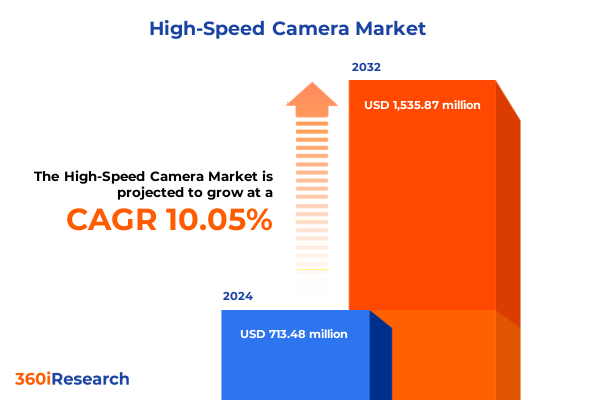

The High-Speed Camera Market size was estimated at USD 784.02 million in 2025 and expected to reach USD 865.27 million in 2026, at a CAGR of 10.08% to reach USD 1,535.87 million by 2032.

Discover How High-Speed Camera Technologies Are Revolutionizing Modern Industries Across Automotive, Scientific Research, Industrial Automation, and Beyond

High-speed camera technology represents a pivotal innovation that is transforming our understanding of phenomena occurring in fractions of a second. From capturing the dynamics of automotive crash tests to unraveling the intricacies of fluid behavior in scientific laboratories, these imaging systems provide the temporal resolution needed to decode complex events with unparalleled clarity. In industries driven by precision and safety, the ability to visualize minute, rapid changes has become indispensable for product development, quality assurance, and breakthrough research.

Recent advancements in sensor technology and processing capabilities have elevated high-speed cameras from niche laboratory tools to essential components across diverse sectors. Enhanced light sensitivity, dynamic range improvements, and accelerated data transfers have expanded the applicability of these systems into challenging environments, such as low-light industrial inspection lines and high-contrast biological imaging setups. As a result, engineers and researchers are now empowered to capture and analyze data at unprecedented frame rates and resolutions, driving deeper insights and more informed decision-making.

Looking ahead, the confluence of increased computational power, compact form factors, and advanced optics is setting the stage for even broader adoption of high-speed cameras. As organizations strive to optimize performance, minimize risk, and unlock new scientific frontiers, these imaging technologies are poised to play a central role in shaping the next wave of innovation across automotive safety, industrial automation, defense programs, and beyond.

Explore the Transformative Technological Shifts Reshaping the High-Speed Camera Landscape With AI Integration and Advanced Sensor Innovations

The high-speed camera industry is undergoing a profound transformation driven by breakthroughs in sensor design and computational imaging. Back-illuminated CMOS sensors have emerged as a leading technology, offering superior light sensitivity and reduced noise levels that make ultra-fast imaging possible even under suboptimal lighting conditions. Moreover, the convergence of powerful on-board processors and artificial intelligence capabilities allows for real-time image analysis, automated event detection, and intelligent data compression, significantly reducing the burden on storage and post-processing workflows.

Compact and portable high-speed camera systems are becoming ubiquitous as manufacturers strive to deliver professional-grade performance in smaller form factors. Innovations in battery-powered operation, wireless data streaming, and sub-microsecond synchronization accuracy enable seamless integration into complex multi-camera setups, industrial production lines, and field-based experiments. These portable solutions empower engineers to capture high-speed phenomena across diverse environments without the constraints of bulky, tethered equipment.

Simultaneously, the synergy between high-speed imaging and the Industrial Internet of Things is unlocking new capabilities for digital twinning and smart manufacturing. Vision-based systems continuously feed real-time data into predictive maintenance algorithms, enabling early fault detection and reducing unplanned downtime. Additionally, emerging digital twin frameworks leverage high-speed camera inputs to create precise virtual replicas of production lines, facilitating advanced performance simulations and operational analytics. This deep integration of imaging, connectivity, and analytics marks a significant shift towards more agile, data-driven industrial ecosystems.

Uncover the Cumulative Impact of Recent United States Tariff Actions on High-Speed Camera Supply Chains Components and Pricing Structures

Trade policy developments in the United States have introduced new cost pressures and supply chain complexities for high-speed camera manufacturers and end users. As of May 2025, the Office of the U.S. Trade Representative announced an extension of exclusions under the China Section 301 tariffs through August 31, 2025, providing temporary relief for select components. However, broader tariff increases on electronic integrated circuits classified under HTS headings 8541 and 8542 took effect on January 1, 2025, raising rates from 25% to 50%, directly impacting image sensors and processing modules used in high-speed cameras.

