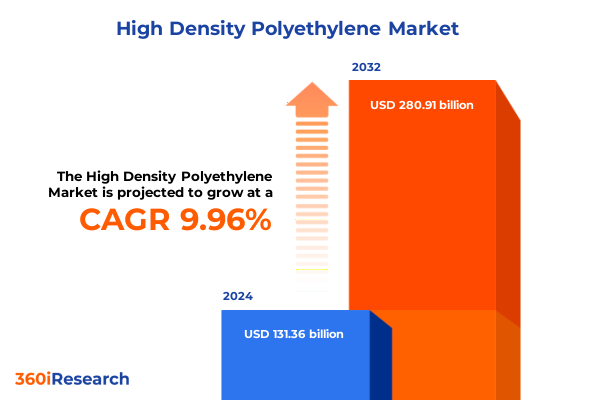

The High Density Polyethylene Market size was estimated at USD 142.61 billion in 2025 and expected to reach USD 154.83 billion in 2026, at a CAGR of 10.16% to reach USD 280.91 billion by 2032.

Unveiling the Fundamentals and Intrinsic Properties of High Density Polyethylene While Highlighting Its Pivotal Role Across Diverse Industrial Applications

High density polyethylene stands as a cornerstone polymer renowned for its exceptional strength-to-density ratio and its remarkable chemical resistance. Its semi-crystalline structure endows it with stiffness and tensile resilience, making it ideally suited for demanding industrial applications. From robust piping systems to durable consumer packaging, this material bridges the gap between performance requirements and cost efficiency, offering producers a versatile solution capable of meeting stringent regulatory and environmental standards.

Over the decades, production technologies have evolved to optimize reactor design, catalyst performance, and process economics. These advances have driven down production costs while enhancing molecular weight distribution control, enabling fine-tuning of mechanical and barrier properties. As a result, manufacturers can tailor formulations to address specific end-use applications, ranging from high-strength compounding for automotive parts to ultra-thin films for flexible packaging.

Furthermore, the feedstock flexibility of high density polyethylene allows integration with a variety of cracking processes, fostering closer alignment with evolving petrochemical supply chains. In doing so, this polymer has secured its position at the forefront of polymer science, continuing to open new avenues for high-performance materials and reinforcing its pivotal role in modern industrial ecosystems.

Examining the Transformative Shifts Reshaping the High Density Polyethylene Landscape Driven by Technological Innovation and Sustainability Imperatives

The high density polyethylene landscape is undergoing transformative shifts driven by technological innovation, sustainability imperatives, and evolving regulatory frameworks. Emerging catalysts and reactor designs are redefining polymerization pathways, allowing producers to achieve unprecedented control over molecular architecture. These breakthroughs pave the way for next-generation resins with enhanced strength and improved processing behavior, unlocking new performance thresholds in film extrusion, blow molding, and rotational molding processes.

Meanwhile, end-of-life considerations have taken center stage, prompting investments in advanced recycling and mechanical reprocessing. Chemical recycling pathways that depolymerize polyethylene back into monomers are gaining traction, heralding a circular economy model that shifts the industry away from linear resource usage. As a result, stakeholders across the value chain are collaborating to establish closed-loop supply systems and bolster the credibility of recycled content in high-performance applications.

Concurrently, digital transformation is permeating production and supply chain management. Real-time analytics and predictive maintenance tools enhance operational efficiency, while digital twins enable rapid troubleshooting and process optimization. Taken together, these forces are reshaping value creation in the high density polyethylene market, driving material innovation, operational excellence, and sustainability to new heights.

Analyzing the Far Reaching Cumulative Impact of 2025 United States Tariffs on the High Density Polyethylene Market and Supply Chain Dynamics

In 2025, the United States imposed targeted tariff measures on high density polyethylene imports, triggering significant repercussions across the supply chain. These tariffs increased landed costs for downstream manufacturers reliant on imported resin, compelling many to reevaluate sourcing strategies. In response, several industrial processors accelerated efforts to secure domestic production volumes while exploring new partnerships with regional producers capable of delivering competitive pricing and reliable logistics.

The cumulative impact of these trade measures has been most pronounced in price-sensitive segments such as packaging and agricultural films. Fabricators faced margin compression and, in many cases, passed higher costs onto end users, which in turn influenced product design choices and material substitution trends. Consequently, procurement teams intensified negotiations with both domestic and alternative suppliers, seeking stable multi-year contracts to hedge against ongoing tariff uncertainties.

Furthermore, the shift in import dynamics spurred logistical realignments, with ports in the Gulf Coast and East Coast emerging as critical hubs for diverted trade flows. Rail and trucking networks were optimized to handle increased domestic movements, underscoring the interdependence between trade policy and infrastructure planning. Looking ahead, market participants continue to monitor potential tariff adjustments and bilateral negotiations that could redefine cost structures and supply risk in the high density polyethylene sector.

