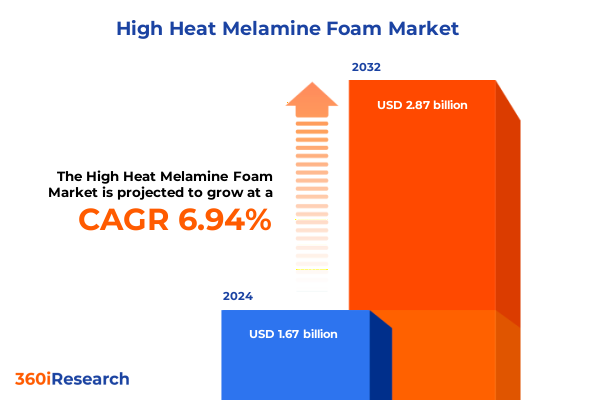

The High Heat Melamine Foam Market size was estimated at USD 1.79 billion in 2025 and expected to reach USD 1.92 billion in 2026, at a CAGR of 6.94% to reach USD 2.87 billion by 2032.

High Heat Melamine Foam Emerges as a Critical Solution Amid Escalating Demands for Sustainable and High-Efficiency Cleaning in Advanced Industries

High heat melamine foam has emerged as a pivotal material in demanding cleaning and industrial applications, where both temperature resilience and fine particle removal are critical. This unique polymeric substance combines an open-cell structure with exceptional thermal stability, enabling it to withstand sustained exposure to elevated temperatures without compromising structural integrity. As industries seek more efficient, sustainable, and non-abrasive cleaning solutions, high heat melamine foam has rapidly transitioned from a niche offering to a mainstream option across multiple sectors.

The foam’s micro-porous architecture allows it to function as a delicate yet highly effective decontamination tool, engaging microscopic contaminants at the molecular level. Its ability to deliver consistent performance in automotive manufacturing lines, healthcare facilities, and precision electronics assembly has reinforced its reputation as an indispensable asset for operators targeting both cleanliness and component preservation. Furthermore, growing environmental concerns have driven end users to shift away from solvent-based cleaners toward water-based or dry foam alternatives like high heat melamine, which produce negligible chemical runoff and reduce occupational hazards. Consequently, manufacturers are intensifying efforts to optimize foam density grades, packaging formats, and application-specific formulations to meet evolving end-use demands and regulatory mandates.

In sum, the high heat melamine foam market is poised at a transformative juncture, where technological enhancements, sustainability imperatives, and diversified application requirements converge. This report delves into the core market dynamics, key segmentation insights, regional variations, and strategic imperatives shaping the industry’s trajectory, empowering stakeholders to make informed decisions and drive future growth.

Dynamic Technological and Regulatory Shifts Are Reshaping the High Heat Melamine Foam Industry Toward Innovative Applications and Stringent Quality Standards

The high heat melamine foam industry is undergoing a profound metamorphosis driven by rapid technological advancements and shifting regulatory landscapes. Advances in polymer chemistry and manufacturing processes have enabled the production of foam variants with optimized cell structures, significantly enhancing thermal resilience and cleaning efficacy. Simultaneously, digital manufacturing techniques, such as precision foaming and additive layering, are enabling tailored density profiles that align with specific application requirements, eliminating waste and improving cost efficiency.

Alongside these innovations, regulatory bodies are imposing more stringent quality and safety standards. Emerging guidelines on chemical exposure limits and residue thresholds have compelled producers to reformulate products, reduce trace contaminants, and validate performance through rigorous testing protocols. Consequently, certification schemes have proliferated, offering assurances of compliance and facilitating market access in sensitive sectors such as food processing and pharmaceutical manufacturing.

Amid these technological and regulatory shifts, sustainability has become a core industry driver. End users increasingly evaluate products based not only on performance metrics but also on life-cycle environmental impact, including carbon footprint and end-of-life disposal considerations. In response, manufacturers are exploring bio-based precursors, recycled raw material integration, and closed-loop recycling initiatives. These efforts underscore a broader industry evolution toward circular economy principles, wherein strategic partnerships across the supply chain foster resource efficiency, reduce waste, and enhance overall market resilience.

Recent United States Tariffs Implemented in 2025 Are Transforming Supply Chains and Cost Structures Across the High Heat Melamine Foam Market

In 2025, the United States implemented a comprehensive tariff framework on imported high heat melamine foam, fundamentally altering cost structures and supply chain configurations. These levies, applied at varying rates depending on the product form and country of origin, have elevated landed costs for raw foam blocks, rolls, and sheets, incentivizing buyers to explore alternative sourcing strategies or shift toward domestically manufactured equivalents. As a result, suppliers with U.S.-based production facilities have experienced a competitive advantage, witnessing increased demand for locally produced foam variants that bypass the additional import duties.

