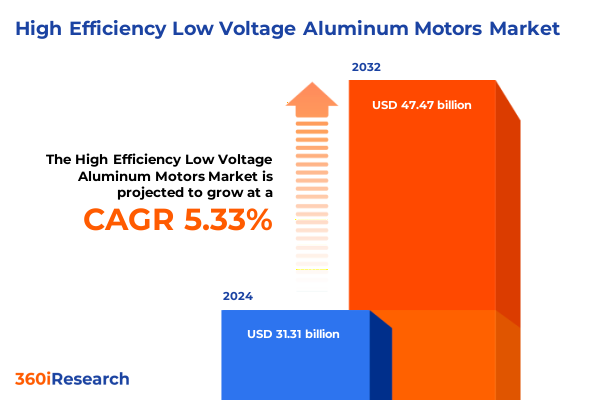

The High Efficiency Low Voltage Aluminum Motors Market size was estimated at USD 32.90 billion in 2025 and expected to reach USD 34.58 billion in 2026, at a CAGR of 5.37% to reach USD 47.47 billion by 2032.

Revolutionary Advances in Aluminum-Based Low Voltage Motor Design Propel Sustainability and Efficiency to New Heights

In an era defined by stringent energy regulations and an unwavering focus on sustainability, high efficiency low voltage aluminum motors have emerged as pivotal components in industrial and commercial applications. Combining the lightweight advantages of aluminum housings with advanced motor topologies, these machines reduce power consumption, lower carbon emissions, and enable more compact system designs. The industry has witnessed a surge of innovation as manufacturers leverage optimized winding techniques, refined lamination processes, and state-of-the-art thermal management to push performance boundaries. Rising demand for energy-efficient solutions across end-use segments-including manufacturing operations, building services, HVAC systems, and water treatment facilities-has propelled aluminum motors to the forefront of electrification strategies.

Transitioning from traditional steel-cased motors, stakeholders are now prioritizing the integration of motors that not only satisfy regulatory benchmarks but also align with corporate sustainability goals. This alignment has fostered collaborative R&D initiatives between OEMs, component suppliers, and research institutions, leading to breakthroughs in motor control algorithms and the adoption of advanced materials like amorphous metal laminations. Moreover, evolving digitalization trends, such as cloud-based condition monitoring and predictive maintenance, have amplified the value proposition of aluminum motors, offering real-time insights into performance and reliability. As the market advances, manufacturers and end users alike are recognizing aluminum low voltage motors as vital assets for achieving operational efficiencies and long-term cost savings.

Technological Disruption and Digital Integration Are Fueling a New Era of Ultra-Efficient Low Voltage Aluminum Motors

The landscape of low voltage motor technology is undergoing fundamental transformation driven by the confluence of regulatory tightening, digital integration, and material innovation. Efficiency standards across global markets have progressively escalated from IE2 and IE3 benchmarks to more ambitious IE4 and IE5 classifications, compelling manufacturers to re-engineer core architectures. The shift toward permanent magnet and synchronous reluctance designs has accelerated, enhancing torque density and reducing reliance on rare-earth elements through novel magnetic materials. Concurrently, advanced manufacturing methods-such as additive layering for precise winding geometries and robotic assembly for consistent tolerances-have enabled consistent, high-yield production of aluminum-cased motors.

Digital enablers are also reshaping product lifecycles and aftermarket services. Embedded sensors and IoT gateways now facilitate continuous performance monitoring, while AI-powered analytics predict equipment health, minimizing unplanned downtime and optimizing energy consumption. Furthermore, modular motor architectures have begun to take hold, allowing for scalable power ratings and swift customization across mounting types, including flange, foot, shaft, and vertical configurations. This modularity not only streamlines production but also supports rapid deployment in varied applications ranging from conveyors and compressors to HVAC units and pumps. Overall, the industry’s technological fervor is fostering an era of interconnected, high-efficiency motor solutions primed to meet evolving operational and environmental imperatives.

