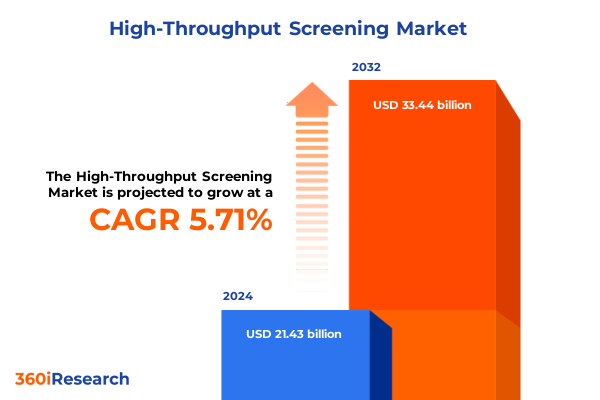

The High-Throughput Screening Market size was estimated at USD 22.32 billion in 2025 and expected to reach USD 23.24 billion in 2026, at a CAGR of 5.94% to reach USD 33.44 billion by 2032.

Unveiling High-Throughput Screening: A Comprehensive Overview of Core Technologies Emerging Market Drivers and Strategic Imperatives for Research Excellence

The realm of high-throughput screening represents a pivotal intersection of automation, data analytics, and biological research that has revolutionized drug discovery and molecular diagnostics. Over the past decade, laboratories worldwide have shifted from manual, low-throughput workflows toward platforms capable of processing thousands of compounds or samples per day. This transformation has been driven by continuous improvements in liquid handling precision, more sensitive detection systems, and advanced software capable of interpreting complex assay data. As a result, organizations can now accelerate early-stage candidate identification while maintaining rigorous standards of reproducibility and quality control.

In parallel, consumables such as specialized labware, reagents, and assay kits have evolved to support miniaturized formats and multiplexed assays, reducing costs and increasing throughput. Detection systems now integrate optical, label-free, and microfluidic technologies, delivering unprecedented sensitivity and dynamic range. Meanwhile, the maturation of compound management and data analysis software provides researchers with intuitive dashboards and AI-driven insights that highlight key trends in screening results. Together, these components form a cohesive ecosystem wherein each innovation amplifies the value of the next.

Transitioning from foundational advances to strategic imperatives, this executive summary will explore transformative shifts reshaping the industry landscape, the 2025 United States tariff environment’s cumulative impact, and critical segmentation, regional, and competitive insights. By synthesizing these dimensions, stakeholders will gain a clear blueprint for navigating the complexities of high-throughput screening, optimizing resource allocation, and securing a leadership position in an increasingly competitive marketplace.

Revolutionary Technological Shifts Reshaping High-Throughput Screening and Redefining Productivity Across Life Science Research

The high-throughput screening landscape has undergone seismic changes as technological breakthroughs and operational refinements converge to reshape research paradigms. Historically, screening was hindered by sequential manual processes prone to variability and extended timelines. Today, automated workstations paired with advanced robotics enable parallel processing of microplates at scales once deemed impractical. This evolution has sharply reduced assay development cycles and expanded the range of biological targets accessible to large-scale campaigns.

Furthermore, the integration of microfluidics and lab-on-a-chip technologies has introduced new possibilities for single-cell analysis and ultra-miniaturized assays, dramatically cutting reagent volumes and environmental footprint. Concurrently, label-free detection methods such as impedance-based and mass spectrometry approaches allow for real-time monitoring of molecular interactions without fluorescent or radioactive markers. These innovations bolster data fidelity while minimizing assay complexity.

Equally impactful are software platforms that leverage cloud computing and machine learning to transform raw screening outputs into predictive models. By identifying structure-activity relationships and off-target liabilities early, organizations can prioritize high-value leads and avoid costly late-stage failures. In this way, the synergy of hardware, consumables, and informatics has redefined productivity benchmarks, empowering researchers to pursue more ambitious screening projects with confidence.

Assessing the Cumulative Impact of United States Tariffs in 2025 on High-Throughput Screening Supply Chains Innovation Strategies and Global Collaborations

The United States’ 2025 tariff adjustments have rippled through global supply chains, affecting every facet of the high-throughput screening ecosystem. By increasing import duties on key raw materials, specialized reagents, and instrument components, manufacturers and end users alike have encountered heightened cost pressures. Instrument developers reliant on precision optics and microfluidic chips have faced extended lead times as suppliers reevaluate production priorities to offset tariff-driven expenses.

Consequently, consumables such as assay kits and labware-often sourced from regions most affected by the new tariff brackets-have experienced price fluctuations that compress laboratory budgets. This situation has prompted some organizations to adopt inventory buffering strategies or to seek alternative regional suppliers where tariff impacts are less severe. At the same time, data analysis and compound management software providers have reassessed their licensing models, adjusting subscription tiers to reflect the evolving cost base of their development teams.

