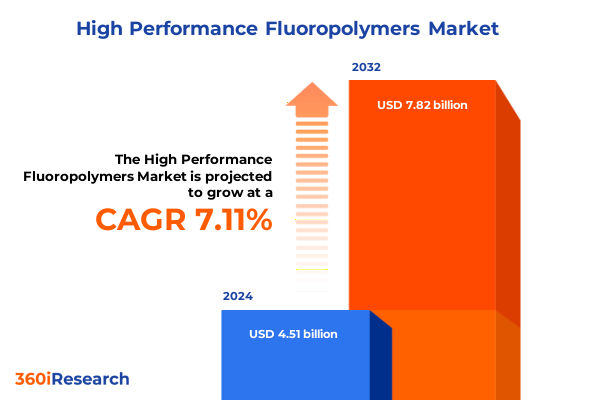

The High Performance Fluoropolymers Market size was estimated at USD 4.83 billion in 2025 and expected to reach USD 5.17 billion in 2026, at a CAGR of 7.11% to reach USD 7.82 billion by 2032.

Exploring how advanced fluoropolymer materials are transforming critical industries by delivering unmatched chemical resistance and thermal stability at scale

Fluoropolymers are distinguished by their unparalleled chemical inertness, exceptional thermal stability, and remarkable resistance to harsh environments. These unique properties have propelled them from niche specialty materials to integral components across critical industries. As manufacturing complexities increase and performance expectations rise, stakeholders require a nuanced understanding of how fluoropolymer innovations can deliver tangible benefits, from enhanced process efficiencies to extended equipment lifecycles.

The next wave of material advancements is being driven by converging trends in sustainability, miniaturization, and digital manufacturing. Cutting-edge production techniques are enabling new grades with tailored molecular structures, supporting applications that demand both high dielectric strength and low friction coefficients. Against this backdrop, decision-makers must navigate an intricate landscape of regulatory standards, supply chain vulnerabilities, and emerging end-use requirements. Establishing a clear strategic framework is essential for capitalizing on growth opportunities and mitigating risks inherent in a market defined by rapid technological evolution and geopolitical shifts.

Examining the groundbreaking technological innovations and supply chain evolutions reshaping the landscape of high performance fluoropolymer manufacturing worldwide

Advancements in polymer chemistry and process engineering have catalyzed transformative shifts in the fluoropolymer landscape. Novel reactor designs and precision control over copolymer ratios have unlocked material grades that offer superior barrier properties while reducing environmental footprint during production. Simultaneously, additive manufacturing and microfabrication techniques are expanding the design freedom for complex component geometries, enabling compact, high-performance parts that were previously unattainable.

On the logistical front, digital supply chain platforms are enhancing real-time visibility across raw material sourcing, production scheduling, and distribution networks. Blockchain-enabled traceability solutions are being piloted to ensure authenticity in critical applications, while artificial intelligence-driven demand forecasting is helping minimize inventory risk. As these technological and operational innovations converge, manufacturers are better positioned to respond to dynamic market demands, ensuring agility and resilience in an increasingly competitive ecosystem.

Assessing the multifaceted effects of 2025 United States import tariffs on high performance fluoropolymer supply chains and global trade dynamics

The introduction of targeted import tariffs in early 2025 has had a pronounced impact on the economics of fluoropolymer trade. Higher duties on several key polymer precursors have increased landed costs for finished products, prompting end users to reassess sourcing strategies and inventory buffers. In response, domestic producers have accelerated capacity expansions, leveraging localized manufacturing to mitigate tariff exposure and ensure continuity for critical supply chains.

Despite upward pressure on pricing, there has been a parallel drive toward value engineering and material substitution where defensible. Collaboration between OEMs and resin suppliers has intensified, focusing on formulation adjustments that maintain performance while reducing the reliance on tariff-affected chemistries. Over time, these shifts are expected to foster a more diversified supply base, with increased participation from emerging regional producers who can offer competitive quality at lower tariff-adjusted costs.

Revealing critical segmentation perspectives across product types, applications, end use industries, material forms, and manufacturing processes in the fluoropolymer domain

Disaggregating the fluoropolymer market reveals a tapestry of product types that serve distinct functional needs. From ethylene chlorotrifluoroethylene grades favored for their mechanical toughness to polytetrafluoroethylene variants prized for ultra-low friction, each polymer class addresses specific performance scenarios. Emerging materials such as perfluoroalkoxy alkane and polyvinylidene fluoride are carving out niches where corrosion resistance and processability converge, illustrating the ongoing diversification of high performance offerings.

