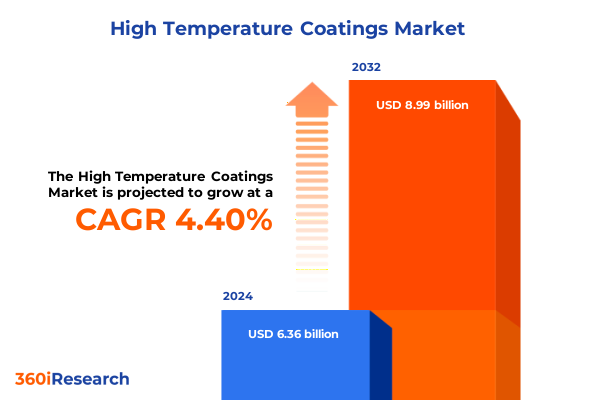

The High Temperature Coatings Market size was estimated at USD 6.64 billion in 2025 and expected to reach USD 6.96 billion in 2026, at a CAGR of 4.40% to reach USD 8.99 billion by 2032.

Unlocking the Strategic Importance of High Temperature Coatings in Enhancing Industrial Performance and Longevity Across Critical Manufacturing Processes

High temperature coatings are advanced functional materials formulated to protect industrial surfaces under extreme thermal conditions while maintaining structural integrity and performance. These specially engineered coatings form robust thermal barriers that resist oxidation, corrosion, and mechanical abrasion at elevated temperatures, thereby safeguarding critical components against premature failure. Their ability to mitigate thermal fatigue and reduce maintenance intervals makes them indispensable in industrial environments where sustained exposure to high heat can compromise operational reliability.

In addition to providing a protective barrier, these coatings contribute to improved energy efficiency by reflecting radiative heat or insulating underlying substrates, which in turn lowers energy consumption and reduces operational costs. Industries ranging from power generation and aerospace to automotive manufacturing increasingly rely on these solutions to meet stringent performance and safety standards. Moreover, as global emphasis on sustainability intensifies, the development of ecofriendly high temperature coatings is gaining momentum, aligning thermal protection capabilities with environmental compliance objectives. Consequently, understanding the evolving role and technological underpinnings of high temperature coatings is essential for stakeholders seeking to optimize asset performance and drive innovation in heat-intensive applications.

Building on decades of material science research, the high temperature coatings landscape has matured into a sophisticated ecosystem where customization, digital application techniques, and integrated performance monitoring converge to deliver tailored solutions. Collaborative efforts between coating formulators, equipment manufacturers, and end users are fostering the co-development of formulations that address application-specific challenges, such as flexible adhesion on complex geometries or rapid curing cycles to support lean manufacturing practices. As industry leaders navigate increasingly competitive markets, a comprehensive appreciation of these coatings’ core functions and benefits provides foundational context for strategic decision making.

Mapping the Emerging Technological and Market Shifts Driving Innovation in High Temperature Coatings for Next Generation Industrial Applications

Recent breakthroughs in material science are reshaping the high temperature coatings landscape, enabling formulations that leverage nanostructured ceramics and hybrid polymer-ceramic matrices to achieve unprecedented thermal stability and mechanical resilience. Nano-reinforced coatings now incorporate precisely engineered particles that distribute heat more evenly and minimize stress concentrations at elevated temperatures. Similarly, the integration of intumescent additives and synergistic resin blends is advancing the development of multifunctional coatings that not only insulate but also self-seal microcracks, thereby extending maintenance cycles. These transformative shifts are underpinned by collaborative research initiatives between academic institutions and industry players, driving the translation of laboratory innovations into scalable industrial solutions.

Moreover, the digital transformation of coating application and monitoring processes is enhancing precision and repeatability. Automated spray and robotic dispensing systems, coupled with real-time thermal imaging and sensor feedback, allow for adaptive control of coating thickness and cure parameters. Predictive analytics and machine learning algorithms are increasingly being deployed to forecast coating degradation, enabling proactive maintenance planning that improves uptime. This convergence of digital technologies is enabling a shift from reactive maintenance to condition-based servicing models that optimize operational efficiency.

Concurrently, sustainability imperatives are driving the reformulation of high temperature coatings to minimize volatile organic compound emissions and incorporate bio-based resins without compromising performance. Regulatory frameworks in leading industrial regions are incentivizing the adoption of low-emission formulations, prompting suppliers to innovate rapidly. As these regulatory and environmental pressures intensify, the coatings industry is poised to undergo a fundamental transformation toward greener, smarter, and more resilient solutions that address the demands of next generation industrial applications.

