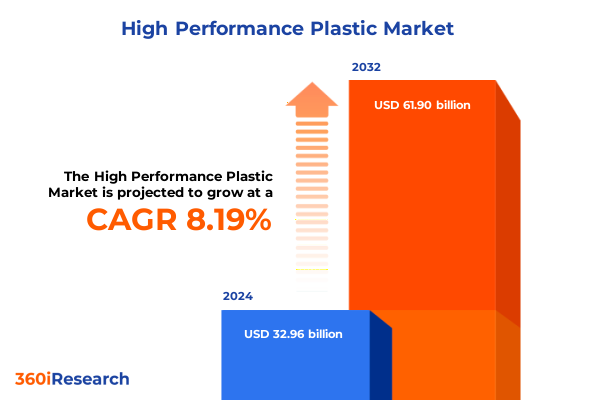

The High Performance Plastic Market size was estimated at USD 35.56 billion in 2025 and expected to reach USD 38.39 billion in 2026, at a CAGR of 8.23% to reach USD 61.90 billion by 2032.

Setting the Stage for High Performance Plastics: A Comprehensive Overview of Market Dynamics and Industry Transformations

High performance plastics encompass a class of polymeric materials engineered to deliver exceptional mechanical, thermal, and chemical performance in the most demanding applications. Distinguished by their elevated temperature resistance, dimensional stability, and robust durability, these advanced polymers extend the capabilities of conventional materials and unlock new design possibilities. From aerospace assemblies requiring extreme heat tolerance to medical devices demanding high purity and biocompatibility, high performance plastics have become indispensable to modern manufacturing.

The growing integration of these materials across diverse sectors reflects their ability to address critical challenges. In the automotive industry, for example, engineers leverage polyetheretherketone and polyimide variants to create lighter, more fuel-efficient components without compromising strength or resistance to harsh operating conditions. Meanwhile, electronics designers depend on fluorinated polymers to ensure signal integrity and thermal management in compact, high-speed architectures. As industries seek to innovate while maintaining regulatory compliance and cost efficiency, these engineered plastics provide an optimal balance of performance and predictability.

Amidst evolving customer expectations and tightening environmental regulations, firms are reevaluating material strategies to optimize lifecycle impacts. Supply chain disruptions, raw material volatility, and emerging sustainability mandates have prompted organizations to pursue resilient sourcing models and circular economy principles. Against this backdrop, a comprehensive understanding of current market dynamics is essential for navigating complexities and capitalizing on opportunities in the high performance plastics landscape.

Unveiling the Technological Innovations and Sustainable Initiatives Driving Unprecedented Changes in the High Performance Plastics Ecosystem

The high performance plastics ecosystem is undergoing rapid transformation as cutting-edge research and development activities accelerate material innovation. Novel resin formulations combining polyamide-imide chemistries with nanocomposite reinforcements are delivering unprecedented strength-to-weight ratios, while advances in additive manufacturing enable the production of complex geometries previously unattainable through traditional processes. This convergence of chemistry and digitization is redefining design parameters and elevating performance benchmarks across industrial end-use sectors.

In parallel, the proliferation of Industry 4.0 technologies is reshaping manufacturing landscapes. Real-time process monitoring, predictive maintenance algorithms, and digital twins streamline production workflows and enhance quality assurance for injection molding, compression molding, and rotational molding operations. By integrating smart sensors and connected platforms, manufacturers optimize throughput, reduce defect rates, and respond with agility to shifting demand patterns without sacrificing precision or consistency.

Sustainability initiatives are also exerting transformative influence, driving the adoption of bio-based polymers and closed-loop recycling systems. Companies are piloting innovative depolymerization techniques to reclaim high value from end-of-life components, while stakeholders collaborate on standards to validate material traceability and circularity claims. As environmental stewardship evolves into a competitive differentiator, these sustainable practices are becoming integral to strategic roadmaps and investment priorities.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on Supply Chains Procurement Costs and Competitive Positioning

In 2025, the United States implemented targeted tariff measures on a range of engineered resin imports, prompting a reevaluation of global supply networks. These duties, designed to protect domestic producers and encourage local manufacturing, have altered procurement costs and introduced new complexities in sourcing strategies. Companies reliant on niche polyetherimide and polyphenylene sulfide feedstocks have particularly felt the impact, as price differentials widened compared to pre-tariff levels.