Meanwhile, distributors and original equipment manufacturers have had to recalibrate procurement forecasts to accommodate these tariff-induced price fluctuations. Bulk and box packaging formats have seen differential impacts, with higher per-unit duties on smaller package sizes prompting buyers to consolidate orders into bulk shipments. Furthermore, tariff-driven cost pressures have accelerated vertical integration efforts, as leading foam producers partner with chemical intermediates suppliers to secure stable feedstock pricing and mitigate margin erosion.

Despite these challenges, the tariff environment has also stimulated innovation and investment in the domestic value chain. Capital expenditures targeting capacity expansion and process automation have ramped up as firms seek to enhance production flexibility and cost competitiveness. Taken together, the cumulative impact of the 2025 U.S. tariffs has not only reconfigured market entry dynamics but also catalyzed strategic realignments across the high heat melamine foam ecosystem.

Deep Segmentation Analysis Reveals Distinct Demand Patterns by Form, Application, End Use Industry and Distribution Channels in Melamine Foam Market

The high heat melamine foam market reveals distinct demand trajectories when examined through multiple segmentation lenses. Variations in product form underscore differing customer priorities: blocks are often deployed for heavy-duty industrial decontamination tasks, while roll configurations cater to continuous cleaning operations in large-scale production lines, and sheets provide precision wiping solutions for delicate electronic assemblies. These form-based preferences influence not only procurement volumes but also storage and handling protocols, shaping the operational footprint of end users.

Differentiated application areas further delineate market pockets. Within automotive cleaning, rapid removal of grease and brake dust at elevated temperatures is paramount, driving the uptake of medium-density foam grades. Cleaning wipes, typically sold in sachet or wrap packaging to maintain moisture control, target consumer and light commercial sectors where ease of use and portability are crucial. In industrial decontamination, bulk foam orders are common to support high-frequency maintenance cycles, whereas specialty cleaning applications-such as mold remediation and heritage artifact preservation-prioritize low-density variants that minimize surface abrasion.

End use industries add another layer of complexity to segmentation. In automotive manufacturing, foam sheets facilitate precision tooling maintenance, while in healthcare settings, the foam’s non-toxic composition and single-use formats align with stringent sterility protocols. Household cleaning solutions capitalize on consumer-friendly packaging types, offering boxed or bulk options for versatile home upkeep. Meanwhile, the industrial sector leverages high-density foam blocks for petrochemical plant cleaning, benefiting from the product’s thermal robustness and chemical inertness.

Distribution channel dynamics also shape market behavior. Offline networks, comprising distributors who aggregate diverse foam forms, retailers who offer consumer-ready sachet or box kits, and wholesalers who manage large-scale bulk shipments, remain vital for end users valuing immediate availability and local support. Conversely, online channels provide direct-sales opportunities with digital configuration tools, facilitating customized density grade selection and small-batch packaging tailored to niche requirements.

Packaging and density grade interplay significantly influences buyer decisions. Box and sachet pack types appeal to users seeking controlled dosing and simplified inventory management, whereas bulk and wrap formats optimize cost efficiencies for high-volume purchasers. High-density grades are preferred where abrasion resistance and thermal conductivity are critical, while low- and medium-density variants serve applications requiring surface sensitivity and moderate heat exposure. Collectively, these segmentation insights underscore the nuanced interplay between form, function, and end-user priorities governing the high heat melamine foam market.

This comprehensive research report categorizes the High Heat Melamine Foam market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Application

- End Use Industry

- Distribution Channel

- Packaging Type

- Density Grade

Regional Dynamics Highlight Unique Growth Drivers and Challenges in Americas, Europe Middle East & Africa, and Asia Pacific High Heat Melamine Foam Markets

Regional variations in high heat melamine foam adoption reflect divergent industrial profiles, regulatory regimes, and sustainability agendas. In the Americas, robust automotive and household cleaning sectors drive consistent foam consumption, underpinned by stringent environmental regulations that favor low-chemical, dry cleaning solutions. U.S. tariff measures have redirected imports toward domestic production hubs, while South American markets exhibit rising interest in foam-based decontamination for food processing and commercial kitchen equipment, supported by localized distribution networks.

