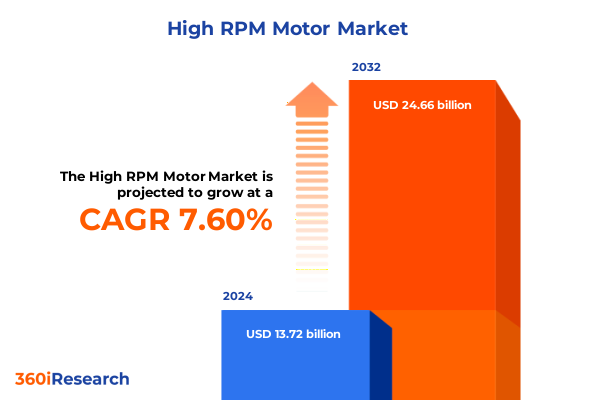

The High RPM Motor Market size was estimated at USD 16.49 billion in 2025 and expected to reach USD 17.24 billion in 2026, at a CAGR of 4.78% to reach USD 22.88 billion by 2032.

Charting the Strategic Imperative and Unprecedented Potential of High RPM Motors in the Era of Rapid Electrification and Automation

The high revolutions per minute (RPM) motor sector stands at the confluence of accelerating electrification mandates and relentless performance demands across industries. As global manufacturers pivot toward more sustainable and efficient powertrain solutions, high RPM motors have emerged as critical enablers of next-generation applications, from electric drivetrain systems to ultrahigh-speed manufacturing processes. These motors offer significantly enhanced power-density ratios, enabling equipment designers to reduce enclosure sizes and weight without sacrificing output, thereby unlocking new possibilities for compact machinery and lightweight mobility platforms.

In parallel, advanced materials science innovations-such as high-strength magnetic alloys and novel insulation compounds-are driving unprecedented improvements in thermal stability and operational lifespans. These advancements allow high RPM motors to operate reliably at extreme speeds and temperatures, addressing long-standing engineering challenges related to mechanical fatigue and electromagnetic interference. As a result, key stakeholders, including original equipment manufacturers (OEMs) and system integrators, are increasingly prioritizing high RPM motor adoption to satisfy evolving performance benchmarks and stringent regulatory requirements. Against this dynamic backdrop, the forthcoming sections dissect the transformative trends, tariff influences, segmentation insights, and regional nuances that will define the strategic roadmap for industry leaders navigating this rapidly evolving market.

Unveiling Transformative Technological and Operational Shifts Reshaping the High RPM Motor Landscape Across Industries Worldwide

A wave of transformative shifts is reshaping the high RPM motor landscape, beginning with the integration of digitalization and connectivity protocols. Embedded sensors, real-time data analytics, and digital twin frameworks are enabling predictive maintenance strategies that minimize unplanned downtime and optimize energy consumption. These smart motor solutions not only deliver end customers greater operational transparency, but also foster new servitization models, wherein manufacturers offer performance-based contracts rather than purely transactional sales.

Concurrently, additive manufacturing techniques are revolutionizing motor component fabrication. By selectively layering high-performance alloys and polymer composites, engineers can produce intricate cooling channels, weight-optimized rotor geometries, and vibration-dampening features previously unattainable through traditional machining. This capability accelerates design iteration cycles, slashes tooling costs, and broadens customization possibilities, thereby empowering niche applications in aerospace, medical devices, and advanced robotics.

Furthermore, the growing demand for high power-density solutions has catalyzed breakthroughs in magnet technology, including the development of rare-earth-reduced permanent magnet formulations and high-temperature samarium cobalt compounds. These innovations mitigate supply chain vulnerabilities and performance trade-offs, enabling motors to operate at peak efficiency across wider speed ranges. Collectively, these technological, operational, and material advancements are forging a new paradigm in high RPM motor capabilities-and setting the stage for the competitive analyses that follow.

Analyzing the Multifaceted Consequences of 2025 United States Tariffs on High RPM Motor Supply Chains, Costs, and Market Dynamics

In early 2025, the United States imposed a revised tariff regime targeting imported high RPM motors and related components, aiming to bolster domestic manufacturing and address strategic supply-chain dependencies. The immediate impact has been a pronounced cost pressure on OEMs reliant on Asian and European imports, compelling many to reassess sourcing strategies and negotiate new supplier agreements to offset elevated duties. Concurrently, this tariff environment has incentivized investment in local production capacity, as both established multinationals and emerging players seek to capitalize on government incentives designed to revitalize domestic advanced manufacturing.