As a consequence, manufacturers adjusted their supply chains by qualifying alternative suppliers in tariff-exempt jurisdictions or redirecting material flows through free-trade zones. While these tactics mitigated some cost pressures, they also introduced additional lead times and logistical intricacies. Procurement teams have been forced to balance the premium associated with nearshoring against the reliability of long-standing overseas partnerships, necessitating more dynamic vendor segmentation and continuous risk assessment.

Competitive positioning has likewise shifted, with agile enterprises leveraging tariff hedging strategies and vertical integration to insulate margins. By investing in domestic compounding and formulating proprietary material blends, forward-thinking firms have secured more stable pricing and reduced exposure to international policy fluctuations. This strategic pivot underscores the importance of adaptability and underscores the enduring influence of trade policy on innovation and cost optimization within the high performance plastics sector.

Decoding Market Segmentation Across Material Types Processing Technologies and Application Verticals to Illuminate Strategic Growth Opportunities

High performance plastics markets are deeply influenced by the inherent properties of each polymer family, with material selection shaping everything from processing parameters to end-use performance. Polyamide (nylon) remains a workhorse in applications demanding toughness and wear resistance, while specialized chemistries such as polyetheretherketone and polyetherimide command premium positioning for high-temperature aerospace components and semiconductor manufacturing. Fluoropolymers like PTFE excel in chemical inertness and low friction, and emerging polyimide formulations are extending service lifetimes in electrified powertrain systems. Meanwhile, more widely used polymers such as polyethylene and polyvinyl chloride continue to support cost-sensitive applications, delivering balanced performance at scale.

Manufacturing processes further delineate strategic opportunities, as each molding and forming technique aligns with unique design requirements. Injection molding retains dominance for high-volume, precision components, leveraging advanced tool designs and rapid cycle times. Compression molding and blow molding find favor in producing large-scale parts and hollow structures with uniform wall thicknesses, while rotational molding offers flexible production runs for complex geometries without the requirement for expensive tooling. Selecting the optimal process depends on balancing tooling investment, material characteristics, and production throughput under evolving manufacturing paradigms.

End-user industries diversify demand profiles and reinforce growth trajectories, with aerospace & defense driving uptake of ultra-high-performance polymers for weight reduction and flame retardance. Agricultural equipment manufacturers capitalize on polymer resilience for hydraulic system components and environmental exposure. The automotive sector’s electrification trend elevates requirements for thermal stability and electrical insulation, while construction stakeholders deploy high performance plastics for corrosion-resistant piping and façade systems. Electronics designers and medical device developers consistently push the envelope on miniaturization and biocompatibility, reinforcing the need for tailored resin portfolios and tight process control.

This comprehensive research report categorizes the High Performance Plastic market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Manufacturing Process

- End-User

Identifying Regional Dynamics in the Americas Europe Middle East Africa and Asia Pacific Highlighting Distinct Drivers and Market Advantage Threads

Regional variations underscore distinct market dynamics that influence investment decisions and competitive strategies. In the Americas, robust demand from automotive and aerospace hubs has spurred capacity expansions in domestic compounding facilities, supported by government incentives aimed at reshoring critical polymer production. This region’s well-established infrastructure and integrated supply networks facilitate rapid scale-up of specialized resin lines, enabling manufacturers to respond quickly to shifts in OEM procurement strategies.

Europe, the Middle East, and Africa present a landscape characterized by stringent environmental regulations and a strong emphasis on circular economy frameworks. Regulatory drivers associated with greenhouse gas reduction and waste minimization have accelerated the adoption of recyclable high performance plastics in construction and industrial applications. Collaboration among regional research consortia has also fostered innovation in bio-based resin synthesis and chemical recycling, positioning the EMEA region as a global leader in sustainable polymer technologies.

