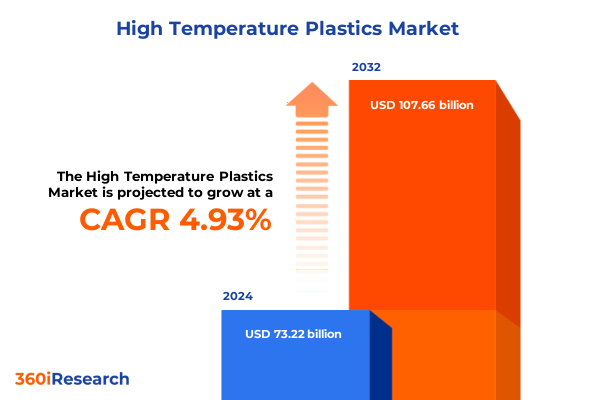

The High Temperature Plastics Market size was estimated at USD 76.75 billion in 2025 and expected to reach USD 80.46 billion in 2026, at a CAGR of 4.95% to reach USD 107.66 billion by 2032.

Unveiling the Strategic Imperative of High Temperature Plastics Driven by Surging Demand for Lightweight, Heat-Resistant Solutions in Critical Industries Worldwide

The high temperature plastics industry is at an inflection point as manufacturers across aerospace, automotive, and electronics seek materials that balance exceptional thermal stability with weight reduction. Rising fuel efficiency mandates and emissions targets have intensified the shift from traditional metal alloys to polymers engineered for continuous service in excess of 200 °C. Contemporary jetliner production illustrates this dynamic: both Airbus and Boeing are integrating durable thermoplastic composites to streamline assembly and reduce curing times, laying groundwork for monthly output rates nearing 100 aircraft. Simultaneously, electrification in North American light vehicle assembly is accelerating, even as overall production dips in anticipation of new trade measures and evolving consumer preferences. These developments underscore the necessity for high temperature plastics that can meet performance thresholds, withstand harsh under-the-hood environments, and contribute to lightweight architectures.

Moreover, the electronics sector’s miniaturization trend and the advent of 5G infrastructure have spurred demand for polymers with superior dielectric properties and heat management capabilities. Emerging applications in semiconductor packaging and power electronics require materials that resist thermal fatigue and chemical exposure while facilitating design complexity. In parallel, the oil and gas industry continues to rely on thermally stable components for downhole tools and sealing systems, driving innovation in formulations that can endure extreme pressures and corrosive media. Collectively, these drivers are reshaping market priorities and reinforcing the strategic importance of high performance polymers in next-generation manufacturing.

Navigating the Paradigm Shifts Reshaping High Temperature Plastics Through Technological Innovation and Agile Supply Chain Strategies

Technological breakthroughs are redefining how high temperature plastics are formulated and processed, opening new avenues for customization and performance enhancement. At the forefront, high-performance polymer families such as PEEK, PEI, PPS, and PPSU are benefiting from advanced catalyst systems and copolymerization techniques that deliver improved crystallinity and enhanced chemical resistance. Additive manufacturing-particularly layer-by-layer fusion methods adapted for semi-crystalline thermoplastics-enables complex geometries that were once impractical with injection molding, accelerating the prototyping process and reducing time to market.

Simultaneously, supply chain strategies are becoming more agile and regionalized. Manufacturers are prioritizing nearshoring initiatives to mitigate lead time volatility and raw material cost spikes tied to global logistics disruptions. This shift is complemented by strategic partnerships between resin producers and tooling specialists to secure capacity for extrusion, compression molding, and injection processes. Environmental considerations are also coming to the fore as circular economy principles drive recycling and reuse programs for engineering plastics. These collective shifts illustrate a landscape in which technological innovation and supply chain resilience converge to enhance competitive advantage in the high temperature plastics sector.

Assessing the Far-Reaching Effects of 2025 United States Trade Measures on High Temperature Plastics Supply Chains and Cost Structures

In early March 2025, the United States implemented a suite of tariffs affecting imports from Mexico and Canada, imposing a uniform 25 percent surcharge on goods that do not meet USMCA rules of origin. Concurrently, tariffs on certain energy and potash imports from Canada and Mexico were set at a lower rate of 10 percent, while existing duties on Chinese goods rose to 20 percent. This multifaceted approach, justified as a measure to curb fentanyl trafficking and illegal migration, has already triggered a notable stock market correction and elevated concerns among manufacturers.

