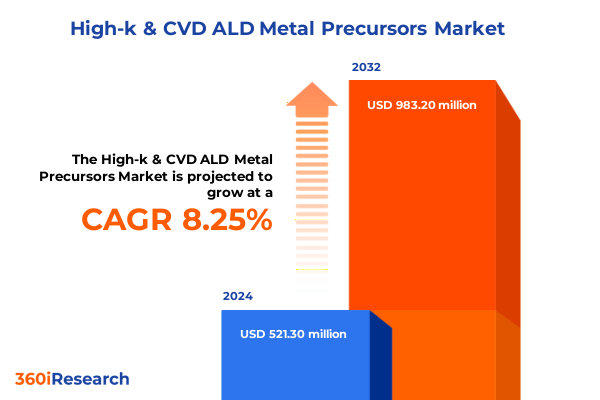

The High-k & CVD ALD Metal Precursors Market size was estimated at USD 559.30 million in 2025 and expected to reach USD 601.47 million in 2026, at a CAGR of 8.39% to reach USD 983.20 million by 2032.

Pioneering the Intersection of High-K and CVD Atomic Layer Deposition Metal Precursors to Unlock Next-Generation Semiconductor Fabrication Innovations

The relentless drive toward ever-shrinking feature sizes and soaring performance demands has elevated the significance of high-k dielectric materials and advanced deposition techniques in semiconductor manufacturing. At the vanguard of this transformation, high-k metal precursors tailored for chemical vapor deposition and atomic layer deposition processes are enabling the next wave of device scaling by offering exceptional dielectric constants, superior conformality, and enhanced thermal stability. As integrated circuits continue to transition to sub-5 nanometer nodes, the industry’s materials supply chain faces unprecedented requirements for purity, process uniformity, and defect control. This introduction examines how evolving performance targets and tightening integration challenges are accelerating the adoption of novel precursors that underpin future device innovations.

Transitioning from legacy silicon dioxide layers to high-k films has necessitated a profound reevaluation of precursor chemistries and deposition protocols. Stakeholders throughout the value chain-ranging from precursor manufacturers and equipment providers to foundries and fabless design houses-must synchronize their roadmaps to navigate competing demands for throughput, cost efficiency, and environmental compliance. Indeed, stringency around chemical safety, greenhouse gas emissions, and end-of-life precursor handling is driving greater emphasis on greener synthetic routes and streamlined deposition recipes. In doing so, the industry is not simply refining existing methodologies but reimagining the role of precursors in achieving both performance and sustainability objectives, setting the stage for transformative shifts that will define semiconductor fabrication for years to come.

Revolutionary Developments in High-K and CVD ALD Precursors Disrupting Deposition Techniques and Reshaping Material Science Paradigms in Semiconductor Fabrication

Over the past few years, the landscape of precursor development has undergone seismic shifts, driven by breakthroughs in molecular design and process integration. Novel ligand architectures, for instance, are now engineered to optimize volatility and minimize undesired byproducts, thereby reducing particulate contamination and defect densities. Simultaneously, advanced reactor designs equipped with in-situ monitoring capabilities are affording unprecedented control over deposition kinetics and film morphology. These technological inflections are not isolated advancements; rather, they converge to form a cohesive ecosystem in which precursor chemistry, equipment innovation, and process analytics co-evolve.

Furthermore, the integration of digital twins and machine learning algorithms into deposition workflows is transcending traditional empirical optimization. By harnessing multivariate data sets-from precursor thermolysis profiles to chamber pressure transients-engineers can predict process windows with remarkable accuracy, shortening development cycles and enhancing yield. As sustainability imperatives gain prominence, researchers are also exploring bio-derived ligands and low-energy activation routes, which promise to curtail carbon footprints without sacrificing performance. Collectively, these trends signal a paradigm shift in which the precursor development process becomes intrinsically interdisciplinary, blending chemistry, data science, and advanced engineering to propel semiconductor manufacturing into its next era.