Across the Asia-Pacific corridor, rapid industrialization and robust infrastructure development fuel accelerating demand for high performance plastics. Major economies are investing significantly in local manufacturing ecosystems, with downstream users in electronics and medical devices driving the need for advanced polymer materials. Strategic partnerships between multinational resin producers and regional converters are fostering technology transfer and capacity growth, while emerging markets in Southeast Asia represent high-potential areas for pilot projects in polymer recycling and process automation.

This comprehensive research report examines key regions that drive the evolution of the High Performance Plastic market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovative Trailblazers Shaping the Future of High Performance Plastics Through Strategic Investments and Partnerships

Leading players in the high performance plastics arena are deploying multifaceted strategies to secure competitive advantages. Established chemical corporations are channeling capital into research collaborations with academic institutions and government labs, accelerating the commercialization of next-generation polymers that cater to stricter performance and sustainability benchmarks. This trend is exemplified by significant investments in nanotechnology-reinforced composites and flame-retardant additives tailored for electrified mobility applications.

Simultaneously, forward-thinking resin manufacturers are forging alliances with downstream equipment producers and Tier-1 suppliers to co-develop application-specific formulations. These partnerships not only streamline product qualification processes but also embed material innovation deeper into design cycles, reducing time-to-market for sophisticated component architectures. At the same time, key market incumbents are enhancing their geographic footprints through strategic acquisitions and joint ventures, ensuring proximity to critical end-user clusters and mitigating geopolitical supply disruptions.

Innovative mid-tier specialists are carving out niche positions by focusing on proprietary compound portfolios that address underserved performance gaps. By offering customized material blends and technical support services, these agile enterprises differentiate themselves in segments such as medical device sterilization packaging and high-speed electronics connectors. Collectively, these corporate maneuvers illustrate how collaboration, vertical integration, and targeted specialization are reshaping competitive landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Performance Plastic market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altana AG

- Arkema S.A.

- Asahi Kasei Corporation

- Avient Corporation

- BASF SE

- Celanese Corporation

- Covestro AG

- Dow Inc.

- DuPont de Nemours, Inc.

- Ensinger Group

- Evonik Industries AG

- Hengst SE

- Heraeus Holding GmbH

- Kraiburg TPE GmbH

- Lanxess AG

- LyondellBasell Industries N.V.

- Merck KGaA

- Mitsubishi Chemical Group Corporation

- Radici Partecipazioni SpA

- RTP Company

- Röchling SE & Co. KG

- SABIC Group

- SGL Carbon SE

- Solvay S.A.

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- TW Plastics GmbH & Co. KG

- Victrex plc

- Wacker Chemie AG

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Technologies Supply Chain Resilience and Evolving Regulatory Landscapes

Industry leaders must prioritize investment in advanced R&D platforms that integrate computational modeling and high-throughput screening to identify polymer candidates with optimal performance and sustainability profiles. By harnessing artificial intelligence-enabled simulations, companies can accelerate material discovery while reducing empirical testing cycles and associated costs. Furthermore, diversifying the supplier base across multiple regions and qualifying secondary feedstock streams will bolster supply chain resilience against policy shifts and raw material volatility.

To stay ahead of regulatory and sustainability imperatives, organizations should establish cross-functional task forces that align product development with circular economy objectives. Implementing closed-loop recycling initiatives and leveraging chemical depolymerization technologies will unlock value from end-of-life components and reduce reliance on virgin feedstocks. Concurrently, fostering strategic partnerships with recyclers and waste management firms will ensure reliable streams of reclaimed polymers for high-value applications.

Finally, embedding digital twins and predictive maintenance frameworks into molding and extrusion operations will optimize production efficiency and minimize downtime. Upskilling the workforce through targeted training in Industry 4.0 tools and sustainability best practices will equip teams to manage increasingly complex processes. By embracing these recommendations, high performance plastics stakeholders can achieve competitive agility, regulatory compliance, and long-term value creation.

