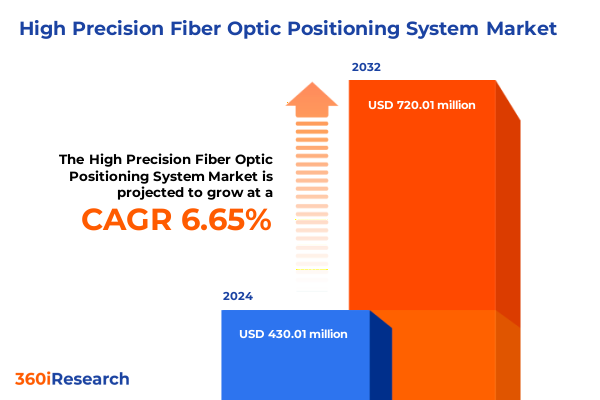

The High Precision Fiber Optic Positioning System Market size was estimated at USD 448.16 million in 2025 and expected to reach USD 481.31 million in 2026, at a CAGR of 7.00% to reach USD 720.01 million by 2032.

Establishing a Strategic Foundation for High Precision Fiber Optic Positioning Systems with an Insightful Overview of Industry Drivers and Technological Imperatives

The high precision fiber optic positioning system stands at the forefront of next-generation spatial measurement, fulfilling critical demands for accuracy and reliability across diverse industrial use cases. As infrastructure projects grow in scale and complexity, the need for instrumentation capable of delivering real-time, sub-millimeter measurements has intensified. This landscape underscores a growing shift toward solutions that not only capture precise spatial data but also integrate seamlessly with broader digital ecosystems, enabling enhanced operational agility and risk mitigation.

Emerging applications now span from urban infrastructure monitoring to deep-mine surveying, where traditional measurement techniques encounter limitations. The fiber optic medium offers inherent advantages in terms of immunity to electromagnetic interference and remote sensing over long distances, driving its adoption in environments where conventional equipment may underperform. Furthermore, the evolution of optical fiber Bragg grating sensors and advanced photonic components has propelled the technology into contexts requiring high-frequency data streams and robust environmental resilience.

Consequently, stakeholders-ranging from engineering consultancies to telecommunications operators-are recalibrating their digital transformation strategies to incorporate fiber optics as a core enabler. By understanding the foundational drivers and the symbiotic relationship between hardware innovation and software analytics, decision makers can set the stage for strategic investments that align with emerging industry benchmarks and environmental mandates.

Analyzing the Convergence of Advanced Technologies and Market Dynamics That Are Transforming the High Precision Fiber Optic Positioning System Landscape with Strategic Implications

The high precision fiber optic positioning sector is currently experiencing a convergence of disruptive technological advancements and evolving market dynamics. Integration with inertial measurement units and global navigation satellite systems is catalyzing a leap in positioning fidelity, while LiDAR-based solutions continue to expand the horizon of three-dimensional scanning and terrain profiling applications. Moreover, recent breakthroughs in optical fiber Bragg grating sensor architectures-spanning intensity-based sensing to wavelength division multiplexing-have unlocked higher data throughput and parallel measurement channels, redefining performance expectations.

In parallel, the proliferation of digital twin frameworks and IoT platforms has established new paradigms for real-time infrastructure monitoring. Projects once bound by discrete inspection intervals are now transitioning to continuous, cloud-connected operational models that harness predictive analytics and automated alerting. Consequently, decision makers are reorienting their investment plans toward solutions that provide not only measurement hardware but also advanced analysis software capable of delivering preemptive insights.

Furthermore, sustainability imperatives and regulatory scrutiny of construction and energy sectors are driving demand for non-intrusive, long-range sensing technologies. As a result, fiber optic positioning systems are gaining traction for their low-footprint installation and minimal maintenance requirements. Taken together, these transformative shifts underscore the necessity for stakeholders to explore integrated technology roadmaps that marry sensor innovation with holistic data management and actionable intelligence.

Evaluating the Comprehensive Impacts of 2025 United States Tariff Policies on High Precision Fiber Optic Positioning System Supply Chains and Competitiveness

The introduction of targeted tariffs by the United States in 2025 on key optical fiber components and associated photonic materials has generated a complex array of operational considerations for market participants. Levies imposed on high-end fiber optic cable assemblies and specialty sensor modules have elevated landed costs for imports, prompting many original equipment manufacturers to reevaluate their global sourcing strategies. In turn, project budgets originally allocated for cutting-edge sensing deployments have faced compression, compelling procurement teams to seek cost-effective design alternatives without compromising system integrity.

