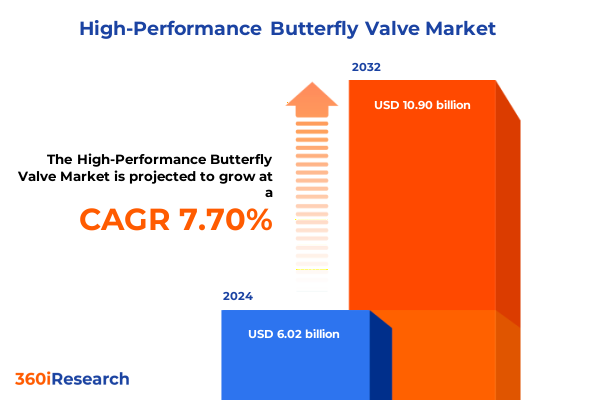

The High-Performance Butterfly Valve Market size was estimated at USD 6.40 billion in 2025 and expected to reach USD 6.81 billion in 2026, at a CAGR of 7.89% to reach USD 10.90 billion by 2032.

Illuminating the critical role of high-performance butterfly valves in optimizing industrial fluid control across evolving global infrastructures

High-performance butterfly valves have emerged as indispensable components in critical fluid control applications, driving operational excellence across multiple industrial domains. As fluid handling systems become increasingly complex, the demand for valves capable of delivering precise modulation, rapid cycling, and exceptional durability has intensified. In response to these exacting requirements, manufacturers have innovated in materials, sealing technologies, and actuation mechanisms to ensure reliability under extreme pressures, corrosive environments, and high-temperature conditions.

The imperative for robust fluid management solutions is underscored by the expanding infrastructure investments in sectors such as energy, water treatment, and chemical processing. High-performance butterfly valves deliver significant gains in maintenance intervals, system uptime, and overall asset ROI by minimizing leakage risks and enabling seamless integration with automated process control platforms. With technological advancements accelerating, stakeholders are reevaluating procurement strategies to prioritize valve offerings that align with stringent performance, safety, and sustainability mandates.

Examining the seismic technological regulatory and sustainability-driven shifts reshaping the performance requirements of industrial butterfly valve solutions

The butterfly valve market is undergoing a technological metamorphosis driven by digitalization, advanced materials, and stricter environmental regulations. Smart valve platforms now incorporate sensor networks and predictive diagnostics, enabling real-time monitoring of flow rates, torque requirements, and seal integrity. This integration of Internet of Things frameworks and data analytics is transforming maintenance regimes from reactive to preventative, thereby reducing unplanned downtime and extending service lifecycles.

Simultaneously, the push toward sustainability has spurred the adoption of low-emission manufacturing processes and eco-friendly materials such as PTFE and EPDM for soft seats, while alloys like Inconel and stainless steel are optimized for corrosive duty. These material innovations complement enhanced designs like triple offset discs and wafer-style bodies that deliver superior sealing under high-pressure differentials. Furthermore, automation in valve operation-spanning electric, pneumatic, hydraulic, and manual actuation-has evolved to support remote control and fail-safe functionalities. Together, these transformative shifts are redefining performance benchmarks and compelling market participants to reassess product portfolios in light of digital readiness and regulatory compliance.

Analyzing the compounded effects of the 2025 United States tariff regime on high-performance butterfly valve supply chains and sourcing strategies

In 2025, revised United States tariff directives have exerted significant pressure on high-performance butterfly valve supply chains, compelling manufacturers to revisit procurement and sourcing frameworks. Heightened duties on imported steel and aluminum have escalated raw material costs, necessitating a recalibration of pricing models. As a result, many valve producers have pivoted toward domestic steel suppliers and alternative alloys to buffer against further tariff volatility.

This recalibration has had a dual impact: it has strengthened regional supply resilience while also introducing short-term constraints on material availability. Several stakeholders have mitigated these effects by diversifying contract portfolios and establishing strategic stock positions for critical components. Additionally, collaborative ventures between end users and valve specialists are now commonplace, aimed at co-developing material formulations that maintain performance standards while reducing exposure to tariff-induced cost fluctuations. These adaptive strategies underscore industry agility amid an increasingly protectionist trade environment and set the stage for more localized value chains.

Revealing nuanced insights across diverse application type connection operation material size and channel segments shaping butterfly valve market dynamics

By application, high-performance butterfly valves are designed to excel in Chemical environments where corrosive media demand PTFE, EPDM, and nickel-alloy seats; in Mining operations that require abrasion-resistant discs and robust mechanical actuation; in Oil and Gas contexts that mandate fire-safe certifications and high-pressure closures; in Power Generation plants where rapid cycling and low fugitive emissions are critical; in Pulp and Paper facilities that handle fibrous slurries; and in Water and Wastewater systems that balance cost-efficiency with leak-proof performance.