Outlining the Methodological Framework Data Collection Validation and Analytical Approaches Underpinning the Comprehensive High Performance Plastics Study

This study combined primary and secondary research methods to ensure a robust and comprehensive analysis. Primary data were collected through in-depth interviews with senior executives from resin producers, molders, OEMs, and industry associations. These discussions provided firsthand insights into strategic priorities, technology roadmaps, and procurement challenges. Detailed site visits to compounding facilities and molding operations validated production capabilities and emerging manufacturing trends.

Secondary research encompassed a thorough review of industry publications, patent filings, technical white papers, and regulatory documents. Trade association reports and material standards guided the assessment of performance criteria for diverse polymer families. Market intelligence was further enriched by analyzing global trade data and customs statistics to quantify import-export flows and gauge the impact of recent tariff implementations.

Analytical frameworks such as SWOT analysis, Porter’s Five Forces, and value chain mapping underpinned the interpretive phase of the research. Statistical techniques, including trend extrapolation and correlation analysis, were employed to identify key drivers and interdependencies. Cross-validation of findings across multiple data sources reinforced the study’s credibility and ensured actionable, data-driven recommendations tailored to high performance plastics stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Performance Plastic market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Performance Plastic Market, by Type

- High Performance Plastic Market, by Manufacturing Process

- High Performance Plastic Market, by End-User

- High Performance Plastic Market, by Region

- High Performance Plastic Market, by Group

- High Performance Plastic Market, by Country

- United States High Performance Plastic Market

- China High Performance Plastic Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Drawing Insights Together to Reinforce Strategic Imperatives and Foster Continued Innovation in the High Performance Plastics Sector

The convergence of material innovation, digital manufacturing, and sustainability considerations has reshaped the high performance plastics sector into a dynamic arena of opportunity. By decoding the nuanced effects of policy shifts, such as the 2025 United States tariffs, and mapping end-use segmentation trends, stakeholders are better positioned to navigate uncertainty and capitalize on lucrative applications. Regional disparities underscore the importance of localized strategies tailored to regulatory environments and industrial clusters.

Leading corporations and agile specialists alike are demonstrating that strategic collaborations and technology integration yield tangible advantages. Whether through the co-development of advanced polymer formulations or the deployment of circular economy initiatives, these initiatives lay the groundwork for sustained growth and resilience. As the sector continues to evolve, organizations that align R&D investments with digital and sustainability imperatives will gain a clear competitive edge.

Ultimately, this report underscores the imperative for holistic market intelligence that bridges technical performance assessments with strategic business analysis. The insights presented herein serve as a blueprint for decision-makers seeking to reinforce their market positioning, innovate with confidence, and drive transformative outcomes in the high performance plastics landscape.

Connect with Ketan Rohom to Secure Your Complete High Performance Plastics Market Research Report and Empower Strategic Decision Making Today

To gain the full spectrum of insights and strategic guidance presented in this report, we invite decision-makers to engage directly with Ketan Rohom. As the Associate Director of Sales & Marketing, he brings a deep understanding of the high performance plastics market and can tailor research outputs to specific organizational challenges. By connecting with him, stakeholders will receive personalized briefings, previews of proprietary data, and recommendations aligned with unique business objectives.

Securing the complete market research report unlocks detailed analyses of material innovations, regulatory developments, regional dynamics, and competitive positioning. This comprehensive resource will inform investment decisions, optimize product development roadmaps, and strengthen supply chain strategies. With Ketan’s expertise, clients can clarify complex market trends and translate insights into actionable plans that drive growth and resilience.

Reach out today to leverage this authoritative study and elevate strategic planning with data-driven intelligence. Partnering with Ketan Rohom ensures ongoing support, updates on emerging opportunities, and access to a network of industry experts. Don’t miss the opportunity to reinforce your competitive edge-engage now to transform market intelligence into tangible results.

- How big is the High Performance Plastic Market?

- What is the High Performance Plastic Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?