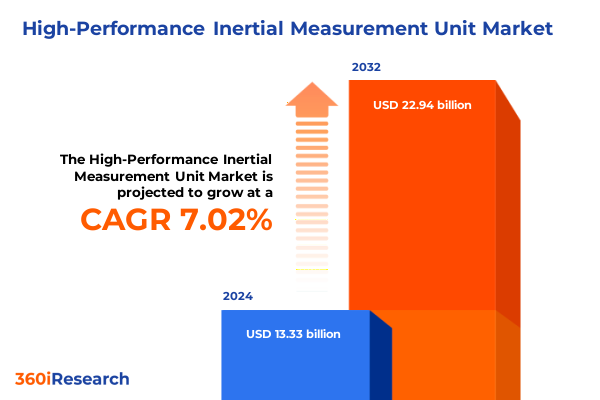

The High-Performance Inertial Measurement Unit Market size was estimated at USD 14.21 billion in 2025 and expected to reach USD 15.15 billion in 2026, at a CAGR of 7.08% to reach USD 22.94 billion by 2032.

Pioneering the Next Frontier in Inertial Measurement: High-Performance IMUs Enabling Precision Navigation and Control Across Industries

As precision navigation and stabilization requirements intensify across aerospace, defense, automotive, and industrial domains, high-performance inertial measurement units have emerged as mission-critical components that enable reliable positioning in GPS-denied or contested environments. These sophisticated sensor assemblies integrate accelerometers and gyroscopes with advanced signal processing algorithms to deliver unparalleled accuracy, stability, and responsiveness. In recent years, the convergence of miniaturization trends, enhanced materials science, and breakthroughs in sensor fusion techniques has driven a renaissance in inertial measurement design, expanding their applicability from core defense platforms to emerging commercial segments such as autonomous vehicles and virtual reality systems.

Against this backdrop, organizations face mounting pressure to adopt IMUs that not only meet exacting performance specifications but also align with tightening regulatory frameworks and evolving end-user expectations. This executive summary provides a concise yet comprehensive overview of the current high-performance IMU landscape, highlighting the disruptive technological shifts, the ripple effects of new tariff regimes, critical segmentation insights, and regional dynamics shaping global competitive positions. Through a blend of rigorous primary research and in-depth analysis, this document equips decision-makers with the insights needed to navigate complexities, mitigate risks, and capitalize on the transformative opportunities inherent in the evolving inertial measurement sector.

Adapting to Technological and Regulatory Disruptions: How Shifting Dynamics in Data Analytics, AI, and Standards Are Accelerating IMU Evolution

The inertial measurement landscape is undergoing a profound transformation driven by advancements in sensor fusion algorithms, artificial intelligence, and edge computing architectures. Enhanced machine learning methodologies now enable dynamic error compensation and adaptive calibration in real time, significantly improving drift performance and long-term stability. Concurrently, the proliferation of multichip packaging techniques and novel piezoelectric materials has facilitated unprecedented levels of sensor integration and robustness, allowing developers to push the boundaries of form factor without compromising accuracy.

Moreover, emerging regulatory frameworks and standardization initiatives-spanning aerospace qualification standards to new automotive functional safety requirements-are reshaping development roadmaps. Organizations are increasingly adopting digital twin simulations to virtually validate inertial systems under diverse environmental scenarios, from extreme temperatures to high-vibration conditions. These transformative shifts require stakeholders to rethink traditional design paradigms, accelerate cross-disciplinary collaboration, and invest in next-generation tooling to maintain competitiveness.

Assessing the Cumulative Impact of 2025 United States Tariffs on Supply Chains Production Costs and Strategic Sourcing for High-Performance IMU Manufacturers

The enactment of new United States tariffs in early 2025 has introduced significant headwinds for high-performance IMU manufacturers that rely on global supply chains for critical components. Tariffs on precision quartz crystals, semiconductor dies, and specialized MEMS wafers have elevated procurement costs and compressed manufacturer margins. In response, many industry players have initiated strategic nearshoring and dual-sourcing initiatives to diversify their supplier base and shield production lines from further geopolitical volatility.

These cumulative tariff pressures have also accelerated the adoption of localized manufacturing hubs, particularly in North America, where incentives for domestic semiconductor fabrication are gaining momentum. While cost increases have been partially absorbed through price adjustments and efficiency improvements, companies are increasingly reevaluating their long-term sourcing strategies. This recalibration not only addresses immediate cost implications but also positions manufacturers to better control intellectual property, enhance supply chain resilience, and align with evolving trade policies.

Uncovering Market Insights Through Distribution Channels Platforms Types and Application Segmentation to Reveal Hidden Opportunities for IMU Deployment

A granular examination of distribution channels reveals that aftermarket demand continues to be driven by service providers seeking retrofit solutions for legacy platforms, while OEM partnerships prioritize seamless integration within new design cycles. Service providers, in particular, are leveraging predictive maintenance analytics to offer value-added support, augmenting traditional reseller relationships. Meanwhile, distribution through OEM channels mandates stringent customization capabilities to meet the unique system architectures of aerospace, defense, and automotive integrators.

