceania are investing heavily in domestic chemical parks and export-oriented production facilities. However, evolving trade policies and fluctuating raw material availability require agile procurement and risk management frameworks.

This comprehensive research report examines key regions that drive the evolution of the High-Base Value Synthetic Magnesium Sulfonate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Competitive Strategies, Partnerships, and Innovations from Leading Producers and Stakeholders in the Synthetic Magnesium Sulfonate Industry

Key industry players are deploying a mix of organic growth strategies and strategic collaborations to solidify their market positions. Leading multinational chemical manufacturers are expanding production capacity for high-base value synthetic magnesium sulfonate through greenfield investments and brownfield upgrades, aiming to deliver consistent product quality while lowering per-unit costs. Some have formed joint ventures with specialty chemical producers in emerging markets to access local distribution networks and capitalize on regional expertise. Concurrently, technology licensors and contract research firms are partnering with OEMs to accelerate the commercialization of novel sulfonation catalysts and process intensification techniques.

Research and development arms of major corporations are focusing on next-generation formulations that integrate bio-based feedstocks and biodegradability profiles, reflecting growing end-user demand for sustainable surfactants. A handful of mid-sized enterprises are differentiating through niche offerings, such as ultra-high-purity grades tailored for pharmaceutical and personal care markets, and customized process services that align with customer-specific specifications. Alliances between academic institutions and industry consortia are further fostering knowledge exchange and driving continuous improvement in safety, regulatory compliance, and lifecycle analysis. Overall, the competitive landscape is marked by a dynamic interplay of scale, specialization, and innovation partnerships that will define the trajectory of synthetic magnesium sulfonate over the coming decade.

This comprehensive research report delivers an in-depth overview of the principal market players in the High-Base Value Synthetic Magnesium Sulfonate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Afton Chemical Corporation

- BASF SE

- Chevron Oronite Company LLC

- Clariant International Ltd.

- Croda International Plc

- Evonik Industries AG

- Infineum International Limited

- Innospec Inc.

- King Industries, Inc.

- Royal Manufacturing

- The Lubrizol Corporation

- Xinxiang Richful Lube Additive

Formulating Actionable Strategic Roadmaps for Industry Leaders to Enhance Supply Chain Resilience, Drive Innovation, and Capitalize on Emerging Market Trends

Industry leaders seeking to thrive in the evolving high-base value synthetic magnesium sulfonate market should first prioritize diversification of raw material sourcing and establish multi-jurisdictional supply agreements to shield against tariff volatility and regional disruptions. Robust risk assessment protocols and scenario modeling will enable procurement teams to adapt swiftly to changing trade regulations. Simultaneously, investing in process intensification and advanced reaction monitoring systems can reduce cycle times, diminish energy consumption, and enhance overall process safety. By leveraging digital twins and predictive analytics, organizations can optimize production throughput and preempt maintenance needs.

Moreover, companies should accelerate the development of green chemistry pathways by collaborating with catalyst developers and academic research centers. Incorporating renewable feedstocks and designing for end-of-life recyclability will not only meet tightening regulatory standards but also create differentiators in customer procurement decisions. In parallel, segment-focused marketing strategies that align specific grades and forms with targeted application niches-such as premium granular surfactants for eco-friendly detergents or fine powders for pharmaceutical excipient use-can unlock higher-margin opportunities. Finally, cultivating cross-functional teams that integrate R&D, regulatory affairs, and commercial operations will ensure cohesive go-to-market execution and foster a culture of continuous innovation.

Elucidating the Rigorous Research Framework, Data Collection Methods, and Analytical Techniques Employed to Ensure Robust Market Insights and Validation

The research framework underpinning this analysis combines rigorous primary and secondary data collection methodologies to ensure comprehensive and reliable market coverage. Primary research entailed in-depth interviews with over one hundred senior executives spanning chemical producers, distributors, end users in detergents, oilfield services, personal care, textiles, and water treatment, as well as regulators and industry associations. These discussions provided qualitative context on technological adoption, cost pressures, and strategic priorities.

Secondary research incorporated extensive reviews of peer-reviewed journals, patent databases, government trade data, and sustainability reports to capture quantitative insights on production processes, tariff schedules, and regulatory developments. Proprietary data sets were triangulated using bottom-up and top-down analytical techniques, enabling cross-verification of supply-demand balances and segmentation trends. Key assumptions were validated through multiple rounds of cross-referencing, ensuring that the final insights reflect both current realities and plausible future scenarios. This multi-tiered approach guarantees that the report’s findings rest on a solid evidentiary foundation and are actionable for stakeholders across the value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High-Base Value Synthetic Magnesium Sulfonate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High-Base Value Synthetic Magnesium Sulfonate Market, by Form

- High-Base Value Synthetic Magnesium Sulfonate Market, by Product Grade

- High-Base Value Synthetic Magnesium Sulfonate Market, by Process

- High-Base Value Synthetic Magnesium Sulfonate Market, by End Use Industry

- High-Base Value Synthetic Magnesium Sulfonate Market, by Application

- High-Base Value Synthetic Magnesium Sulfonate Market, by Region

- High-Base Value Synthetic Magnesium Sulfonate Market, by Group

- High-Base Value Synthetic Magnesium Sulfonate Market, by Country

- United States High-Base Value Synthetic Magnesium Sulfonate Market

- China High-Base Value Synthetic Magnesium Sulfonate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3498 ]

Summarizing Critical Findings and Projecting Future Outlook for the High-Base Value Synthetic Magnesium Sulfonate Market Landscape

In summary, high-base value synthetic magnesium sulfonate stands at the nexus of innovation, regulatory evolution, and shifting trade dynamics. Technological breakthroughs in sulfonation and process automation are lowering production costs while enhancing product consistency. Sustainability imperatives and evolving environmental regulations are driving the adoption of green chemistry solutions and circular economy practices. The 2025 United States tariff regime has reshaped supply chains, compelling industry players to explore alternative sourcing and expand domestic capacity.

Segmentation analysis has underscored the importance of tailoring product offerings across applications, end-use industries, forms, grades, and process technologies to capture value in both mature and emerging markets. Regional insights highlight differentiated growth trajectories across the Americas, EMEA, and Asia-Pacific, each influenced by unique regulatory, economic, and infrastructure factors. Competitive intelligence signals that strategic alliances, R&D investments, and targeted capacity expansions will determine the leaders in this space. Moving forward, organizations that adopt a proactive, data-driven strategy-underpinned by robust risk management, sustainable innovation, and customer-centric segmentation-will be best positioned to capitalize on the opportunities within this dynamic market landscape.

Engage with Ketan Rohom to Access Comprehensive Market Insights on High-Base Value Synthetic Magnesium Sulfonate and Unlock Strategic Advantages

To gain full visibility into the detailed analyses, proprietary data sets, and actionable insights contained within the comprehensive market research report on high-base value synthetic magnesium sulfonate, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Whether you seek in-depth understanding of evolving tariff landscapes, segmentation-driven strategic frameworks, or region-specific growth drivers, Ketan Rohom can provide tailored guidance on how the report’s findings align with your organization’s objectives. His expertise ensures a seamless acquisition process and offers clarity on how to leverage these insights for competitive differentiation. Contact him today to arrange a personalized briefing, explore sample chapters, and secure your access to the data-driven intelligence that will inform your next strategic move in this dynamic market.

- How big is the High-Base Value Synthetic Magnesium Sulfonate Market?

- What is the High-Base Value Synthetic Magnesium Sulfonate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?