Consequently, a ripple effect has emerged across the supply chain, as distributors and aftermarket service providers recalibrate pricing models and inventory levels. Some stakeholders have accelerated partnerships with domestic vendors capable of producing compliant fiber optic materials, while others have invested in localized assembly facilities to bypass certain import duties. Simultaneously, companies are exploring duty drawback programs and enhanced free-trade zone utilization to mitigate the financial impact of these policy changes.

Despite these headwinds, the tariffs have also fueled innovation in materials science and manufacturing processes. Suppliers are investigating novel fiber coating chemistries and streamlined integration techniques that tolerate broader specification ranges, thus reducing dependency on high-cost imports. As a result, market leaders who adapt swiftly to this shifting regulatory terrain stand to reinforce supply resilience and maintain competitive pricing, setting a new benchmark for cost-efficient precision positioning solutions.

Unveiling Critical Segmentation Insights Across Application, End User, Technology, Component, and Distribution Channel Dimensions for Fiber Optic Positioning Systems

Application-driven differentiation underscores the multifaceted role of fiber optic positioning systems across civil engineering, mining, oil and gas exploration, survey and mapping, and telecommunications. In civil engineering contexts, these systems enable continuous structural health monitoring for bridges and tunnels, while within mining operations they facilitate deep seam alignment and subsidence analysis. The oil and gas exploration segment reveals further granularity, as downstream facilities leverage fiber networks for facility monitoring, midstream pipeline operators adopt real-time integrity sensing, and upstream drilling platforms employ distributed sensing for wellbore positioning. Survey and mapping applications extend the technology’s reach into agriculture, where precision topography aids crop yield optimization, archaeology, in which non-invasive subsurface analysis illuminates hidden relics, and urban planning projects that demand three-dimensional city models.

End user segmentation reflects a diverse stakeholder ecosystem encompassing construction contractors, government agencies, oil and gas companies, surveying firms, and utilities and telecommunications providers. Within the construction contracting domain, building developers seek turnkey sensor packages for façade monitoring, heavy civil contractors require ruggedized assemblies for large-scale excavation alignment, and specialty contractors necessitate bespoke solutions for heritage structure preservation. Government agencies-spanning federal transportation departments to state land management offices-are increasingly incorporating fiber optic positioning systems into infrastructure inspection protocols, while local municipalities deploy them for urban asset management.

Technology segmentation highlights the evolution from standalone hardware to sensor fusion platforms. GPS-integrated offerings provide baseline geospatial accuracy, augmented by IMU-integrated variants that compensate for signal loss in confined or subterranean environments. LiDAR-based systems excel in high-resolution profiling and three-dimensional scanning, capturing intricate surface geometries, whereas optical fiber Bragg grating architectures deliver high-speed, parallel measurement through intensity-based sensors or wavelength division multiplexing channels.

Component and distribution channel segmentation further illustrate market heterogeneity. Controllers orchestrate sensor networks and data aggregation, power supplies ensure uninterrupted operation in remote locations, and a spectrum of sensors caters to displacement, vibration, and temperature metrics. Software layers, whether dedicated analysis suites or mapping platforms, translate raw data into actionable intelligence. Distribution channels span direct sales, authorized distributors, and online portals, with OEM distributors and regional partners playing critical roles in market penetration and after-sales support.

This comprehensive research report categorizes the High Precision Fiber Optic Positioning System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- End User

- Distribution Channel

Distilling Regional Market Nuances and Growth Potential Across the Americas, Europe Middle East Africa, and Asia Pacific for Precision Fiber Optic Positioning Systems

Regional market dynamics reveal distinct growth trajectories and investment priorities across the Americas, Europe Middle East and Africa, and Asia Pacific. The Americas market benefits from substantial infrastructure renewal programs and private sector capital allocation, with North American rail and highway projects frequently integrating fiber optic positioning to enhance safety and minimize downtime. Latin American energy initiatives, particularly in offshore exploration and pipeline expansion, increasingly rely on distributed sensing to maintain regulatory compliance and environmental stewardship.

