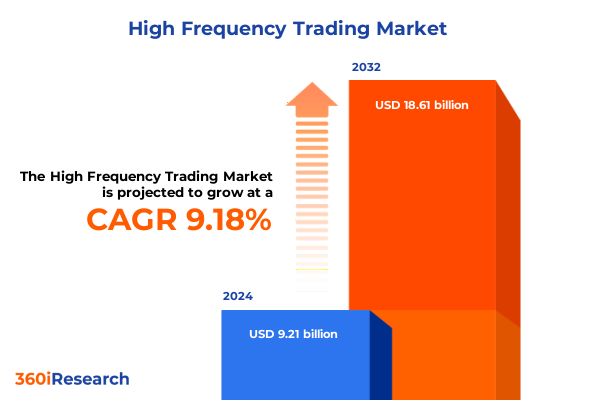

The High Frequency Trading Market size was estimated at USD 10.01 billion in 2025 and expected to reach USD 10.90 billion in 2026, at a CAGR of 9.25% to reach USD 18.61 billion by 2032.

Exploring the Dynamic Evolution of High Frequency Trading and Its Strategic Significance in Contemporary Financial Markets Worldwide

High frequency trading has emerged as a cornerstone of modern financial market operations, reshaping how liquidity, pricing, and risk are managed in milliseconds. As algorithmic execution becomes ever more sophisticated, institutions of all sizes are leveraging advanced computing power, co-location services, and real-time data analytics to achieve minimal latencies and capture fleeting arbitrage opportunities. This report provides an overview of the dynamic forces driving HFT’s evolution, highlighting the strategic importance of technological innovation and regulatory compliance.

By examining the interplay between cutting-edge hardware, machine learning algorithms, and evolving market microstructures, this introduction establishes the foundation for a deeper analysis of industry trends. Stakeholders can anticipate detailed discussions on transformative shifts in infrastructure, the effects of macroeconomic policy such as United States tariffs in 2025, and how these factors collectively influence market participants across diverse segments. Ultimately, this section clarifies the high stakes and competitive imperatives that define success in high frequency trading today.

Unveiling the Technological and Regulatory Transformations Reshaping High Frequency Trading Practices and Infrastructure Across Global Exchanges

The high frequency trading landscape has undergone transformative shifts driven by both technological breakthroughs and heightened regulatory scrutiny. Advances in field-programmable gate arrays and graphic processing units have accelerated algorithmic strategies, enabling market participants to deploy more complex predictive analytics and artificial intelligence models. Meanwhile, the proliferation of machine learning frameworks has imbued trading systems with the ability to adapt to market volatility in real time, identifying patterns and executing orders with unprecedented precision.

On the regulatory front, global exchanges and governing bodies have introduced stricter transparency requirements, enhanced surveillance mechanisms, and updated best execution guidelines. These measures aim to mitigate systemic risks arising from flash crashes and algorithmic anomalies, fostering market integrity while challenging firms to balance compliance with competitive speed. The convergence of infrastructure optimization and policy reform has instigated a new era of collaboration between technology providers and compliance teams, underscoring the importance of designing resilient, auditable trading platforms.

Assessing the Ripple Effects of 2025 United States Tariffs on High Frequency Trading Infrastructures and Cross-Border Capital Flows

The imposition of United States tariffs in 2025 on semiconductor components and data center equipment has created a cascade of operational considerations for high frequency trading firms. Increased import duties on critical hardware have elevated capital costs for co-location facilities and proprietary trading desks, compelling institutions to reevaluate supply chain resilience and vendor diversification strategies. Consequently, some firms have accelerated investments in domestic manufacturing partnerships or sought alternative sourcing from non-tariffed regions to contain price volatility.

Moreover, the tariffs have indirectly influenced cross-border capital flows, as trading desks adjust their footprint to optimize regulatory arbitrage and tax incentives. Firms expanding into Asia-Pacific and EMEA jurisdictions are now recalibrating latency budgets to account for both infrastructure expenses and tariffs’ impact on total cost of ownership. In addition, strategic hedging instruments have grown in sophistication to offset hardware procurement risks, reinforcing the symbiotic relationship between market-making activities and derivative overlays. These cumulative effects underscore the imperative for an agile trading infrastructure that anticipates policy shifts while safeguarding execution performance.

