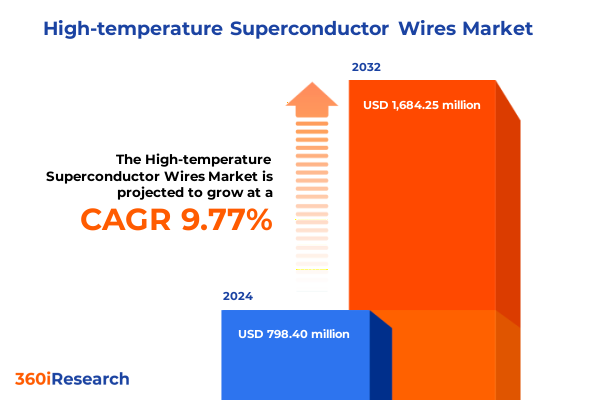

The High-temperature Superconductor Wires Market size was estimated at USD 873.29 million in 2025 and expected to reach USD 956.17 million in 2026, at a CAGR of 9.83% to reach USD 1,684.25 million by 2032.

Advancements in High-Temperature Superconductor Wires Set to Transform Energy Transmission Drive Renewable Infrastructure Innovations and Quantum Computing Progress

The landscape of power transmission and advanced technology is undergoing a profound transformation driven by the emergence of high-temperature superconductor wires. These innovative conductors, operating at temperatures significantly above those required for traditional superconductors, are catalyzing a paradigm shift in the way energy is transmitted, stored, and utilized across critical sectors. As global infrastructure demands continue to surge, the adoption of high-temperature superconductor wires offers a compelling solution to longstanding challenges associated with energy losses, system efficiency, and grid stability.

In recent years, substantial advancements in material science, cryogenic cooling, and manufacturing techniques have accelerated the transition from laboratory-scale demonstrations to commercially viable applications. This evolution reflects a maturation of core technologies, as research institutions and industry consortia collaborate to optimize conductor architectures, enhance critical current densities, and develop scalable production methods. Consequently, stakeholders across the energy, medical, transportation, and electronics industries are exploring integration pathways that promise to redefine performance benchmarks and reduce operational costs.

Moreover, the strategic impetus for decarbonization and resilience in power systems has intensified investment in high-temperature superconductor infrastructure. Grid operators and utilities are evaluating pilot projects for fault current limiters, superconducting cables, and energy storage devices that leverage these advanced wires. In parallel, technology innovators are harnessing their unique properties to enable compact, high-field magnets for medical imaging and next-generation computing platforms. Thus, the introduction of high-temperature superconductor wires marks a new era in which energy efficiency and system compactness converge to unlock transformative applications.

As this report unfolds, it will explore the key drivers, barriers, and technological milestones shaping the high-temperature superconductor wire market, comprehensively analyzing how these conductors are set to revolutionize global energy architecture and advanced technology ecosystems.

Emerging Developments in Material Science and Manufacturing Processes Redefining the High-Temperature Superconductor Wire Landscape and Supply Chains

The high-temperature superconductor wire sector is experiencing a wave of transformative shifts fueled by breakthroughs in material formulations and manufacturing processes. Notably, tailored chemical compositions and doping strategies are delivering substantial improvements in critical temperature and current-carrying capacity, enabling wires to operate reliably at temperatures accessible with liquid nitrogen cooling. These scientific innovations are complemented by enhanced fabrication techniques such as advanced tape casting, continuous deposition, and precision winding, which together are driving down production costs and increasing throughput.

Furthermore, collaborative research frameworks among national laboratories, universities, and private enterprises are fostering a convergence of expertise that accelerates commercialization timelines. This cooperative ecosystem is nurturing a pipeline of next-generation wire architectures, including textured substrates and multilayer coatings, designed to optimize performance under high magnetic fields. Simultaneously, digital manufacturing tools, such as real-time process monitoring and machine learning–driven quality control, are ensuring consistent product reliability at scale.

In addition, the maturing supply chain for precursor materials, including rare earth elements and specialized alloys, is enhancing the industry’s ability to support large-scale deployments. Supplier diversity initiatives and strategic partnerships are mitigating risks associated with single-source dependencies, thereby strengthening overall supply chain resilience. As a result, energy providers can plan grid modernization projects with greater confidence, while medical and transportation sectors gain access to superconducting components that were previously limited to research environments.