Plastics industry associations across North America have flagged potential disruptions, cautioning that the new duties will inflate costs for critical resin imports, capital equipment, and molded components that traverse cross-border supply chains. For high temperature plastics, which often rely on specialty monomers sourced from Canada and critical additives from Mexico, the tariffs translate into higher input costs and compressed margins. As a result, many processors are re-evaluating supplier contracts, exploring domestic alternative sources, and passing through partial cost increases to end users. In the long term, these measures are expected to drive deeper localization of polymer compounding and downstream manufacturing, fundamentally altering the economics of high temperature plastics production in North America.

In-Depth Analysis of Market Segmentation Revealing Material, Industry, Technology and Format Dynamics in High Temperature Plastics

Insights derived from the examination of material, industry, technology, and format segments reveal nuanced dynamics that are shaping investment and innovation priorities. When segmented by material type, PEEK continues to lead because of its unmatched combination of thermal endurance and mechanical integrity, while growing interest in PEI, PPA, PPS, and PSU reflects diverse performance requirements across sectors. Within end use industries, aerospace and defense segments are integrating high temperature plastics into electrical systems, interior cabin components, and primary structures, and the automotive sector is adopting these materials beneath the hood, in exterior body panels, in cockpit interiors, and within advancing electrical architectures. Meanwhile, the electrical and electronics segment is driving demand for connectors, insulators, and semiconductor handling tools, and the healthcare field is leveraging implants, medical devices, and surgical instruments that benefit from sterilization compatibility. Industrial machinery purchasers are specifying gears, bearings, pumps, compressors, valves, and fittings made from heat-stable polymers to enhance equipment longevity, while the oil and gas sector applies these compounds in downhole tubulars, pipeline assemblies, and high-performance seals.

Processing technology also exerts a significant influence. Additive manufacturing is gaining traction for low-volume, high-complexity parts, and compression molding remains a preferred route for dimensional stability in large components. Extrusion processes are tailored to produce continuous profiles and films, and injection molding persists as the workhorse method for precision, high-volume production. Product format choices-ranging from films and sheets to pellets and powders-further determine downstream processing flexibility, supply chain logistics, and recycling potential. This layered segmentation underscores the importance of aligning material selection and processing method with application demands to maximize performance and cost efficiency.

This comprehensive research report categorizes the High Temperature Plastics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Processing Technology

- Product Format

- End Use Industry

Comparative Regional Perspectives Highlighting Distinct Opportunities and Challenges for High Temperature Plastics Across Global Markets

Regional dynamics in the high temperature plastics market present diverse opportunities and challenges. In the Americas, established manufacturing hubs in the United States and Canada are coping with trade policy shifts and shifting demand in automotive production, while Latin American initiatives are exploring localized polymer compounding to serve burgeoning infrastructure projects. Moving eastward, the Europe, Middle East & Africa region combines longstanding aerospace and automotive clusters with growing defense investments and energy diversification programs, particularly in the Middle East, where polymer-based solutions are increasingly specified for offshore and desert applications. Regulatory harmonization across the European Union and Gulf Cooperation Council is supporting standardized material approvals and encouraging investment in recycling infrastructure.

In the Asia-Pacific region, substantial capacity additions by resin producers and downstream converters continue to shorten lead times, enabling rapid turnaround for PEEK, PEI, PPA, PPS, and PSU across consumer electronics, 5G telecommunications, and electric vehicle battery enclosures. Government-sponsored industrial policies in China, South Korea, and Japan are fostering vertical integration and advanced research in polymer chemistry, while Southeast Asian plants are emerging as competitive sites for high-volume extrusion and injection molding. Collectively, these regional insights illustrate how geopolitical context, infrastructure investment, and policy frameworks converge to influence market growth and supply chain architecture globally.

This comprehensive research report examines key regions that drive the evolution of the High Temperature Plastics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading High Temperature Plastics Manufacturers and Innovators Shaping Market Direction Through Strategic Initiatives and Partnerships

Major players in the high temperature plastics arena are intensifying their focus on innovation, capacity expansion, and strategic partnerships to secure market leadership. Established chemical conglomerates are investing in new reactor lines and compounding facilities to introduce next-generation PEEK and PEI grades with enhanced fatigue resistance. Collaborations between resin suppliers and additive manufacturing equipment manufacturers are facilitating certification programs for aerospace-qualified thermoplastic filaments and powders. Joint ventures in Asia and North America aim to localize production of resin precursors and specialty additives, reducing dependency on long-haul logistics and absorbing tariff-related cost pressures.

