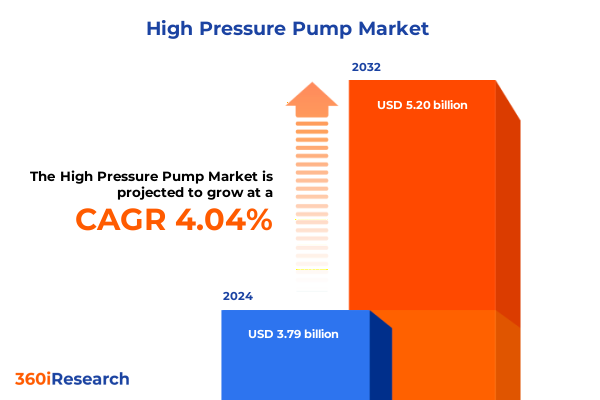

The High Pressure Pump Market size was estimated at USD 3.92 billion in 2025 and expected to reach USD 4.06 billion in 2026, at a CAGR of 4.11% to reach USD 5.20 billion by 2032.

High Pressure Pump Market Trends and Dynamics: Shaping the Future of Fluid Handling Solutions Worldwide and Emerging Opportunities Fueling Growth Across Sectors

The high pressure pump market operates at the heart of fluid handling systems across critical industrial sectors, where the ability to sustain elevated pressures under challenging conditions defines operational success. These robust mechanical devices harness advanced engineering principles to deliver precise fluid control in applications ranging from chemical processing to power generation. Their performance under high stress demands precision materials, rigorous quality standards, and adaptive designs that balance efficiency and reliability.

As industries evolve, key drivers such as aging infrastructure, stringent environmental regulations, and the push for energy-efficient operations are amplifying interest in next-generation pumping solutions. Demand is intensifying for systems that not only deliver high performance but also minimize downtime, lower life cycle costs, and support remote monitoring capabilities. Innovations in sensor integration, predictive maintenance, and modular construction are reshaping expectations for what a high pressure pump can achieve, from reducing unplanned shutdowns to enabling real time performance optimization.

This executive summary synthesizes these industry developments, offering a cohesive narrative of transformative trends, regulatory influences, and strategic imperatives shaping the market landscape. By exploring shifts in technology adoption, tariff impacts, segmentation dynamics, regional variations, and leading company strategies, this analysis provides decision-makers with a clear framework for action. The objective is to equip stakeholders with the insight needed to navigate complexity and seize emerging opportunities in the high pressure pump arena

Revolutionary Forces Accelerating the High Pressure Pump Industry: Digitalization, Sustainability Mandates, and Shifting End-User Demands

The high pressure pump industry is experiencing radical shifts triggered by digital transformation, as manufacturers adopt smart technologies to enhance system intelligence. By integrating advanced sensors, IoT connectivity, and real time analytics, operators can now monitor vibration, temperature, and flow parameters continuously. This level of visibility enables proactive maintenance strategies that substantially improve uptime and extend the service life of critical assets. Moreover, digital twins are being leveraged to simulate operational scenarios, allowing engineers to optimize performance under varying load conditions without disrupting live processes.

Simultaneously, sustainability mandates and environmental stewardship are driving design innovation. Regulators and end users alike demand lower emissions and reduced energy consumption, prompting the introduction of variable frequency drives and high-efficiency impeller geometries. These enhancements not only reduce carbon footprints but also lower operating expenses, creating a compelling value proposition for adoption across energy-intensive sectors. Incorporating renewable energy compatibility further underscores the industry’s focus on green credentials.

Moreover, end-user requirements are shifting toward customized solutions that address specific process challenges. In sectors such as petrochemical manufacturing and water treatment, operators require pumps that accommodate distinct fluid chemistries, abrasiveness levels, and temperature ranges. As a result, manufacturers are emphasizing modular architectures that facilitate rapid reconfiguration and material substitution. This adaptability, combined with strong aftermarket support networks, ensures that clients can scale operations and respond to evolving production demands without lengthy lead times

Assessing the Ripple Effect of 2025 United States Tariff Measures on High Pressure Pump Supply Chains, Accelerated Cost Increments, Strategic Competitive Realignments Across Regions, and Overall Market Fluidity

In early 2025, the United States implemented revised tariff measures targeting key components used in high pressure pump assemblies, reflecting broader trade policy adjustments. These new duties have introduced added complexity to global supply chains, influencing sourcing decisions and prompting many manufacturers to reevaluate their vendor networks. Components such as high-grade alloys, precision seals, and specialized bearings have become subject to additional import levies, thereby increasing landed costs for producers relying on offshore procurement.

Consequently, companies are adopting localized manufacturing strategies to mitigate tariff exposure. By establishing production hubs closer to major consumption markets, they can reduce cross border shipments and benefit from regional trade agreements. This strategic shift often involves capital investment in facility upgrades, workforce training, and quality assurance processes to match prior output standards. As a result, some players have successfully offset increased input costs through optimized logistics and reduced lead times, ultimately preserving margin integrity.