Consequently, these advancements collectively reshape the competitive landscape, lowering barriers to entry and fostering an environment ripe for disruptive applications. With these shifts in motion, industry participants must adapt to evolving technology benchmarks and align strategic investments with emerging manufacturing and material science trends.

Assessing the Multiple Effects of 2025 United States Tariffs on Supply Chains Production Costs and Innovation Trajectories in High-Temperature Superconductor Wires

Effective January 1, 2025, the United States implemented enhanced Section 301 tariffs on select advanced materials imported from China, including specialized wafers and polysilicon at 50 percent and certain tungsten products at 25 percent, signaling a broader strategic shift in trade policy and supply chain prioritization. These tariff increases are part of a statutory four-year review cycle, aiming to reinforce critical supply chains and support domestic production investments under the clean energy transition framework. Besides polysilicon and tungsten, additional tariff hikes of up to 50 percent on semiconductors will affect components integral to superconductor wire manufacturing, raising production costs for import-dependent firms.

In response to these measures, manufacturers are recalibrating sourcing strategies, accelerating efforts to localize precursor material production, and deepening engagement with domestic suppliers. This shift is also stimulating government-industry collaborations to expand domestic manufacturing capacity, supported by federal incentives and research grants targeting scalable conductor fabrication. Consequently, while short-term cost pressures have emerged, the policy environment is fostering a more resilient ecosystem for high-temperature superconductor wire value chains.

Moreover, these tariff adjustments have prompted a revaluation of global partnerships, as stakeholders seek to diversify import origins beyond China. Regions such as Southeast Asia and Latin America are emerging as alternative suppliers for key raw materials and specialized components, enabling companies to balance cost, quality, and geopolitical risk. At the same time, strategic stockpiling and multi-year supply agreements are mitigating volatility in input costs and ensuring continuity of production pipelines.

Ultimately, the cumulative impact of the 2025 tariffs is catalyzing a strategic realignment across the superconductor wire industry, where the pursuit of supply chain sovereignty intersects with innovations in domestic manufacturing and material science.

Critical Segmentation Perspectives Revealing Dynamics of Superconductor Types Applications Capacities and Cooling Methods Driving Market Direction

Insights into market dynamics become richer when viewed through the lens of key segmentation parameters that shape adoption patterns and technology maturity. Based on superconductor type, distinctions among first generation BSCCO conductors, iron pnictide alloys, magnesium diboride compositions, and second generation YBCO tapes reveal a spectrum of performance benchmarks. Each class balances critical temperature thresholds, current density capabilities, and cost profiles, influencing selection for specific industrial and research applications.

Moreover, by application domain, superconducting wires are enabling breakthroughs in electronics, driving miniaturization and power efficiency in components. In energy storage systems, these conductors are integrated into next-generation magnetic energy storage units to boost reliability and reduce footprint. Medical imaging devices leverage high-field magnets constructed from specialized wires for sharper diagnostics and enhanced patient throughput. Additionally, superconducting cables are progressively transforming power transmission infrastructure, while research instruments demand ultra-stable fields for cutting-edge scientific exploration. Transportation motors equipped with superconducting windings deliver higher torque densities and lighter powertrains.

Further differentiation emerges when considering current capacity ranges. Capacity brackets from up to one kiloampere to one–five kiloamperes, and above five kiloamperes, cater to diverse use cases, from laboratory prototypes to utility-scale deployments. Projects requiring concentrated power delivery increasingly adopt wires rated above five kiloamperes, while lower-capacity solutions continue to serve experimental and light commercial systems.

Finally, cooling method segmentation underscores the importance of thermal management strategies. Cryocooled systems, with closed-loop refrigeration cycles, offer precise temperature control for high-performance applications, whereas liquid nitrogen cooling presents a cost-effective alternative for large-scale power infrastructure. Understanding these intersecting segmentation dimensions is essential for aligning product development roadmaps and go-to-market strategies with evolving end-user requirements.

This comprehensive research report categorizes the High-temperature Superconductor Wires market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Manufacturing Technology

- Cooling Method

- End-User

Comparative Regional Analyses Highlighting Demand Drivers Regulatory Environments and Infrastructure Readiness Across Americas Europe Middle East Africa and Asia Pacific

Regional analyses of the high-temperature superconductor wire market uncover distinct demand drivers, policy environments, and infrastructure readiness across key global territories. In the Americas, significant investments in grid resilience and renewable energy integration serve as the primary catalyst for superconducting cable adoption. Pioneering utility projects and fault current limiter installations exemplify early demonstrations, supported by federal and state-level incentives aimed at modernizing aging transmission networks.