The tariff structure has also accelerated the trend toward nearshoring and regional supply chain realignment. Companies are increasingly forging partnerships with North American foundries and metal-processing facilities to develop critical motor components, thereby reducing lead times and enhancing logistical resilience. This shift has prompted a proliferation of joint ventures and technology transfer agreements, particularly in states with robust manufacturing infrastructures and skilled labor pools. As a result, the competitive landscape is evolving, with domestic firms consolidating their positions and international suppliers recalibrating their market strategies in response to a more protected environment.

Finally, the tariff disruptions have underscored the importance of vertical integration and value-chain control. In response, several OEMs have pursued captive component production, expanding in-house magnet pressing, winding, and end-of-line assembly capabilities. By internalizing key processes, these organizations not only mitigate exposure to fluctuating duty rates but also accelerate product development timelines and safeguard intellectual property. The cumulative effects of these policy changes illustrate a market in transition, one where strategic agility and supply-chain diversification are paramount to maintaining competitiveness.

Deriving In-Depth Insights from Multidimensional Segmentation of the High RPM Motor Market to Illuminate Strategic Growth Levers

A nuanced segmentation of the high RPM motor market reveals distinct demand patterns across product typologies, with alternating-current induction variants-available in both single-phase and three-phase configurations-continuing to serve cost-sensitive applications where robustness and simplicity are paramount. In contrast, brushless direct-current designs, differentiated into sensored and sensorless architectures, are gaining traction in precision-driven end uses such as robotics and ancillary automotive systems. The brushed direct-current segment, subdivided into series and shunt topologies, remains relevant for legacy installations and cost-constrained deployments, while permanent magnet synchronous motors-offered in axial flux and radial flux formats-are capturing high-efficiency premium niches in electric traction and aerospace subsystems. Meanwhile, synchronous hysteresis and reluctance machines are carving out positions in specialized industrial processes requiring near-instantaneous torque response.

Assessment by end use underscores the profound influence of sector-specific requirements. Aerospace and defense platforms, encompassing aircraft systems, drone propulsion, and missile guidance units, demand ultra-high reliability and weight-optimized designs. Automotive applications span ancillary systems, chassis components, and electric vehicle traction, each with unique performance thresholds and regulatory considerations. Within consumer electronics, high RPM motors are integral to compact household appliances, HVAC blowers, and portable power tools, where noise reduction and service life are critical. The industrial domain, covering chemicals, manufacturing, mining, and oil and gas, prioritizes robustness under continuous duty and harsh environmental conditions. Medical applications, including diagnostic devices, imaging equipment, and surgical robotics, impose stringent sterilization and precision standards that elevate design complexity.

From an application perspective, the distribution spans compressors-both reciprocating and rotary-fans categorized as axial or centrifugal, and machine tools such as CNC units and conventional lathes and mills. Pumps bifurcate into centrifugal and positive displacement types, addressing hydraulic and process-fluid management, while robotics segments differentiate collaborative and fully industrial robotic platforms. Power rating stratification ranges from sub-kilowatt assemblies to those exceeding 20 kW, with key tiers at 1–5 kW and 5–20 kW highlighting transitional adoption zones. Speed-range distinctions, including bands below 3,000 rpm (further split into under 1,000 rpm and 1,000–3,000 rpm), mid-range speeds of 3,000–9,000 rpm, and ultra-high speeds above 9,000 rpm (with a subset spanning 9,000–15,000 rpm and another beyond 15,000 rpm), reflect application-driven performance demands. Cooling methodologies vary between air-cooled and liquid-cooled designs, the latter offering oil or water circulation to manage thermal loads. Mounting preferences alternate between flange-mounted variants-either face mount or foot flange attachments-and traditional foot-mounted configurations. Finally, voltage classifications into low (under 480 V and 480–1,000 V), medium (1–3.3 kV and 3.3–5 kV), and high voltage grades (5–7.2 kV and above 7.2 kV) guide integration into diverse electrical infrastructures.

