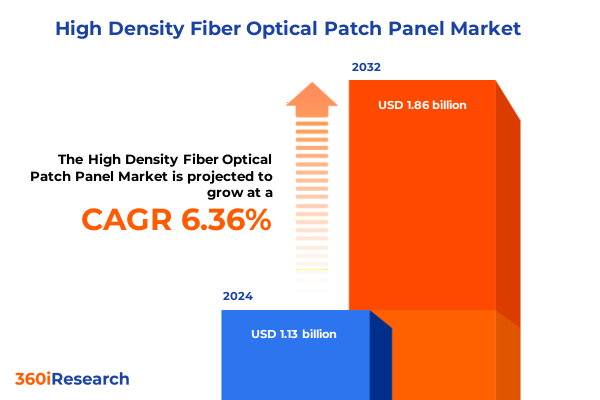

The High Density Fiber Optical Patch Panel Market size was estimated at USD 1.31 billion in 2025 and expected to reach USD 1.44 billion in 2026, at a CAGR of 9.97% to reach USD 2.55 billion by 2032.

Unlocking the Promise of High Density Fiber Optical Patch Panels to Meet the Demands of Next-Generation Connectivity Across Industries

In an era defined by explosive data growth and escalating connectivity demands, high density fiber optical patch panels have emerged as indispensable components in the backbone of modern communications. Acting as the critical interface between fiber optic cables and networking equipment, these panels enable service providers and enterprises to achieve unparalleled port density, streamline cable management, and facilitate rapid reconfiguration of network links. As digital transformation initiatives accelerate across industries, the role of patch panels in supporting high-speed data transfer and ensuring network reliability has never been more pronounced.

Against this backdrop, the high density fiber optical patch panel market is experiencing a paradigm shift. From sprawling hyperscale data centers to mission-critical telecom infrastructures, demand for solutions that deliver both scalability and operational efficiency is rapidly rising. Technological advances in connector design, splice enclosures, and cable routing architectures have further elevated the capabilities of next-generation panels, offering end-users enhanced flexibility and reduced deployment complexity. Consequently, organizations are rethinking traditional network topologies and investing in modular, high-density interconnect systems that can accommodate evolving operational requirements.

This executive summary presents a concise yet comprehensive overview of the transformative trends reshaping this sector. It explores the drivers of demand, examines the impact of recent trade policies, uncovers key segmentation and regional dynamics, profiles leading industry players, and concludes with actionable recommendations for stakeholders seeking to optimize their strategies and fortify competitive positioning.

Embracing the Drivers of Digital Transformation That Are Redefining the High Density Fiber Optical Patch Panel Landscape in the Age of 5G Cloud and Edge

The high density fiber optical patch panel landscape is undergoing a seismic realignment driven by a confluence of transformative forces. Foremost among these is the global rollout of 5G networks, which is catalyzing demand for robust backhaul and fronthaul infrastructures capable of supporting unprecedented bandwidth requirements and ultra-low latency performance. Simultaneously, the rapid expansion of cloud computing and edge-computing architectures is reshaping data center designs, placing a premium on solutions that optimize space utilization and simplify cable management workflows.

Moreover, the proliferation of Internet of Things (IoT) devices and the rise of artificial intelligence applications are sparking a parallel surge in edge deployments, driving the need for compact, high-density interconnect solutions at the network edge. In response, manufacturers are innovating new panel form factors, integrating advanced cable routing features, and leveraging plug-and-play modules that accelerate installation and reduce operational overhead. This wave of innovation is further complemented by the adoption of automated infrastructure management systems, which provide real-time monitoring and visualization capabilities, enhancing network reliability and proactive maintenance.

Taken together, these shifts are redrawing the competitive landscape and redefining value propositions. As network ecosystems evolve toward greater complexity and heterogeneity, stakeholders across the supply chain-from component suppliers to system integrators-must embrace agile product development strategies and forge strategic partnerships to stay ahead of the curve.

Assessing the Far-Reaching Consequences of the 2025 U.S. Trade Tariffs on High Density Fiber Optical Patch Panels Supply Chains and Cost Structures

Over the past year, U.S. trade policies have introduced new layers of complexity for companies in the fiber optics value chain. Initially, a sweeping tariff was implemented on a broad range of imports, affecting all incoming goods at a uniform rate and creating immediate cost pressures for network hardware providers. Shortly afterward, reciprocal tariffs on select imports from the People’s Republic of China were intensified, escalating duties to levels that substantially increased landed costs for critical components, including fiber optic splice enclosures and modular patch panels.

In a turn of events earlier this summer, a bilateral trade agreement eased the steepest reciprocal levies by reducing duties on China-origin goods to a more moderate rate, while preserving existing sector-specific tariffs under longstanding trade remedies. Although this concession alleviated some near-term inflationary pressures, the cumulative impact of multiple tariff regimes has compelled manufacturers to reassess sourcing strategies and reconfigure supply networks. Many have accelerated initiatives to diversify production bases outside of China and invest selectively in domestic assembly operations to safeguard against future policy volatility.