These tariff measures have also influenced competitive dynamics, compelling incumbents and new entrants alike to differentiate through value added services. Enhanced warranty offerings, extended service contracts, and digital performance monitoring are increasingly used to justify premium pricing. At the same time, pressure to maintain cost competitiveness encourages operational efficiency programs, including lean manufacturing and automation. Taken together, these responses underscore the industry’s resilience in adapting to policy driven cost variances

Unveiling Core Segmentation Insights: Types, Materials, Applications, and Distribution Channels Defining the High Pressure Pump Ecosystem

An in depth examination of the high pressure pump market through the lens of type reveals that centrifugal designs dominate general industrial applications, while jet pumps address specialized scenarios requiring fluid jet entrainment. Equally, the realm of positive displacement pumps encompasses diaphragm, gear, piston, and plunger variants that offer precise volumetric control for high viscosity or high pressure requirements. This segmentation by type underscores how end users select technology based on pressure thresholds, fluid properties, and maintenance profiles.

Delving into material segmentation, cast iron remains the workhorse choice for cost effective durability, whereas stainless steel is preferred for corrosive environments or hygiene critical processes. Plastic materials, including high performance polymers, are gaining traction in lightweight applications and where chemical resistance is paramount. Each material category aligns with specific operating conditions, influencing pump lifecycle and maintenance protocols.

In application oriented segmentation, the chemical sector-including petrochemical and specialty chemicals-demands robust pumps capable of handling aggressive fluids under extreme pressures. The food and beverage industry prioritizes hygienic designs and easy cleaning, while oil and gas operations from upstream extraction to downstream processing require scalable solutions. Power generation facilities stress efficiency in boiler feed and condensate return systems. Water and wastewater treatment, across industrial and municipal settings, relies on pumps engineered for reliability amidst particulate laden or corrosive streams. Distribution channels further shape market accessibility through direct sales engagement, distributor partnerships, and increasing online procurement platforms

This comprehensive research report categorizes the High Pressure Pump market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Application

- Distribution Channel

Mapping Regional Dynamics: How Americas, Europe Middle East & Africa, and Asia-Pacific Are Steering High Pressure Pump Market Trajectories

Across the Americas, demand for high pressure pumps is underpinned by robust infrastructure renewal and expanding hydrocarbon processing capacity. Operators in North America prioritize digital readiness, driving uptake of pumps with integrated monitoring platforms. Latin American markets, while still maturing, demonstrate accelerated adoption in municipal water treatment projects, where public spending on clean water initiatives is rising. Taken together, these regional dynamics underscore the Americas’ role as both a testing ground for advanced solutions and a key growth driver.

Europe, Middle East, and Africa present a mosaic of regulatory complexities and project pipelines. In Europe, stringent emissions standards and industrial decarbonization targets fuel investments in high efficiency pump systems. The Middle East’s petrochemical expansions and desalination ventures sustain strong demand, while African markets-though nascent-offer long term potential through infrastructure enhancements. Cross regional synergies, such as technology transfers and joint ventures, are shaping competitive positioning and innovation trajectories.

In Asia Pacific, the confluence of rapid industrialization, urbanization, and energy diversification is propelling significant demand. China’s emphasis on downstream refining and specialty chemical production drives large scale pump procurement. Southeast Asian nations pursue modernization of water infrastructure and renewable energy projects, while Australia’s mining sector continuously seeks optimized pumping solutions for mineral processing. These Regional variations highlight the importance of tailored go to market approaches and strategic partnerships to capture evolving opportunities

This comprehensive research report examines key regions that drive the evolution of the High Pressure Pump market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders: Strategic Initiatives, Portfolio Diversification, and Partnerships Driving Competitive Edge in High Pressure Pumps

Leading companies in the high pressure pump landscape are distinguished by their multifaceted strategies encompassing technology investment, strategic alliances, and geographic expansion. Several industry pioneers have prioritized development of modular pump platforms that can be rapidly configured for diverse applications, thereby shortening order to delivery timelines. Others have forged partnerships with automation providers to bundle smart control systems with pump offerings, positioning themselves at the forefront of Industry 4.0 integration.

Corporate acquisitions are defining competitive contours, as larger pump manufacturers seek to augment their portfolios with specialized sub assembly capabilities or regional distribution networks. These targeted mergers and acquisitions facilitate cross selling of complementary products and extend service footprints. Concurrently, select companies are channeling resources into research collaborations with materials experts to pioneer advanced alloys and coatings that enhance pump endurance in corrosive or abrasive environments.

Sustainability credentials have become a critical differentiator. Market leaders are publicizing life cycle assessments and energy performance guarantees, aligning with customer ESG objectives. At the same time, a growing number of firms have established dedicated digital hubs to support predictive analytics, remote diagnostics, and spare parts optimization. This confluence of technology leadership, strategic consolidation, and sustainability focus is shaping the competitive paradigm in the high pressure pump sector

This comprehensive research report delivers an in-depth overview of the principal market players in the High Pressure Pump market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ANDRITZ Group

- Aqua Energy International Limited

- Bieri Hydraulik AG

- Comet S.p.A.

- Danfoss A/S

- Gardner Denver Inc.

