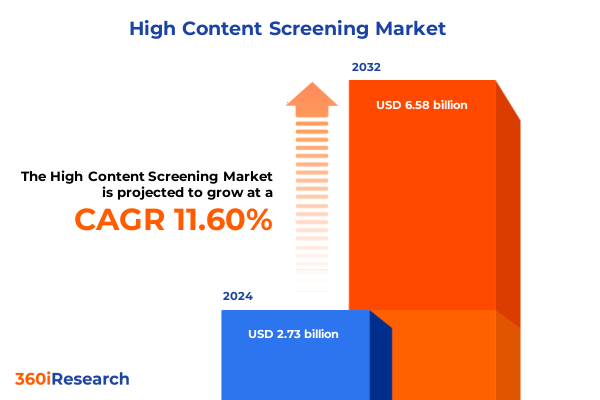

The High Content Screening Market size was estimated at USD 2.73 billion in 2024 and expected to reach USD 3.03 billion in 2025, at a CAGR of 11.60% to reach USD 6.58 billion by 2032.

Exploring the Evolution and Strategic Value of High Content Screening Platforms to Drive Breakthrough Innovation and Efficiency in Drug Discovery and Biotechnology Research

High content screening has evolved from a specialized technique into a foundational pillar for modern drug discovery and biotechnology research. Fueled by advances in imaging capabilities, automated sample handling, and sophisticated data analytics, it empowers scientists to interrogate complex cellular phenomena at unprecedented scale and resolution.

In the realm of early-stage drug discovery, this convergence of hardware and software has accelerated target validation and lead optimization by enabling multiplexed assays that reveal functional and phenotypic insights. Researchers now routinely leverage high content screening to profile compound libraries against disease-relevant cellular models, extracting multidimensional data that informs decision making and risk assessment.

Furthermore, the integration of artificial intelligence and machine learning algorithms has transformed raw image data into actionable knowledge. Automated pipelines process thousands of images per day, identifying subtle morphological changes and streamlining hit identification processes. As a result, teams can focus on experimental design and hypothesis testing rather than manual image interpretation.

Looking ahead, emerging trends such as live-cell imaging, 3D organoid models, and high throughput phenotypic screening promise to expand the utility of high content platforms. These advancements underscore the transition from simple endpoint assays to dynamic, longitudinal studies that capture real-time biological responses. Consequently, stakeholders across pharma, biotech, and academia must adopt agile strategies that balance technological adoption with robust validation frameworks.

As we embark on an era defined by precision medicine and complex biologics, it is critical to contextualize high content screening within broader innovation ecosystems. A holistic understanding of its capabilities and limitations will guide investments, partnerships, and technological development required to maintain competitive advantage in this rapidly evolving landscape.

Uncovering Transformative Technology Shifts Redefining High Content Screening Landscape Through Advanced Automation AI Integration and Robust Data Analytics

Over the past decade, high content screening platforms have undergone radical transformation driven by advances in automation, artificial intelligence, and data analytics. Originally pioneered as manual fluorescence microscopy setups with limited throughput, these systems have evolved into fully integrated automated workstations capable of handling thousands of assays per day.

Central to this transformation is the integration of robotics and microfluidic technologies that streamline sample preparation and plate handling. Automated liquid handlers now perform complex reagent dispensing and washing steps with microliter precision, reducing human error and increasing reproducibility. In tandem, modern incubation and imaging modules maintain optimal experimental conditions, further accelerating assay throughput.

In parallel, the incorporation of machine learning and deep learning algorithms has revolutionized image analysis workflows. These models can detect subtle phenotypic changes, classify cell populations, and predict compound efficacy with higher accuracy than traditional image processing techniques. As a result, research teams can extract richer biological insights while minimizing time spent on manual data annotation.

Additionally, the rise of cloud-based data platforms and advanced analytics tools enables researchers to manage vast datasets, perform multivariate analyses, and integrate multiomics information. Interactive dashboards and collaborative environments foster cross-functional collaboration, ensuring that experimental findings translate swiftly from bench to decision makers.

Taken together, these technology shifts have not only elevated the performance of high content screening but also redefined its role as a strategic asset. Organizations that embrace these capabilities position themselves to accelerate discovery pipelines and deliver solutions that address unmet medical needs more effectively.

Assessing the Cumulative Impact of United States Tariff Measures on High Content Screening Supply Chains Cost Structures and Competitive Dynamics in 2025

Since 2018, the United States has implemented a series of tariff measures affecting a broad range of imports, including high content screening reagents, imaging instruments, and laboratory consumables. In 2025, additional duties imposed on key reagents such as fluorescent dyes and luminescent substrates have further increased input costs for end users.