In contrast, Europe, the Middle East, and Africa present a multifaceted landscape where European research institutions and energy conglomerates lead innovation initiatives. Collaborative pilot programs for superconducting magnetic energy storage and public-private partnerships for medical imaging infrastructure underscore a highly regulated yet well-funded environment. Meanwhile, Middle Eastern nations are exploring superconductor applications to optimize efficient delivery of power across vast desert grids, and African markets are evaluating niche deployments in mining and resource extraction sectors.

Asia-Pacific emerges as the most dynamic region, propelled by extensive manufacturing capabilities, robust government support, and ambitious electrification targets. Major economies in East Asia continue to scale production of second generation YBCO wires, while Southeast Asian markets focus on accelerating transportation electrification with superconducting motors. Regional supply chains are further strengthened by proximity to precursor material sources and advanced component fabrication facilities, allowing faster time to market and competitive cost structures.

These regional distinctions highlight the necessity for companies to tailor engagement strategies, regulatory compliance approaches, and partnership models to local market nuances in order to maximize uptake and long-term viability.

This comprehensive research report examines key regions that drive the evolution of the High-temperature Superconductor Wires market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles Illustrating Competitive Positioning Innovation Partnerships and Technological Roadmaps of Leading High-Temperature Superconductor Wire Manufacturers

A closer examination of leading companies reveals competitive dynamics shaped by technology portfolios, strategic alliances, and vertical integration efforts. Major players in the high-temperature superconductor domain have developed distinct specializations, from advanced material synthesis to turnkey cable manufacturing. Several organizations are investing in proprietary deposition technologies and process automation to secure cost advantages and performance consistency.

Moreover, collaborative partnerships between established corporations and research entities are accelerating technology transfer and pilot scale deployments. Joint ventures focused on scaling second generation wire production underscore a shift toward co-development models that share risk and pool technical expertise. Concurrently, some firms are forging alliances with cryogenic equipment suppliers to deliver integrated solutions, enhancing value propositions for utilities and industrial end users.

In addition, mergers and acquisitions are reshaping the competitive landscape as companies seek to expand product catalogs and access new geographical markets. Strategic acquisitions of precursor material producers and specialized coating equipment manufacturers have provided some entities with end-to-end control over critical production inputs. Such vertical integration strengthens supply chain resilience and creates barriers to entry, granting incumbents a strategic edge.

Collectively, these company-level insights underscore the importance of aligning research investments with market entry strategies, forging alliances to complement core competencies, and actively managing intellectual property portfolios to sustain competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the High-temperature Superconductor Wires market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Conductor Technologies LLC

- American Superconductor Corporation

- AMPeers LLC

- BASF SE

- Beijing Intronic Superconducting Technology Co., Ltd.

- Brookhaven Technology Group

- Bruker Corporation

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- General Electric Company

- High Temperature Superconductors, Inc

- Hitachi, Ltd.

- Kobe Steel Ltd.

- LS Cable & System Ltd.

- Merck KGaA

- MetOx Technologies, Inc.

- Nexans S.A.

- Patil Group

- Sam Dong

- Siemens AG

- Solid Material Solutions, LLC

- Strescon Group

- Sumitomo Electric Industries, Ltd.

- SuperOx Company

- THEVA Dünnschichttechnik GmbH

- VEIR Corporation

Strategic Recommendations Guiding Industry Leaders to Navigate Technological Advancements Regulatory Complexities and Supply Chain Optimization for Sustainable Growth

Industry leaders aiming to capitalize on high-temperature superconductor wire opportunities should prioritize technology investments that align with evolving performance benchmarks and cost targets. Establishing cross-functional teams to evaluate the viability of next-generation conductor materials, alongside traditional public-private research collaborations, can accelerate development cycles and strengthen patent portfolios. Furthermore, allocating resources toward scalable manufacturing processes, such as in situ deposition and tape winding automation, will be critical for achieving competitive unit costs and consistent quality.

In parallel, companies must proactively engage with policymakers and standards bodies to shape regulatory frameworks that facilitate infrastructure integration and ensure safety compliance. Developing pilot programs in partnership with utilities and government agencies can demonstrate operational reliability and build stakeholder confidence. Simultaneously, diversifying supplier networks for critical precursor materials and cryogenic components will mitigate concentration risk and buffer against geopolitical disruptions.