This comprehensive research report categorizes the High RPM Motor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Power Rating

- Speed Range

- Cooling Type

- Mounting Type

- Voltage Rating

- End Use Industry

- Sales Channel

Deciphering Regional Nuances and Strategic Drivers Fueling High RPM Motor Market Expansion Across Americas, EMEA, and Asia-Pacific

Regional dynamics in the Americas are shaped by a robust combination of advanced manufacturing hubs and proactive infrastructure modernization initiatives. In the United States and Canada, federal programs aimed at electrifying transportation networks and upgrading energy grids have generated pronounced demand for high RPM motors, particularly in automotive traction and renewable energy applications. Latin American nations are increasingly exploring partnerships with North American suppliers to enhance local production capabilities, leveraging incentives to reduce import dependency and optimize spare-parts availability.

In the Europe, Middle East, and Africa region, policy frameworks such as the European Green Deal and various national decarbonization roadmaps have accelerated adoption of high RPM solutions in energy-intensive industries. German and Scandinavian OEMs are pioneering products with integrated sensor and connectivity functionalities, while Middle Eastern oil and gas operators invest in retrofit programs to extend equipment lifecycles. Meanwhile, African markets remain in early stages of infrastructure enhancement, with pilot projects focused on power-plant retrofits and mining equipment upgrades driving nascent motor demand.

Asia-Pacific continues to command substantial manufacturing output, underpinned by low-cost production ecosystems in China, India, and Southeast Asia. Regional leaders are advancing automation initiatives in discrete manufacturing and exploring indigenous magnet supply chains to reduce reliance on imports. Japan and South Korea maintain leadership in high-precision designs, emphasizing reliability and miniaturization for semiconductor fabrication and medical device applications. Collectively, these regional insights underscore a tripartite market structure in which local policy incentives, supply-chain robustness, and industrial modernization trajectories converge to dictate the pace and profile of high RPM motor adoption.

This comprehensive research report examines key regions that drive the evolution of the High RPM Motor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Giants Shaping the Competitive High RPM Motor Landscape Through Strategic Initiatives

Leading global manufacturers are differentiating their offerings through a combination of advanced technology integration and strategic collaborations. One prominent player has deepened its commitment to electrification by launching a new series of axial flux permanent magnet motors tailored for ultralight electric mobility platforms, partnering with university research centers to refine magnet alloys for enhanced thermal endurance. Another established multinational has expanded its global footprint through joint ventures in North America and Southeast Asia, focusing on localized assembly of three-phase AC induction and liquid-cooled synchronous reluctance motors to serve regional automotive and renewable energy end markets.

Innovators in the brushless DC segment are leveraging sensorless designs to reduce maintenance requirements in factory automation environments, announcing software upgrades that enhance field-oriented control algorithms for smoother torque delivery and lower acoustic noise. At the same time, several mid-tier companies are forging alliances with cloud-based analytics providers to embed real-time performance monitoring into their high RPM motor platforms, offering subscription-based diagnostics that align with Industry 4.0 strategies.

Meanwhile, pure-play motor specialists are investing heavily in process optimization and scale-up of magnet manufacturing, aiming to secure critical raw materials and ensure supply-chain continuity amidst global scarcity. These combined strategic initiatives-spanning R&D alliances, regional partnerships, digital service models, and upstream integration-highlight a competitive arena where technological leadership and supply-chain mastery determine market standing.

This comprehensive research report delivers an in-depth overview of the principal market players in the High RPM Motor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- AEROTECH Inc.

- Baldor Electric Company

- Danfoss A/S

- Emerson Electric Co.

- Kirloskar Electric Company Ltd.

- Mitsubishi Electric Corporation

- Moog Inc.

- Nidec Corporation

- Parker-Hannifin Corporation

- Regal Beloit Corporation

- Rockwell Automation, Inc.

- Siemens Aktiengesellschaft

- WEG S.A.

- Yaskawa Electric Corporation

Actionable Strategic Recommendations for Industry Leaders to Optimize Performance, Resilience, and Sustainable Growth in High RPM Motors

Industry participants should prioritize the development of modular motor architectures that can be swiftly adapted to evolving application profiles. By standardizing key interfaces and leveraging plug-and-play cooling and mounting subsystems, manufacturers can compress development cycles and drive economies of scale across multiple end use segments. In tandem, creating a digital ecosystem that integrates motor telematics, predictive analytics, and remote update capabilities will position suppliers to offer differentiated service contracts and foster customer lock-in through ongoing performance optimization.