Consequently, the high density fiber optical patch panel market is grappling with a recalibrated cost structure and heightened lead-time risks. As companies navigate this complex tariff environment, emphasis is shifting toward strategic inventory planning, long-term supplier agreements, and co-innovation partnerships that can absorb short-term shocks and maintain continuity in critical fiber interconnect solutions.

Illuminating Key Market Segmentation Insights Revealing How Product Variations and Application Verticals Shape High Density Fiber Optical Patch Panel Demand

In the evolving landscape of high density fiber optical patch panels, product type distinctions reveal an important dichotomy between panels that arrive pre-populated with adaptors and splice trays, and those that are designed as unloaded chassis awaiting customer-specific configurations. This differentiation influences installation timelines, upfront investment, and on-site labor requirements, making it a vital consideration for integrators and network architects.

Meanwhile, enclosure type plays a pivotal role in aligning physical infrastructure with deployment scenarios. Rack mount variants cater to the high-volume port demands of data center racks and telecom exchanges, whereas wall mount options deliver compact field-deployable interconnects for enterprise wiring closets or remote office environments. Port count further refines the offering, with panels configured to accommodate a dozen fibers for smaller installations, to twenty-four ports for mid-tier environments, and up to forty-eight ports for deployments where density and scalability are paramount.

Connector format is another cornerstone of market segmentation. Common interfaces such as LC, MPO, MTP, SC, and ST connectors address a spectrum of use cases-from dense parallel optics in hyperscale data centers to point-to-point links in enterprise buildings. End-user industries themselves present layered segmentation opportunities: banking and financial services leverage reliable fiber backbones for secure transaction networks, data center operators demand tailored solutions for colocation, enterprise, and hyperscale facilities, government entities require compliant and resilient systems, healthcare providers seek high-performance connectivity across clinics, diagnostic centers, and hospitals, and IT and telecom operators continue to upgrade infrastructure to support evolving consumer and business needs.

This comprehensive research report categorizes the High Density Fiber Optical Patch Panel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Enclosure Type

- Port Count

- Connector Type

- End-User Industry

Uncovering Regional Dynamics Highlighting How the Americas Europe Middle East Africa and Asia-Pacific Drive Growth and Innovations in Fiber Patch Panel Technology

Geographic dynamics exert profound influence on the adoption and evolution of high density fiber optical patch panels. In the Americas, a robust ecosystem of service providers and data center operators is driving demand for modular, high-port count solutions that support large-scale hyperscale and enterprise deployments. North American legislative stimuli and infrastructure initiatives further bolster investments in fiber-broadband networks and next-generation mobile backhaul architectures.

Across Europe, the Middle East, and Africa, diverse regulatory landscapes and the need to bridge digital divides shape the purchasing calculus. European operators emphasize standards compliance, energy efficiency, and lifecycle management, while emerging economies in the Middle East and Africa focus on scalable and cost-effective panel systems to expand connectivity. Collaborative projects backed by regional development banks are also accelerating deployment of fiber networks in underserved areas.

In Asia-Pacific, rapid urbanization and the proliferation of smart city initiatives are fueling demand for dense fiber interconnection points. Leading Asian markets combine high-density designs with advanced infrastructure management features to support extensive 5G rollouts, smart manufacturing environments, and distributed cloud networks. Meanwhile, regional manufacturers continue to innovate at pace, enhancing panel designs to meet stringent performance and cost requirements.

This comprehensive research report examines key regions that drive the evolution of the High Density Fiber Optical Patch Panel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Innovators Showcasing How Top Manufacturers Are Shaping the Competitive Landscape of High Density Fiber Optical Patch Panels

The competitive terrain for high density fiber optical patch panels is defined by a mix of global conglomerates and specialized innovators. Major players are leveraging deep R&D capabilities to introduce lightweight, tool-free mounting systems and next-generation splice holders that reduce overall installation time and enhance signal integrity. These established manufacturers often collaborate with network equipment providers to deliver integrated solutions, ensuring compatibility and optimized performance.

Concurrently, mid-sized firms and nimble startups are carving out niches by focusing on customized engineering services, rapid prototyping, and vertical market specialization. By offering tailored panels designed for specific end-use scenarios-such as harsh industrial environments or mission-critical healthcare facilities-these companies differentiate themselves on agility and bespoke design expertise.

Strategic alliances and partnerships are also reshaping the competitive landscape. Cross-industry collaborations between fiber optic component suppliers and software firms highlight the growing importance of automated infrastructure management and remote monitoring solutions, which complement physical panel hardware. As market participants vie for leadership, differentiation increasingly hinges on holistic value propositions that marry high-density interconnection performance with intelligent network management capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Density Fiber Optical Patch Panel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amphenol Corporation

- Belden Inc.

- Black Box Corporation

- CommScope, Inc.

- Corning Incorporated

- Delta Electronics, Inc.

- Fibertronics Corporation

- Furukawa Electric Co., Ltd.

- GCabling Electronic Co., Ltd.

- Hubbell Incorporated

- Legrand S.A.

- Leviton Manufacturing Co., Inc.

- Molex LLC

- Norden Communication Co., Ltd.

- Otrans Communication Co., Ltd.

- Panduit Corp.

- Primus Cable & Wire, Inc.