These tariffs have translated into longer lead times for proprietary reagents and specialized antibodies, as vendors adjust supply chains to mitigate financial exposure. Laboratory managers now face the dual challenge of securing critical materials while controlling budgets, which can delay pivotal experiments and lengthen development timelines.

In response, many organizations have sought to diversify sourcing strategies by qualifying domestic suppliers and exploring alternative chemistries that fall outside tariff classifications. Some instrument manufacturers have accelerated plans for localized assembly lines to reduce import reliance, thereby preserving competitive pricing structures.

Furthermore, distributors and service providers are adapting their pricing models to absorb a portion of the tariff burden while maintaining volume-based discounts. This approach enables research teams to preserve grant budgets and project notebooks in the face of rising operational expenses.

By adopting agile sourcing frameworks and fostering collaborations with regional production hubs, organizations can mitigate tariff-related risks. Continuous monitoring of policy updates and active engagement with trade associations provide further safeguards against sudden cost escalations, ensuring uninterrupted research progress.

Revealing Critical Segmentation Insights in High Content Screening by Product Type End User and Application to Drive Precision Market Positioning and Resource Allocation

Analysis of high content screening by product type reveals that consumables form the backbone of day-to-day operations, with detection probes such as antibody and dye probes and reagent kits encompassing fluorescent and luminescent chemistries. These reagents underpin assay sensitivity and specificity, driving demand for high-quality, batch-consistent supplies. Meanwhile, instruments including automated microscopes-both fixed stage and inverted stage configurations-alongside high throughput systems optimized for ninety six plate and two plate formats, deliver the mechanical precision and scale required for large screens. Imaging stations of Type A and Type B further complement these platforms by offering adaptable detection options, while software and services components span robust analysis software for data management and image processing, as well as on site and remote maintenance support to ensure uninterrupted workflow efficiency.

When evaluating end users, academic and research institutions, including both government and non profit research institutes alongside private and public universities, continue to leverage high content screening for fundamental biology investigations. Contract research organizations offering clinical and preclinical services, from Phase I and II clinical trials to in vivo and in vitro preclinical assays, depend on flexible screening solutions that can be tailored to study-specific protocols. In parallel, pharmaceutical and biotech firms pursuing biologics and small molecule portfolios utilize these platforms to advance antibody development, cell therapy, and both in house and outsourced small molecule discovery initiatives.

Application segmentation highlights drug discovery efforts focused on hit identification through primary and confirmatory screening followed by lead optimization via ADME-Tox profiling and structure activity relationship studies. Oncology research activities encompass apoptosis assays, such as Annexin V and TUNEL assays, and cell proliferation assessments using BRDU and Ki-67 markers. Toxicology screening further extends into cytotoxicity testing techniques like live/dead and MTT assays, alongside genotoxicity evaluations employing comet and micronucleus assays. This multifaceted segmentation model empowers stakeholders to align product offerings, service capabilities, and commercial strategies with precise scientific requirements and workflow demands.

This comprehensive research report categorizes the High Content Screening market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Throughput

- Plate Format

- Application

- End User

- Sales Channel

- Delivery Mode

Highlighting Key Regional Dynamics Influencing High Content Screening Adoption Trends Regulatory Frameworks and Investment Patterns in Americas EMEA and Asia Pacific

In the Americas region, high content screening adoption continues to accelerate within the United States and Canada, driven by strong investment in biotechnology and pharmaceutical research. Research campuses and contract research organizations benefit from streamlined regulatory pathways and grant incentives that support advanced cellular imaging and screening initiatives. Latin American markets, while smaller in scale, show growing interest as local biotech companies and academic consortia pilot high content workflows for tropical disease research and agricultural biotechnology applications. The presence of regional distributors offering tailored service agreements and reagent bundles further catalyzes adoption by mitigating capital expenditure barriers and enabling scalable implementations.

Across Europe, the Middle East, and Africa, diverse regulatory frameworks and funding landscapes generate both opportunities and challenges. Western European nations lead in high content deployment, supported by robust life science clusters and public–private partnerships. Meanwhile, emerging markets in Eastern Europe and the Middle East invest in capacity building through collaborative research centers and technology transfer agreements. In sub-Saharan Africa, targeted initiatives focus on leveraging high content screening for infectious disease studies, bolstered by international research grants and non-profit collaborations. Barriers related to import logistics and infrastructure maintenance persist but are gradually addressed through localized training programs and remote technical support offerings.