Simultaneously, the USTR’s statutory review concluded in late 2024 led to new duties on polysilicon and wafer imports from China, further inflating the cost base for semiconductor-based camera components essential to ultra-fast imaging performance. These measures have prompted major manufacturers to adjust pricing strategies; Nikon, for example, announced price increases for its U.S. imaging products as of June 23, 2025, attributing a projected $70 million profit impact to the tariffs.

While these cumulative tariff actions aim to reinforce domestic manufacturing and critical supply chain resilience, they also risk slowing equipment deployment and elevating end-user costs. Industry stakeholders are navigating this environment by seeking alternative sourcing strategies, advocating for targeted duty exclusions, and exploring localized production partnerships to mitigate the financial and operational impacts of ongoing trade measures.

Key Market Segmentation Insights Revealing Variations in High-Speed Camera Adoption by Type Application End User Resolution Frame Rate and Distribution Channels

By type, the high-speed camera market is bifurcated between CCD and CMOS architectures, each offering unique advantages for specialized imaging tasks. CCD sensors, with their high quantum efficiency and low noise characteristics, remain preferred for precise scientific measurements and low-light applications, utilizing frame transfer and interline transfer technologies for rapid exposures. In contrast, CMOS sensors dominate emerging domains through global shutter and rolling shutter designs that facilitate high frame rates, reduced power consumption, and on-chip processing capabilities, broadening their appeal across industrial and automotive use cases.

In terms of application, high-speed cameras serve critical roles in automotive crash testing, capturing milliseconds of impact dynamics to inform safety improvements. Industrial inspection processes rely on these cameras for automotive component screening, electronics quality assurance, and food safety assessments, where defect detection at high throughput is paramount. In more specialized arenas, military surveillance leverages ultra-fast imaging for ballistics analysis, scientific research uses these systems to study fluid dynamics and material behaviors, and sports analysis exploits slow-motion captures to deliver immersive broadcast experiences and performance optimizations.

From an end-user perspective, the aerospace and defense sector demands robust, high-resolution systems to monitor rapid flight events and support engineering validations, while the automotive industry integrates high-speed imaging into design validation and advanced driver assistance system development. Healthcare applications focus on biomechanics and surgical research, and manufacturing facilities embed these cameras within assembly lines for continuous quality control. Research and development institutes push the boundaries of sensor performance, warranting diverse form factors, resolutions, and frame rates to satisfy experimental requirements.

Resolution-based segmentation underscores a spectrum from sub-1 MP sensors, subdivided into under 0.5 MP and 0.5–1 MP classes for ultra-high-speed, low-resolution tasks, to 1–4 MP arrays (1–2 MP and 2–4 MP) for balanced speed and detail, and beyond 4 MP configurations (4–8 MP and greater than 8 MP) where image clarity and measurement accuracy are critical. Frame rate distinctions further delineate solutions that operate below 10,000 FPS-spanning 1,000–5,000 FPS and 5,000–10,000 FPS-for standard motion analysis, and those exceeding 10,000 FPS-covering 10,000–50,000 FPS and above 50,000 FPS-for specialized high-speed events.

Distribution channels vary between direct sales agreements, comprising OEM contracts and project-based engagements, distributor networks involving system integrators and value-added resellers, and online platforms such as manufacturer websites and third-party e-commerce portals, each offering distinct pathways for customer engagement and after-sales support.

This comprehensive research report categorizes the High-Speed Camera market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Resolution

- Frame Rate

- Application

- End User

- Distribution Channel

Critical Regional Insights Highlighting How the Americas Europe Middle East Africa and Asia-Pacific Regions Are Shaping High-Speed Camera Trends

In the Americas, North America leads the global high-speed camera landscape, fueled by robust research and development ecosystems, advanced automotive and aerospace testing facilities, and a thriving entertainment industry. The United States and Canada drive demand through stringent safety regulations, expansive defense programs, and pioneering scientific research initiatives, positioning the region as a hub for innovation and early technology adoption.

Europe, the Middle East, and Africa exhibit a dynamic mix of mature markets and emerging opportunities. Western Europe continues to invest heavily in automotive crash test infrastructures and defense applications, leveraging EU funding programs that support cutting-edge imaging research. In the Middle East and Africa, rapid industrialization and expanding smart city projects are prompting the integration of high-speed cameras into infrastructure monitoring and public safety systems, establishing a pathway for future growth.