In Europe, Middle East & Africa, the market is characterized by advanced manufacturing clusters and rigorous chemical safety standards. European end users prioritize certifications that attest to residue-free cleaning and minimal volatile organic compound emissions. The region’s focus on circularity has led to pilot initiatives exploring foam recycling and bio-based raw precursors. Middle Eastern oil and gas operations leverage high-density foam blocks for high-temperature equipment cleaning, whereas African healthcare facilities are increasingly adopting portable sheet formats for point-of-care sanitization.

Asia-Pacific demonstrates the fastest overall growth, driven by rapid industrialization, expansion of automotive assembly lines, and growing healthcare infrastructure investments. China and Southeast Asian manufacturing hubs require roll formats for automated cleaning systems, while Japan’s precision electronics sector demands ultra-low density specialty cleaning sheets. Online direct-sales platforms have gained traction in India and Australia, enabling end users to procure customized density grades and packaging configurations with minimal lead times. Together, these regional insights highlight tailored strategies needed to address distinct market dynamics and capitalize on localized growth drivers.

This comprehensive research report examines key regions that drive the evolution of the High Heat Melamine Foam market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Are Accelerating Innovation and Strategic Partnerships to Capture High Heat Melamine Foam Market Opportunities

Key industry players are intensifying efforts to cement their positions through targeted investments, strategic collaborations, and product innovation. Established chemical conglomerates are expanding their high heat melamine foam capacities by integrating advanced foaming reactors and continuous production lines, boosting throughput while maintaining stringent quality controls. Simultaneously, specialty foam manufacturers are forging alliances with automotive and healthcare equipment producers to co-develop application-specific formulations, enhancing performance attributes such as thermal conductivity, micro-abrasion precision, and biocompatibility.

Strategic partnerships extend into supply chain optimization, where leading foam suppliers collaborate with resin and additive producers to vertically coordinate raw material sourcing. This integration not only mitigates feedstock price volatility but also accelerates product customization cycles, enabling rapid response to evolving regulatory requirements and customer specifications. Moreover, joint ventures in emerging markets are facilitating local production setups, thereby circumventing import tariffs and reducing delivery lead times for end users in growth regions.

On the innovation front, research and development initiatives are exploring next-generation foam architectures. Examples include gradient cell structures that balance surface gentleness with internal rigidity, as well as composite formulations incorporating antimicrobial agents to address hygiene-critical environments. These advancements, coupled with digital quality monitoring-leveraging in-line spectroscopy and AI-driven defect detection-are setting new benchmarks for performance consistency and regulatory compliance. Collectively, these company-driven initiatives are reshaping competitive dynamics and accelerating the industry’s shift toward value-added, application-tailored high heat melamine foam solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Heat Melamine Foam market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3A Composites

- Acoustafoam Ltd.

- Armacell International S.A.

- BASF SE

- Dow Chemical

- Evonik Industries AG

- Huntsman Corporation

- JPS Foam

- JSP Corporation

- Kingspan Group PLC

- Momentive

- Owens Corning Corporation

- PPG Industries

- Puren GmbH

- Puyang Green Yu Foam Co. Ltd.

- Recticel

- Rogers Corporation

- SABIC

- Saint-Gobain S.A.

- SINOYQX

- Ube Industries, Ltd.

- Wacker Chemie AG

- Wilhams Insulation Ltd.

- Zhejiang Yadina New Materials Technology Co. Ltd.

Practical Strategic Imperatives Empower Industry Leaders to Optimize Production, Strengthen Supply Chains, and Enhance Product Differentiation in Melamine Foam Sector

To navigate the evolving high heat melamine foam landscape, industry leaders must prioritize production flexibility, ensuring capacity can adjust swiftly to emerging tariff regimes and regional demand fluctuations. This entails implementing modular manufacturing cells that can switch between block, roll, and sheet outputs without extensive downtime. Concurrently, supply chain resilience should be fortified through multi-sourcing strategies, contracting with both domestic and global feedstock suppliers to hedge against tariff impacts and logistical disruptions.

Another imperative is to deepen collaboration with end users in high-growth sectors such as automotive and healthcare. Co-innovating with equipment manufacturers will yield purpose-built foam variants that meet precise thermal and cleaning performance criteria. Embedding product sampling and pilot testing into the sales cycle not only demonstrates credibility but also accelerates adoption rates by reducing perceived risk among procurement teams.

Sustainability must be embedded across the value chain, from raw material selection to end-of-life management. Investing in closed-loop recycling programs and exploring bio-based resin substitutes will resonate with stakeholders focused on environmental, social, and governance metrics. Finally, developing digital platforms for custom configuration and order tracking will enhance customer engagement, streamline order fulfillment, and generate valuable usage data that can inform iterative product improvements. By executing these actionable recommendations, industry leaders will position themselves to capture growth opportunities and drive market leadership in the high heat melamine foam sector.