Asia Pacific represents a dynamic frontier for high content screening, with China, Japan, India, and Australia at the forefront of technology adoption. Rapid expansion of domestic reagent manufacturers and instrument assemblers in China has driven cost competitiveness, while Japan maintains leadership in precision instrumentation and automation integration. India’s contract research sector continues to scale services across early-stage drug discovery, and Australia’s research institutions invest in niche applications such as personalized medicine and environmental toxicology. Strategic partnerships between global equipment vendors and local distributors ensure end users receive comprehensive solutions, from financing options to continuous maintenance services.

This comprehensive research report examines key regions that drive the evolution of the High Content Screening market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading High Content Screening Companies and Their Innovative Strategies Fueling Competitive Differentiation and Market Leadership Across the Value Chain

Leading companies within the high content screening market have distinguished themselves through strategic investments in technological innovation, service diversification, and global expansion. Established life science equipment providers have leveraged decades of microscopy expertise to integrate advanced optics, robotics, and software into comprehensive screening platforms. These incumbents focus on delivering turnkey solutions that combine customizable hardware modules with proprietary analytics pipelines, enabling end users to accelerate assay development and derive deeper phenotypic insights.

Concurrently, specialist instrument manufacturers and software developers have emerged as disruptive forces, offering niche solutions tailored to specific market segments. Some firms prioritize modular architectures that allow seamless upgrades from two-plate systems to fully automated high throughput configurations, while others emphasize cloud-based image analysis suites that democratize access to machine learning capabilities. Maintenance and support service providers augment these offerings with on-site technical assistance, remote diagnostics, and proactive consumable replenishment programs designed to maximize instrument uptime.

Collaborations and mergers among leading players continue to reshape the competitive landscape. By acquiring software start-ups and partnering with AI innovators, major vendors enhance their value propositions with predictive analytics and workflow optimization tools. At the same time, focused mergers among reagent suppliers and instrument manufacturers foster more vertically integrated supply chains, reducing time to market for new assay reagents and hardware components.

As a result, end users now benefit from increasingly cohesive ecosystems in which instrumentation, consumables, and analytical services coalesce under unified agreements. This trend toward integrated solutions underscores the importance of strategic partnerships and continuous innovation in maintaining market leadership and responding to evolving research demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Content Screening market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Ardigen S.A.

- Axxam S.p.A

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc

- Carl Zeiss AG

- Cell Signaling Technology, Inc.

- Charles River Laboratories International, Inc.

- Corning Incorporated

- Creative Biolabs

- Curia Global, Inc.

- Danaher Corporation

- Evident Corporation

- Evotec SE

- GE HealthCare Technologies Inc.

- Hamamatsu Photonics K.K.

- Logos Biosystems by Aligned Genetics, Inc.

- Miltenyi Biotec B.V. & Co. KG

- Ncardia Services B.V.

- Nikon Corporation

- Olympus Corporation

- Pharmaron Beijing Co., Ltd.

- Revvity, Inc.

- Sartorius AG

- Sonraí Analytics

- SPT Labtech Ltd.

- Tecan Group Ltd.

- Thermo Fisher Scientific Inc.

- TissueGnostics GmbH

- Yokogawa Electric Corporation

Crafting Actionable Recommendations and Strategic Roadmaps for Industry Leaders to Capitalize on High Content Screening Opportunities and Sustain Long Term Growth

To capitalize on the accelerating momentum in high content screening, industry leaders should prioritize investment in fully integrated automation solutions that align with evolving assay requirements. Establishing modular hardware frameworks enables seamless scalability, allowing research teams to transition from small-scale proof-of-concept studies to high throughput campaigns without incurring significant downtime or retraining costs. Concurrently, organizations must cultivate in-house expertise in artificial intelligence and machine learning by investing in dedicated talent and fostering cross-disciplinary collaborations with data science experts.

Supply chain resilience represents another critical strategic imperative. Stakeholders should actively diversify reagent and instrument sourcing by qualifying multiple vendors and exploring regional manufacturing hubs. This approach mitigates exposure to tariff fluctuations and logistical disruptions, ensuring uninterrupted access to vital consumables and replacement parts. Complementary to this, forging long-term partnerships with maintenance service providers can secure preferential rates and reduce operational risk through proactive support and remote monitoring agreements.

Engagement with academic institutions and contract research organizations can unlock novel application areas and accelerate technology validation. Co-development initiatives focused on emerging cell models, three-dimensional cultures, and live-cell phenotypic assays will expand the utility of high content platforms and generate new revenue streams. Furthermore, vendors and end users alike should prioritize user-friendly software enhancements that lower the barrier to entry for multidisciplinary teams, leveraging intuitive interfaces and automated analysis workflows.

Finally, industry participants must adopt a customer-centric mindset by offering flexible pricing models, bundled service contracts, and performance-based agreements. By aligning commercial structures with research objectives and budget cycles, organizations can foster deeper customer loyalty and differentiate their value propositions in an increasingly competitive marketplace.