Concurrently, technology-centric entrants and niche specialists are carving out positions in medical and downhole applications, developing ultra-pure formulations for biocompatible implants and high-modulus compounds capable of withstanding geothermal conditions. Many of these companies are forging alliances with research institutions to advance catalyst technologies and exploring licensing agreements to expedite market entry. These strategic initiatives reflect a competitive landscape where scale advantages, innovation pipelines, and regional agility determine the ability to meet evolving customer requirements and regulatory standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the High Temperature Plastics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- BASF SE

- Celanese Corporation

- DIC Corporation

- DuPont de Nemours, Inc.

- Ensinger GmbH

- Evonik Industries AG

- Huntsman Corporation

- Mitsubishi Chemical Corporation

- Saudi Basic Industries Corporation

- Solvay S.A.

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- Victrex plc

- Wacker Chemie AG

Actionable Strategic Imperatives for Industry Leaders to Capitalize on High Temperature Plastics Growth and Mitigate Emerging Market Risks

To capitalize on emerging opportunities in high temperature plastics, industry leaders should pursue a dual approach of innovation acceleration and supply chain diversification. Investing in modular production lines that can switch rapidly between semi-crystalline and amorphous polymer grades will enable responsiveness to shifting end user specifications. Simultaneously, cultivating strategic alliances with upstream monomer producers and downstream system integrators can secure preferential capacity allocations and foster co-development of tailored formulations.

Additionally, adopting circular economy principles-such as closed-loop recycling for post-industrial scrap and collaborating with OEMs on end-of-life recovery programs-will address sustainability mandates and differentiate brands in environmentally conscious markets. Engaging proactively with regulatory bodies to influence material standards and participating in cross-industry consortia will also help shape favorable policy outcomes. Finally, leveraging digital twins and advanced analytics to optimize process parameters and predict performance under thermal stress can reduce trial cycles and accelerate product qualification. This integrated strategy will empower companies to mitigate cost headwinds, navigate trade complexities, and sustain leadership in the high temperature plastics domain.

Rigorous Methodological Framework Underpinning Comprehensive Analysis of High Temperature Plastics Market Insights and Recommendations

This analysis is grounded in a multi-stage research framework combining qualitative and quantitative approaches. Primary research comprised in-depth interviews with polymer scientists, processing equipment engineers, and procurement executives across aerospace, automotive, electronics, and energy sectors. These engagements provided firsthand insights into material performance requirements, supply chain constraints, and application-specific challenges.

Secondary research involved the review of industry publications, technical standards, and regulatory guidelines, supplemented by analysis of public financial reports and patent filings to map innovation trajectories and capacity developments. Data triangulation methodologies were applied to validate key findings, ensuring consistency across diverse sources. Finally, internal quality checks and peer reviews were conducted to guarantee analytical rigor and objectivity, yielding a comprehensive view of the high temperature plastics market landscape and supporting robust strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High Temperature Plastics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High Temperature Plastics Market, by Material Type

- High Temperature Plastics Market, by Processing Technology

- High Temperature Plastics Market, by Product Format

- High Temperature Plastics Market, by End Use Industry

- High Temperature Plastics Market, by Region

- High Temperature Plastics Market, by Group

- High Temperature Plastics Market, by Country

- United States High Temperature Plastics Market

- China High Temperature Plastics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Synthesis Reinforcing the Strategic Importance of High Temperature Plastics in Addressing Next-Generation Performance Requirements

The high temperature plastics sector stands at the nexus of performance innovation and market complexity, driven by the convergence of stringent thermal requirements, lightweighting goals, and evolving supply chain paradigms. Technological advancements in polymer formulation and processing are enabling broader application across aerospace, automotive, electronics, healthcare, and energy industries, while trade policy shifts and sustainability imperatives are redefining cost structures and investment priorities. By synthesizing segmentation insights, regional dynamics, and competitive strategies, this executive summary underscores the critical importance of aligning material science innovations with agile supply chain and regulatory strategies. This comprehensive perspective serves as a strategic compass for stakeholders seeking to harness the transformative potential of high temperature plastics in next-generation applications.

Engage with Ketan Rohom to Access Exclusive High Temperature Plastics Market Research Insights and Drive Strategic Decision-Making

To explore in-depth analysis, strategic insights, and actionable recommendations tailored for high temperature plastics, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the market research report and gain the competitive intelligence necessary for informed decision-making.

- How big is the High Temperature Plastics Market?

- What is the High Temperature Plastics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?