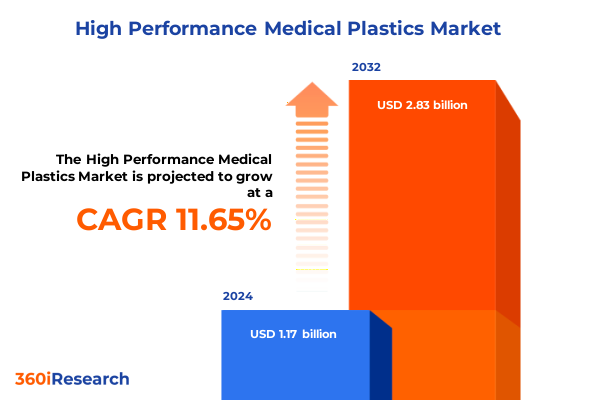

The High Performance Medical Plastics Market size was estimated at USD 1.30 billion in 2025 and expected to reach USD 1.46 billion in 2026, at a CAGR of 11.66% to reach USD 2.83 billion by 2032.

Setting the Stage for Innovation, Enhanced Resilience, and Strategic Growth Opportunities Amidst Rapid Evolution in the High Performance Medical Plastics Industry Landscape

The landscape of high performance medical plastics has never been more dynamic, driven by rapid technological advancements and evolving healthcare demands. This introduction frames the critical role of specialized polymers in facilitating groundbreaking medical device innovations ranging from minimally invasive surgical tools to implantable technologies. As regulatory scrutiny intensifies and patient safety remains paramount, materials that can deliver superior biocompatibility, sterilization resistance, and mechanical strength are increasingly prioritized by device manufacturers and healthcare providers.

Against this backdrop, the industry is navigating a convergence of challenges and opportunities. Manufacturers are pressed to optimize supply chains, adopt sustainable production practices, and enhance product differentiation in a competitive market. Simultaneously, clinicians and end users continue to demand devices that reduce procedure times, minimize patient risk, and drive better clinical outcomes. By setting this stage, we underscore how strategic material selection and process innovation contribute to both operational resilience and enhanced patient care, establishing the foundation for deeper exploration of emerging trends and critical market forces throughout this executive summary.

Uncovering the Critical Technological, Sustainability-Driven, and Regulatory Transformations Redefining High Performance Medical Plastics for Diverse Healthcare Applications

The high performance medical plastics sector is undergoing transformative shifts fueled by accelerated material innovation and tightening regulatory frameworks. Cutting-edge polymer chemistries are enabling next-generation device capabilities, from antimicrobial surface treatments that reduce hospital-acquired infections to ultra-high-temperature polymers that withstand repeated sterilization cycles. These advancements are reshaping design parameters, allowing for slimmer, more ergonomic surgical instruments and lighter, more durable implantable devices.

In parallel, regulatory bodies across major markets are introducing more stringent biocompatibility assessments and environmental compliance requirements. This convergence of scientific progress and regulatory rigor is compelling stakeholders to invest in robust testing protocols and to adopt sustainable manufacturing methodologies. As a result, companies that proactively integrate these transformative shifts into their R&D roadmaps are poised to establish market leadership, while those that lag risk obsolescence in an increasingly quality-driven environment.

Analyzing the Far-Reaching Cumulative Effects of New United States Tariff Policies on Cost Structures, Supply Chain Resilience, and Medical Plastics Manufacturing Dynamics

The introduction of updated tariff measures in the United States in 2025 has exerted a cumulative impact on the cost structures and supply chain resilience of medical plastics manufacturers. Tariff increases on imported polymer resins have driven up raw material costs, compelling firms to reevaluate supplier agreements and explore domestic sourcing alternatives. While nearshoring initiatives have gained traction, capacity constraints among local resin producers have created new bottlenecks, influencing lead times and production planning.

Moreover, these tariff policies have catalyzed strategic shifts in procurement strategies. Device manufacturers are forming deeper partnerships with resin suppliers, negotiating long-term contracts to mitigate price volatility, and co-investing in polymer formulation facilities to secure critical inputs. Although these adaptations have introduced complexity into operational workflows, they have also spurred investments in supply chain transparency and inventory optimization tools. As a result, companies embracing these insights are better equipped to maintain production continuity and manage margin pressures amidst an evolving trade policy environment.

Deep Insights into Application, Material Type, End User, and Manufacturing Process Dynamics Driving High Performance Medical Plastics Markets and Emerging Competitive Opportunities

A nuanced understanding of market segmentation is essential for stakeholders seeking to align product offerings with end user needs across the medical plastics landscape. In terms of application, cardiovascular devices, dental equipment, and diagnostic imaging systems demand materials with excellent fatigue resistance and sterilization compatibility. Drug delivery catheters and neurological implants require polymers that combine flexibility with biostability, while orthopedic devices-spanning bone plates, joint prostheses, spinal implants, and trauma fixation devices-call for high modules and impact strength. Patient monitoring devices and surgical instruments prioritize lightweight, chemically inert materials that maintain precision under repetitive use.