In the Europe Middle East and Africa region, regulatory frameworks governing construction and energy sectors have heightened demand for precise monitoring technologies. European smart city initiatives often leverage fiber optic positioning to monitor historical monuments and subterranean transit systems, whereas Middle Eastern solar farms employ long-range sensing to optimize panel alignment. Across Africa, mining enterprises are progressively adopting fiber-based systems for tailings dam surveillance and shaft alignment, driven by both corporate responsibility mandates and foreign direct investment in mineral extraction.

Asia Pacific continues to lead in adoption rates due to rapid urbanization and large-scale civil engineering endeavors. China’s high-speed rail expansion and India’s metro infrastructure projects have integrated fiber optic positioning into real-time safety systems. Japan’s seismic monitoring networks harness the technology to deliver continuous tremor detection along fault lines, and Southeast Asian oil and gas platforms implement fiber sensing to enhance operational uptime in remote offshore fields.

Collectively, these regional insights emphasize the importance of aligning technology investment with local infrastructure priorities, regulatory requirements, and end user objectives to capture emerging opportunities effectively.

This comprehensive research report examines key regions that drive the evolution of the High Precision Fiber Optic Positioning System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Strategic Collaborations Shaping the Competitive Landscape of High Precision Fiber Optic Positioning Systems

Market leadership within the high precision fiber optic positioning sector is characterized by a blend of legacy geospatial instrumentation providers and emerging photonic innovators. Established geospatial firms have augmented their offerings with fiber optic modules to complement existing GPS and LiDAR portfolios, thereby delivering comprehensive sensor fusion platforms. Simultaneously, pure-play photonics companies have introduced specialty fiber Bragg grating solutions with enhanced multiplexing capabilities, carving out niche positions in applications requiring high-speed, multi-parameter monitoring.

Strategic partnerships and collaborative ventures have become a hallmark of competitive differentiation. Geospatial technology integrators are aligning with component manufacturers to co-develop next-generation controllers that support edge computing and machine learning algorithms. At the same time, alliances between fiber optic sensor specialists and software analytics vendors are producing vertically integrated systems that streamline installation and reduce time-to-insight. Recent mergers have reflected a trend toward consolidation in supply chains, enabling larger entities to offer end-to-end sensing solutions while smaller innovators maintain agility in specialized segments like urban planning and facility management.

Product roadmaps indicate intensified R&D investment in areas such as wavelength division multiplexing enhancements and miniaturized fiber sensor packaging. Several market participants are piloting satellite-reliable configurations that combine fiber optic positioning with space-based augmentation systems for improved accuracy in remote or contested environments. Moreover, companies are broadening their services portfolios to include training, predictive maintenance programs, and remote diagnostics, recognizing that after-sales support is a critical lever for customer retention in high-precision deployments.

This evolving competitive landscape underscores the importance of aligning corporate strategy with technological differentiation and comprehensive ecosystem development. By leveraging both organic innovation and strategic collaborations, leading firms are fortifying their market positions while setting benchmarks for system performance and customer value delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Precision Fiber Optic Positioning System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems plc

- General Dynamics Corporation

- Honeywell International Inc.

- iXblue SAS

- KVH Industries, Inc.

- Leonardo S.p.A

- Northrop Grumman Corporation

- Safran SA

- Teledyne Technologies Incorporated

- Thales SA

Formulating Strategic and Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends in Fiber Optic Positioning Technologies

Industry stakeholders seeking sustained leadership in the fiber optic positioning market should prioritize the development of modular, interoperable system architectures that accommodate rapid sensor upgrades and third-party integration. By adopting open standards and API-driven software frameworks, vendors can foster ecosystem expansion and encourage value-chain partners to co-innovate, thereby accelerating time to market for advanced solutions. In addition, targeted investment in research and development aimed at enhancing multiplexing density and reducing component costs will reinforce competitive differentiation and protect margins in an increasingly price-sensitive environment.

Organizations should also diversify their supply chains by establishing regional manufacturing and assembly hubs, mitigating geopolitical risks associated with concentrated sourcing, and streamlining logistics. Coupled with proactive engagement in trade advocacy forums, these measures can help navigate evolving tariff landscapes and maintain uninterrupted component availability. Furthermore, cultivating strategic alliances with academic institutions and national laboratories will facilitate access to emerging materials research-such as novel photonic coatings-and foster a pipeline of specialized talent.