Assessing the Far-Reaching Effects of 2025 United States Tariffs on High-K and CVD ALD Metal Precursor Supply Chains and Competitive Dynamics

In 2025, a series of adjustments to U.S. tariff schedules targeting specialty chemicals introduced new complexities into the procurement strategies for high-k and CVD ALD metal precursors. Tariffs on specific organometallic compounds prompted dual impacts: immediate cost pressures for domestic fabs and recalibrated supply routes for global precursor suppliers. With certain ligands now subject to additional duties, fabrication facilities have been compelled to reevaluate inventory buffers and negotiate alternative sourcing contracts to mitigate margin erosion. These procurement adaptations are not one-off responses; they reflect a broader shift in how material flows will be managed in a landscape where trade policy can swiftly alter cost structures.

The cumulative effect of these tariffs extends beyond mere price escalations. Downstream equipment utilization rates and tool productivity have faced increased volatility, as fabs balance the urgency of node advancement against the risk of supply disruptions. Strategic stockpiling and near-shoring of precursor synthesis capabilities have emerged as prevalent risk-mitigation tactics, albeit at the expense of higher working capital burdens. Moreover, collaborative consortia among material suppliers, equipment OEMs, and end-users are gaining traction as stakeholders seek to pool resources and share the risks associated with tariff-induced unpredictability. These cooperative frameworks are paving the way for more resilient supply chains, ensuring that technological progress remains uninterrupted by geopolitical shifts.

Deep Dive into Technology, Material, Functional, Application, End-User, and Distribution Channel Segmentation of High-K and CVD ALD Precursor Markets

A nuanced understanding of the market requires an exploration of key segmentation dimensions that collectively define the high-k and CVD ALD metal precursor ecosystem. From a technology perspective, atomic layer deposition processes demand precursors engineered for self-limiting surface reactions and ultrahigh purity, while chemical vapor deposition variants favor higher deposition rates and broader substrate compatibility. Material type segmentation further deciphers the market’s complexity by distinguishing nitrides-such as aluminium nitride, prized for its thermal conductivity and dielectric strength, and silicon nitride, valued for etch resistance-from oxides including silicon dioxide, the stalwart dielectric layer, and zinc oxide, which offers unique optoelectronic properties.

Functional segmentation illuminates the multifaceted roles precursors play in conformal coating applications, dielectric layer formation for capacitance scaling, nucleation layer establishment to facilitate heterogeneous integration, and selective deposition techniques that underpin next-generation patterning workflows. Application segmentation, meanwhile, bridges material science with end-product demands by linking precursor use to memory devices-such as DRAM for high-speed data buffering, NAND flash for non-volatile storage, and SRAM for low-power cache memory-alongside optoelectronic components like diodes, light-emitting diodes, and optical fibers, and traditional semiconductor building blocks encompassing integrated circuits and transistor technologies. Evaluating the market through the lens of end-user industries-including aerospace and defense, which leverage high-reliability coatings; automotive sectors pursuing electrification and advanced safety systems; electronics manufacturers targeting miniaturized consumer devices; and healthcare device producers seeking biocompatible substrates-provides clarity on demand trajectories. Lastly, distribution channels ranging from direct sales agreements, which ensure prioritized supply and technical collaboration, to traditional distributors and agile online platforms, illustrate how access and logistics strategies influence market penetration and customer engagement.

This comprehensive research report categorizes the High-k & CVD ALD Metal Precursors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Material Type

- Function

- Application

- End-User Industry

- Distribution Channel

Unveiling Regional Trends and Growth Drivers across the Americas, Europe Middle East Africa, and Asia Pacific High-K and CVD ALD Precursor Market Evolution

Regional dynamics play a pivotal role in shaping precursor adoption, as each geography contends with distinct regulatory environments, industrial priorities, and supply chain infrastructures. In the Americas, significant investments in domestic semiconductor capacity and government incentives have elevated demand for localized precursor production. U.S. and Canadian fabs are prioritizing suppliers that can meet rigorous environmental, health, and safety standards, while also offering responsive technical support to accelerate ramp-up timelines. This drive for onshore capabilities is complemented by Mexico’s burgeoning electronics assembly sector, which is integrating advanced deposition processes to respond to near-market manufacturing imperatives.