Material type plays a pivotal role in addressing these diverse application demands. Polycarbonate delivers clarity and toughness for diagnostic components, PEEK provides exceptional thermal and chemical resistance for implantable devices, and Polyetherimide balances strength with ease of processing for surgical devices. Polysulfone and polyphenylsulfone excel in environments requiring repeated steam or chemical sterilization. Each polymer grade influences design freedom, regulatory pathways, and manufacturing requirements, underscoring the importance of informed material selection.

End users, including ambulatory surgical centers, clinics, diagnostic centers, hospitals, and research institutes, further shape market dynamics. Clinics and ambulatory centers often demand cost-effective solutions that streamline outpatient procedures, whereas hospitals and research institutes emphasize performance validation and compliance with stringent accreditation standards. Understanding these distinctions guides product customization, service models, and value propositions tailored to each care setting.

Manufacturing processes such as 3D printing, extrusion, and injection molding determine not only part complexity and production speed but also material compatibility. Additive techniques facilitate rapid prototyping and bespoke device architectures, extrusion methods deliver consistent tubing and film profiles, and injection molding enables high-volume production of intricate components. The interplay of these process choices with material and application requirements drives production efficiencies and time-to-market advantages.

This comprehensive research report categorizes the High Performance Medical Plastics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Manufacturing Process

- Application

- End User

Comparing Regional Drivers, Innovation Trends, and Market Challenges Shaping High Performance Medical Plastics Demand Across Americas, EMEA, and Asia-Pacific Markets

Regional perspectives reveal distinct drivers and challenges shaping the trajectory of high performance medical plastics. In the Americas, established healthcare infrastructures and a robust regulatory framework create a demand for innovative, high-quality materials. The regulatory emphasis on quality systems and device registration processes ensures that new polymer formulations undergo comprehensive validation, driving collaboration between material suppliers and device manufacturers. Meanwhile, domestic resin production initiatives are gaining momentum in response to tariff-induced cost pressures, fostering a trend toward nearshoring and vertical integration.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts such as Medical Device Regulation updates in the European Union are influencing material approvals and device certification timelines. Manufacturers face cost containment pressures from centralized healthcare procurement models, prompting a focus on sustainable materials and circular economy principles. In emerging markets within EMEA, investment in healthcare infrastructure and rising demand for diagnostic imaging and orthopedic applications present growth opportunities for suppliers able to navigate complex regulatory landscapes and tailor offerings to local clinical environments.

In the Asia-Pacific region, rapid economic development and expanding healthcare access are driving accelerated adoption of advanced medical devices. Governments in key markets are prioritizing domestic manufacturing capabilities through incentives and public–private partnerships, creating attractive conditions for polymer producers to establish local production hubs. Additionally, a growing emphasis on minimally invasive surgical procedures and outpatient care is elevating demand for ultra-thin, biocompatible polymer components, further stimulating innovation in material design and process technologies.

This comprehensive research report examines key regions that drive the evolution of the High Performance Medical Plastics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves, R&D Initiatives, and Innovation Portfolios of Leading High Performance Medical Plastics Providers for Sustained Competitive Advantage

Leading polymer producers and device manufacturers are deploying a variety of strategic initiatives to strengthen their positions in the high performance medical plastics arena. Industry incumbents have intensified R&D investments to expand polymer portfolios with next-generation materials offering enhanced biocompatibility and sterilization resilience. Collaborative development agreements between specialty resin suppliers and device OEMs have accelerated time-to-market for innovative formulations, while mergers and acquisitions have streamlined value chains and broadened technological capabilities.

Several firms have also embraced digitalization, integrating advanced analytics and Internet of Things–enabled production monitoring to optimize process control and ensure consistent material performance. These data-driven approaches not only reduce scrap rates and cycle times but also support traceability requirements critical to regulatory compliance. Meanwhile, partnerships with additive manufacturing specialists have enabled co-development of tailored 3D printable polymers, opening new avenues for patient-specific implants and surgical guides.

In addition to product innovation, companies are prioritizing sustainability initiatives, implementing chemical recycling pilots and exploring bio-based polymer alternatives. Through cross-industry collaborations, they are addressing end-of-life considerations and circular economy objectives without compromising on the stringent safety standards inherent to the medical sector. This multifaceted approach underscores a commitment to both technological leadership and environmental stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Performance Medical Plastics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AGC Inc.

- Arkema S.A.

- Avient Corporation

- BASF SE

- Celanese Corporation

- Covestro AG

- Daikin Industries, Ltd.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Ensinger GmbH

- Evonik Industries AG

- Mitsubishi Chemical Corporation

- Quadrant AG

- Saint-Gobain Performance Plastics Corporation

- Saudi Basic Industries Corporation

- Solvay S.A.