- Giant Pumps

- Hammelmann GmbH

- Hughes Pumps Ltd.

- Interpump Group S.p.A.

- Jetstream of Houston, LLP

- KAMAT GmbH & Co. KG

- Kerr Pumps

- Lenntech B.V.

- LEUCO S.p.A.

- LEWA GmbH by Atlas Copco

- Mazzoni S.r.l.

- NLB Corporation

- Parker Hannifin Corporation

- Pentair PLC

- SPX FLOW, Inc.

- Sulzer Ltd

- The Poul Due Jensen Foundation

- United Pumps Australia by Sterling Pump

- URACA GmbH & Co. KG

- WOMA GmbH

Strategic Imperatives for Industry Leaders to Capitalize on High Pressure Pump Market Opportunities and Mitigate Emerging Operational Challenges

To navigate emerging complexities, industry leaders should prioritize investment in digital twin development and integrated asset management solutions. By doing so, organizations can simulate operational scenarios, predict maintenance needs, and optimize energy consumption, thereby reducing total cost of ownership. This strategic focus on advanced analytics will also enable data driven decision making, strengthening competitive positioning in service oriented business models.

Another imperative lies in diversifying manufacturing and supply chain footprints to buffer against policy shifts and geopolitical risks. Establishing regional production nodes and securing multiple supplier relationships for critical components will minimize exposure to tariff fluctuations and shipping disruptions. Leaders should also explore nearshoring opportunities that align production capacity with core demand centers, fostering greater responsiveness and cost control.

Finally, embedding sustainability at the core of product development will resonate with environmentally conscious end users and regulatory bodies. This includes adopting high efficiency designs, integrating renewable energy compatibility, and documenting environmental performance metrics. By aligning product roadmaps with emerging green standards, companies will unlock new procurement pipelines, enhance brand reputation, and support long term growth trajectories

Robust Research Methodology Integrating Primary Expert Interviews, Secondary Data Analysis, and Validation Protocols for Reliable Market Insights

This analysis integrates a robust research framework encompassing primary and secondary methodologies to ensure comprehensive market coverage. Primary insights were gathered through in depth interviews with pump manufacturers, industry experts, and key end users across critical sectors, validating trends and strategic priorities from multiple vantage points. The rigorous selection of interview participants was based on established experience levels and direct engagement with high pressure pump procurement and maintenance processes.

Complementing the primary research, secondary data was meticulously reviewed from a diverse array of reputable industry publications, standardization bodies, and regulatory filings. This step ensured that historical context, material innovations, and policy developments were accurately documented. Cross referencing across multiple sources enhanced data integrity and provided a granular understanding of technology adoption timelines and regional market drivers.

To synthesize these inputs, a multi stage validation protocol was implemented. Initial findings were presented to a panel of subject matter specialists for critique, following which quantitative data points underwent triangulation to identify any discrepancies. The final report reflects this iterative process, delivering a coherent narrative that balances qualitative insights with validated technical and commercial data

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Pressure Pump market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Pressure Pump Market, by Type

- High Pressure Pump Market, by Material

- High Pressure Pump Market, by Application

- High Pressure Pump Market, by Distribution Channel

- High Pressure Pump Market, by Region

- High Pressure Pump Market, by Group

- High Pressure Pump Market, by Country

- United States High Pressure Pump Market

- China High Pressure Pump Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Integrating Key Findings into Strategic Vision: Concluding Perspectives on High Pressure Pump Market Resilience and Growth Pathways

As evidenced throughout this analysis, the high pressure pump market demonstrates both resilience and dynamism in the face of evolving technological, regulatory, and geopolitical influences. Core segments, from centrifugal to positive displacement, continue to adapt through material advancements and modular design philosophies. Regional variations offer unique growth vectors, with digitalization driving North American uptake and regulatory mandates catalyzing European innovation.

The cumulative impact of recent tariff adjustments has underscored the importance of adaptive supply chain strategies and value added service differentiation. Companies that have embraced localized manufacturing and strengthened digital service offerings are well positioned to maintain margin stability and defend market share. Meanwhile, sustainability and end user customization remain critical differentiators, permeating product roadmaps and go to market strategies.

Moving forward, industry participants must integrate foresight into strategic planning, leveraging analytics driven asset management and resilient sourcing practices. By aligning initiatives with customer priorities and global trade dynamics, leaders can not only mitigate risk but also capitalize on emerging opportunities. The convergence of innovation, efficiency, and environmental stewardship will define the next wave of competitive advantage in the high pressure pump sector

Empower Your Strategic Decisions with Exclusive Market Insights—Connect with Ketan Rohom to Access the Comprehensive High Pressure Pump Report

Ready to elevate your market strategy with in-depth analysis tailored to your needs? Engage directly with our Associate Director, Ketan Rohom, to secure full access to the comprehensive high pressure pump market report. His insights will empower your team with the clarity and precision needed to make strategic decisions and gain a competitive advantage.

Connect with Ketan today to transform data into actionable direction and unlock the full potential of your investment in high pressure pump technologies

- How big is the High Pressure Pump Market?

- What is the High Pressure Pump Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?