Asia-Pacific stands out as an innovation hotspot, driven by the rapid expansion of electronics manufacturing, industrial automation deployments, and major sports broadcasting events. Countries such as Japan, China, and India are advancing domestic imaging technology capabilities, while trade shows like the Asia Photonics Expo highlight the region’s appetite for next-generation high-speed camera solutions. This momentum is underpinned by significant investments in smart factory initiatives and research collaborations that accelerate technology transfer and local production capacity.

This comprehensive research report examines key regions that drive the evolution of the High-Speed Camera market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Insights Spotlighting the Leading High-Speed Camera Innovators and Their Strategic Approaches to Technology and Market Leadership

Vision Research, a subsidiary of AMETEK, leads the industry with its Phantom series, renowned for achieving up to one million frames per second with consistent image fidelity and extensive software support. The company’s strategic focus on vertical integration of sensor and processing technologies enables tailored solutions for scientific research, industrial testing, and media production, reinforcing its position at the forefront of ultra-high-speed imaging.

Photron, headquartered in Japan, differentiates itself through ruggedized, compact designs that excel in harsh environments and high-vibration applications. Its FASTCAM lineup delivers balanced performance between resolution and frame rate, supporting up to 2.1 million frames per second. Photron’s emphasis on continuous product innovation and close collaboration with automotive and aerospace testing partners underscores its role as a pioneer in extreme condition imaging.

Teledyne DALSA’s comprehensive portfolio spans line scan and area scan high-speed cameras, leveraging decades of expertise in industrial imaging. By integrating advanced sensor architectures and customizable software interfaces, the company addresses diverse inspection and automation requirements, from semiconductor wafer inspection to pharmaceutical process monitoring. Teledyne’s strategic presence at major industry exhibitions showcases its commitment to broadening market access and technology adoption.

PCO AG, a German manufacturer specializing in scientific-grade sCMOS cameras, combines low noise performance with precise triggering capabilities, addressing applications such as fluorescence microscopy and particle image velocimetry. The company’s focus on high-precision photon detection and customizable hardware options positions it as a key player in research-intensive fields.

Basler AG, renowned for its industrial camera solutions, brings CMOS-based high-speed options to manufacturing and logistics applications. Basler’s emphasis on seamless integration with machine vision software ecosystems and scalable networking interfaces underscores its strategy to drive automation efficiency and throughput improvements in factory environments.

Additional innovators such as Optronis and Mikrotron in Germany deliver specialized high-resolution and high-frame-rate systems for defense and sports analysis, while Andor Technology and Fastec Imaging introduce portable platforms that cater to field-based experimental setups. These diverse approaches highlight a competitive landscape defined by continuous technological advancement and targeted market specialization.

This comprehensive research report delivers an in-depth overview of the principal market players in the High-Speed Camera market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Vision Technologies GmbH

- AOS Technologies AG

- Automation Technology GmbH

- Basler AG

- Baumer Holding AG

- Camera Control

- DEL Imaging Systems LLC

- DITECT Co., Ltd.

- Fastec Imaging Corporation

- Integrated Design Tools, Inc.

- iX Cameras Inc.

- LaVision GmbH

- Luxel Corporation

- Mega Speed Corporation

- Mikrotron GmbH

- Motion Engineering Company

- NAC Image Technology, Inc.

- OPTRIS GmbH

- Optronis GmbH

- PCE Deutschland GmbH

- Photron Limited

- Shimadzu Corporation

- Vision Research, Inc.

- Ximea GmbH

Actionable Recommendations for Industry Leaders to Capitalize on Emerging High-Speed Camera Innovations and Navigate Evolving Market Dynamics

Industry leaders should prioritize the integration of artificial intelligence and on-board processing capabilities to deliver turnkey solutions capable of real-time event detection and automated data curation, thereby reducing downstream analytics costs and accelerating time to insight. Establishing collaborative research initiatives that explore digital twin frameworks with high-speed camera inputs can further enhance predictive maintenance and process optimization in complex production environments.

To mitigate the financial impact of ongoing tariff pressures, organizations are advised to diversify component sourcing through strategic partnerships with regional manufacturers and to explore partial assembly within free trade zones. This approach can lower duty liabilities while bolstering supply chain resilience against future trade disruptions. Companies should also engage with trade authorities to seek targeted exclusions or temporary relief for critical imaging components.