- The Chemours Company

- Victrex plc

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends, Mitigate Risks, and Build Long-Term Resilience in Medical Plastics

Industry leaders can strengthen their market position by embracing several strategic imperatives. First, diversifying supply chains through multi-sourcing strategies and strategic inventory buffers can alleviate tariff-induced cost pressures and safeguard production continuity. Companies should also invest in building strategic partnerships with local resin producers to secure long-term access to critical polymers and foster collaborative innovation.

Second, focusing on sustainable material development and manufacturing practices can deliver dual benefits of regulatory compliance and market differentiation. By advancing chemical recycling capabilities and integrating bio-based polymer alternatives, organizations can align with evolving environmental standards and meet heightened expectations for corporate responsibility.

Third, the adoption of digital manufacturing solutions, including real-time process monitoring and predictive maintenance, can enhance operational efficiency and quality assurance. Combining these capabilities with advanced analytics enables proactive identification of process deviations, reducing downtime and ensuring consistent material performance essential for regulatory adherence.

Finally, engaging with end users through co-development initiatives and clinical validation studies can refine product features to address specific care setting requirements. By fostering close collaboration with healthcare providers, manufacturers can accelerate adoption, demonstrate clinical value, and build long-term trust in new polymer-based solutions.

Robust Methodology Combining Qualitative Expert Insights, Secondary Data Analysis, and Rigorous Validation to Ensure Accurate, Actionable Medical Plastics Market Findings

This market analysis was developed using a rigorous, multi-faceted research methodology designed to deliver accurate and actionable insights. Primary research included in-depth interviews with polymer specialists, device OEM executives, and clinical end users across key geographies. These qualitative discussions provided nuanced perspectives on material performance criteria, regulatory challenges, and evolving application requirements.

Secondary research involved comprehensive analysis of regulatory filings, published standards, patent landscapes, and industry white papers. Data triangulation techniques were applied to validate market drivers, competitive dynamics, and qualification pathways, ensuring that findings reflect current realities and emerging trends.

Quantitative validation was achieved through structured vendor analysis and matrix scoring of polymer properties, production capabilities, and strategic initiatives. This process enabled objective comparison of material grades and supplier strengths. Finally, internal expert reviews and iterative workshops were conducted to refine conclusions and ensure relevance for decision-makers seeking to navigate the complex high performance medical plastics environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Performance Medical Plastics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Performance Medical Plastics Market, by Material Type

- High Performance Medical Plastics Market, by Manufacturing Process

- High Performance Medical Plastics Market, by Application

- High Performance Medical Plastics Market, by End User

- High Performance Medical Plastics Market, by Region

- High Performance Medical Plastics Market, by Group

- High Performance Medical Plastics Market, by Country

- United States High Performance Medical Plastics Market

- China High Performance Medical Plastics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Perspectives on Future Trajectory, Strategic Imperatives, and Innovation Pathways for High Performance Medical Plastics Stakeholders

As the high performance medical plastics industry continues its rapid evolution, stakeholders must navigate a confluence of technological, regulatory, and commercial forces. Material innovation remains at the heart of device differentiation, driving enhanced patient outcomes and facilitating novel therapeutic approaches. At the same time, tariff dynamics and supply chain reconfigurations underscore the importance of strategic sourcing and operational agility.

Regional variations in healthcare infrastructure and procurement practices present both challenges and opportunities. Companies that adapt to localized regulatory requirements and collaborate closely with end users can unlock new growth avenues, while sustainability considerations are increasingly shaping product roadmaps and corporate priorities.

Ultimately, success in this sector will depend on a balanced approach that integrates advanced material development, sustainable manufacturing practices, and strategic partnerships. By aligning resources with emerging trends and maintaining a forward-looking perspective, medical plastics stakeholders can secure competitive advantage and support the next generation of medical device innovations.

Take the Next Step Today to Unlock Comprehensive Medical Plastics Market Intelligence with Personalized Guidance from Associate Director Ketan Rohom to Drive Informed Decision-Making

Engaging directly with personalized expert support ensures that key decision-makers can rapidly translate market intelligence into effective strategies.

Connecting with Associate Director Ketan Rohom opens a direct channel for tailored insights that align with specific organizational goals and operational contexts. Through a collaborative consultation, stakeholders can identify critical market dynamics, assess competitive landscapes, and prioritize investment areas to drive product innovation and supply chain optimization.

Taking this step not only accelerates access to in-depth analysis but also fosters a partnership that elevates strategic planning. By leveraging Ketan’s expertise in sales and marketing within the medical plastics domain, teams can refine go-to-market approaches, validate business cases, and secure the data-driven confidence required to move forward.

Reach out today to discuss how this comprehensive report can inform your next major decisions, unlock hidden opportunities, and strengthen your competitive positioning in high performance medical plastics.

- How big is the High Performance Medical Plastics Market?

- What is the High Performance Medical Plastics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?