Navigating Heightened Import Duties Catalyzes Strategic Reconfigurations in North American High Efficiency Motor Supply Chains

In 2025, the United States intensified its tariff regime on imported electric motors, aiming to protect domestic manufacturing and encourage local sourcing of critical components. These measures have introduced incremental duties on low voltage aluminum motor imports, heightening procurement costs for original equipment manufacturers reliant on global supply bases. While tariffs have invigorated domestic production capacity expansion, they have also prompted OEMs and distributors to reevaluate their sourcing strategies to mitigate margin compression. Many stakeholders are now prioritizing local partnerships and investing in in-country assembly facilities to circumvent trade barriers and secure just-in-time delivery.

The tariff amendments have had a ripple effect across the broader supply chain, incentivizing component suppliers-such as lamination vendors and bearing manufacturers-to establish footprints within North America. This regional localization is gradually reducing lead times and transportation overhead, though initial capital expenditures for facility development remain substantial. Simultaneously, companies are exploring tariff mitigation strategies, including tariff engineering through harmonized system code classification optimization and leveraging free trade agreements where feasible. As the industry grapples with these policy-induced adjustments, the overarching objective remains clear: balance cost optimization with compliance and ensure consistent market access in a dynamic regulatory environment.

In-Depth Examination of Efficiency Classes, Mounting Styles, Power Thresholds, Motor Architectures, and End-Use Applications

Analyzing market partitions through the lens of efficiency reveals that international demand is pivoting toward motors classified under the highest tiers, notably IE4 and IE5, driven by end users seeking maximal energy savings. This trend dovetails with the surge in digitally enhanced products, where high-efficiency classes integrate seamlessly with IoT-based monitoring platforms. When evaluating installation requirements, foot-mounted and flange-mounted variants dominate retrofitting projects, whereas vertical and shaft-mounted configurations find niche applications in specialized equipment and confined spaces. Insights into power rating preferences indicate that the segment representing machines above five kilowatts is expanding, especially in industrial sectors requiring robust performance, though units up to one kilowatt remain prevalent in residential and light commercial appliances.

Delving into motor topology preferences, brushless DC designs are increasingly favored for precision-driven applications due to their exceptional speed control, while induction motors continue to underpin cost-sensitive deployments. Synchronous motors are gaining traction where consistent torque delivery and power factor correction are paramount. End users in commercial building services, HVAC, and water treatment are gravitating towards advanced solutions to meet sustainability mandates, whereas industrial domains spanning chemical processing, food and beverage, and manufacturing prioritize durability in harsh environments. Within residential settings, demand for motors embedded in appliances and HVAC equipment underscores consumer expectations for quiet operation and efficient energy utilization. Application-wise, centrifugal pumps and axial fans maintain a strong presence, while reciprocating compressors and positive displacement pumps are selected for specialized process control tasks. These segmented dynamics underscore the necessity for motor providers to tailor product portfolios in alignment with the distinct performance and compliance requirements of each vertical.

This comprehensive research report categorizes the High Efficiency Low Voltage Aluminum Motors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Efficiency Class

- Mounting Type

- Power Rating

- Motor Type

- End User

- Application

Regional Nuances and Policy-Driven Market Drivers Shape Distinct Adoption Patterns Across Americas, EMEA, and Asia-Pacific Regions

Regional dynamics in the Americas are characterized by a robust push for network modernization and green infrastructure investments. North American utilities and manufacturing hubs are rapidly adopting high efficiency low voltage aluminum motors to meet federal and state-level sustainability targets, complemented by incentives for energy retrofits. Meanwhile, Latin American markets are emerging as growth frontiers, leveraging cost-effective aluminum motor solutions to address expanding industrialization and urbanization challenges.

