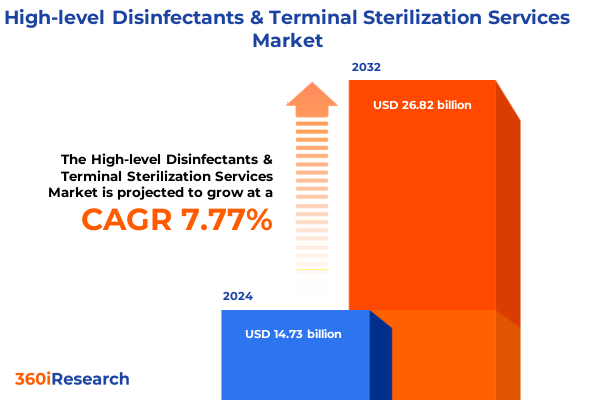

The High-level Disinfectants & Terminal Sterilization Services Market size was estimated at USD 15.79 billion in 2025 and expected to reach USD 16.92 billion in 2026, at a CAGR of 7.86% to reach USD 26.82 billion by 2032.

Unveiling the Future of Patient Safety Through Advanced Disinfection and Sterilization Strategies Shaping Healthcare Environments Worldwide

In a landscape defined by heightened patient safety imperatives and ever-evolving infection control protocols, high-level disinfectants and terminal sterilization services have emerged as indispensable pillars of modern healthcare. From ambulatory surgical centers to research laboratories, the demand for robust, reliable, and efficient decontamination processes has accelerated, driven by regulatory scrutiny and the relentless pursuit of zero-tolerance for healthcare-associated infections. Within this context, understanding the latest innovations, service delivery models, and regulatory frameworks is not just an operational necessity, but a strategic priority for healthcare providers, device manufacturers, and service vendors alike.

Moreover, the convergence of patented chemistries, advanced sterilization technologies, and digital process controls is reshaping how organizations approach instrument reprocessing and surface decontamination. Stakeholders are compelled to evaluate and adopt solutions that not only meet stringent efficacy standards but also deliver operational scalability, cost optimization, and environmental sustainability. As the complexity of medical devices and the diversity of clinical settings continue to expand, this executive summary provides an essential foundation for grasping the dynamic forces molding the future of disinfection and terminal sterilization.

Exploring Paradigm Shifts Driving Innovation in Disinfection and Sterilization through Cutting-Edge Technologies and Evolving Regulatory Dynamics

Over the past decade, the disinfection and sterilization landscape has undergone a series of transformative shifts, each redefining expectations for efficacy, throughput, and safety. Pioneering chemistries such as ortho-phthalaldehyde and peracetic acid have delivered accelerated kill times and reduced exposure risks, while hydrogen peroxide variants and glutaraldehyde formulations have been engineered for compatibility with a broader array of instruments and surfaces. Concurrently, the advent of vaporized hydrogen peroxide and electron beam technologies has introduced new paradigms for terminal sterilization of temperature-sensitive devices, seamlessly integrating into established workflows.

Regulatory bodies have simultaneously enacted more rigorous standards, mandating validation protocols and performance thresholds that spur further innovation. Industry stakeholders now leverage automated monitoring, data analytics, and remote connectivity to ensure consistent compliance and to anticipate deviations before they escalate. As operational priorities shift toward leaner, more agile processes, the synergy between technological breakthroughs and real-time quality assurance platforms will continue to define market leaders and reshape capital investment strategies.

Assessing the Far-Reaching Effects of 2025 United States Tariff Policies on Supply Chain Costs Regulatory Compliance and Market Accessibility

In 2025, the implementation of updated tariff measures by United States authorities has introduced a new layer of complexity to the supply chain for high-level disinfectants and sterilization consumables. Import duties on raw chemical precursors for glutaraldehyde and peracetic acid have increased input costs, while levies on specialized equipment such as gamma radiation chambers and ethylene oxide sterilizers have altered procurement strategies. These adjustments have reverberated throughout the value chain, prompting manufacturers to reassess sourcing models and to invest in domestic production capabilities where feasible.

As a result, service providers have confronted elevated servicing expenses, which in turn influence contract negotiations with healthcare institutions. To mitigate these headwinds, organizations are reevaluating inventory holding periods, consolidating shipments, and exploring cross-border partnerships that optimize total landed costs. At the same time, long-term contracts indexed to tariff fluctuations and collaborative agreements with logistics firms offer pathways to preserve margin integrity, underscoring the importance of agile supply chain management in maintaining both compliance and profitability.

