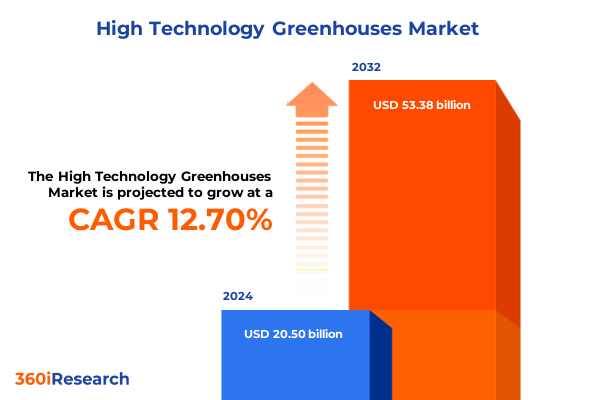

The High Technology Greenhouses Market size was estimated at USD 23.11 billion in 2025 and expected to reach USD 25.86 billion in 2026, at a CAGR of 12.70% to reach USD 53.38 billion by 2032.

Embracing Cutting-Edge Controlled Environment Agriculture to Revolutionize Crop Production and Sustainability in Next-Generation High-Technology Greenhouses

In an era defined by rising global food demand, constrained arable land, and mounting environmental concerns, high-technology greenhouses have emerged as a cornerstone of sustainable agriculture. These controlled environment facilities leverage cutting-edge systems to optimize crop yields, conserve natural resources, and deliver consistent product quality year-round. As the intersection of agricultural science, engineering innovation, and digital transformation, modern greenhouses enable precise manipulation of light, climate, and nutrition to meet the evolving needs of producers and consumers alike.

Against the backdrop of rapid urbanization and supply chain volatility, greenhouse operations offer unparalleled resilience and proximity to end markets. When integrated with sensor networks, automation software, and advanced lighting solutions, these facilities reduce water usage, minimize chemical inputs, and lower energy consumption per unit of output. Consequently, stakeholders across the value chain-from seed suppliers to retailers-are embracing these technologies to balance profitability with environmental stewardship. This report opens by exploring the foundational principles and catalysts that have propelled the high-technology greenhouse sector into its current phase of dynamic growth and strategic importance.

Navigating Unprecedented Technological, Environmental, and Market Transformations Redefining the High-Technology Greenhouse Landscape for Sustainable Agriculture

Over the past decade, the greenhouse industry has undergone transformative shifts driven by technological breakthroughs, changing consumer preferences, and heightened regulatory expectations. Digital platforms now collect vast streams of environmental and operational data, which feed into machine learning models for predictive analytics and automated decision-making. This real-time intelligence has fundamentally altered cultivation strategies, enabling operators to fine-tune microclimates, anticipate pest and disease risks, and optimize nutrient delivery with unprecedented precision.

Concurrently, sustainability imperatives have spurred investment in resource-efficient systems, from closed-loop water recycling to renewable energy integration. Innovations in LED lighting have reduced energy envelopes while tailoring spectral outputs to specific plant growth stages, accelerating photosynthesis and improving crop quality. Meanwhile, the emergence of modular and prefabricated greenhouse structures has accelerated deployment timelines and reduced capital expenditure barriers. Taken together, these shifts are reshaping the competitive landscape, as businesses strive to balance scalability, environmental responsibility, and the quest for premium produce.

Assessing the Cumulative Impact of United States Tariff Measures on High-Technology Greenhouse Materials and Operational Costs through 2025

The cumulative effect of United States tariff measures through 2025 has introduced complex cost dynamics for greenhouse developers and operators. Tariffs imposed on steel and aluminum under Section 232 have elevated the cost of structural frames and glazing support systems, prompting a reevaluation of material sourcing and supplier diversification strategies. Similarly, duties applied to certain Chinese-origin components have impacted the procurement of advanced sensors, control modules, and LED panels, necessitating longer lead times and elevated inventory buffers.

These trade policies have driven more greenhouse projects to explore domestic fabrication and local partnerships, fostering shorter supply chains and increased responsiveness to design changes. Yet, several operators face the challenge of balancing higher upfront capital costs against long-term operational savings achieved through energy-efficient technologies. Moreover, the evolving tariff landscape underscores the importance of agile procurement frameworks and proactive engagement with customs and trade specialists to mitigate potential disruptions.

Unveiling Strategic Insights from Diverse Crop, Cultivation, Technology, End-Use, and Structural Segmentation Spheres in Greenhouse Markets

A nuanced understanding of market segmentation reveals the multifaceted nature of high-technology greenhouse applications. When considered by crop type, the industry addresses the diverse requirements of flowers and ornamentals, where aesthetic uniformity and bloom timing are critical, as well as fruits that demand precise pollination and ripening controls. Herbs and spices thrive under tailored spectral and nutrient regimens, and vegetable cultivation leverages robust climate management to ensure consistent size and texture.