Assessing the Broad Economic and Supply Chain Repercussions of United States Tariffs on High Temperature Coatings Throughout 2025

Throughout 2025, the imposition of tariffs by the United States on imported high temperature coating constituents has generated wide-ranging repercussions across the industry. These measures, targeting key raw materials such as specialized ceramic powders, metal oxide pigments, and high-performance resins, have increased input costs for both domestic formulators and equipment manufacturers. In response, supply chain stakeholders have reassessed vendor agreements and explored alternative sourcing strategies to mitigate cost pressures. This environment has prompted intensified collaboration between raw material suppliers and coating producers to secure preferential pricing and stable supply commitments.

These tariff-driven cost fluctuations have also prompted a strategic pivot toward onshore manufacturing and localized production hubs. Companies are evaluating the viability of expanding domestic blending and finishing facilities to bypass import duties and reduce lead times. Such re-shoring initiatives, while requiring upfront capital investment, offer the dual benefit of enhanced supply chain control and a more responsive manufacturing footprint. At the same time, some formulators are optimizing their product portfolios by adjusting resin formulations and pigment compositions to leverage domestically available inputs that fall outside tariff classifications.

However, this realignment has introduced new challenges, including navigating complex regulatory requirements for import substitution and managing inventory buffers to address potential offshore supply disruptions. To maintain competitive positioning, industry leaders are embracing greater transparency in procurement practices and leveraging digital supply chain platforms that provide end-to-end visibility. By adopting these strategic measures, organizations can navigate the cumulative effects of tariffs and reinforce operational resilience in a dynamic trade policy environment.

Uncovering the Intricate Product, Resin, Application, and End Use Industry Segmentation Dynamics Shaping Demand Patterns in High Temperature Coatings

Examining the product type landscape reveals distinct performance attributes and application priorities. Aluminum based coatings are prized for their reflective properties, making them well suited for applications where radiative heat loss must be minimized. In contrast, ceramic based formulations offer superior temperature resistance and chemical inertness, catering to environments characterized by aggressive atmospheres. Intumescent coatings provide an active defense by expanding under heat to form an insulating char layer, while mica based systems combine flexible adhesion with good heat dissipation. Silicone based coatings offer outstanding thermal shock resistance and weather durability, whereas zinc based variants excel in corrosion protection at moderate high temperatures.

Resin chemistry further differentiates market offerings, with acrylics delivering rapid cure cycles and ease of application, and epoxy systems standing out for their chemical resistance and adhesion to metallic substrates. Polyester resins balance cost and performance for general industrial settings, whereas polyimide coatings exhibit exceptional thermal endurance and insulating capabilities for demanding high temperature scenarios. Silicone resins, meanwhile, maintain structural integrity across a broad temperature range, supporting continuous exposure applications.

Application segmentation highlights the diversity of operational requirements. Coatings for chimneys and stacks are optimized for flue gas contact and corrosion mitigation, while exhaust system solutions emphasize thermal fatigue and vibration resistance. Furnace components such as melting furnaces, recuperators, and reheating furnaces demand tailored chemistries to withstand cyclic heating. Heat exchangers and steam boilers operate under high pressure and temperature regimes that necessitate robust adhesion and thermal conductivity, and water treatment equipment coating solutions must resist chemical attack in high temperature aqueous environments.

End use industries shape demand drivers through distinct performance expectations. In aerospace, commercial, defense, and maintenance operations require lightweight, thermally efficient coatings that contribute to fuel savings and reliability. Automotive applications span original equipment manufacturers and aftermarket services, with emphasis on rapid curing and cost efficiency. The metal processing sector relies on coatings that protect furnaces and rolling mill components. The oil and gas industry across upstream, midstream, and downstream operations demands corrosion and heat resistant systems for pipelines and processing facilities. Finally, power generation in nuclear, renewable, and thermal segments depends on coatings that ensure thermal stability, regulatory compliance, and long-term asset integrity.

This comprehensive research report categorizes the High Temperature Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Resin Type

- Application

- End Use Industry

Evaluating Regional Performance Trends and Growth Drivers of High Temperature Coatings Across the Americas, EMEA, and Asia Pacific Landscapes

The Americas region encompasses a mature industrial base, strong presence of end use sectors such as aerospace and automotive, and an established aftermarket services network. North American regulatory frameworks and sustainability mandates are catalyzing the adoption of low-VOC and energy-efficient coating solutions. Meanwhile, Latin America’s growing investments in infrastructure and power generation projects are expanding opportunities for protective coatings that extend equipment lifespan in harsh environmental conditions. This blend of market maturity and emerging development projects creates a diverse demand profile that coatings suppliers must navigate through tailored product portfolios and strategic partnerships.