Unlocking Critical Segmentation Insights Revealing Form Application and Distribution Channel Dynamics Shaping the High Density Polyethylene Market

The high density polyethylene market exhibits distinct behavioral patterns when examined through the lens of form, application, and distribution channel segmentation. In the realm of form, granules remain the predominant resin shape, prized for their ease of handling and consistent melt behavior during extrusion and molding processes. Powder form, although less common, has carved out specialized niches within rotational molding and additive manufacturing, where controlled flow and targeted particle size distribution are paramount.

Diving into applications, the diversity of end-use sectors underscores the material’s adaptability. In agriculture, the polymer is the backbone of greenhouse films, irrigation pipes, and mulching films, enabling yield enhancement and water conservation. Within the automotive sphere, components, exterior parts, and underbody parts benefit from the resin’s durability and impact resistance. Consumer goods manufacturers rely on the polymer for household goods, sports equipment, and toys that require safety and longevity, while electrical and electronics sectors leverage its insulating properties in casings, connectors, and insulation components. The healthcare domain utilizes the material for medical equipment and packaging materials that must meet rigorous safety and sterility standards. In packaging, applications span bottles and containers, caps and closures, films and sheets, as well as liners and bags, each demanding specific barrier, strength, and clarity attributes. Finally, pipes and fittings like gas distribution pipes, sewage pipes, and water supply pipes highlight the material’s capacity to withstand harsh environmental conditions and high-pressure service.

When considering distribution channels, direct sales arrangements foster close collaboration between polymer producers and blue-chip customers, enabling custom resin development and integrated supply agreements. Distributors play a crucial role in serving regional fabricators, offering inventory logistics and technical support. E-commerce platforms have gained momentum more recently, granting smaller end-users streamlined ordering processes and access to a broader array of product grades, ultimately democratizing material procurement across geographies.

This comprehensive research report categorizes the High Density Polyethylene market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Application

- Distribution Channel

Uncovering Regional Dynamics and Growth Enablers Across Americas Europe Middle East & Africa and Asia Pacific Markets Impacting High Density Polyethylene

Regional dynamics in the high density polyethylene market reveal a tapestry of growth drivers, regulatory frameworks, and infrastructure capacities that vary significantly across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, the abundant feedstock availability resulting from shale gas revolution has underpinned competitive production costs. This advantage has fortified domestic polymer producers and encouraged export initiatives to Latin American and global markets. Government incentives for infrastructure modernization and sustainable manufacturing have further catalyzed investment in advanced plants and recycling facilities, fostering a resilient domestic ecosystem.

Contrastingly, Europe Middle East & Africa presents a multifaceted environment where regulatory rigor and environmental mandates guide market behavior. Stringent recycling targets and extended producer responsibility programs have elevated the importance of recycled content, compelling resin producers to integrate mechanical and chemical recycling processes. Simultaneously, the Middle East leverages its petrochemical legacy to expand capacity, focusing predominantly on export markets, while African demand continues to grow steadily, primarily in packaging and construction applications.

In the Asia Pacific region, demand intensity is driven by rapid urbanization, infrastructure development, and expanding consumer markets. China remains a leading consumer and producer, investing heavily in capacity expansions and downstream valorization projects. Southeast Asian economies are emerging as growth hotspots for agricultural films and consumer packaging, supported by improving logistics and favorable trade agreements. Australia and Japan demonstrate advanced circular economy practices, piloting large-scale recycling initiatives and stringent product stewardship programs. Collectively, these regional patterns underscore the necessity for tailored market approaches and highlight opportunities for strategic partnerships that align with localized market conditions.

This comprehensive research report examines key regions that drive the evolution of the High Density Polyethylene market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Leading Industry Players Pioneering Innovations Operational Strategies and Collaborative Ventures in the High Density Polyethylene Sector

Leading global producers have adopted distinct strategies to maintain competitiveness in the evolving high density polyethylene sector. Major energy companies leverage integrated operations spanning feedstock production, polymerization, and distribution networks, thereby capturing value across the supply chain. Their investments in advanced catalyst technologies and high-efficiency reactor systems have yielded resins with enhanced mechanical properties and lower carbon footprints.

Specialty chemical manufacturers differentiate through high-end product portfolios, focusing on niche applications such as medical-grade films, barrier packaging, and high-impact engineering components. Collaboration with research institutes and strategic alliances with end-users drive co-development of tailor-made grades that address sector-specific challenges. This approach not only accelerates innovation cycles but also cultivates deep customer loyalty and premium pricing potential.

New entrants and regional champions are carving out market share by targeting underserved geographies and emerging application segments. They deploy agile supply models, including flexible mini-plant configurations and tolling agreements, to meet local demand and mitigate logistical complexity. Moreover, partnerships with recyclers and cross-industry alliances underscore a collective drive toward circularity, positioning these players as forward-thinking participants in an increasingly sustainability-focused landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Density Polyethylene market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Borealis AG

- Braskem S.A.

- Chevron Phillips Chemical Company LLC

- Dow Inc.

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Hanwha Solutions Corporation

- INEOS Group Holdings S.A.

- LG Chem Ltd.