Additionally, adopting flexible business models-such as equipment leasing or performance-based contracts-can lower adoption barriers for end users and accelerate market penetration. Tailoring go-to-market strategies to regional nuances, including leveraging local partnerships and aligning with sustainability mandates, will further enhance competitive positioning. Equally important is the continuous monitoring of emerging use cases, such as superconducting quantum computing and high-field research magnets, to identify adjacent revenue streams and guide long-term R&D roadmaps.

By combining strategic R&D investments with robust supply chain management and stakeholder engagement, industry players can secure leadership positions in this rapidly evolving technology sector.

Comprehensive Research Methodology Integrating Primary Industry Interviews Secondary Data Analysis and Expert Consultations for Robust Market Insights

This research report utilizes a multi-method approach designed to ensure comprehensive and accurate market insights. Primary data was collected through in-depth interviews with industry stakeholders, including executives from leading superconductor wire manufacturers, utility companies, technology adopters, and regulatory experts. These conversations provided qualitative context on adoption drivers, technical challenges, and investment priorities.

Secondary research encompassed a systematic review of peer-reviewed journals, conference proceedings, white papers, and patent filings to map advancements in material science, cooling methodologies, and conductor architectures. In addition, trade association publications and government policy documents were analyzed to assess the impact of regulatory instruments, tariff adjustments, and incentive programs on market trajectory.

Quantitative analysis leveraged company financial reports, import/export data, and documented project case studies to triangulate technology adoption rates, capacity deployments, and regional infrastructure readiness. Data validation was conducted through cross-referencing multiple independent sources, ensuring reliability and minimizing bias. Expert consultations with academic researchers and industry consultants further enhanced the robustness of the findings, providing critical feedback loops for refining market assumptions and scenario planning.

Overall, this rigorous methodology integrates primary insights with extensive secondary data, delivering a holistic view of the high-temperature superconductor wire landscape to inform strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High-temperature Superconductor Wires market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High-temperature Superconductor Wires Market, by Type

- High-temperature Superconductor Wires Market, by Manufacturing Technology

- High-temperature Superconductor Wires Market, by Cooling Method

- High-temperature Superconductor Wires Market, by End-User

- High-temperature Superconductor Wires Market, by Region

- High-temperature Superconductor Wires Market, by Group

- High-temperature Superconductor Wires Market, by Country

- United States High-temperature Superconductor Wires Market

- China High-temperature Superconductor Wires Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Perspectives Emphasizing the Transformative Potential of High-Temperature Superconductor Wires in Global Energy Systems and Advanced Technology Ecosystems

High-temperature superconductor wires stand at the forefront of a technological revolution poised to redefine energy transmission, medical imaging, transportation electrification, and beyond. The interplay of advanced material formulations, innovative manufacturing processes, and supportive policy frameworks is catalyzing a transition from niche applications to widespread commercial deployments. As tariff realignments and supply chain diversification efforts reshape cost structures, stakeholders have a unique opportunity to accelerate domestic production capabilities and mitigate geopolitical risks.

Moreover, segmentation insights based on conductor type, capacity range, application domain, and cooling strategies enable companies to tailor solutions that meet specific performance requirements and budget constraints. Regional analyses underscore the necessity of context-driven market approaches, while company profiles reveal the strategic maneuvers essential for sustaining competitive advantage. Robust research methodologies underpin the validity of these findings, offering decision-makers a reliable foundation for strategic planning.

In conclusion, the high-temperature superconductor wire market is entering a phase of rapid maturation, marked by collaborative innovation, scaling of production technologies, and an evolving policy environment. Stakeholders that effectively leverage these insights to align investments, partnerships, and regulatory engagement will be best positioned to capture emerging opportunities and drive the next wave of technological transformation.

This executive summary lays the groundwork for deeper exploration into market dynamics, technological advancements, and strategic imperatives that define the future trajectory of high-temperature superconductor wires.

Empower Your Organization with Exclusive High-Temperature Superconductor Wire Market Research Insights by Connecting with Ketan Rohom to Unlock Strategic Advantages

Ready to elevate your strategic decision-making with unparalleled insights into the high-temperature superconductor wire market? Reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, to secure immediate access to our comprehensive market research report and stay ahead of emerging industry trends and opportunities.

- How big is the High-temperature Superconductor Wires Market?

- What is the High-temperature Superconductor Wires Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?