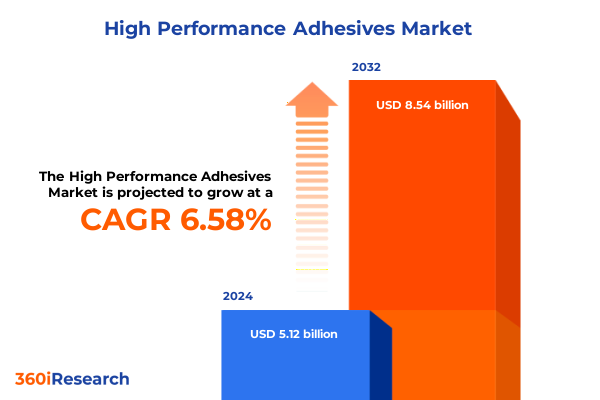

The High Performance Adhesives Market size was estimated at USD 5.45 billion in 2025 and expected to reach USD 5.80 billion in 2026, at a CAGR of 6.62% to reach USD 8.54 billion by 2032.

Discover the evolving landscape and strategic significance of high performance adhesives in modern manufacturing and industrial applications

High performance adhesives have emerged as indispensable enablers of innovation and efficiency across a wide spectrum of industrial and manufacturing sectors. From the assembly lines of aerospace systems to the precision-driven requirements of medical device fabrication, these advanced bonding solutions deliver unparalleled strength, chemical resilience, and operational reliability. As global production processes increasingly demand lightweight and multifunctional materials, the role of adhesives transcends simple joining; it becomes a core enabler of design flexibility and performance optimization.

In contrast to commodity glues, high performance adhesives are formulated to withstand extreme environmental conditions, dynamic mechanical stresses, and stringent regulatory standards. Their chemistries span a diverse range of technologies engineered for specific applications: acrylics that balance tensile strength with flexibility, cyanoacrylates that provide rapid bonding, epoxies renowned for structural integrity, and silicones designed for high-temperature resistance. This technological diversity fuels their adoption in sectors where long-term durability and reliability are non-negotiable, influencing product lifecycles and total cost of ownership more than ever before.

Underpinning this evolution are critical market drivers such as the imperatives of weight reduction in transportation, the integration of smart manufacturing processes, and the pursuit of more sustainable material solutions. Advancements in automation and assembly robotics continue to raise the bar for adhesive performance, necessitating formulations that cure faster, bond dissimilar substrates, and exhibit lower environmental impact. Consequently, organizations are placing adhesives at the strategic center of their engineering roadmaps, seeking partnerships that can deliver customizable, high-performance chemistries to meet tomorrow’s manufacturing challenges.

Unveiling the pivotal technological and sustainability-driven transformations reshaping the high performance adhesives market dynamics and competitive landscape

Recent years have witnessed a series of transformative shifts in the high performance adhesives ecosystem, driven by technological breakthroughs, sustainability mandates, and evolving end-use demands. Innovative chemistries have emerged-such as bio-derived resins and next-generation UV-curable systems-that reconcile high bond strength with reduced environmental footprint. Concurrently, manufacturers have invested heavily in smart adhesive dispensers and inline monitoring solutions that integrate seamlessly with Industry 4.0 infrastructures, enabling real-time process optimization and consistent quality control.

Parallel to technological innovation, sustainability has ascended to the forefront of strategic priorities. Regulatory frameworks and customer expectations now compel companies to reduce volatile organic compound (VOC) emissions, lower energy consumption during curing, and adopt lifecycle-friendly materials. In response, formulators are refining waterborne and solventless adhesive platforms without sacrificing performance, thereby aligning product portfolios with circular economy principles. This sustainable pivot is steadily reshaping procurement and supplier selection, as stakeholders seek materials that can endure rigorous certification regimes and support green building and manufacturing standards.