Platform segmentation underscores that airborne applications-encompassing both commercial aviation and defense aviation-remain the largest adopters of high-performance IMUs due to stringent navigational requirements and certification processes. On the ground, autonomous vehicles and robotic platforms are fueling growth in high-bandwidth inertial sensing. Naval and space applications prioritize radiation-hardened architectures and long-duration reliability, driving specialized design roadmaps.

Within the product portfolio, fiber optic gyroscopes featuring single, dual, or tri-axis configurations address use cases that demand unparalleled stability, whereas hemispherical resonator and ring laser gyroscopes cater to environments requiring extreme ruggedness or precision. Application insights highlight that while automotive advanced driver-assistance systems and fully autonomous vehicles are key growth drivers, consumer electronics deployments-particularly in drones and VR/AR-are expanding the lower end of the performance curve. Defense and aerospace systems continue to demand integrated guidance, navigation, and stabilization modules, just as healthcare devices for patient monitoring and industrial factory automation and robotics leverage high-precision inertial data. Oil and gas exploration and drilling equipment are innovating with modular IMU packages to withstand harsh environments and improve operational safety.

This comprehensive research report categorizes the High-Performance Inertial Measurement Unit market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Platform

- Application

- Distribution Channel

Examining Regional Dynamics Across Americas Europe Middle East & Africa and Asia-Pacific to Highlight Growth Drivers Challenges and Emerging Use Cases for High-Performance Inertial Systems

Regionally, the Americas market is characterized by robust aerospace and defense spending, supported by government programs for next-generation fighter jets, space exploration vehicles, and tactical unmanned systems. Legacy platform upgrades and aftermarket service contracts drive sustained demand for high-performance IMUs, and recent incentives to bring semiconductor manufacturing onshore are creating new domestic opportunities for component fabrication. In addition, the North American automotive sector’s push toward advanced driver-assistance systems and Level 4 autonomy has increased investment in precision inertial sensors to ensure reliable navigation in complex urban scenarios.

In Europe, the Middle East, and Africa, growth is propelled by an uptick in drone deployments and stringent aviation safety regulations that mandate certified inertial systems for pilot assistance and cargo monitoring. Collaborative initiatives among European aerospace OEMs aim to standardize inertial sensor interfaces, reducing integration costs and accelerating time to market. Simultaneously, nations in the Middle East are investing heavily in smart infrastructure and defense modernization projects, creating demand for ruggedized IMUs designed to withstand extreme temperatures and desert conditions.

Asia-Pacific stands out as a dynamic manufacturing hub, with major automotive, electronics, and space sectors driving rapid adoption of high-performance IMUs. China’s commercial space launches and India’s lunar and interplanetary missions underscore the region’s ambition in navigation systems, while Southeast Asia’s expanding drone logistics networks illustrate the versatility of inertial technologies. Ongoing government initiatives to support domestic semiconductor foundries further enhance supply chain security and reduce lead times across the value chain.

This comprehensive research report examines key regions that drive the evolution of the High-Performance Inertial Measurement Unit market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Shaping the High-Performance IMU Ecosystem by Leveraging Strategic Partnerships Innovation and Manufacturing Excellence for Competitive Advantage

Leading organizations are differentiating themselves through a blend of organic innovation, strategic collaborations, and targeted acquisitions. Honeywell and Northrop Grumman have strengthened their portfolios by integrating proprietary navigation algorithms with custom gyroscope designs, aiming to provide turnkey inertial navigation solutions to defense agencies. Safran Aerosystems has formed alliances with specialized material science firms to advance fiber optic gyroscope performance, focusing on reducing noise and extending operational lifetimes under harsh conditions.

Analog Devices and Bosch are capitalizing on their semiconductor expertise to develop MEMS-based IMUs for commercial aviation and autonomous vehicles, respectively, negotiating joint ventures to scale production capacity in key regional markets. KVH Industries and Teledyne e2v have introduced modular IMU architectures to service providers and OEMs requiring rapid customization, while Murata and Innalabs continue to refine low-SWaP sensor packages for emerging consumer and space applications. Across the board, these companies are investing in digital service platforms and predictive maintenance tools to extend product lifecycles and reinforce customer loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the High-Performance Inertial Measurement Unit market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACEINNA Inc.

- Advanced Navigation Pty Ltd.

- Analog Devices, Inc.

- Gladiator Technologies

- Hexagon AB

- Honeywell International Inc.

- Inertial Labs, Inc.

- iXblue SAS

- Japan Aviation Electronics Industry, Ltd.

- Memsense, LLC

- Moog, Inc.

- Northrop Grumman Corporation

- Parker Hannifin Corporation

- Robert Bosch GmbH

- RTX Corporation

- Safran Group

- SBG Systems S.A.S

- Sensorwell Vertriebs GesmbH

- SkyMEMS

- STMicroelectronics NV

- TDK Corporation

- Thales Group

- Trimble Inc.