Looking through the lens of cultivation systems, aeroponic setups differentiate themselves with high-pressure and low-pressure atomization techniques that maximize oxygenation and nutrient uptake, while aquaponic designs marry fish and plant production via media-based or NFT approaches, promoting circular resource flows. Hydroponic environments-including deep water culture, ebb and flow, and nutrient film technique-enable soil-free production with strict pH and EC regulation, while soil-based greenhouses deploy raised beds and traditional soil practices to accommodate heirloom crops and consumer preferences.

From a technology standpoint, automation and monitoring frameworks encompass integral control software and sensor technology, feeding into advanced climate control solutions that blend cooling, heating, and ventilation for granular environment modulation. Irrigation systems range from precision drip lines to fine-mist fogging architectures and full-coverage sprinklers, all underpinned by water-recycling protocols. LED lighting advances encompass full spectrum designs for broad plant responses as well as high-intensity and low-intensity fixtures tailored to specific photoperiod strategies.

End-use segmentation delineates commercial farming operations pursuing scale and consistency from educational institutions leveraging live demonstrations to teach horticultural principles, and research and development facilities pushing the boundaries of cultivar innovation. Structural typology further shapes project blueprints, with glasshouses prized for light transmission, plastic and polycarbonate installations favored for cost and insulation performance, and shade houses applied where light diffusion and heat reduction are paramount.

This comprehensive research report categorizes the High Technology Greenhouses market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Crop Type

- Cultivation System

- Greenhouse Technology

- Structure Type

- End Use

Exploring Regional Dynamics and Growth Drivers Across Americas, Europe, Middle East & Africa, and Asia-Pacific High-Technology Greenhouse Markets

Regional dynamics play a pivotal role in shaping demand drivers and technology adoption pathways. In the Americas, a strong emphasis on food safety certifications and retail traceability underpins the growth of greenhouse farming clusters across California’s Central Valley, Florida’s Sunshine State, and Ontario’s greenhouse belt. These operations integrate renewable energy assets and circular water systems to comply with stringent sustainability mandates and maintain proximity to urban centers.

Within Europe, Middle East and Africa, the Netherlands continues to lead with high-tech glasshouse complexes, combining robotics and artificial intelligence to optimize labor efficiency and crop consistency. In the Middle East, arid conditions have accelerated investment in desalination-powered irrigation and climate adaptive structures, while select African markets are at the cusp of greenhouse pilot projects driven by development agencies and public-private partnerships.

Turning to Asia-Pacific, China’s push for agricultural modernization has catalyzed large-scale greenhouse zones, many employing AI-guided controls and integrated pest management. Japan’s research institutions focus on spectral tuning and plant morphology, leveraging compact greenhouse footprints. Australia’s greenhouse sector emphasizes water stewardship and drought-resilient designs, testing innovative moisture retention mediums and solar-assisted climate systems.

This comprehensive research report examines key regions that drive the evolution of the High Technology Greenhouses market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Drivers Shaping the Future of Cutting-Edge High-Technology Greenhouse Solutions and Systems

Leading solution providers and system integrators continue to redefine the boundaries of greenhouse performance. Industry stalwarts in LED lighting have introduced spectrum-adaptive fixtures that dynamically adjust wavelengths to match plant phenology. Automation platform vendors are expanding their cloud-native offerings, integrating AI-driven analytics for anomaly detection and energy optimization. Climate control pioneers are bundling heating, cooling, and air exchange modules with real-time weather integration to minimize manual intervention and ensure environmental stability.

In parallel, irrigation specialists have advanced precision dosing algorithms, enabling micronutrient delivery at the drip-line level and integrating remote diagnostics to prevent blockages. Companies focusing on control software are forging partnerships with sensor manufacturers to deliver turnkey monitoring suites that track humidity, CO2, and leaf temperature. Moreover, certain R&D-centric players are collaborating with universities to develop next-generation crop varieties engineered for shorter photoperiods and higher resource use efficiency, setting the stage for accelerated adoption of novel greenhouse formats.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Technology Greenhouses market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agra Tech, Inc.

- AgraTec Greenhouses Ltd.

- Atlas Manufacturing, Inc.

- Certhon Builders B.V.

- Cravo Equipment Ltd.

- Criterion Greenhouses Ltd.

- Dalsem Complete Greenhouse Projects B.V.

- GGS Structures Inc.

- Greenhouse Megastore

- Growers Supply

- Harnois Greenhouses Inc.

- Ludy Greenhouse Manufacturing Corporation

- Priva Holding B.V.

- Richel Group SA

- Rough Brothers Inc.