Detailing the Comprehensive Research Methodology Underpinning Rigorous Data Collection Analysis and Validation Procedures for High Content Screening Insights

Ensuring the robustness and credibility of insights into high content screening markets requires a rigorous research methodology combining both qualitative and quantitative approaches. Initial desk research engaged extensive secondary sources, including peer-reviewed literature, regulatory filings, and publicly available company disclosures, to establish a foundational understanding of technology trends, competitive landscapes, and policy environments.

Building upon this foundation, primary research involved structured interviews and surveys with a broad cross-section of stakeholders, including senior scientists, procurement managers, and C-level executives within pharmaceutical, biotechnology, and academic organizations. These engagements provided firsthand perspectives on purchasing criteria, workflow challenges, and emerging application areas, enriching the analysis with contextual nuance.

Data triangulation techniques were employed to reconcile disparate data points and validate findings. Cross-referencing company announcements with practitioner feedback and third-party technology benchmarks ensured consistency and minimized bias. Additionally, in-depth case studies of representative end users illuminated real-world deployment scenarios and ROI considerations, offering granular insights that complement aggregate observations.

Analytical procedures incorporated statistical trend analysis and thematic coding of qualitative data to identify recurring patterns and critical inflection points. Emerging technology impact assessments were conducted through scenario modeling, exploring how variables such as AI adoption rates and regulatory shifts might influence future platform utilization. Throughout the process, peer review and expert validation sessions were convened to challenge assumptions and refine conclusions, reinforcing the overall integrity of the study.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Content Screening market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Content Screening Market, by Product Type

- High Content Screening Market, by Technology

- High Content Screening Market, by Throughput

- High Content Screening Market, by Plate Format

- High Content Screening Market, by Application

- High Content Screening Market, by End User

- High Content Screening Market, by Sales Channel

- High Content Screening Market, by Delivery Mode

- High Content Screening Market, by Region

- High Content Screening Market, by Group

- High Content Screening Market, by Country

- United States High Content Screening Market

- China High Content Screening Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2703 ]

Synthesizing Core Findings Strategic Insights and Imperatives that Define the Present State and Future Trajectory of High Content Screening Technologies

As synthesized throughout this report, high content screening stands at the nexus of technological innovation and translational research. The evolution from manual microscopy to fully automated, AI-driven platforms has transformed screening workflows, enabling researchers to capture multidimensional phenotypic data with unprecedented throughput and precision. Concurrently, shifting geopolitical and policy landscapes, exemplified by recent tariff measures, have prompted stakeholders to reexamine supply chain strategies and embrace diversified procurement models.

Segmentation insights reveal that consumables, instruments, and software services each play distinctive roles in shaping user requirements and purchasing behaviors. End users ranging from academic institutes and universities to contract research organizations and pharmaceutical companies demand tailored solutions that address unique application needs in drug discovery, oncology research, and toxicology screening. Regional analyses underscore the heterogeneity of adoption patterns across the Americas, EMEA, and Asia Pacific, with varying regulatory frameworks, funding mechanisms, and infrastructure maturity influencing uptake.

Leading companies have responded by bolstering integrated offerings through strategic partnerships, M&A, and continuous technological upgrades. To maintain competitive advantage, industry participants must adopt an agile approach that balances investment in automation and AI with supply chain resilience and customer-centric service models. By leveraging the comprehensive insights detailed herein, decision makers can craft targeted strategies that harness the full potential of high content screening and drive sustainable innovation.

This executive summary thus crystallizes the imperative for organizations to align technological capabilities with evolving research demands, navigate external policy pressures, and cultivate strategic alliances. Moving forward, the interplay of automation, analytics, and application diversity will determine how effectively high content screening platforms inform scientific breakthroughs and deliver value across the life sciences ecosystem.

Engage Directly with Ketan Rohom to Secure Your Definitive High Content Screening Market Research Report and Empower Data Driven Decision Making

Unlock unparalleled insights into high content screening trends and technologies by securing the complete market research report. To discuss customized research packages, explore detailed segment analyses, or receive bespoke consultation on strategic integration, reach out to Ketan Rohom, Associate Director, Sales & Marketing. By engaging directly, you gain an opportunity to align the report’s findings with your organization’s unique objectives, facilitate data-driven decision making, and identify high-impact opportunities ahead of competitors. Ketan will guide you through methodical overviews of supply chain considerations, technology adoption roadmaps, and targeted recommendations tailored to your research and commercial imperatives. Don’t miss the chance to leverage these actionable insights to enhance your project outcomes and secure a leadership stance in the high content screening arena.

- How big is the High Content Screening Market?

- What is the High Content Screening Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?