- Vectornav Technologies LLC

- Wuxi Bewis Sensing Technology LLC

Strategic Imperatives for Industry Leaders to Enhance Operational Agility Foster Innovation and Navigate Regulatory and Market Complexities for Inertial Measurement Success

Industry leaders should prioritize investment in advanced sensor fusion and machine learning capabilities to enhance real-time error correction and support emerging autonomy requirements. By adopting modular design frameworks, organizations can accelerate product customization cycles and reduce time to integration across diverse platforms. Simultaneously, diversifying supplier networks-through strategic nearshoring and the establishment of secondary sourcing partnerships-will bolster supply chain resilience and mitigate exposure to future tariff adjustments or geopolitical disruptions.

In parallel, companies must engage proactively with regulatory bodies and standards consortia to shape certification guidelines and leverage digital twin simulations for rapid validation. Integrating predictive maintenance services and subscription-based analytics can also unlock recurring revenue streams, strengthen customer relationships, and differentiate offerings in a crowded market. Finally, forging joint development agreements with system integrators and end-user consortiums will facilitate early-stage innovation, ensuring that inertial measurement solutions remain aligned with evolving application demands and performance benchmarks.

Explaining the Robust Research Methodology Utilized to Ensure Data Integrity Validity and Comprehensive Coverage of High-Performance Inertial Measurement Technologies and Applications

This research relies on a dual approach combining extensive primary engagement with industry stakeholders and in-depth secondary analysis of technical literature, regulatory filings, and patent databases. Primary research includes qualitative interviews with system integrators, OEM product managers, and defense procurement officers, complemented by quantitative surveys of aftermarket service providers and platform developers. These efforts offer real-world perspectives on design priorities, purchasing criteria, and integration challenges.

Secondary research encompasses an exhaustive review of company annual reports, standards documentation from aerospace and automotive regulatory agencies, and white papers from leading academic institutions. Data triangulation methods are used to validate findings, cross-referencing technology adoption rates, procurement trends, and tariff schedules. This layered methodology ensures that the insights presented are both comprehensive and grounded in verifiable evidence, providing decision-makers with confidence in the strategic recommendations and market interpretations contained herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High-Performance Inertial Measurement Unit market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High-Performance Inertial Measurement Unit Market, by Type

- High-Performance Inertial Measurement Unit Market, by Platform

- High-Performance Inertial Measurement Unit Market, by Application

- High-Performance Inertial Measurement Unit Market, by Distribution Channel

- High-Performance Inertial Measurement Unit Market, by Region

- High-Performance Inertial Measurement Unit Market, by Group

- High-Performance Inertial Measurement Unit Market, by Country

- United States High-Performance Inertial Measurement Unit Market

- China High-Performance Inertial Measurement Unit Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesizing Critical Insights from Market Trends Technological Advances and Regulatory Impacts to Chart a Clear Path Forward for High-Performance IMU Innovation

The high-performance inertial measurement unit market stands at an inflection point marked by converging technological, regulatory, and geopolitical factors. Breakthroughs in sensor fusion, AI-driven calibration, and materials engineering have unlocked performance levels previously confined to defense platforms, enabling broader commercial adoption in automotive, consumer electronics, and industrial sectors. At the same time, evolving tariff regimes and supply chain reconfigurations underscore the importance of strategic sourcing and manufacturing agility.

By aligning product roadmaps with segmented market needs-from aftermarket service solutions to OEM integration across airborne, ground, naval, and space platforms-companies can capture value in both established and nascent applications. Regional nuances in the Americas, EMEA, and Asia-Pacific further shape competitive strategies, while leading players illustrate the power of partnerships and targeted innovation. Moving forward, stakeholders who embrace modular architectures, proactive regulatory engagement, and recurring service models will be best positioned to navigate complexities and sustain growth in this dynamic landscape.

Empowering Decision-Makers to Secure In-Depth Market Intelligence and Drive Growth by Contacting Ketan Rohom for Comprehensive High-Performance IMU Research

To gain an authoritative edge in understanding the intricate dynamics of the high-performance inertial measurement unit market and to empower your strategic decision-making with unparalleled detail, we invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan Rohom brings deep expertise in translating complex market data into actionable intelligence tailored for senior executives and technical leaders. He will guide you through the extensive research dossier, answer any questions regarding methodology and findings, and facilitate access to the full market study.

This conversation will provide clarity on how the latest technological evolutions, regulatory shifts, and tariff impacts coalesce to shape the competitive landscape. By engaging directly with Ketan Rohom, you secure timely insights that can inform investment decisions, product roadmaps, and go-to-market strategies. Seize this opportunity to reinforce your market positioning and to capitalize on emerging growth avenues before they become mainstream.

Contact Ketan Rohom today to acquire the comprehensive market research report, tailored briefings, and bespoke advisory services designed to accelerate your company’s trajectory in the high-performance inertial measurement unit sector.

- How big is the High-Performance Inertial Measurement Unit Market?

- What is the High-Performance Inertial Measurement Unit Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?