- Stuppy Greenhouse Manufacturing Inc.

- Van Der Hoeven Horticultural Projects B.V.

- Vegtech Les Serres R. Perron Inc.

Implementing Strategic Recommendations and Best Practices to Elevate Competitiveness and Sustainability in the High-Technology Greenhouse Ecosystem

In light of evolving market conditions and trade dynamics, industry leaders should prioritize an agile procurement strategy that balances international sourcing with domestic fabrication partnerships. This dual approach safeguards against tariff volatility and supply chain disruptions while unlocking cost savings through localized production efficiencies. Simultaneously, stakeholders are advised to invest in modular greenhouse designs, which streamline deployment timelines and facilitate scalable expansions as demand patterns shift.

Embracing integrated data platforms that harmonize sensor inputs, weather forecasts, and energy consumption metrics will enhance predictive maintenance and reduce operational unpredictability. Cross-functional teams should collaborate on pilot initiatives that test novel irrigation and lighting configurations, with performance outcomes feeding back into controlled trials. Finally, forging alliances with academic and research institutions can accelerate varietal innovation and underpin claims of product differentiation, positioning businesses at the forefront of consumer and regulatory expectations.

Detailing Rigorous Research Methodologies and Analytical Frameworks That Underpin Insights into High-Technology Greenhouse Markets

This analysis draws upon a robust methodological framework, combining primary research with comprehensive secondary data review. Primary insights were derived from interviews with greenhouse operators, technology suppliers, and agronomic experts, alongside surveys measuring adoption rates and operational bottlenecks. These perspectives were triangulated with field visits to operational sites, where on-site measurements and process observations provided ground-truth validation of reported efficiencies.

Secondary research encompassed peer-reviewed journals, technical white papers, and regulatory filings, complemented by manufacturer specifications and technology roadmaps. Trade data and tariff schedules were scrutinized to quantify the impact of international policy measures on component costs and lead times. Analytical models employed scenario analysis to map potential operational outcomes under varying tariff and energy cost trajectories. Rigorous data cleaning protocols and sensitivity testing ensured the integrity of findings and the reproducibility of results.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Technology Greenhouses market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Technology Greenhouses Market, by Crop Type

- High Technology Greenhouses Market, by Cultivation System

- High Technology Greenhouses Market, by Greenhouse Technology

- High Technology Greenhouses Market, by Structure Type

- High Technology Greenhouses Market, by End Use

- High Technology Greenhouses Market, by Region

- High Technology Greenhouses Market, by Group

- High Technology Greenhouses Market, by Country

- United States High Technology Greenhouses Market

- China High Technology Greenhouses Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Perspectives on the Evolution, Challenges, and Opportunities Driving Growth in the High-Technology Greenhouse Industry

As high-technology greenhouses continue to evolve, they represent a nexus of agricultural innovation, environmental stewardship, and economic resilience. The interplay of advanced controls, selective crop genetics, and sustainable resource management is redefining what is possible within controlled environment agriculture. While tariff policies and supply chain complexities pose challenges, they also catalyze strategic realignment toward local partnerships and modular infrastructures that enhance responsiveness.

Looking ahead, the convergence of AI-enabled decision support, renewable energy integration, and precision horticulture will shape the next phase of greenhouse advancement. Key success factors will include the ability to pivot rapidly in response to regulatory shifts, to harness R&D networks for continuous product differentiation, and to maintain an unwavering focus on sustainability metrics. By synthesizing technological prowess with operational agility, industry participants can secure a resilient foothold in a food production landscape marked by uncertainty and opportunity.

Unlock Comprehensive High-Technology Greenhouse Market Intelligence and Strategic Insights with Ketan Rohom to Accelerate Your Decision-Making Today

Embark on a transformative journey with Ketan Rohom, whose expertise in high-technology greenhouse sales and marketing ensures you gain unparalleled insights and actionable data to drive your strategic initiatives. By partnering directly with Ketan, you secure privileged access to comprehensive analysis, in-depth segment evaluations, and region-specific intelligence tailored for decision-makers seeking to optimize their operational efficiency and investment strategies. Accelerate your competitive advantage by commissioning a customized report that decodes the complexities of crop diversification, system integration, and technology adoption in modern greenhouses.

Unlock the potential concealed within advanced climate control, AI-driven monitoring, and precision irrigation practices, all meticulously chronicled in our latest research. Whether your focus lies in enhancing yield quality, reducing resource consumption, or penetrating new end-use segments, this report offers the strategic framework necessary to inform executive decisions with confidence. Reach out to Ketan Rohom today to initiate your access and catalyze growth in the dynamic high-technology greenhouse sector.

- How big is the High Technology Greenhouses Market?

- What is the High Technology Greenhouses Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?