Across Europe, the Middle East, and Africa, evolving regulatory frameworks around chemical handling and cross-border trade agreements influence precursor procurement strategies. European Union directives on chemical registrations and environmental compliance have heightened scrutiny on ligand toxicity and byproduct management, prompting suppliers to substantiate green credentials. In parallel, consortium-based research initiatives in the Middle East are cultivating local expertise in ALD techniques for defense and aerospace applications, while African research partnerships focus on leveraging oxide and nitride films for next-generation photonics. Shifting to the Asia-Pacific region, the epicenter of global semiconductor manufacturing, competition among precursor providers is fiercest. Leading fabs in Taiwan, South Korea, Japan, and China emphasize ultra-high purity and supply chain consistency to maintain node leadership, whereas emerging Southeast Asian hubs pursue cost-effective deposition routes to support growing foundry ecosystems. These diverse regional nuances underscore how regulatory pressures, industrial policy, and local R&D ecosystems collectively steer precursor market evolution.

This comprehensive research report examines key regions that drive the evolution of the High-k & CVD ALD Metal Precursors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles and Competitive Positioning of Leading Players Shaping the High-K and CVD ALD Metal Precursor Industry Landscape

The competitive landscape of high-k and CVD ALD metal precursors is defined by a cohort of specialized chemical manufacturers, semiconductor material divisions of global conglomerates, and nimble startups forging niche chemistries. Established players leverage integrated production facilities and deep process expertise to offer comprehensive precursor portfolios that address both legacy and emerging application requirements. Their strategic focus centers on sustaining long-term supply agreements, co-development projects with leading semiconductor fabs, and incremental innovation to extend process windows and reduce defectivity.

Conversely, innovative newcomers are disrupting the market through tailored chemistries that address specific pain points-such as precursors engineered for low-temperature deposition, rapid purge cycles, or bespoke ligand architectures that minimize carbon residue. Strategic alliances between material specialists and reactor OEMs are accelerating the co-optimization of chemistries and hardware, enabling seamless integration of new precursors into existing toolsets. Additionally, some stakeholders are pursuing vertical integration, securing upstream feedstock streams to stabilize costs and safeguard against raw material shortages. Across the board, competition is accentuated by merger and acquisition activities that aim to consolidate technical capabilities and broaden geographic footprints, while joint ventures are forging cross-border synergies that align research investment with market demand projections. This confluence of strategic maneuvers underscores a dynamic market in which collaboration and specialization are both drivers of competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the High-k & CVD ALD Metal Precursors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adeka Corporation

- Air Liquide S.A.

- Beneq Oy

- City Chemical LLC

- DNF Co., Ltd. by Soulbrain Group

- Dockweiler Chemicals GmbH

- DuPont de Nemours, Inc.

- Entegris, Inc.

- EpiValence

- Evonik Industries AG

- Fujifilm Holdings Corporation

- Gelest, Inc. by Mitsubishi Chemical Corporation

- JSR Corporation

- Linde PLC

- Merck KGaA

- Nanmat Technology Co., Ltd.

- Nanomate Technology Inc.

- Pegasus Chemicals Private Limited

- Pegasus Chemicals Private Limited

- Samsung Electronics Co., Ltd.

- Shanghai Aladdin Biochemical Technology Co., Ltd.

- Tanaka Holdings Co., Ltd.

- The Dow Chemical Company

- Tokyo Electron Limited

- UP Chemical Co., Ltd.

Pragmatic Strategic Initiatives and Operational Tactics to Empower Industry Leaders in Maximizing Returns from High-K and CVD ALD Metal Precursor Innovations

Industry leaders seeking to capitalize on the burgeoning demand for advanced deposition materials should first prioritize supply chain diversification, establishing relationships with multiple precursor suppliers to buffer against geopolitical and logistical disruptions. In tandem, organizations can intensify research and development investments to co-innovate next-generation precursors that address emerging process challenges, such as low thermal budgets for 3D-stacked architectures or selective deposition for heterogeneous integration. By forming strategic alliances with foundries and equipment OEMs, companies can accelerate time-to-market and de-risk scale-up through pilot deployments that refine both chemistry and equipment configurations.