Type segmentation illustrates that double-flange valves deliver enhanced stability for large-bore pipelines, lug-style valves simplify installation and maintenance in retrofit scenarios, triple-offset configurations provide zero-leakage performance for high-pressure differentials, and wafer models reduce weight and footprint in space-constrained settings. When considering end connections-flanged, lug, and wafer-designers evaluate footprint compatibility and torque requirements to optimize footprint and actuation dynamics.

Operation types range from electric actuators offering precise flow control through integrated feedback loops, hydraulic systems providing high thrust in rapid-cycle applications, manual handles serving reliable low-cost fallback operations, to pneumatic actuation enabling swift response times in safety shutdown systems. Pressure class diversity spans ANSI 150 and ANSI 300 standards, as well as PN16 and PN25 ratings, each matching specific system pressure and temperature envelopes.

Seat construction is either metal or soft, with metal seats-such as Inconel and stainless steel-delivering high wear and temperature resistance, while soft seats-comprising EPDM, NBR, and PTFE-ensure low torque performance and tight shut-off in less severe conditions. Body materials include alloy steel for elevated temperature service, carbon steel for general industrial applications, ductile iron for cost-effective strength, and stainless steel for aggressive chemical exposure. Size differentiation from below two-inch designs to above twelve-inch configurations accommodates diverse flow capacities and hydraulic profiles. Finally, sales channels-direct sales relationships, distribution networks, and online platforms-shape customer engagement by balancing technical support with rapid access to inventory.

This comprehensive research report categorizes the High-Performance Butterfly Valve market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- End Connection

- Operation Type

- Pressure Class

- Seat Material

- Body Material

- Size

- Application

- Sales Channel

Uncovering the strategic performance variances and growth drivers across Americas Europe Middle East & Africa and Asia-Pacific regional domains

The Americas region continues to be a cornerstone for innovation in high-performance butterfly valve design, driven by large-scale infrastructure projects and stringent regulatory frameworks that prioritize energy efficiency. Regional OEMs and end users collaborate closely to align valve specifications with local standards, and recent investments in renewable energy capacity have further catalyzed demand for valves suited to solar thermal, hydroelectric, and biofuel applications.

In Europe, Middle East & Africa, diverse regulatory landscapes and mature process industries heighten the emphasis on compliance with EU pressure equipment directives and local environmental mandates. European manufacturers lead in integrating digital diagnostics with advanced seat materials to meet exacting safety certifications, while Middle Eastern petrochemical projects favor high-temperature alloy designs. African infrastructure initiatives, particularly in water treatment, are expanding the use of cost-optimised wafer and lug configurations suitable for municipal distribution networks.

Asia-Pacific’s rapid industrialization, especially in chemical processing, power generation, and mining, underpins robust growth in both capital and aftermarket segments. China and India are focal points for local manufacturing scale-up, spurred by government incentives for domestic value chains, while Southeast Asian economies emphasize supply chain agility to support fluctuating raw material costs. Across all regions, collaboration between local distributors and global valve specialists ensures the timely delivery of customized solutions.

This comprehensive research report examines key regions that drive the evolution of the High-Performance Butterfly Valve market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting competitive strategies innovation trajectories and collaborative partnerships among leading butterfly valve manufacturers and solution providers

Leading corporations in the butterfly valve space are differentiating through targeted R&D investments and strategic partnerships. Major industrial automation firms are embedding condition-monitoring modules and digital twin capabilities into valve control platforms, enabling predictive maintenance workflows and remote commissioning capabilities. Specialist manufacturers of alloy components are collaborating with material science institutions to develop next-generation Inconel and stainless steel formulations that deliver superior fatigue resistance and corrosion protection.

Strategic alliances between actuator providers and seat material innovators are producing integrated valve systems capable of complying with the most stringent fugitive emission limits. Concurrently, aftermarket service businesses are expanding global footprints through localized repair centers and calibrated refurbishment programs, reducing lead times for critical spares. Key players also leverage digital sales channels alongside traditional distribution to offer rapid configuration tools, enabling customers to customize valve parameters online and access technical support virtually. These multi-pronged strategies underscore a competitive ecosystem where value chain integration and customer-centric innovation drive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the High-Performance Butterfly Valve market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anhui Tongdu Flow Control Technology Co., Ltd.

- Assured Automation, LLC

- Crane Co.

- Davis Valve Company

- Emerson Electric Co.

- Flowserve Corporation

- Gaoshan Valve Co., Ltd.

- Georg Fischer AG

- Haitima Corporation

- IMI plc

- Johnson Valves

- KB Valves Co., Ltd.

- KITZ Corporation

- KSB SE & Co. KGaA

- Metso Outotec Corporation

- Neway Valve Group Co., Ltd.

- NIBCO Inc.

- Pentair plc

- Shandong Yidu Valve Co., Ltd.

- SUFA Valves Co., Ltd.

- Valtorc, Inc.

- Velan Inc.

- Wm. Powell Co.

- Yuanda Valve Co., Ltd.