Moreover, the consolidation of end-use industries continues to influence market dynamics. Strategic alliances between chemical innovators and system integrators are accelerating the co-development of application-specific adhesives tailored to critical sectors like aerospace and medical devices. This collaborative ethos extends further as digital simulation tools and computational chemistry accelerate R&D cycles, enabling faster time to market for next-wave adhesive technologies. Collectively, these shifts are redrawing competitive boundaries and compelling both established players and emerging innovators to refine their value propositions.

Examining the comprehensive effects of the 2025 United States tariff measures on the high performance adhesives supply chain, cost structures, and market resilience

In 2025, the imposition and adjustment of United States tariffs on key raw materials and intermediate chemicals reverberated throughout the high performance adhesives supply chain, reshaping cost structures and sourcing strategies. Tariffs on petrochemical derivatives, essential for epoxy and polyurethane production, raised input prices and compelled formulators to reevaluate long-standing supplier relationships. These policy measures also introduced volatility into procurement cycles, prompting manufacturers to secure extended contracts or explore alternative feedstock origins.

The cumulative impact extended beyond direct material costs, as logistics networks encountered higher cross-border fees and delayed shipment timelines. Companies with vertically integrated operations found themselves better insulated against these shifts, while those relying on global imports experienced compressed margins and the need to pass costs onto end users. Some manufacturers responded by establishing localized production hubs or forging joint ventures with domestic chemical suppliers to mitigate exposure to tariff fluctuations and streamline regulatory compliance.

Despite these headwinds, resilience strategies have emerged to maintain supply continuity and competitive positioning. Diversification of raw material sourcing, investment in alternative chemistries less dependent on tariff-affected inputs, and greater emphasis on near-shoring logistics have all contributed to stabilizing operations. As a result, the adhesives industry is adapting to a new paradigm where geopolitical developments and trade policies are as critical to strategic planning as technological innovation and end-use demand.

Insights into product, form, end use industry, and distribution channel segmentation revealing diversification, customization, and value creation strategies

A nuanced understanding of market segmentation reveals how product diversity, form factors, end use applications, and distribution channels collectively drive competitive differentiation and customer value. When slicing the market by product type, acrylics command significant attention given their versatility, with non-structural and structural variants catering to light-assembly and load-bearing applications respectively. Cyanoacrylates deliver rapid cure times optimal for high-speed manufacturing lines, while epoxies remain the standard for structural bonding in demanding environments. Polyurethanes contribute elasticity and impact resistance, silicones offer superior thermal stability through both acetoxy and neutral cure approaches, and UV cure adhesives enable fast, solvent-free processing.

Form factors further refine value propositions: liquid formulations ensure precise metering and full coverage in automated dispensers, solid adhesives support convenience in adhesive gun applications, and tape and film carriers provide a pre-laminated alternative that streamlines assembly by eliminating cure time and minimizing waste. End use industry segmentation underscores the application-driven nature of demand, spanning aerospace assemblies engineered for extreme durability, automotive manufacturing optimized for weight reduction, and building and construction scenarios including façade sealing, flooring and tiling, and structural glazing. In the electrical and electronics arena, adhesives bond display and touch panels, secure PCB components, and insulate wire and cable assemblies. The medical field requires biocompatible, sterilizable adhesives for device fabrication, while packaging applications range from food and beverage closures to pharmaceutical containment.

Distribution channels represent the final axis of segmentation, where direct sales enable tailored technical support and formulation customization, and indirect channels through distributors, dealers, and e-commerce platforms offer accessibility and rapid replenishment. By navigating these four segmentation dimensions, industry participants can identify high-value niches, tailor product development roadmaps, and optimize channel strategies to outpace the competition.

This comprehensive research report categorizes the High Performance Adhesives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- End Use Industry

- Distribution Channel

Analyzing regional variations across Americas, Europe, Middle East & Africa, and Asia-Pacific uncovering growth trajectories and strategic opportunities

Regional dynamics play a pivotal role in shaping demand patterns, regulatory environments, and competitive positioning within the high performance adhesives landscape. In the Americas, established aerospace and automotive clusters continue to drive advanced bonding solution requirements, while regulatory emphasis on environmental compliance incentivizes the adoption of low-VOC and bio-based formulations. North American and South American markets each exhibit distinct logistical challenges and growth drivers, with domestic production capacity and regional trade agreements influencing supply chain configurations.