Despite these challenges, the industry has shown resilience through strategic collaborations. Cross-border partnerships have emerged to share the burden of increased manufacturing costs, and contract research organizations have expanded their domestic service offerings, leveraging local production capabilities. In sum, while the 2025 tariff landscape has introduced complexity, it has also galvanized stakeholders to innovate supply chain strategies, invest in regional manufacturing hubs, and uphold the momentum of high-throughput screening advancement.

Unlocking Market Dynamics through Segmentation Insights across Products Technologies Applications and End User Verticals Driving Future Growth

A granular view of the market through segmentation reveals nuanced drivers of adoption and investment. When examining the product type dimension, consumables including labware and reagents & assay kits continue to dominate purchasing cycles, driven by ongoing assay development and validation efforts. Instruments such as detection systems and liquid handling platforms gain traction as laboratories scale up throughput demands, while services encompassing assay development & validation and screening become central to outsourcing strategies. Meanwhile, software solutions dedicated to compound management and data analysis underpin the digital transformation agenda, ensuring that data-driven insights translate into tangible research outcomes.

Technology segmentation underscores the growing influence of cell-based assays, especially fluorometric imaging plate reader and reporter-based formats that provide physiologically relevant data. Lab-on-a-chip approaches and microfluidics based systems address the need for miniaturization and multiplexing, whereas label-free platforms maintain a critical role in applications requiring direct interaction measurements.

Plate format analysis highlights the transition from traditional 96-well and 384-well plate formats toward high-density 1536-well plates, catalyzing cost efficiencies and enabling ultra-high-throughput campaigns. In application domains, drug discovery remains a principal use case, complemented by genomics & proteomics, molecular screening, and toxicology & safety assessments. End users from academic and research institutes to contract research organizations, hospitals & diagnostic labs, and pharmaceutical & biotechnology companies all exhibit distinct adoption patterns aligned to their core objectives. By integrating these segmentation insights, market participants can tailor product development roadmaps and customer engagement strategies to meet the precise needs of each segment.

This comprehensive research report categorizes the High-Throughput Screening market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Plate Format

- Application

- End User

Regional High-Throughput Screening Insights Highlighting Key Trends Opportunities and Challenges across Americas EMEA and Asia-Pacific Research Ecosystems

Regional disparities in high-throughput screening adoption reflect broader economic and regulatory landscapes. In the Americas, extensive R&D infrastructure coupled with strong government funding mechanisms has accelerated the uptake of both established and emerging screening platforms. North American centers of excellence continually push the boundaries of throughput and miniaturization, while Latin American research hubs show increasing interest in cost-effective consumables and localized service partnerships.

Europe, the Middle East & Africa present a heterogeneous market, where Western Europe leads in integrating microfluidic and label-free technologies under stringent regulatory frameworks. This region’s emphasis on personalized medicine and advanced diagnostics propels growth in cell-based assay workflows. Simultaneously, emerging markets in Eastern Europe and parts of the Middle East are building capacity for broader adoption by leveraging contract research organizations and collaborative networks.

Asia-Pacific remains the fastest-growing region, driven by robust investment in biotech innovation across China, Japan, South Korea, and Southeast Asia. State-sponsored initiatives and public-private partnerships have fueled the expansion of local manufacturing capabilities for consumables and instruments, diminishing reliance on imports. As a result, regional players are rapidly enhancing their product portfolios and service offerings to compete on a global stage. Understanding these regional nuances enables companies to optimize go-to-market strategies and align supply chains with local demand drivers.

This comprehensive research report examines key regions that drive the evolution of the High-Throughput Screening market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Showcasing Initiatives Technological Innovations Competitive Positioning and Partnerships in the High-Throughput Screening Sector

Leading companies in the high-throughput screening space continue to refine their portfolios through acquisitions, strategic alliances, and in-house innovation. Instrument manufacturers are prioritizing integration between liquid handling robotics and multi-mode detection systems to deliver turnkey solutions that minimize setup complexity. These providers also invest heavily in modular architectures, allowing end users to customize configurations in response to evolving assay requirements.

Consumables suppliers differentiate through the development of next-generation assay kits and labware designed for compatibility with high-density plate formats, emphasizing reagent stability and automation compatibility. In the services arena, contract research organizations are expanding their capacity for high-throughput campaigns, offering turnkey screening projects that include assay development, validation, and data reporting.

Software vendors, recognizing the critical role of informatics in driving screening success, are integrating AI-powered analytics and cloud-native architectures to support real-time data sharing and remote collaboration. Competitive positioning strategies increasingly feature end-to-end offerings that span consumables, instruments, services, and software. Through partnerships and joint ventures, these companies enhance global reach while maintaining a focus on customer-centric innovation that addresses the specific challenges of diverse research workflows.

This comprehensive research report delivers an in-depth overview of the principal market players in the High-Throughput Screening market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Aurora Biomed, Inc.

- Bio-Rad Laboratories, Inc.

- Biomat S.r.l

- BMG LABTECH GmbH

- BRAND GMBH + CO KG

- Charles River Laboratories International, Inc.