- Lotte Chemical Corporation

- LyondellBasell Industries N.V.

- Mitsui Chemicals, Inc.

- PTT Global Chemical Public Company Limited

- Reliance Industries Limited

- SABIC

- Sumitomo Chemical Co., Ltd.

- Tosoh Corporation

- TotalEnergies SE

Strategic Actionable Recommendations Guiding Industry Leaders to Optimize High Density Polyethylene Operations Embrace Innovation and Sustain Competitive Advantage

Industry leaders are positioned to capture significant advantages by embracing a suite of strategic actions. First, integrating advanced feedstock diversification strategies can help mitigate the impact of raw material volatility. By sourcing from multiple suppliers and investing in feedstock co-processing ventures, companies can ensure consistent production throughput while optimizing cost structures. Next, accelerating digital transformation across production and supply chain functions will unlock operational efficiencies. Real-time process monitoring, predictive maintenance, and digital twins not only reduce downtime but also enhance product quality and yield.

In parallel, forging deeper partnerships with recycling and chemical upcycling specialists can bolster access to recycled content, meeting both regulatory requirements and consumer expectations. Establishing transparent chain-of-custody systems and leveraging blockchain-based traceability tools will reinforce trust in circular supply chains. Furthermore, investing in service excellence through tailored technical support and collaborative problem-solving labs will differentiate suppliers in a commoditized marketplace.

Finally, embedding sustainability metrics into core performance indicators and aligning portfolios with ESG commitments can attract new investment and satisfy evolving stakeholder demands. By systematically embedding these recommendations into strategic roadmaps, high density polyethylene producers and converters can secure robust growth trajectories and sustain competitive advantage in a dynamic global market.

Detailing the Rigorous Mixed Methodology Research Framework Leveraging Quantitative and Qualitative Approaches to Deliver Robust Market Intelligence

The research underpinning this analysis employed a rigorous mixed methodology framework to ensure depth, accuracy, and relevance. Primary insights were gleaned through interviews with leading executives, technical experts, and channel partners across the value chain. These conversations provided real-world perspectives on production challenges, application trends, and emerging regulatory influences.

Complementing qualitative inputs, secondary research entailed comprehensive review of industry journals, government publications, trade association reports, and patent filings. This desk research established a foundation of factual data regarding production capacities, technological advancements, and policy frameworks. Cross validation was achieved through triangulation, comparing multiple sources to confirm consistency and identify areas of divergence.

Quantitative analysis harnessed proprietary databases to examine historical shipment data, pricing trends, and raw material indices. Statistical modeling and trend analysis illuminated correlations between market events and performance indicators. Throughout the process, strict data governance protocols were observed to maintain confidentiality and uphold the highest standards of research integrity. This multi-layered methodology ensures that the insights presented here offer a robust platform for informed strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Density Polyethylene market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Density Polyethylene Market, by Form

- High Density Polyethylene Market, by Application

- High Density Polyethylene Market, by Distribution Channel

- High Density Polyethylene Market, by Region

- High Density Polyethylene Market, by Group

- High Density Polyethylene Market, by Country

- United States High Density Polyethylene Market

- China High Density Polyethylene Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Insights to Illuminate the Future Trajectory of the High Density Polyethylene Industry and Inform Strategic Decision Making

Through comprehensive exploration of high density polyethylene’s foundational properties, transformative market shifts, and the ripple effects of recent tariff policies, this analysis illuminates the complex forces shaping the industry. Insight into form, application, and distribution segmentation underscores the material’s versatility and the nuanced demands of different end-use sectors. Regional examination reveals distinct growth imperatives and regulatory drivers that inform localized strategies, while company-level scrutiny highlights the operational and collaborative models propelling innovation.

Strategic recommendations presented here offer a clear blueprint for industry leaders seeking to optimize feedstock diversity, accelerate digitalization, and embed sustainable practices throughout the value chain. As the market continues to adapt to evolving policy landscapes, supply chain realignments, and circular economy imperatives, decision makers must remain agile in response to emerging opportunities and risks.

In closing, the future trajectory of high density polyethylene will be defined by those who embrace integrated approaches to innovation, sustainability, and operational excellence. The insights articulated in this document provide both a strategic compass and an actionable foundation for navigating the next chapter of this dynamic market.

Engage with Ketan Rohom to Secure Comprehensive High Density Polyethylene Market Insights and Drive Strategic Growth with an In Depth Research Report Acquisition

By partnering with Ketan Rohom, Associate Director of Sales & Marketing, prospective stakeholders gain direct access to expert guidance that translates market intelligence into decisive action. Collaboration with Ketan brings clarity to complex industry dynamics and ensures that the investment in an in-depth report delivers immediate value. Whether refining product portfolios, adapting distribution strategies, or benchmarking against competitors, this engagement paves the way for measured growth. Readers are encouraged to reach out and secure their comprehensive report to unlock tailored insights that empower informed decision making and sustained competitive positioning in the high density polyethylene market

- How big is the High Density Polyethylene Market?

- What is the High Density Polyethylene Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?