Rigorous Multi-Source Qualitative and Quantitative Research Methodology Ensures Reliability and Integrity of High Heat Melamine Foam Market Intelligence

This research leverages a dual-pronged methodology encompassing both qualitative interviews and quantitative analysis. Primary data was gathered through structured interviews with C-level executives and technical managers across foam manufacturing firms, automotive OEMs, healthcare equipment suppliers, and leading distribution partners. These discussions illuminated emerging application requirements, cost pressures, and regulatory compliance strategies, providing a nuanced understanding of market drivers and barriers.

Secondary research involved a thorough review of industry white papers, patent filings, regulatory publications, and peer-reviewed journals to validate primary insights. Trade association reports and publicly available customs and tariff data were incorporated to assess the impact of the 2025 United States tariffs on import volumes and pricing dynamics. Market segmentation parameters-spanning form, application, end use industry, distribution channel, packaging type, and density grade-were applied to categorize demand patterns and supply capabilities.

Data triangulation techniques were employed to cross-verify findings, ensuring consistency between field inputs and external records. This included reconciling reported production capacities with trade shipment statistics, and comparing product performance claims against published laboratory test results. The resulting dataset was subjected to trend analysis and scenario modeling to identify strategic inflection points and forecast potential shifts in cost structures. Together, this rigorous methodology underpins the credibility and actionable nature of the high heat melamine foam market insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Heat Melamine Foam market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Heat Melamine Foam Market, by Form

- High Heat Melamine Foam Market, by Application

- High Heat Melamine Foam Market, by End Use Industry

- High Heat Melamine Foam Market, by Distribution Channel

- High Heat Melamine Foam Market, by Packaging Type

- High Heat Melamine Foam Market, by Density Grade

- High Heat Melamine Foam Market, by Region

- High Heat Melamine Foam Market, by Group

- High Heat Melamine Foam Market, by Country

- United States High Heat Melamine Foam Market

- China High Heat Melamine Foam Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Comprehensive Synthesis of Trends Underscores the Strategic Importance of High Heat Melamine Foam in Evolving Cleaning and Industrial Applications

The high heat melamine foam market stands at a pivotal intersection of technical innovation, regulatory evolution, and shifting end-user priorities. Enhanced foam architectures and digital manufacturing techniques have unlocked new levels of thermal resilience and cleaning precision, while stricter safety and environmental guidelines continue to refine product formulations and certification requirements. The advent of U.S. tariffs in 2025 has recalibrated supply chain strategies, accelerating domestic capacity expansions and prompting novel sourcing models to mitigate cost volatility.

Segmentation analysis reveals that specific market pockets-driven by form factors like blocks, rolls, and sheets-offer differentiated value propositions aligned with varied industrial needs. Application verticals from automotive cleaning to specialty decontamination underscore the foam’s versatility, while distribution channels ranging from offline distributors and wholesalers to digital direct-sales platforms reflect evolving procurement preferences. Regional dynamics further illustrate the necessity for localized approaches: the Americas’ regulatory focus, EMEA’s advanced manufacturing clusters, and Asia-Pacific’s rapid industrial growth each demand tailored market strategies.

Industry leaders are responding with targeted investments in production agility, supply chain resilience, and collaborative innovation. The strategic integration of sustainability initiatives, digital customer engagement tools, and product customization capabilities will differentiate winning players in this competitive landscape. As market participants continue to refine their offerings and adapt to policy shifts, high heat melamine foam is set to remain an indispensable material for high-temperature and precision cleaning applications globally.

Secure Exclusive Access to In-Depth High Heat Melamine Foam Insights and Propel Strategic Decision Making with Our Expertly Curated Report

To obtain unparalleled market visibility and leverage strategic insights into the high heat melamine foam landscape, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engaging with our experts will grant your organization immediate access to comprehensive analyses, detailed segmentation deep dives, and authoritative competitive intelligence. This collaboration will equip your team to confidently navigate supply chain complexities, anticipate regulatory shifts, and capitalize on emerging growth vectors.

Elevate your decision-making processes and secure a competitive edge by acquiring the full report today. Connect with Ketan Rohom for customized guidance on integrating these insights into your strategic roadmap and unlocking the full potential of the high heat melamine foam market.

- How big is the High Heat Melamine Foam Market?

- What is the High Heat Melamine Foam Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?