- Reichle & De-Massari AG

- Siemon Company

- TE Connectivity Ltd.

Delivering Actionable Strategies for Industry Leaders to Optimize Supply Chains Enhance Product Portfolios and Navigate the Future of Fiber Patch Panel Markets

To capitalize on emerging opportunities, industry leaders should prioritize the diversification of supply chains by establishing dual-sourcing arrangements and cultivating local manufacturing partnerships. This approach mitigates exposure to geopolitical risks and tariff volatility, while fostering closer collaboration with regional stakeholders and accelerating time to deployment. Moreover, organizations should invest in modular platform architectures that allow for seamless integration of future connector standards and advanced cable management features without requiring costly hardware overhauls.

Simultaneously, embedding intelligent infrastructure management capabilities into patch panel offerings can deliver significant operational advantages. By providing real-time link monitoring and predictive analytics, manufacturers and service providers can reduce downtime, streamline maintenance cycles, and reinforce SLA compliance. Investing in software-driven asset management tools not only enhances end-user value but also creates opportunities for recurring revenue through managed services and upgrades.

Finally, forging strategic partnerships with hyperscale data center operators, telecom carriers, and system integrators is essential for co-creation and rapid proof-of-concept development. Collaborative pilots focused on optimization of splice enclosures, high-density fiber arrays, and automation interoperability can accelerate product validation and drive adoption at scale.

Detailing the Rigorous Research Methodology Underpinning the Analysis to Ensure Robust Data-Driven Insights into High Density Fiber Optical Patch Panel Markets

This research draws on a structured methodology that integrates comprehensive secondary research with targeted primary interviews. Initial data collection involved a thorough review of industry publications, technical white papers, regulatory filings, and corporate disclosures to map the competitive landscape and identify prevailing technology trends. These insights provided a foundation for and informed the design of primary research instruments.

Subsequently, in-depth interviews were conducted with senior executives, product managers, network architects, and key opinion leaders across service providers, data center operators, and system integrators. These discussions validated market drivers, uncovered emerging use cases, and captured firsthand perspectives on supply chain challenges and innovation priorities. Quantitative data obtained from proprietary shipment reports and trade databases was then triangulated with qualitative feedback to ensure robustness and reliability of findings.

Throughout the research process, a rigorous data validation protocol was employed, including cross-verification with third-party industry experts and peer review by subject-matter advisors. This multi-layered approach ensured that the analysis reflects real-world dynamics and offers actionable insights to guide strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Density Fiber Optical Patch Panel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Density Fiber Optical Patch Panel Market, by Product Type

- High Density Fiber Optical Patch Panel Market, by Enclosure Type

- High Density Fiber Optical Patch Panel Market, by Port Count

- High Density Fiber Optical Patch Panel Market, by Connector Type

- High Density Fiber Optical Patch Panel Market, by End-User Industry

- High Density Fiber Optical Patch Panel Market, by Region

- High Density Fiber Optical Patch Panel Market, by Group

- High Density Fiber Optical Patch Panel Market, by Country

- United States High Density Fiber Optical Patch Panel Market

- China High Density Fiber Optical Patch Panel Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing the Core Themes and Strategic Imperatives Emerging from the Executive Summary of High Density Fiber Optical Patch Panel Market Analysis

The high density fiber optical patch panel sector stands at a pivotal juncture, shaped by accelerating digital transformation, evolving trade policies, and shifting end-user requirements. As connectivity paradigms expand to accommodate 5G, cloud, edge, and IoT workloads, the demand for modular, high-port-count interconnect solutions will continue to intensify. Market players must therefore balance the imperatives of innovation, supply chain agility, and cost optimization in an increasingly complex operating environment.

Insights from segmentation analysis underscore the importance of tailoring product portfolios to specific installation scenarios, whether by offering pre-populated splice panels for rapid deployment or unloaded frames for custom configurations. Geographic dynamics further highlight the need for regionally optimized strategies that align with legislative stimuli, infrastructure investments, and local manufacturing capabilities. Competitive profiling reveals that differentiation will hinge on integrated hardware-software offerings and strategic ecosystem partnerships.

Ultimately, the synthesis of these themes points to a set of strategic imperatives: embrace modular product architectures, leverage data-driven management tools, diversify sourcing networks, and engage in collaborative innovation. By doing so, stakeholders can position themselves to capture the next wave of growth and reinforce the resilience of critical fiber-optic infrastructures.

Connect with Ketan Rohom to Unlock Comprehensive Market Intelligence and Drive Strategic Decisions with the Definitive High Density Fiber Optical Patch Panel Report

If you’re ready to gain a strategic advantage with an authoritative deep dive into the high density fiber optical patch panel market, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He can guide you through the rich insights and actionable intelligence packed into this comprehensive report. By connecting with him, you’ll secure access to the full breadth of data, analysis, and strategic recommendations needed to drive high-value decisions. Take the next step towards future-proofing your network infrastructure and supply chain by arranging a personalized briefing or obtaining the complete market research deliverable today

- How big is the High Density Fiber Optical Patch Panel Market?

- What is the High Density Fiber Optical Patch Panel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?