Enhancing value-added services constitutes another critical dimension of competitive strategy. By integrating predictive maintenance analytics and remote monitoring capabilities into service agreements, firms can transition from transactional hardware sales to recurring revenue models that deepen customer relationships. Finally, a concerted focus on sustainability-demonstrated through lifecycle assessments and carbon footprint reduction initiatives-will resonate with both regulatory bodies and end users committed to environmental stewardship. Collectively, these recommendations provide a roadmap for industry leaders to capitalize on emerging market trends and reinforce long-term resilience.

Outlining a Robust and Rigorous Research Methodology Employed to Ensure Data Integrity and Comprehensive Analysis in Fiber Optic Positioning Studies

The research underpinning this analysis employs a comprehensive methodology, combining primary and secondary data collection techniques to ensure depth and accuracy. Primary research comprised structured interviews with senior executives from system integrators, end user organizations across civil infrastructure and energy sectors, and specialized component suppliers. These discussions provided qualitative context on technology adoption cycles, procurement criteria, and regional deployment challenges.

Secondary research involved an extensive review of peer-reviewed journals, technical white papers, industry reports, and regulatory frameworks relevant to fiber optic sensing and photonic components. Proprietary databases were utilized to track patent filings and technology roadmaps, enabling identification of innovation hotspots. Additionally, publicly available infrastructure project databases and government procurement portals were analyzed to quantify recent system deployments and gauge market momentum.

Data triangulation techniques were applied to reconcile insights across different sources, with cross-validation workshops held with subject matter experts to vet preliminary findings. A dual approach integrating both top-down market mapping and bottom-up use case validation ensured that segmentation frameworks accurately reflected real-world deployment scenarios. The result is a robust, multi-layered intelligence foundation designed to inform strategic decision making and support ongoing market surveillance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Precision Fiber Optic Positioning System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Precision Fiber Optic Positioning System Market, by Component

- High Precision Fiber Optic Positioning System Market, by Technology

- High Precision Fiber Optic Positioning System Market, by Application

- High Precision Fiber Optic Positioning System Market, by End User

- High Precision Fiber Optic Positioning System Market, by Distribution Channel

- High Precision Fiber Optic Positioning System Market, by Region

- High Precision Fiber Optic Positioning System Market, by Group

- High Precision Fiber Optic Positioning System Market, by Country

- United States High Precision Fiber Optic Positioning System Market

- China High Precision Fiber Optic Positioning System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings and Strategic Outlook to Guide Decision Makers in Navigating the Future of High Precision Fiber Optic Positioning Systems

This executive summary has distilled critical insights on the technological evolution, regulatory pressures, segmentation dynamics, regional nuances, and competitive strategies defining the high precision fiber optic positioning system market. Stakeholders are now equipped with a clearer understanding of the major transformative shifts-ranging from sensor fusion innovations to tariff-induced supply chain realignments-and how these forces interact to create opportunities and challenges.

The segmentation analysis reveals the breadth of application and end user profiles served by these systems, highlighting the importance of tailored solutions that address the specific requirements of civil engineering, energy, and public sector clients. Regionally, diverse infrastructure priorities across the Americas, Europe Middle East and Africa, and Asia Pacific suggest that market expansion will be driven by localized strategies and partnerships. Meanwhile, the competitive landscape continues to evolve through strategic alliances, M&A activity, and sustained R&D investment.

Looking ahead, industry participants should leverage the multifaceted insights presented herein to refine their product roadmaps, optimize supply chains, and design value propositions that resonate with emerging customer demands. By aligning technology development with market realities and policy environments, organizations can position themselves for sustained growth and operational excellence in the coming years.

Drive Strategic Advantage with Exclusive Market Intelligence – Engage Ketan Rohom to Unlock Comprehensive Insights into High Precision Fiber Optic Positioning Systems

For organizations seeking to unlock unparalleled insights into the high precision fiber optic positioning system market, engaging directly with Ketan Rohom, the Associate Director of Sales & Marketing, offers a streamlined path to acquiring the comprehensive market research report. His expertise in aligning research deliverables with strategic business objectives ensures that stakeholders receive tailored analysis, actionable findings, and dedicated support for implementation. By partnering with this team, decision makers will gain access to in-depth market intelligence, facilitating informed investment, procurement, and partnership decisions in a rapidly evolving technological environment. Reach out to schedule a consultation and discover how this strategic resource can drive competitive advantage and long-term growth in high precision fiber optic positioning systems

- How big is the High Precision Fiber Optic Positioning System Market?

- What is the High Precision Fiber Optic Positioning System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?