Across Europe, the Middle East, and Africa, stringent EU ecodesign regulations and Middle Eastern renewable energy projects are driving uptake of advanced motor technologies. European nations are retrofitting legacy systems in industrial parks, whereas GCC countries are integrating energy-efficient motors into large-scale desalination and petrochemical operations. In Africa, infrastructure development initiatives, supported by international donors, are creating fresh demand for reliable low voltage motors with minimal maintenance requirements.

In the Asia-Pacific region, a confluence of rapid manufacturing expansion, smart city rollouts, and government-backed efficiency schemes is fueling adoption. China continues to dominate production volumes and is advancing domestic design capabilities, while India’s growing industrial base is benefiting from affordable aluminum motor imports. Southeast Asian economies are capitalizing on motors optimized for tropical climates, emphasizing corrosion resistance and robust thermal management to withstand high humidity and temperature conditions.

This comprehensive research report examines key regions that drive the evolution of the High Efficiency Low Voltage Aluminum Motors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Overview Highlights Digital Service Integration, Material Innovations, and Verticalization Strategies

The competitive landscape is populated by multinational conglomerates and specialized motor manufacturers, each leveraging unique strengths. Global leaders are investing heavily in digital platforms that offer predictive maintenance services and performance analytics, thereby locking in long-term service contracts. These corporations are also expanding additive manufacturing capabilities to produce complex rotor geometries that enhance thermal dissipation and torque density. In parallel, innovative mid-sized companies are carving out niches by integrating advanced magnet materials and proprietary cooling systems, achieving high power-to-weight ratios.

Additionally, a wave of regional manufacturers is emerging with vertically integrated supply chains, controlling lamination production, housing fabrication, and winding processes to reduce dependency on third-party vendors. Strategic partnerships between motor companies and drive technology providers are intensifying, enabling seamless integration of variable frequency drives with motor assemblies. These collaborations not only enhance energy efficiency but also accelerate time-to-market for tailored solutions. Through aggressive R&D investment, companies are rapidly iterating product lines to comply with evolving IEC and NEMA efficiency mandates, thereby solidifying their positions in both established and frontier markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Efficiency Low Voltage Aluminum Motors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- AC-MOTOREN GmbH

- Anhui Wannan Electric Machine Company,. Ltd

- Arkadiusz Mysiakowski

- Bonfiglioli Drive Systems Pvt. Ltd

- Cantoni Group

- Danfoss

- HD Hyundai Electric Co., Ltd.

- Hengsu Holdings Co.,Ltd.

- Hitachi Ltd.

- Hoyer Motors

- Impetus Turnomatics

- Indusquip

- LETRA Water Technologies and Engineering

- Longbank Motor Manufacturer

- Makharia Electricals Pvt Ltd.

- Prakash Electric Stores

- Regal Beloit Corporation

- Siemens AG

- Soga S.p.A.

- TECO Electric & Machinery Co. Ltd.

- Toshiba Corporation

- VYBO Electric a.s.

- Yantralink Machine Tools

- ZCL Electric Motor Technology Co., Ltd.

Strategic Imperatives for Stakeholders to Enhance Agility, Digitalization, and Supply Chain Resilience

Industry leaders should prioritize the development of highly modular motor platforms that allow rapid reconfiguration across efficiency classes and mounting variants, enabling faster response to shifting customer demands. Embracing digital twin technology in the design and testing phase can drastically reduce development cycles while optimizing thermal and mechanical performance under varying load conditions. Collaborating with raw material suppliers to secure sustainable sources of aluminum and advanced magnetic materials will help mitigate supply chain risks associated with trade policies and commodity price volatility.

Furthermore, establishing joint ventures with local assemblers in key markets can streamline logistics, reduce lead times, and bypass tariff barriers. Investing in comprehensive after-sales service networks with remote monitoring capabilities will drive customer retention and create recurring revenue streams through predictive maintenance offerings. Finally, aligning product roadmaps with emerging regulatory frameworks-such as anticipated US Department of Energy efficiency updates and future ecodesign requirements-will ensure compliance and unlock incentive programs, reinforcing market leadership and long-term profitability.