Applications across aerospace, automotive, and electrical sectors demand tailored resin solutions that can withstand extreme temperature cycling and chemical exposure. In food and beverage or medical environments, stringent purity requirements and regulatory compliance drive the adoption of fluoropolymer coatings and liners that enhance operational safety. End use industries that span chemical processing and oil and gas rely on these materials for critical sealing and containment functions, underscoring their role in enabling complex industrial workflows.

Form factors ranging from emulsions and latex to precision polymer pellets and powders support versatile processing methods, including extrusion, injection molding, and advanced coating techniques. Meanwhile, polymer solutions facilitate applications such as thin-film deposition and specialty adhesives. The choice of manufacturing process-whether emulsion, solution, or suspension polymerization-further influences material characteristics and cost dynamics, highlighting the importance of process selection in aligning product performance with operational constraints.

This comprehensive research report categorizes the High Performance Fluoropolymers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Manufacturing Process

- Application

- End Use Industry

Unveiling how the Americas, Europe Middle East Africa, and Asia Pacific regions uniquely drive demand, innovation, and growth for high performance fluoropolymers

Regional dynamics in the fluoropolymer space reflect varied drivers and maturity levels. In the Americas, robust industrial infrastructure and a strong focus on technology-intensive sectors such as aerospace and electronics have created sustained demand for high purity polymers. Local capacity expansions and investments in downstream compounding capabilities are reinforcing supply chain resilience and reducing lead times for critical components.

The Europe Middle East Africa region is characterized by stringent environmental regulations and a pronounced emphasis on circular economy principles. These factors have spurred the development of recyclable formulations and bio-based fluoropolymer alternatives. Partnerships between chemical manufacturers and academic institutions are driving research into next-generation materials that align with regional sustainability targets while meeting the rigorous performance demands of chemical processing and automotive applications.

Asia Pacific continues to be a hotbed of manufacturing growth, with escalating demand from sectors such as renewable energy, consumer electronics, and infrastructure development. Regional producers are rapidly scaling production capacities, supported by favorable policy frameworks and investments in advanced production technologies. Collaborative efforts across national borders are enhancing technology transfer, while local compounding facilities are tailoring grades to meet the specific requirements of burgeoning end use markets.

This comprehensive research report examines key regions that drive the evolution of the High Performance Fluoropolymers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading high performance fluoropolymer manufacturers and innovators whose strategic collaborations and product portfolios are shaping market leadership

Market leadership in high performance fluoropolymers is defined by a blend of process innovation, global reach, and strategic partnerships. Established chemical manufacturers are investing heavily in R&D to advance copolymer architectures and streamline manufacturing efficiencies. These initiatives are often coupled with targeted acquisitions of specialty compounding firms, enabling a more integrated value proposition from monomer to finished component.

In parallel, collaborations between polymer producers and OEMs are creating co-development platforms that accelerate product qualification cycles. By pooling technical expertise and leveraging mutual testing facilities, stakeholders can rapidly validate material performance under real-world conditions. This cooperative model not only enhances product reliability but also reduces time to market for specialized applications, reinforcing competitive positioning across diverse end use segments.

Startups and materials innovators are also making disruptive entries, focusing on bio-based monomers and novel reactor technologies that reduce carbon intensity. Their agility in piloting prototype grades and engaging with early adopters has introduced fresh momentum into the market. As a result, traditional players are evolving toward more open innovation frameworks, balancing core portfolio optimization with exploratory ventures into adjacent polymer chemistries and digital manufacturing solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Performance Fluoropolymers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AGC Inc.

- Arkema S.A.

- Daikin Industries, Ltd.

- Gujarat Fluorochemicals Limited

- Kureha Corporation

- Shandong Dongyue Group Co., Ltd.

- Shandong Dongyue Polymer Material Co., Ltd.

- Solvay S.A.

- The Chemours Company

- Zeon Corporation

- Zhejiang Juhua Co., Ltd

Strategic guidance for industry leaders to optimize supply chains, innovate product offerings, and navigate regulatory and trade environments effectively

Industry leaders should prioritize supply chain diversification to insulate operations from tariff fluctuations and raw material bottlenecks. Establishing dual-source agreements for key monomers and investing in agile inventory management systems will enable rapid responses to geopolitical shifts. Concurrently, deepening partnerships with downstream converters ensures alignment on resin specifications, reducing validation timelines and quality risks.