Uncovering Segmentation Insights Spanning Product Types Technologies Service Models Forms End Users Applications and Sales Channels in Healthcare Sterilization

A granular examination of market segmentation reveals varied growth trajectories and adoption patterns across distinct categories. In product type, glutaraldehyde remains a stalwart for semi-critical device reprocessing, whereas ortho-phthalaldehyde’s superior material compatibility is accelerating its uptake in endoscope disinfection protocols, and peracetic acid is gaining traction for limited-run terminal sterilization tasks. Within technology, steam sterilization continues to anchor high-volume turnover, though vaporized hydrogen peroxide is rapidly infiltrating facilities requiring low-temperature cycles, and radiation-based modalities support complex device geometries.

Service models likewise differentiate market participants, as on-site reprocessing centers cater to immediate procedural demands and off-site contractors vie for volume efficiencies. Formulation preferences-liquid concentrates, foams for precise surface applications, sprays for rapid area coverage, and wipes for point-of-care convenience-further underscore the need for product portfolios that align with client-specific workflows. End users from government hospitals to private clinics exhibit distinct decision drivers, while diagnostic and research laboratories require bespoke sterilization regimens for sensitive instruments. Application pockets such as endoscope reprocessing, medical device sterilization, surface treatment of healthcare-grade environments, and surgical instrument preparation each demand tailored chemistries and technology integrations. Finally, sales channel dynamics illustrate a bifurcation between direct engagement with enterprise accounts and hybrid distribution networks enhanced by digital commerce platforms.

This comprehensive research report categorizes the High-level Disinfectants & Terminal Sterilization Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Service Model

- Form

- End User

- Application

- Sales Channel

Navigating Regional Dynamics of Disinfection and Sterilization Services Across the Americas EMEA and Asia-Pacific Healthcare Markets and Growth Drivers

A regional lens illustrates that the Americas continue to lead in adoption rates of advanced terminal sterilization methods, driven by robust regulatory oversight and substantial capital investment in healthcare infrastructure. Within North America, vaporized hydrogen peroxide systems and gamma radiation services dominate high-volume facilities, while Latin American markets show growing interest in cost-effective chemistries like hydrogen peroxide and ortho-phthalaldehyde, supported by emerging local manufacturing partnerships.

Conversely, Europe, the Middle East, and Africa exhibit heterogenous trends: Western Europe pioneers electron beam sterilization for single-use devices, whereas the Middle Eastern market prioritizes modular steam sterilizers for rapid facility deployment, and African regions focus on portable, battery-operated disinfection solutions for remote clinics. Across Asia-Pacific, rapid hospital expansion in countries such as China and India amplifies demand for service providers offering off-site terminal sterilization hubs, while the Asia-Pacific medical device industry integrates ethylene oxide services into new product launches, reflecting local regulatory harmonization with international standards.

This comprehensive research report examines key regions that drive the evolution of the High-level Disinfectants & Terminal Sterilization Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Innovations Partnerships and Market Positioning of Leading Companies in High-Level Disinfection and Terminal Sterilization Services

Leading firms are continually redefining boundaries through targeted acquisitions, strategic partnerships, and portfolio diversification. Global sterilization specialists have expanded their footprints via alliances with contract sterilization hubs, thereby securing volume commitments and extending technological reach. Meanwhile, disinfectant producers are collaborating with instrumentation manufacturers to co-develop device-compatible chemistries, embedding value-added service contracts within broader equipment sales.

Emerging companies are also disrupting traditional models by integrating digital traceability platforms with sterilization equipment, enabling real-time process validation and predictive maintenance. Such initiatives are often backed by venture capital investments, underscoring confidence in data-driven service differentiation. Additionally, collaborations between chemical innovators and materials scientists have led to novel formulations that reduce cycle times and environmental impact, setting new benchmarks for efficacy and sustainability. Across the spectrum, the competitive landscape is characterized by a race to deliver end-to-end sterilization ecosystems that encompass both consumables and managed services.

This comprehensive research report delivers an in-depth overview of the principal market players in the High-level Disinfectants & Terminal Sterilization Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Andersen Sterilizers

- Belimed AG

- Ecolab Inc.

- Getinge AB

- Johnson & Johnson Services Inc.

- Kao Corporation

- Metrex Research LLC

- Parker Laboratories, Inc.

- Sharp Services, LLC

- Sol-Millennium, Inc.