Across Europe, the Middle East & Africa, multifaceted regulatory regimes and diverse application sectors contribute to a complex market tapestry. Western Europe’s stringent building codes and emphasis on green infrastructure underpin demand for sustainable sealants and adhesives in façade sealing, structural glazing, and flooring applications. In Central and Eastern Europe, expanding manufacturing footprints and infrastructural investments are fueling demand for structural epoxies and UV cure adhesives. The Gulf region’s infrastructure development and renewable energy projects are also creating pockets of specialized demand for high-temperature and chemical-resistant bonding solutions.

The Asia-Pacific region represents a confluence of mature manufacturing hubs and rapidly growing end use sectors. East Asian electronics powerhouses continue to refine precision adhesives for display, PCB, and cable applications, while Southeast Asian automotive assembly plants integrate lightweight bonding systems to meet fuel efficiency targets. China and India, in particular, are investing heavily in local adhesive production capabilities to reduce import dependency and enhance supply chain resilience. Collectively, these regional insights underscore the imperative for companies to adopt market-specific strategies, align product portfolios with local regulations, and leverage regional partnerships to maximize growth potential.

This comprehensive research report examines key regions that drive the evolution of the High Performance Adhesives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading companies pioneering innovation, strategic collaborations, and market positioning within the high performance adhesives industry

Leading players in the high performance adhesives arena are distinguished by their commitment to innovation, strategic collaborations, and agile market positioning. Major global manufacturers have expanded their R&D footprints with specialized labs focused on emerging chemistries, such as bio-based resins and next-generation photo-initiators. Partnerships with academic institutions and material science consortia facilitate early access to breakthrough adhesive technologies, while co-development agreements with OEMs ensure alignment with exacting application requirements.

In parallel, nimble specialty producers are carving out competitive advantages by targeting high-growth niches and offering rapid customization capabilities. These firms often integrate end-to-end service models that encompass application engineering, on-site technical support, and digital dispensers equipped with process analytics. Joint ventures and strategic acquisitions remain a popular route to broaden geographic reach and augment product portfolios, particularly in regions where local regulatory demands or logistical constraints favor domestic partners.

Furthermore, an emerging cohort of disruptors is leveraging advanced computational methods and machine learning algorithms to accelerate adhesive formulation cycles. By simulating polymer interactions and curing kinetics in silico, these entrants reduce development timelines and cost barriers, enabling faster commercialization of specialized bonding solutions. Collectively, these corporate strategies underscore a marketplace defined by relentless innovation, strategic alliances, and an unwavering focus on meeting the specific needs of diverse end use industries.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Performance Adhesives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Akzo Nobel N.V.

- Arkema S.A.

- Ashland Inc.

- Avery Dennison Corporation

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- Dow Inc.

- Dymax Corporation

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hexcel Corporation

- Huntsman International LLC

- Illinois Tool Works Inc.

- Jowat SE

- MAPEI S.p.A.

- Master Bond Inc.

- Permabond LLC

- Pidilite Industries Ltd.

- Sika AG

- Toagosei Co., Ltd.

- Wacker Chemie AG

Implementing data-driven strategies for industry leaders to enhance operational excellence, innovation pipelines, and competitive advantage in adhesives market

In an increasingly complex and competitive high performance adhesives market, strategic agility and forward-looking investments are essential for industry leaders seeking sustained advantage. First, prioritizing a robust R&D agenda that balances eco-friendly chemistries with high-performance specifications will be critical to addressing tightening environmental standards and evolving customer requirements. Allocating resources to pilot projects on bio-based and solventless adhesive platforms can establish a first-mover advantage in sustainability-driven segments.