Robust Multi-Methodology Framework Combining Secondary Analysis, Patent Reviews, Primary Interviews, and Expert Validation

This research leverages a dual-pronged approach combining extensive secondary data collection with targeted primary investigations. Secondary research entailed a thorough review of industry standards, regulatory publications, and technical literature to contextualize efficiency classifications and material developments. Concurrently, detailed patent analyses and technology white papers were examined to map innovation trajectories in motor topology and manufacturing techniques. Market channels, distribution networks, and regional policy frameworks were also assessed through reputable government databases and trade association reports.

On the primary side, structured interviews were conducted with C-level executives, design engineers, and procurement specialists across leading motor manufacturers, component suppliers, and key end users. Surveys captured insights on procurement strategies, retrofit priorities, and digitalization plans, while on-site visits provided firsthand observations of emerging production processes and assembly line automation. Data were triangulated through cross-verification of supplier shipment statistics, trade data, and input from independent industry consultants to ensure robust accuracy. Finally, iterative validation workshops with expert panels refined the analysis, ensuring the report delivers actionable and reliable intelligence for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Efficiency Low Voltage Aluminum Motors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Efficiency Low Voltage Aluminum Motors Market, by Efficiency Class

- High Efficiency Low Voltage Aluminum Motors Market, by Mounting Type

- High Efficiency Low Voltage Aluminum Motors Market, by Power Rating

- High Efficiency Low Voltage Aluminum Motors Market, by Motor Type

- High Efficiency Low Voltage Aluminum Motors Market, by End User

- High Efficiency Low Voltage Aluminum Motors Market, by Application

- High Efficiency Low Voltage Aluminum Motors Market, by Region

- High Efficiency Low Voltage Aluminum Motors Market, by Group

- High Efficiency Low Voltage Aluminum Motors Market, by Country

- United States High Efficiency Low Voltage Aluminum Motors Market

- China High Efficiency Low Voltage Aluminum Motors Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Convergence of Technological Innovation, Regulatory Evolution, and Sustainability Priorities Signals a Paradigm Shift in Motor Technologies

As global demands for energy efficiency and sustainability intensify, high efficiency low voltage aluminum motors stand poised to redefine industrial and commercial powertrain solutions. Their unique combination of lightweight materials, advanced topologies, and digital capabilities positions them as indispensable enablers of modern electrification strategies. While regulatory shifts and tariff policies present near-term challenges, they also catalyze strategic realignments in supply chains and product innovation.

Looking ahead, the ability of manufacturers and end users to adapt through modular designs, localized assembly, and digital service offerings will determine market winners. By embracing these imperatives, stakeholders can not only comply with escalating efficiency mandates but also achieve a competitive edge through operational resilience and differentiated offerings. Ultimately, this transformative wave underscores the convergence of technology, policy, and sustainability goals, heralding a new chapter in electric motor evolution.

Unlock Strategic Intelligence and Drive Market Leadership in High Efficiency Low Voltage Aluminum Motors by Connecting with Our Associate Director of Sales & Marketing

For organizations seeking unparalleled insights into the global high efficiency low voltage aluminum motors market, reaching out to Ketan Rohom provides direct access to comprehensive analysis, detailed data, and expert guidance. By engaging with the Associate Director of Sales & Marketing, decision-makers can explore customized research solutions, receive in-depth clarifications on market dynamics, and secure timely delivery of the full report tailored to specific business needs. This partnership opportunity ensures that stakeholders have the strategic intelligence required to steer product development, optimize supply chains, and identify emerging growth segments with confidence. Connect with Ketan to initiate your access, discuss pricing options, and unlock actionable intelligence that will drive innovation and competitive advantage in your organization

- How big is the High Efficiency Low Voltage Aluminum Motors Market?

- What is the High Efficiency Low Voltage Aluminum Motors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?