Deciphering Market Dynamics Through Offering, Execution Strategies, Asset Classes, Deployment Modes, and Diverse End User Profiles

Analysis based on offering reveals a nuanced competition between services and software solutions tailored to HFT participants. Service providers are emphasizing managed co-location, network optimization, and real-time monitoring, while software firms advance proprietary execution algorithms and data-fusion platforms. Execution strategy segmentation underscores the divergent risk-return profiles of arbitrage versus market-making approaches, where arbitrage encompasses convertible, merger, and pure arbitrage tactics designed to exploit price differentials, and market-making systems focus on balancing bid-ask spreads through continuous quoting.

When examining asset classes, high frequency strategies deploy across commodities, derivatives, equities, and foreign exchange, with specialized sub-strategies in energy and metals markets, futures and options trading floors, and large-cap versus mid- and small-cap stocks. The choice between cloud-based and on-premises deployment modes hinges on firms’ latency tolerance, security protocols, and scalability requirements. Finally, end user segmentation captures the spectrum from high net worth individuals to institutional investors-spanning hedge funds, investment banks, and proprietary trading firms-and retail traders who leverage streamlined algorithmic platforms to access automated strategies.

This comprehensive research report categorizes the High Frequency Trading market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Execution Strategy

- Asset Class

- Deployment Mode

- End User

Mapping Growth and Innovation in High Frequency Trading Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics in the Americas continue to benefit from advanced infrastructure networks and deep liquidity pools, positioning this region at the forefront of innovation in high frequency trading. Leading U.S. and Canadian exchanges offer extensive co-location services and low-latency connectivity to global markets, enabling firms to execute high-speed strategies across time zones. In Europe, Middle East & Africa, regulatory harmonization initiatives have enhanced cross-border trading frameworks, while emerging fintech hubs in the Middle East invest in next-generation trading platforms to diversify financial ecosystems.

Asia-Pacific markets exhibit rapid growth fueled by robust technology investment, expanding equity markets, and increased institutional participation. The proliferation of domestic electronic exchanges in Japan, Australia, and Southeast Asia has attracted both local and international HFT players, stimulating partnerships with cloud service providers to overcome geographic dispersion challenges. These regional insights illuminate how trading venues, regulatory environments, and technology ecosystems converge to shape competitive advantages in high frequency trading operations worldwide.

This comprehensive research report examines key regions that drive the evolution of the High Frequency Trading market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Driving Algorithmic Innovation Strategic Partnerships and Competitive Dynamics in the Global High Frequency Trading Ecosystem

A handful of global firms dominate the high frequency trading landscape by consistently pushing the boundaries of algorithmic sophistication and execution speed. Technology vendors specializing in ultra-low latency network switches and proprietary risk-management engines are forming strategic alliances with leading quant funds to co-develop bespoke trading solutions. At the same time, prominent exchanges are collaborating with cloud and telecom providers to offer hybrid hosting options that balance performance with regulatory compliance.

Other notable players include algorithmic software providers that integrate alternative data streams-such as news sentiment, social media analytics, and satellite telemetry-into high frequency models to enhance alpha generation. Similarly, emerging startups are carving out niches by focusing on ESG-aware trading strategies and blockchain-enabled settlement processes, compelling incumbents to accelerate their innovation roadmaps. Through partnerships, acquisitions, and in-house research, these key companies are orchestrating an ecosystem where technological leadership is synonymous with market influence.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Frequency Trading market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akuna Technologies LLC

- AlphaGrep

- ASA Computers Inc.

- Blackcore Technologies

- Citadel Enterprise Americas LLC

- Dolat Capital

- DRW Holdings, LLC

- Estee Advisors Private Ltd

- Flow Traders Group

- Graviton Research Capital LLP

- Hudson River Trading LLC

- Hypertec Group Inc.

- IMC Trading B.V.

- Jane Street Group, LLC

- Jump Trading, LLC.

- Mako Europe Ltd.

- Maven Securities

- Morgan Stanley

- Optiver

- QE Securities LLP

- Renaissance Technologies LLC

- RSJ Securities a.s.