Proposing targeted strategies for industry leaders to streamline supply chains foster product innovation and capture butterfly valve growth opportunities

Industry leaders must first prioritize material diversification to mitigate tariff exposure and potential supply disruptions. By qualifying alternative alloy and polymer formulations through accelerated testing protocols, organizations can preserve performance standards while reducing dependency on at-risk imports. Concurrently, establishing dual sourcing agreements and regional stock buffers for key valve components will enhance supply continuity and support just-in-time assembly practices.

Second, accelerating the integration of smart sensor arrays and data analytics into valve packages will transform maintenance paradigms and unlock new service revenue streams. Companies should partner with IIoT and analytics specialists to develop predictive algorithms tailored to butterfly valve operation profiles, ensuring extended seal longevity and proactive fault prediction. Third, embracing modular design principles in valve architecture will streamline customization processes, reduce manufacturing complexity, and facilitate rapid on-site replacements.

Furthermore, executives are advised to invest in strategic collaborations with end users to co-innovate solutions that address specific industry pain points, from hydrogen compatibility in energy transition projects to low-emission requirements in urban water networks. Lastly, enhancing digital channels for configuration, ordering, and technical support will reinforce customer engagement, shorten procurement cycles, and provide a scalable platform for introducing value-added digital services.

Detailing rigorous research methodologies and analytical frameworks employed to ensure robust insights on butterfly valve market dynamics

The research underpinning this analysis employed a multi-layered methodology to ensure rigor and impartiality. Primary interviews were conducted with engineers, procurement executives, and technical directors across major industrial sectors to capture firsthand perspectives on performance challenges and procurement drivers. These qualitative insights were reinforced by secondary data collection from industry publications, regulatory filings, and publicly disclosed technical specifications, ensuring alignment with current standards and emerging best practices.

Analytical frameworks encompassed material performance benchmarking, tariff impact modeling, and regional supply chain mapping. Each framework applied quantifiable metrics-such as corrosion rates, cycle life benchmarks, and lead-time variability-to validate narrative insights. Data triangulation techniques cross-referenced primary feedback with secondary sources to confirm consistency and isolate divergent viewpoints. Finally, all findings underwent expert validation through peer review by independent technical consultants and former valve operations managers to ensure methodological integrity and practical relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High-Performance Butterfly Valve market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High-Performance Butterfly Valve Market, by Type

- High-Performance Butterfly Valve Market, by End Connection

- High-Performance Butterfly Valve Market, by Operation Type

- High-Performance Butterfly Valve Market, by Pressure Class

- High-Performance Butterfly Valve Market, by Seat Material

- High-Performance Butterfly Valve Market, by Body Material

- High-Performance Butterfly Valve Market, by Size

- High-Performance Butterfly Valve Market, by Application

- High-Performance Butterfly Valve Market, by Sales Channel

- High-Performance Butterfly Valve Market, by Region

- High-Performance Butterfly Valve Market, by Group

- High-Performance Butterfly Valve Market, by Country

- United States High-Performance Butterfly Valve Market

- China High-Performance Butterfly Valve Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 1908 ]

Synthesizing key insights market influences and strategic imperatives driving the evolution of high-performance butterfly valves in industrial ecosystems

This executive summary has illuminated the critical factors reshaping the high-performance butterfly valve arena, from digital transformation and material innovation to the strategic ramifications of U.S. tariff policies. We have synthesized segmentation insights, revealing the nuanced performance and procurement considerations across industries, valve types, materials, and channel strategies. Regional analyses have underscored how local regulatory environments and infrastructure priorities influence valve design preferences and supply chain configurations.

Competitive intelligence has highlighted leading players’ emphasis on integrated digital diagnostics, material science collaborations, and expanded aftermarket capabilities. Actionable recommendations have been offered to guide industry leaders in navigating supply risks, accelerating smart valve adoption, and fostering customer-centric innovation. Together, these insights provide a cohesive blueprint for engineering, procurement, and business strategy teams looking to optimize valve performance, mitigate cost pressures, and sustain competitive differentiation in an increasingly dynamic global market.

Engage with Ketan Rohom Associate Director Sales & Marketing to access insights and secure your high-performance butterfly valve market research report today

To seize the competitive advantage in the evolving butterfly valve landscape, reach out today and collaborate directly with Ketan Rohom Associate Director Sales & Marketing for personalized guidance. By engaging with Ketan Rohom, you will gain exclusive access to proprietary insights tailored to your unique operational challenges, including detailed analysis of supply resiliency, tariff mitigation strategies, and advanced material performance. This direct partnership will equip you with the practical intelligence needed to optimize procurement decisions, streamline go-to-market plans, and accelerate time to value across your fluid control projects.

Secure your comprehensive high-performance butterfly valve market research report today and transform market intelligence into tangible business outcomes. Connect with Ketan Rohom now to discuss customized reporting options, schedule a live briefing, and unlock a strategic roadmap designed for your organization’s growth objectives. Act now to harness the power of targeted data and expert consultation that will empower your enterprise to navigate complex industrial demands with confidence and precision.

- How big is the High-Performance Butterfly Valve Market?

- What is the High-Performance Butterfly Valve Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?