Supply-chain resilience must be addressed through diversified sourcing of critical components, especially magnets and power electronics. Establishing multiple regional partnerships and securing strategic raw material off-take agreements will mitigate the effects of trade policy shifts and raw material scarcity. Furthermore, industry leaders should explore captive manufacturing of subassemblies to gain greater control over quality, cost, and lead times. These vertical integration strategies will fortify competitiveness in the face of mounting tariff pressures and logistical uncertainties.

Finally, stakeholders should actively engage in emerging standards consortia and collaborative R&D initiatives to shape interoperability requirements and drive collective innovation. By contributing to cross-industry working groups on motor benchmarking and certification protocols, companies can influence regulatory frameworks, accelerate market acceptance of novel high RPM technologies, and ensure that new designs meet stringent safety and environmental mandates.

Outlining a Rigorous and Transparent Research Methodology Ensuring Data Integrity and Insightful Analysis of the High RPM Motor Market

The foundation of this analysis rests on a blended research approach that combines exhaustive secondary data collection with targeted primary insights. Initially, technical and trade publications, patent databases, and regulatory filings were evaluated to establish historical baselines and identify emergent technology trajectories. Concurrently, financial reports and investor presentations from leading motor manufacturers were examined to map strategic priorities and investment patterns.

To augment these findings, a series of in-depth interviews were conducted with senior executives, research and development directors, and supply-chain managers across diverse regions. These discussions provided first-hand perspectives on tariff impacts, product development challenges, and regional policy influences. Quantitative data was triangulated against publicly available import-export statistics and customs records to validate shifts in trade flows and cost structures.

Finally, all insights were subjected to a rigorous validation protocol that included cross-referencing against independent expert panels and peer academic research. This multi-tiered validation ensures reliability while minimizing bias, delivering a comprehensive and transparent methodological framework that underpins the detailed insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High RPM Motor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High RPM Motor Market, by Product Type

- High RPM Motor Market, by Power Rating

- High RPM Motor Market, by Speed Range

- High RPM Motor Market, by Cooling Type

- High RPM Motor Market, by Mounting Type

- High RPM Motor Market, by Voltage Rating

- High RPM Motor Market, by End Use Industry

- High RPM Motor Market, by Sales Channel

- High RPM Motor Market, by Region

- High RPM Motor Market, by Group

- High RPM Motor Market, by Country

- United States High RPM Motor Market

- China High RPM Motor Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 3180 ]

Consolidating Key Takeaways on High RPM Motor Trends, Challenges, and Strategic Imperatives to Guide Informed Decision-Making

In summary, high RPM motors are poised to drive the next wave of industrial and commercial innovation, underpinned by technological breakthroughs in materials, connectivity, and manufacturing processes. The 2025 US tariff regime has catalyzed supply-chain realignment and heightened focus on domestic capabilities, while segmentation and regional analyses illuminate the nuanced demands shaping product strategies. As industry leaders navigate a complex landscape marked by evolving policy, innovation cycles, and global competition, adaptability and strategic foresight remain paramount.

By leveraging the detailed insights on segmentation, regional dynamics, and competitive initiatives, stakeholders can chart a course toward sustainable growth and operational excellence. The convergence of digitalization, decarbonization, and advanced motor architectures heralds a transformative era-one in which informed decision-making and targeted investments will determine market leadership.

As you integrate these findings into your strategic planning, the imperative is clear: harness the full spectrum of insights to optimize product portfolios, strengthen supply‐chain resilience, and capitalize on emerging opportunities within the high RPM motor ecosystem.

Engage with Ketan Rohom to Unlock Comprehensive High RPM Motor Insights and Empower Strategic Market Decisions with Expert Guidance

We invite you to take decisive action and secure an authoritative resource that will empower your strategic planning and operational decisions. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore bespoke research offerings tailored to your unique requirements. With direct guidance and access to comprehensive data on high RPM motor innovations, regulatory impacts, and competitive positioning, you can drive growth, mitigate risks, and stay ahead of shifting market dynamics.

Connect with Ketan Rohom today to unlock the full potential of the high RPM motor market through detailed insights, customized analyses, and dedicated support that will underpin your next generation of products and market strategies

- How big is the High RPM Motor Market?

- What is the High RPM Motor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?