In the Europe, Middle East and Africa landscape, stringent environmental regulations and decarbonization targets have elevated the importance of ecofriendly formulations. European initiatives to limit greenhouse gas emissions are spurring innovation in thermal barrier and reflective coatings, particularly for renewable energy infrastructure. The Middle East’s oil and gas driven investment cycle continues to underpin demand for high temperature corrosion resistant systems, while African industrialization and mining projects present new growth avenues. The regional complexity of regulatory and geopolitical factors necessitates flexible supply chain strategies and localized technical support.

Asia Pacific remains the fastest evolving market, driven by rapid industrial expansion in countries such as China, India, and Southeast Asia. The region’s aggressive infrastructure development enhances demand for high performance coatings in power plants, petrochemical facilities, and manufacturing hubs. Concurrently, technological advancements in local coating production and rising consumer awareness of environmental standards are fostering an increasingly competitive environment. Suppliers are responding by establishing regional R&D centers and forging alliances with local distributors to accelerate market penetration and cater to diverse application needs.

This comprehensive research report examines key regions that drive the evolution of the High Temperature Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Advancing High Temperature Coatings Technologies and Competitive Positioning in the Global Market

Leading companies are intensifying research and development efforts to deliver next generation high temperature coatings with enhanced performance characteristics such as extended thermal cycles, chemical resistance, and self-healing capabilities. These organizations are leveraging advanced materials science, including proprietary nanocomposites and functional additives, to differentiate product portfolios. Investment in pilot plants and specialized testing facilities underscores a commitment to validating new formulations under real-world conditions prior to full-scale commercialization. Collaboration with academic laboratories and joint venture partnerships accelerates the innovation pipeline and drives cost efficiencies in raw material utilization.

Strategic collaborations and mergers are reshaping the competitive landscape as companies seek to expand technical capabilities and geographic reach. Joint development agreements with pigment producers and resin manufacturers enable integrated supply models that optimize quality control and reduce lead times. Mergers and acquisitions among mid-tier suppliers are consolidating fragmented segments, creating entities with broader application expertise and financial scale. At the same time, alliances with technology providers are facilitating the adoption of digital application and monitoring solutions.

To strengthen customer engagement, these players are embedding technical support services alongside product offerings, providing tailored application guidance, troubleshooting assistance, and performance benchmarking tools. Digital platforms that offer remote asset monitoring and predictive maintenance insights are becoming integral to service portfolios. While established giants maintain market leadership through comprehensive global networks, emerging specialized firms are carving niches by addressing underserved applications and pioneering bespoke solutions for high-stakes industrial environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Temperature Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AGC Inc.

- Akzo Nobel N.V.

- Aremco

- Asian Paints Limited

- Axalta Coating Systems LLC

- BASF SE

- Belzona International Ltd

- Carboline Company

- Chemco International Ltd

- Chugoku Marine Paints Ltd.

- Daikin Industries Ltd.

- Diamond Vogel Paints

- General Magnaplate Corporation

- Hempel A/S

- Henkel AG & Co. KGaA

- Jotun A/S

- Kansai Paint Co. Ltd.

- KCC Corporation

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- Weilburger Coatings GmbH

Crafting Targeted Strategic and Operational Recommendations to Propel Market Leadership and Innovation in High Temperature Coatings Industry

To achieve sustained competitive advantage, industry leaders should prioritize the development of sustainable coating formulations that align with evolving environmental regulations and customer expectations for low-emission products. Investing in bio-based resin alternatives and low-VOC chemistries can enhance brand reputation and facilitate market access in regions with stringent environmental mandates. Simultaneously, optimizing process efficiency through digital coating application systems and real-time quality control will streamline operations and reduce waste generation.

Building supply chain resilience is imperative in the face of trade policy uncertainties and raw material volatility. Organizations should evaluate strategic partnerships with domestic suppliers, consider onshore blending capacity, and implement supplier diversification strategies that mitigate disruption risks. Employing digital procurement platforms can increase transparency and agility in response to market fluctuations.

Embracing digital integration across the value chain can unlock new service models. Real-time sensor data on coating performance, coupled with predictive maintenance analytics, enables clients to anticipate coating degradation and plan maintenance windows proactively. Leveraging these insights can foster deeper customer relationships and generate recurring service revenues. Furthermore, fostering talent through specialized training programs and cross-functional teams will ensure a skilled workforce capable of driving innovation and responding to technical challenges.