From a go-to-market perspective, deploying modular distribution strategies that combine direct OEM collaborations with value-added reseller networks and optimized online platforms will maximize market reach. Tailoring service offerings, such as short-term equipment rentals and subscription-based software analytics, can attract emerging end users in research institutes and small-to-medium enterprises. By adopting these recommendations, firms can position themselves to capitalize on evolving market dynamics and sustain competitive advantage.

Robust Research Methodology Outlining Data Collection Primary and Secondary Research Expert Validation and Comprehensive Market Analysis Techniques

The research methodology underpinning this report combines rigorous secondary research with comprehensive primary validation to ensure the highest standards of accuracy and relevance. Secondary data sources include government trade publications, industry association reports, technical journals, and reputable news outlets, which provide foundational context on technology trends and policy developments.

Primary research was conducted through structured interviews with supply chain experts, imaging technology engineers, and end-user representatives across automotive, aerospace, and scientific research domains. This qualitative feedback was triangulated against quantitative data to refine segmentation categorizations and to identify emerging use cases and adoption barriers.

Data analysis involved systematic cross-referencing of tariff schedules, patent filings, and corporate press releases, alongside detailed examinations of product specifications and software capabilities. An expert panel comprising seasoned imaging scientists, trade policy analysts, and manufacturing executives reviewed preliminary findings to validate assumptions and ensure holistic coverage of market dynamics.

Throughout the study, meticulous attention was given to data integrity, with final outputs subjected to stringent quality checks and editorial oversight. This robust approach provides readers with confidence in the insights and recommendations presented, enabling informed strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High-Speed Camera market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High-Speed Camera Market, by Type

- High-Speed Camera Market, by Resolution

- High-Speed Camera Market, by Frame Rate

- High-Speed Camera Market, by Application

- High-Speed Camera Market, by End User

- High-Speed Camera Market, by Distribution Channel

- High-Speed Camera Market, by Region

- High-Speed Camera Market, by Group

- High-Speed Camera Market, by Country

- United States High-Speed Camera Market

- China High-Speed Camera Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3021 ]

Conclusion Synthesizing the Strategic Importance and Future Prospects of High-Speed Camera Technologies Across Diverse Industry Applications

High-speed camera technologies stand at the nexus of innovation, offering unparalleled capabilities for capturing and analyzing phenomena that unfold in microseconds. The convergence of advanced sensor architectures, artificial intelligence integration, and real-time data processing is redefining the boundaries of what these systems can achieve, driving new applications in automotive safety, industrial automation, scientific discovery, and beyond.

As global trade policies continue to evolve, industry participants must remain vigilant in managing cost pressures introduced by tariff actions while exploring strategic partnerships and localized production options. Simultaneously, the diverse market segmentation by type, application, resolution, frame rate, and distribution channel underscores the importance of tailored product offerings to meet distinct end-user requirements.

Regional dynamics further highlight the varied pace of technology adoption, with North America leading in research and industrial use cases, EMEA harnessing regulatory support and defense mandates, and Asia-Pacific accelerating deployment through robust manufacturing and broadcast ecosystems. Competitive intensity among established players-each leveraging unique technological strengths-fuels ongoing innovation, emphasizing the need for continuous R&D investment and agile go-to-market strategies.

In this dynamic environment, organizations that embrace actionable insights, foster cross-sector collaborations, and prioritize customer-centric solutions will be well-positioned to harness the full potential of high-speed imaging. The strategic importance of these technologies will only grow as industries demand ever-greater precision, speed, and automation capabilities.

Take Action to Secure Your Detailed High-Speed Camera Market Research Report Today With Ketan Rohom Associate Director of Sales and Marketing

To gain comprehensive insights into the high-speed camera market, we invite you to secure your copy of the detailed market research report by reaching out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. This report delivers in-depth analysis, expert commentary, and actionable data to guide your strategic decisions in this rapidly evolving industry.

By partnering with Ketan Rohom, you will receive a personalized consultation that outlines how the report’s findings align with your business objectives, including tailored recommendations for technology investments, market entry strategies, and competitive positioning. Don’t miss the opportunity to leverage this exclusive resource to stay ahead of industry trends, optimize your product roadmap, and uncover high-value growth opportunities.

Contact Ketan Rohom today to discuss report customization options, volume licensing, or enterprise-wide access. Act now to ensure your organization is equipped with the intelligence needed to lead in the high-speed camera landscape and capitalize on emerging market dynamics.

- How big is the High-Speed Camera Market?

- What is the High-Speed Camera Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?