- Corning Incorporated

- Creative Biolabs, Inc.

- Danaher Corporation

- DIANA Biotechnologies, a.s

- Eppendorf SE

- EUROFINS SCIENTIFIC SE

- Gilson Company, Inc.

- Hamilton Company

- HighRes BioSolutions, Inc.

- Lonza Group AG

- Merck KGaA

- Mettler Toledo International, Inc.

- PerkinElmer, Inc.

- Revvity, Inc.

- Sartorius AG

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

- Waters Corporation

Actionable Strategies and Practices for Industry Leaders to Harness High-Throughput Screening Innovations Optimize Workflows and Drive Competitive Advantage

To capitalize on the evolving high-throughput screening landscape, industry leaders should prioritize a holistic approach that balances technology investment, supply chain resilience, and data governance. First, decision-makers must conduct thorough technology audits to identify bottlenecks in liquid handling precision and detection sensitivity. By deploying pilot projects on microfluidic platforms or label-free systems, organizations can evaluate performance gains and cost trade-offs before large-scale rollouts.

Second, forging strategic alliances with regional suppliers and service providers can mitigate the impact of tariff fluctuations and logistical disruptions. Establishing dual-source agreements for critical consumables, while maintaining buffer inventories, enhances operational continuity. Concurrently, organizations should adopt cloud-based compound management systems with standardized data formats to facilitate seamless collaboration across internal and external stakeholders.

Finally, building an in-house center of excellence for high-throughput screening ensures that best practices in assay development, validation, and data interpretation are institutionalized. By investing in continuous training programs and cross-functional teams that bridge biology, engineering, and data science, companies can foster an innovative culture that drives sustained competitive advantage.

Comprehensive Methodology Combining Primary Interviews Secondary Research and Analytical Frameworks to Validate High-Throughput Screening Market Insights

The research underpinning these insights rests on a comprehensive methodology that integrates primary and secondary data sources. Interviews were conducted with senior R&D executives, service providers, and procurement specialists to capture firsthand perspectives on technology adoption and market challenges. Secondary research involved a detailed review of published patents, regulatory filings, and peer-reviewed literature to map the evolution of core technologies and workflow innovations.

Analytical frameworks such as SWOT and PESTEL were employed to assess the strategic positioning of key market participants and to understand the broader external factors shaping market dynamics. Segmentation matrices aligned product types, technologies, plate formats, applications, and end-user categories to ensure a holistic market view. Throughout the process, findings were validated through expert workshops and roundtables, ensuring that the final insights reflect both quantitative data and qualitative expertise. This rigorous approach guarantees that the recommendations and market narratives are robust, actionable, and reflective of current industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our High-Throughput Screening market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- High-Throughput Screening Market, by Product Type

- High-Throughput Screening Market, by Technology

- High-Throughput Screening Market, by Plate Format

- High-Throughput Screening Market, by Application

- High-Throughput Screening Market, by End User

- High-Throughput Screening Market, by Region

- High-Throughput Screening Market, by Group

- High-Throughput Screening Market, by Country

- United States High-Throughput Screening Market

- China High-Throughput Screening Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing the Strategic Imperatives and Future Outlook for High-Throughput Screening as a Cornerstone of Next-Generation Drug Discovery and Biotech Innovation

As the high-throughput screening sector moves forward, the convergence of advanced automation, miniature assay formats, and AI-enabled analytics will continue to accelerate discovery timelines and enhance experimental reproducibility. Stakeholders must remain agile, integrating emerging technologies such as organ-on-a-chip systems and real-time label-free detection to unlock new frontiers in drug discovery and molecular diagnostics.

Moreover, the evolving geopolitical and regulatory landscape, particularly tariff policies, underscores the importance of resilient supply chains and adaptive sourcing strategies. By leveraging segmentation insights and regional market nuances, organizations can tailor their offerings to meet the precise demands of diverse end users, from academic research institutes to global pharmaceutical companies.

Ultimately, sustained success hinges on fostering collaborative ecosystems that bridge technology providers, service organizations, and end users. Through strategic partnerships and continuous innovation, the high-throughput screening community can deliver on its promise of faster, more accurate, and cost-effective solutions, paving the way for the next generation of life science breakthroughs.

Reach Out to Ketan Rohom Associate Director Sales and Marketing to Secure Your High-Throughput Screening Market Research and Advance Your Strategic Planning

Reach Out to Ketan Rohom, Associate Director of Sales and Marketing, to Secure Your High-Throughput Screening Market Research and Advance Your Strategic Planning

To access the comprehensive market insights that can guide your next breakthrough, connect directly with Ketan Rohom. Leveraging years of experience in strategic consulting, he will help you obtain the full high-throughput screening report that delivers in-depth analysis, qualitative perspectives, and actionable recommendations. Engage today to ensure your organization remains at the forefront of innovation and translates cutting-edge data into decisive competitive advantage.

- How big is the High-Throughput Screening Market?

- What is the High-Throughput Screening Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?