- Sotera Health Company

- STERIS plc

Driving Strategic Success in Disinfection and Sterilization through Data-Driven Investments Operational Excellence and Collaborative Ecosystem Development

To navigate this intricate environment, industry leaders should prioritize investments in modular sterilization platforms that facilitate seamless integration with both legacy and next-generation medical devices. By leveraging data analytics and IoT-enabled monitoring, organizations can achieve end-to-end visibility of sterilization cycles, ensuring compliance while reducing unplanned downtime. Establishing collaborative frameworks with chemical suppliers and equipment vendors will foster co-innovation, enabling quicker adoption of breakthrough chemistries and process optimizations.

Furthermore, developing flexible service models that blend on-site rapid-response units with centralized off-site hubs can balance cost efficiencies and responsiveness. Stakeholders should also explore strategic partnerships with logistics providers to mitigate tariff-induced supply chain disruptions, employing predictive analytics to anticipate cost fluctuations and inventory demands. Ultimately, a holistic approach combining technology, process, and partnership strategies will empower decision-makers to deliver safe, efficient, and sustainable disinfection and sterilization operations.

Ensuring Rigor and Credibility through Comprehensive Research Methodologies Leveraging Primary Insights Secondary Analysis and Expert Validation Processes

This research employs a robust methodology grounded in both primary and secondary intelligence gathering. Expert interviews with sterilization engineers, infection control specialists, and regulatory authorities provided nuanced perspectives on emerging technologies and compliance imperatives. Meanwhile, an exhaustive review of scientific literature, patent filings, and industry publications ensured comprehensive coverage of innovation pipelines and performance benchmarks.

Quantitative data were triangulated using proprietary performance datasets from service providers and chemical manufacturers to validate adoption trends and cost implications. Market participant profiling drew upon financial disclosures, corporate presentations, and partnership announcements, while regional dynamics were assessed through country-specific regulatory analysis and infrastructure assessments. Finally, all findings underwent expert validation workshops to confirm applicability and to refine strategic recommendations, guaranteeing that the insights deliver both rigor and real-world relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High-level Disinfectants & Terminal Sterilization Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High-level Disinfectants & Terminal Sterilization Services Market, by Product Type

- High-level Disinfectants & Terminal Sterilization Services Market, by Technology

- High-level Disinfectants & Terminal Sterilization Services Market, by Service Model

- High-level Disinfectants & Terminal Sterilization Services Market, by Form

- High-level Disinfectants & Terminal Sterilization Services Market, by End User

- High-level Disinfectants & Terminal Sterilization Services Market, by Application

- High-level Disinfectants & Terminal Sterilization Services Market, by Sales Channel

- High-level Disinfectants & Terminal Sterilization Services Market, by Region

- High-level Disinfectants & Terminal Sterilization Services Market, by Group

- High-level Disinfectants & Terminal Sterilization Services Market, by Country

- United States High-level Disinfectants & Terminal Sterilization Services Market

- China High-level Disinfectants & Terminal Sterilization Services Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Summarizing Core Insights into Technological Advancements Regulatory Shifts and Strategic Imperatives Shaping the Future of Healthcare Sterilization Practices

In summary, the continued evolution of high-level disinfectants and terminal sterilization services is underscored by relentless innovation across chemistries, technologies, and service paradigms. Regulatory enhancements and cost pressures introduced through recent tariff policies compel stakeholders to adopt agile supply chain strategies and to invest in domestically resilient manufacturing networks. Segmentation analysis reveals that growth vectors differ substantially across product types, technologies, service models, and end-user requirements, demanding a tailored approach to portfolio development.

Regional disparities in adoption and regulatory frameworks further highlight the importance of localized market intelligence and strategic partnerships. Key market participants are differentiating through integrated ecosystems that combine consumables, equipment, and digital controls, striving to deliver seamless, validated sterilization workflows. As the industry moves forward, organizations that align technology investments with data-driven process optimization and collaborative innovation will be best positioned to elevate patient safety, control costs, and secure competitive advantage.

Secure Exclusive Insights on Disinfection and Sterilization from Associate Director Ketan Rohom by Accessing the Definitive Market Research Report

To gain unlimited access to the full breadth of analysis, strategic insights, and proprietary data, connect directly with Associate Director Ketan Rohom. His deep expertise in sales and marketing for high-level disinfectants and terminal sterilization services ensures that every question receives an informed response and that your organization benefits from tailored guidance. Engage with Ketan Rohom to explore customized packages, secure priority delivery of the report, and unlock the actionable intelligence critical for maintaining a competitive edge in healthcare environments. Don’t miss this opportunity to harness the definitive market research report and transform your strategic planning with precision and confidence.

- How big is the High-level Disinfectants & Terminal Sterilization Services Market?

- What is the High-level Disinfectants & Terminal Sterilization Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?