Second, integrating digital tools across the value chain will unlock significant operational and customer-facing benefits. By deploying smart dispensing equipment, real-time quality monitoring, and predictive maintenance algorithms, manufacturers can enhance throughput, reduce waste, and reinforce long-term customer relationships through data-backed service offerings. Collaboration with automation and robotics partners can further streamline complex assembly processes.

Third, fortifying supply chain resilience through regional partnerships and near-shoring strategies will mitigate exposure to geopolitical and tariff-related disruptions. Building strategic alliances with local chemical producers and logistics providers in key markets can accelerate response times and ensure uninterrupted access to critical raw materials. Finally, fostering cross-functional teams that blend material science expertise with application engineering and market intelligence will enable more nuanced product positioning, faster time to market, and stronger alignment with end user priorities.

Outlining the rigorous research framework, data collection techniques, and analytical protocols underpinning the high performance adhesives market insights

This research report is grounded in a comprehensive methodology that combines qualitative and quantitative techniques to deliver robust market insights. Primary research involved in-depth interviews with senior executives, application engineers, and procurement specialists across key global regions. These conversations provided direct perspectives on emerging trends, procurement challenges, and application-specific performance criteria.

Secondary research included systematic reviews of industry publications, regulatory filings, corporate presentations, and patent databases. Publicly available trade data and technical journals were analyzed to contextualize raw material dynamics, technological advancements, and policy impacts. Data triangulation methods were applied to reconcile divergent viewpoints and ensure the highest degrees of reliability and accuracy.

The segmentation framework was validated through iterative stakeholder consultations, ensuring that product type, form, end use industry, and distribution channel classifications accurately reflect market realities. Regional insights were enriched by collaboration with market experts situated in each geography, while competitive intelligence was derived from detailed company profiling and financial disclosures. Throughout the research process, stringent quality controls and peer-review mechanisms were employed to uphold methodological rigor and analytical transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Performance Adhesives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Performance Adhesives Market, by Product Type

- High Performance Adhesives Market, by Form

- High Performance Adhesives Market, by End Use Industry

- High Performance Adhesives Market, by Distribution Channel

- High Performance Adhesives Market, by Region

- High Performance Adhesives Market, by Group

- High Performance Adhesives Market, by Country

- United States High Performance Adhesives Market

- China High Performance Adhesives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing critical findings and outlining strategic considerations to navigate future challenges and leverage opportunities in the adhesives sector

The high performance adhesives industry stands at a crossroads defined by technological ingenuity, regulatory pressures, and shifting end use demands. Critical findings underscore the necessity of adopting sustainable chemistries without compromising performance, leveraging digitalization to enhance manufacturing excellence, and securing resilient supply chains amidst evolving trade landscapes. Market segmentation insights illuminate how product types, form factors, application sectors, and channel strategies intersect to create differentiated value propositions.

Regional analysis reveals that market dynamics are not monolithic; diverse regulatory environments, infrastructure investments, and industrial priorities shape distinct growth trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific. Competitive profiling highlights how both global incumbents and agile specialists are employing innovation partnerships, computational formulation techniques, and strategic acquisitions to capture market share and meet specialized performance requirements.

Looking ahead, industry stakeholders must embrace a holistic approach that integrates environmental stewardship, digital transformation, and collaborative ecosystems. By doing so, they will be well-positioned to navigate market complexities, capitalize on emerging opportunities, and deliver advanced adhesive solutions that power the next generation of industrial and manufacturing excellence.

Engage with Ketan Rohom to secure tailored market research insights and strategic guidance on high performance adhesives for decisive leadership

Elevate your strategic planning by engaging with Ketan Rohom, Associate Director of Sales & Marketing, to unlock bespoke high performance adhesives intelligence designed to drive impactful decisions and sustained competitive edge through acquisition of the comprehensive market research report

- How big is the High Performance Adhesives Market?

- What is the High Performance Adhesives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?