Another pivotal recommendation involves the integration of digital process controls, leveraging predictive analytics to optimize precursor usage rates, minimize purge durations, and forecast maintenance intervals. Embedding such data-driven protocols into manufacturing execution systems can yield significant improvements in throughput and yield consistency. Additionally, stakeholders should adopt rigorous environmental, health, and safety frameworks that not only satisfy regulatory mandates but also resonate with corporate sustainability goals, thereby enhancing brand equity and stakeholder trust. Finally, a proactive engagement with policy makers and industry consortia can influence future trade and regulatory landscapes, ensuring that precursor development trajectories align with broader semiconductor strategy roadmaps. By executing these tactical initiatives, industry leaders will be well positioned to harness the full potential of high-k and CVD ALD precursors.

Robust Multimodal Research Framework Integrating Qualitative Interviews with Data Triangulation for High-K and CVD ALD Metal Precursor Analysis

This research leverages a robust multimodal framework to ensure that findings reflect both empirical rigor and practical relevance. Primary inputs were gathered through in-depth interviews with senior executives from leading material suppliers, process engineers at high-volume fabs, and R&D specialists at tool OEMs. These qualitative insights were cross-validated against secondary data sources, such as technical papers, patent filings, and regulatory filings, to triangulate emerging technology trends and commercialization timelines.

Quantitative validation was achieved through analysis of procurement patterns, contract announcements, and supply chain disclosures, complemented by expert panel reviews to examine data interpretations and surface potential blind spots. Wherever possible, process performance metrics-such as growth per cycle, ligand utilization efficiency, and film defect statistics-were incorporated to provide objective benchmarks. Throughout the research, iterative validation loops ensured that hypotheses were tested against real-world deployments, forging a research methodology that balances depth, accuracy, and actionable intelligence for stakeholders in the high-k and CVD ALD metal precursor space.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High-k & CVD ALD Metal Precursors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High-k & CVD ALD Metal Precursors Market, by Technology

- High-k & CVD ALD Metal Precursors Market, by Material Type

- High-k & CVD ALD Metal Precursors Market, by Function

- High-k & CVD ALD Metal Precursors Market, by Application

- High-k & CVD ALD Metal Precursors Market, by End-User Industry

- High-k & CVD ALD Metal Precursors Market, by Distribution Channel

- High-k & CVD ALD Metal Precursors Market, by Region

- High-k & CVD ALD Metal Precursors Market, by Group

- High-k & CVD ALD Metal Precursors Market, by Country

- United States High-k & CVD ALD Metal Precursors Market

- China High-k & CVD ALD Metal Precursors Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesis of Critical Insights and Future-Proof Imperatives for Stakeholders Navigating the High-K and CVD ALD Metal Precursor Ecosystem

Drawing together the multifaceted insights revealed throughout this report, it is clear that precursor innovation sits at the core of future semiconductor progress. The interplay of advanced chemistries, process analytics, and geopolitical dynamics has created an environment where agility and collaboration determine competitive positioning. Stakeholders who adeptly navigate the evolving tariff landscape, harness the potential of digital process controls, and cultivate diversified supply networks will be best prepared to sustain momentum in device scaling and functional innovation.

Looking forward, the maturation of selective deposition techniques, the pursuit of greener chemistries, and the adoption of next-generation deposition reactors will define the trajectory of high-k and CVD ALD precursor markets. As research methodologies continue to integrate real-time data and predictive modeling, the feedback loop between laboratory breakthroughs and manufacturing practice will only intensify. In this context, decision-makers must maintain vigilant monitoring of regulatory changes, align R&D investments with performance inflection points, and foster ecosystem partnerships that accelerate commercialization. By internalizing these imperatives, organizations can crystallize their strategic roadmaps and secure a durable advantage in a landscape shaped by both technological leaps and shifting global dynamics.

Prompting engagement with Ketan Rohom (Associate Director Sales and Marketing) to Secure the High-K and CVD ALD Metal Precursor Market Research Report

For a tailored consultation or to acquire the market research report that delves into every critical facet of high-k and CVD ALD metal precursors, please reach out directly to Ketan Rohom, Associate Director Sales and Marketing, who will guide you through the insights and facilitate access to the solution that best aligns with your strategic goals. Engaging with Ketan will ensure you receive comprehensive support, personalized demonstrations of key findings, and prompt delivery of the detailed research you need to make informed, high-impact decisions in the rapidly evolving semiconductor materials landscape.

- How big is the High-k & CVD ALD Metal Precursors Market?

- What is the High-k & CVD ALD Metal Precursors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?