- Susquehanna International Group, LLP

- Tower Research Capital LLC.

- Tradebot Systems

- Two Sigma Investments, LP

- VIRTU Financial Inc.

- Xenon Systems Pty Ltd.

- XR Trading LLC.

- XTX Markets Technologies Limited

Implementing Strategic Roadmaps for Infrastructure Enhancement Regulatory Compliance and Adaptive Market Engagement in High Frequency Trading Operations

Industry leaders should prioritize the modernization of exchange connectivity by adopting next-generation network fabrics and deploying machine learning-based latency prediction tools. This approach will not only reduce microsecond variances but also optimize execution costs. Alongside infrastructure upgrades, establishing robust governance frameworks that align with evolving global regulations will safeguard trading operations against compliance risks while fostering trust with counterparties and regulators.

Furthermore, decision-makers must cultivate cross-functional teams that integrate quants, data scientists, and regulatory specialists to accelerate product development cycles. By embracing modular software architectures and open API standards, firms can more rapidly onboard emerging data sources and third-party analytics, thereby enhancing alpha diversification. Finally, strategic investments in talent development-through partnerships with universities and specialized training programs-will ensure a pipeline of skilled professionals capable of navigating the complex intersection of technology, regulation, and market dynamics in high frequency trading.

Detailing the Comprehensive Research Framework Data Collection Techniques and Analytical Approaches Underpinning This High Frequency Trading Study

This study employs a multi-tiered research methodology combining primary and secondary data collection to ensure comprehensive coverage of high frequency trading trends. Primary insights were gathered through in-depth interviews with C-suite executives, trading desk leaders, and technology architects across proprietary trading firms, hedge funds, and market-making operations. These qualitative inputs were complemented by a detailed review of regulatory filings, industry white papers, and academic research publications to validate emerging patterns in algorithmic trading.

Secondary sources included analysis of exchange data feeds, financial news services, and technology vendor reports, which provided contextual benchmarking and historical perspectives. Quantitative modeling techniques were applied to proprietary transaction datasets to identify performance differentials across execution strategies, asset classes, and deployment environments. The triangulation of these data streams ensures that findings accurately reflect the current state of high frequency trading and offer actionable insights for industry stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Frequency Trading market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Frequency Trading Market, by Offering

- High Frequency Trading Market, by Execution Strategy

- High Frequency Trading Market, by Asset Class

- High Frequency Trading Market, by Deployment Mode

- High Frequency Trading Market, by End User

- High Frequency Trading Market, by Region

- High Frequency Trading Market, by Group

- High Frequency Trading Market, by Country

- United States High Frequency Trading Market

- China High Frequency Trading Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Perspectives on the Future Trajectory of High Frequency Trading Amidst Technological Advances Regulatory Evolutions and Market Volatility

High frequency trading stands at the intersection of technological prowess and regulatory stewardship, with its future trajectory shaped by continued innovation in algorithmic intelligence and market infrastructure. The convergence of AI-driven models, edge computing, and hybrid cloud environments promises to redefine execution capabilities, while emerging regulations will necessitate transparent, auditable systems. Market participants who successfully navigate these dual imperatives will secure competitive advantages in liquidity provision and risk management.

In conclusion, as trading speeds accelerate and market complexities deepen, firms must remain vigilant in adapting their technology stacks and governance frameworks. The insights presented in this report illuminate the critical strategic levers and operational priorities that will define high frequency trading’s next chapter. By synthesizing technological, regulatory, and market factors, decision-makers can craft resilient strategies that sustain profitable, compliant, and innovative trading operations in an increasingly dynamic environment.

Secure Consultation with Ketan Rohom Associate Director Sales & Marketing at 360iResearch to Unlock Premium High Frequency Trading Intelligence

To gain immediate access to the full breadth of our high frequency trading intelligence, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His specialized expertise ensures you receive tailored guidance on utilizing the report’s insights to optimize trading strategies, strengthen compliance, and seize market opportunities. Engaging with Ketan means securing a comprehensive understanding of emerging technologies and competitive landscapes that shape high frequency trading. Connect today to initiate a personalized consultation and unlock the complete market research report that will drive your next phase of growth.

- How big is the High Frequency Trading Market?

- What is the High Frequency Trading Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?