Innovation roadmaps must align with evolving end use requirements, emphasizing material grades that support lower environmental impact without sacrificing performance. Allocating resources to pilot-scale production and co-development programs with strategic customers can yield differentiated product offerings and bolster brand equity. Additionally, active engagement with regulatory bodies on substance use regulations and trade policies will help shape favorable industry standards.

Finally, embracing digitalization across R&D, manufacturing, and supply chain operations will unlock efficiency gains and improved visibility. Deploying advanced analytics to predict demand patterns, optimize batch scheduling, and monitor material performance in service can drive cost reductions and enhance customer value. This holistic approach to operational excellence and innovation will fortify market positioning amid intensifying global competition.

Outlining the comprehensive research framework combining primary interviews, secondary data analysis, and expert validation to ensure robust market intelligence

The foundation of this research rests on a robust multi-tiered methodology combining expert insights, authoritative secondary sources, and rigorous data validation. Primary interviews were conducted with senior executives from polymer manufacturing firms, original equipment manufacturers, and industry associations to capture first-hand perspectives on market dynamics and emerging challenges. Structured questionnaires and follow-up consultations ensured consistency and depth in qualitative inputs.

Complementing these interviews, secondary research encompassed peer-reviewed journals, patent databases, and publicly available regulatory filings to contextualize technological trends and policy developments. Trade publications and conference proceedings provided additional granularity on regional project pipelines and collaboration frameworks. Quantitative data points were cross-referenced against industry benchmarks and historical trends to ensure analytical robustness.

Finally, a multi-channel validation process was applied, triangulating findings through expert workshops and stakeholder reviews. This iterative feedback loop refined core hypotheses and uncovered nuanced insights, reinforcing the credibility of the presented conclusions. The resulting market intelligence delivers a balanced view of current realities and forward-looking scenarios, equipping decision-makers with actionable knowledge.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Performance Fluoropolymers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Performance Fluoropolymers Market, by Product Type

- High Performance Fluoropolymers Market, by Form

- High Performance Fluoropolymers Market, by Manufacturing Process

- High Performance Fluoropolymers Market, by Application

- High Performance Fluoropolymers Market, by End Use Industry

- High Performance Fluoropolymers Market, by Region

- High Performance Fluoropolymers Market, by Group

- High Performance Fluoropolymers Market, by Country

- United States High Performance Fluoropolymers Market

- China High Performance Fluoropolymers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing critical insights to underscore the pivotal role of high performance fluoropolymers in driving future industrial advancements and sustainability goals

High performance fluoropolymers have emerged as indispensable materials that bridge the gap between engineering demands and operational realities. From safeguarding critical aerospace components to enabling sophisticated medical devices and renewable energy infrastructure, these polymers underpin advancements across numerous sectors. The convergence of technological innovation, regulatory evolution, and shifting trade landscapes highlights both opportunities and strategic imperatives for industry participants.

As market dynamics continue to evolve, a nuanced appreciation for segmentation, regional drivers, and competitive positioning will be essential. Organizations that proactively adapt to tariff regimes, invest in collaborative innovation, and harness digital tools stand to capture disproportionate value. Above all, the ability to translate material science breakthroughs into scalable, cost-effective solutions will determine who leads in the next chapter of materials chemistry.

Engage directly with Associate Director Sales Marketing to secure the in-depth fluoropolymer market research report and stay ahead with strategic insights

To gain an in-depth understanding of emerging trends and actionable insights in the high performance fluoropolymer market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the comprehensive research deliverables, bespoke data sets, and tailored strategic recommendations designed to align with your organization’s objectives. By partnering directly with him, you can accelerate decision-making, validate your product roadmaps, and secure a competitive advantage in an industry defined by rapid innovation and evolving trade dynamics.

Connect today to explore volume licensing options, market deep dives, and custom consulting engagements for the fluoropolymer materials sector. Ensure your team stays ahead of supply chain disruptions, regulatory shifts, and emerging application opportunities by leveraging exclusive data and expert analysis. Your pathway to elevated market intelligence begins with a conversation.

- How big is the High Performance Fluoropolymers Market?

- What is the High Performance Fluoropolymers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?