Finally, forging collaborative partnerships with end users and research institutions can accelerate innovation. Co-development projects that address application-specific needs will enhance solution relevance and expedite time-to-market. By aligning R&D priorities with strategic customer pain points, companies can differentiate offerings and capture high-value opportunities in critical industrial sectors.

Detailing the Comprehensive Research Methodology Employed for Rigorous Data Collection, Analysis and Validation in High Temperature Coatings Market Intelligence

This market intelligence effort was structured around a rigorous combination of secondary and primary research methodologies to ensure comprehensive coverage and data integrity. The secondary research phase comprised an extensive review of industry publications, technical journals, patent filings, and regulatory documents to map the evolution of high temperature coating technologies and performance benchmarks. Publicly available trade association reports and government regulatory notices provided contextual insights into sustainability requirements and regional compliance frameworks.

Primary research was conducted through structured interviews with key industry stakeholders, including coating formulators, end users, equipment manufacturers, and raw material suppliers. An expert advisory panel convened senior scientists and application engineers to validate emerging trends and technical performance attributes. These qualitative inputs were supplemented by site visits to production facilities and coating application centers to observe process workflows and quality control measures firsthand.

Data triangulation and analysis were achieved through cross verification of secondary findings with primary insights, ensuring consistency and reliability. Quantitative data points relating to material performance, operational parameters, and application cycles were benchmarked across multiple sources to identify consensus trends. A systematic coding framework was employed to categorize qualitative feedback and derive actionable insights.

Regional case studies were incorporated to capture market nuances in the Americas, EMEA, and Asia Pacific. Scenario analysis and supply chain mapping exercises further illuminated strategic considerations for manufacturers and end users. The result is a validated, multidimensional view of the high temperature coatings landscape that underpins the strategic recommendations outlined herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Temperature Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Temperature Coatings Market, by Product Type

- High Temperature Coatings Market, by Resin Type

- High Temperature Coatings Market, by Application

- High Temperature Coatings Market, by End Use Industry

- High Temperature Coatings Market, by Region

- High Temperature Coatings Market, by Group

- High Temperature Coatings Market, by Country

- United States High Temperature Coatings Market

- China High Temperature Coatings Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Insights and Strategic Imperatives to Inform Decision Making and Foster Sustainable Growth in the High Temperature Coatings Sector

The high temperature coatings industry is navigating a period of dynamic evolution driven by advanced material developments, digital transformation, and sustainability imperatives. Key insights underscore the critical need for multifunctional formulations that not only withstand extreme thermal and chemical stresses but also contribute to energy efficiency and emissions reduction. Simultaneously, trade policy shifts and tariff impacts are prompting supply chain realignments that favor onshore production and localized partnerships to mitigate cost pressures.

Segmentation analysis reveals differentiated performance requirements across product types, resin chemistries, applications, and end use industries, highlighting the importance of targeted solution portfolios. Regional market dynamics further illustrate that while mature markets demand regulatory-compliant, low-emission coatings, emerging economies are focused on cost-effective durability and rapid infrastructure deployment. The competitive landscape is characterized by a dual track of large integrated suppliers investing in global R&D and specialized firms delivering niche solutions.

Stakeholders are advised to act decisively on strategic initiatives that balance innovation, operational efficiency, and sustainability. By embracing digital application technologies, reinforcing supply chain resilience, and pursuing collaborative development partnerships, industry players can position themselves to capture growth opportunities and address evolving customer requirements. These imperatives form the foundation for long-term value creation and market leadership in a sector poised for continued transformation.

Partner with Ketan Rohom to Unlock In-Depth Market Intelligence and Drive Strategic Success in High Temperature Coatings Investments

To access in-depth analysis, detailed segmentation insights, and strategic recommendations tailored to the high temperature coatings sector, engage with Ketan Rohom, Associate Director of Sales and Marketing. His expertise and guidance can help you navigate complex market dynamics and identify high-impact growth opportunities. By partnering with this seasoned leader, you will benefit from a personalized consultation that aligns research findings with your organization’s strategic objectives.

Leveraging the full report enables you to capitalize on emerging trends, optimize your product development roadmap, and refine your go-to-market strategies for critical industrial applications. The comprehensive intelligence package includes regional case studies, supply chain assessments, and technology trend overviews that equip you with the insights needed to make informed decisions. Schedule a discussion to explore how this research can support your business goals and enhance your competitive positioning.

Take the next step in fortifying your market strategy and ensuring operational excellence. Connect directly to arrange a briefing, secure your customized research package, and unlock targeted support designed to accelerate your success in the demanding field of high temperature coatings.

- How big is the High Temperature Coatings Market?

- What is the High Temperature Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?